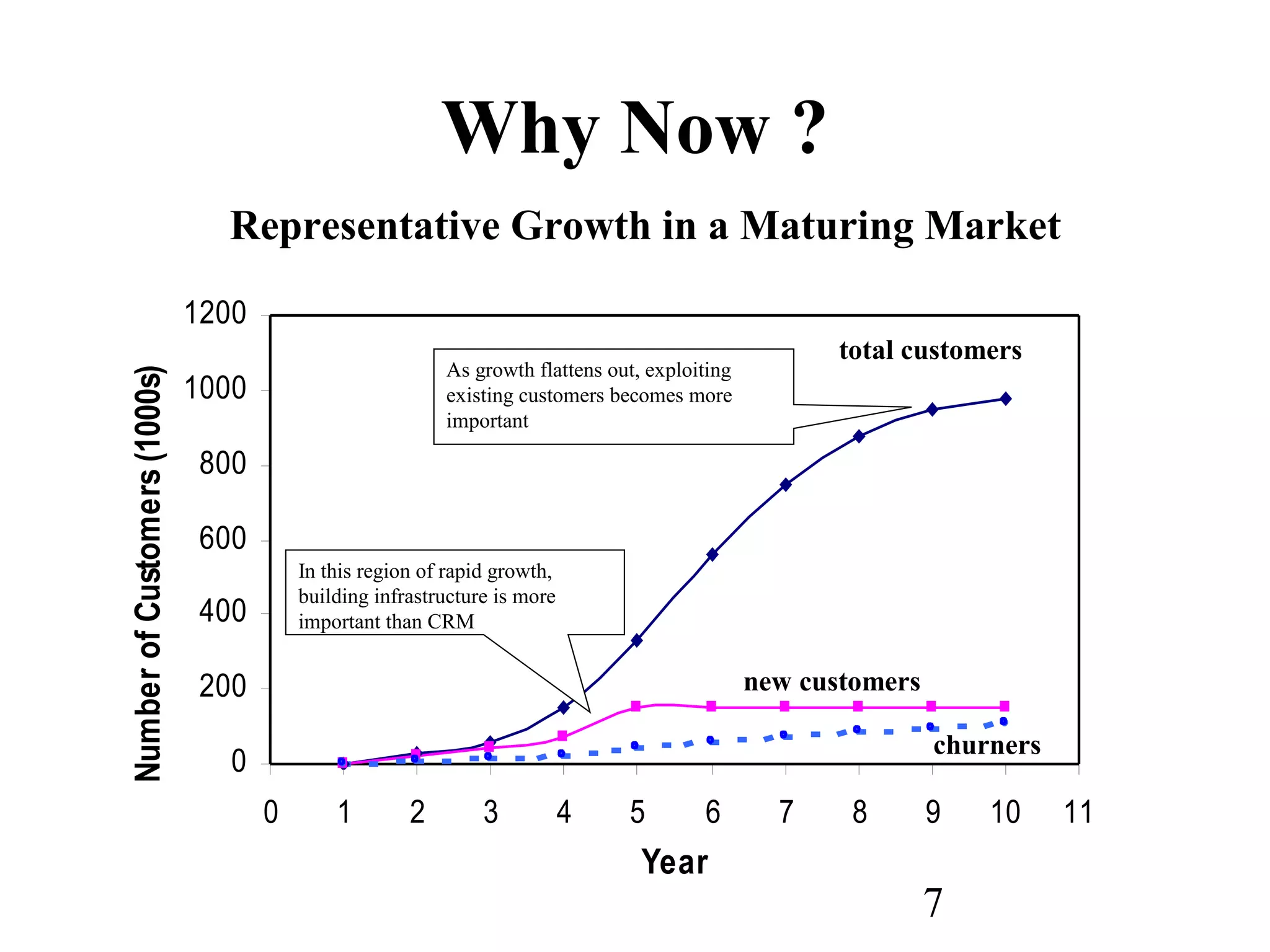

