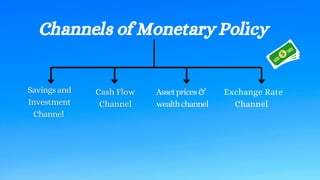

The monetary transmission mechanism refers to the process through which central banks' monetary policy decisions impact the economy. There are four main channels through which this occurs:

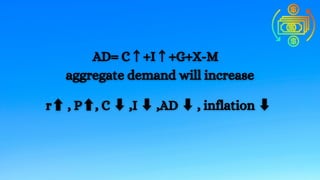

1. Interest rates - changes to interest rates affect borrowing and saving incentives, which then impact consumption, investment, and economic growth.

2. Asset prices and wealth - changes in interest rates also affect stock and bond prices, impacting household wealth and spending.

3. Exchange rates - interest rate changes attract foreign investment and influence currency exchange rates, impacting trade and domestic prices.

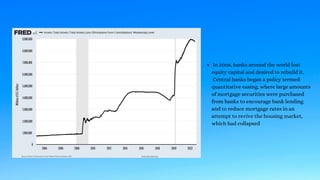

4. Bank lending - monetary policies like quantitative easing provide banks more reserves and lower rates, encouraging more lending to boost sectors like housing. Central banks in different economies