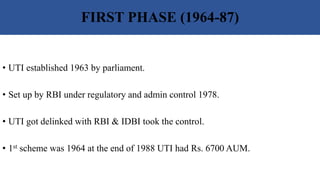

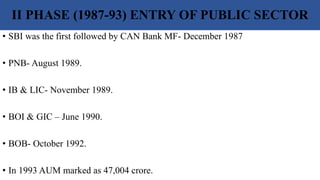

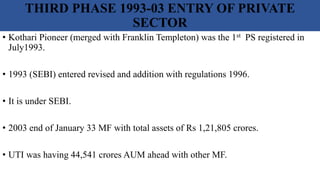

The document discusses the history and development of mutual funds in India. It outlines 4 phases: (1) 1964-1987 with only UTI, growth was slow; (2) 1987-1993 saw entry of public sector players which accelerated growth; (3) 1993-2003 was the entry of private sector players under new SEBI regulations; (4) growth continues into the present fourth phase. The document provides context on mutual funds by defining them and discussing their purpose of pooling funds from savers to invest in instruments issued by businesses to reduce risk through diversification.