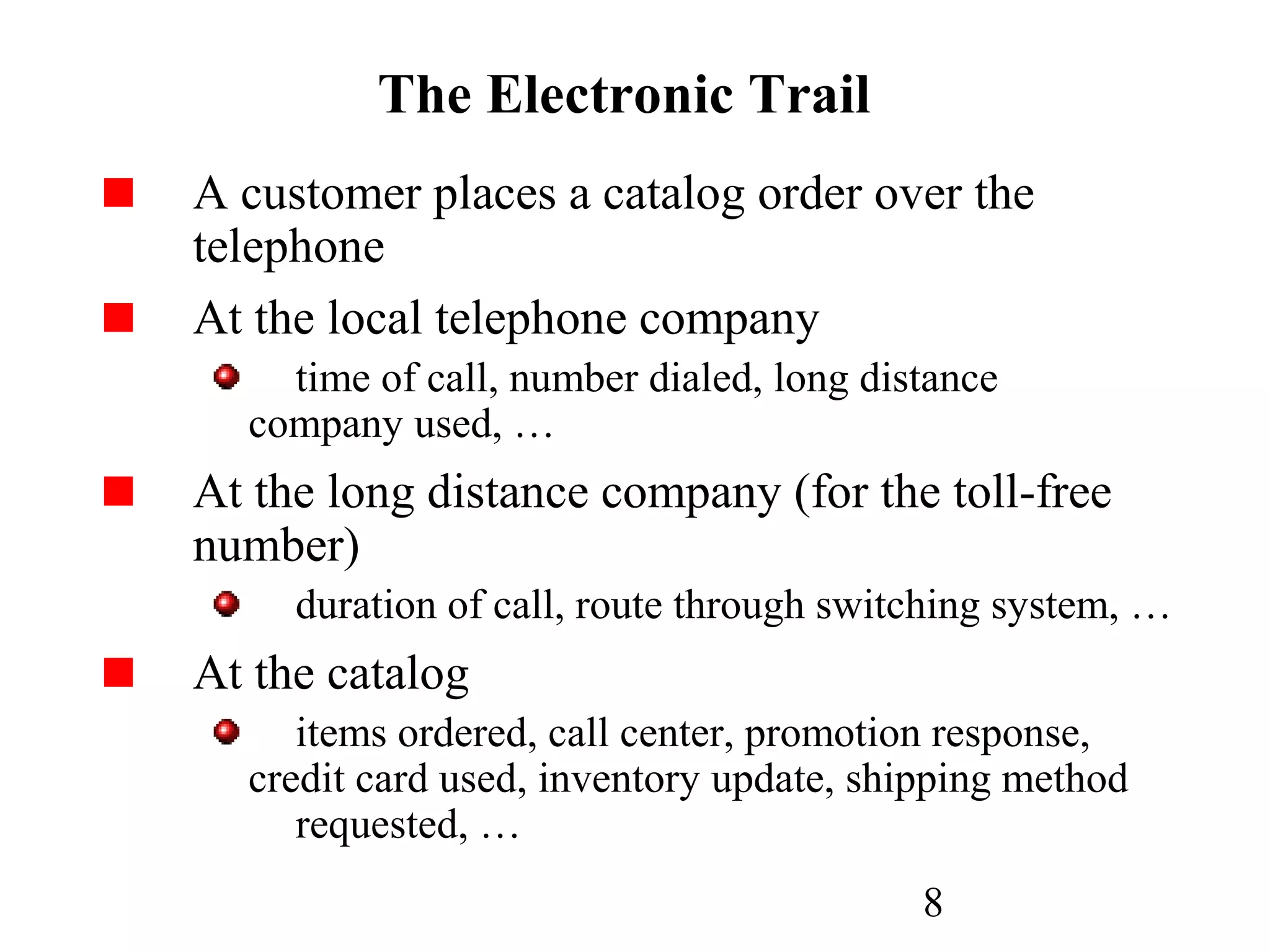

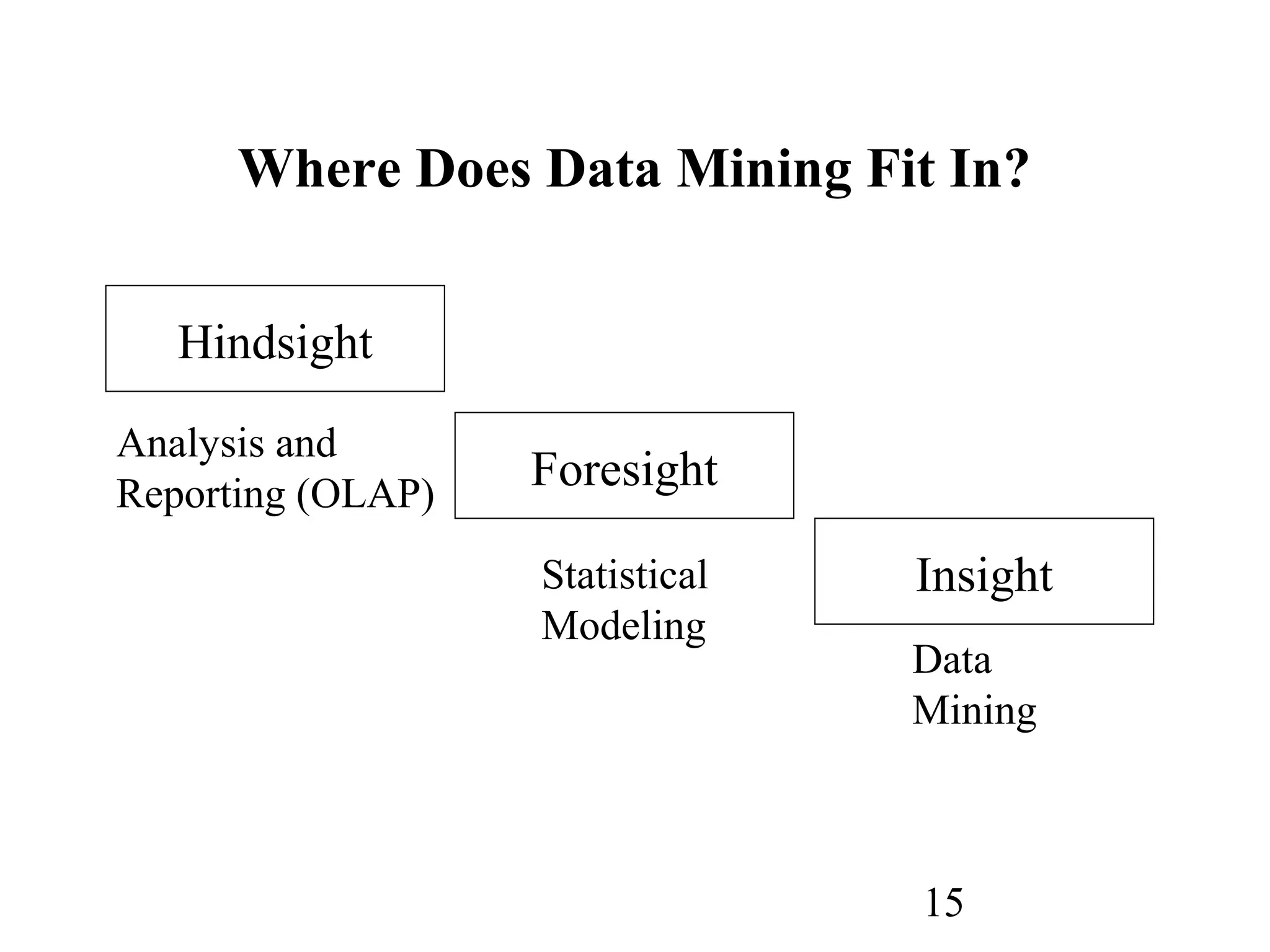

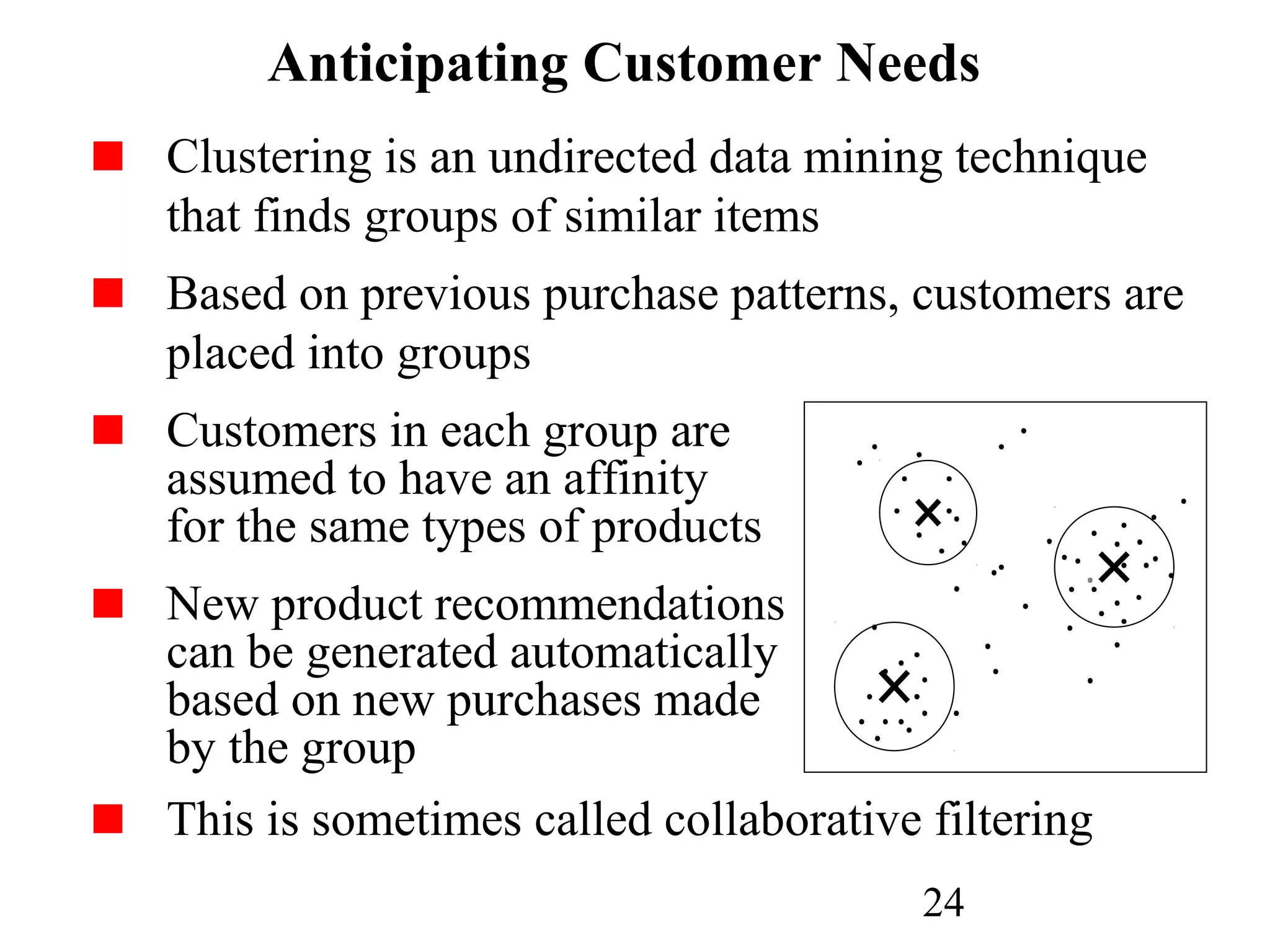

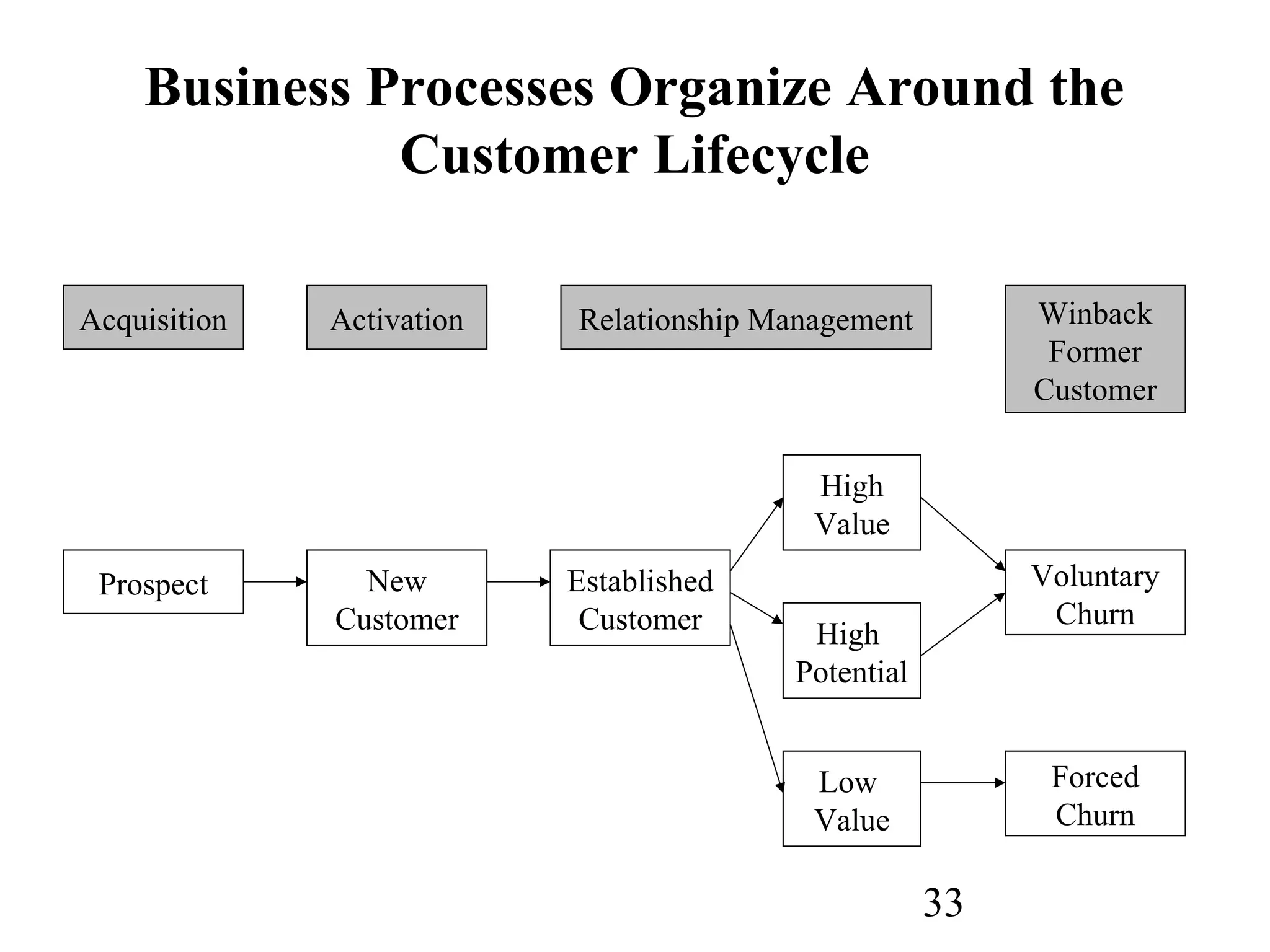

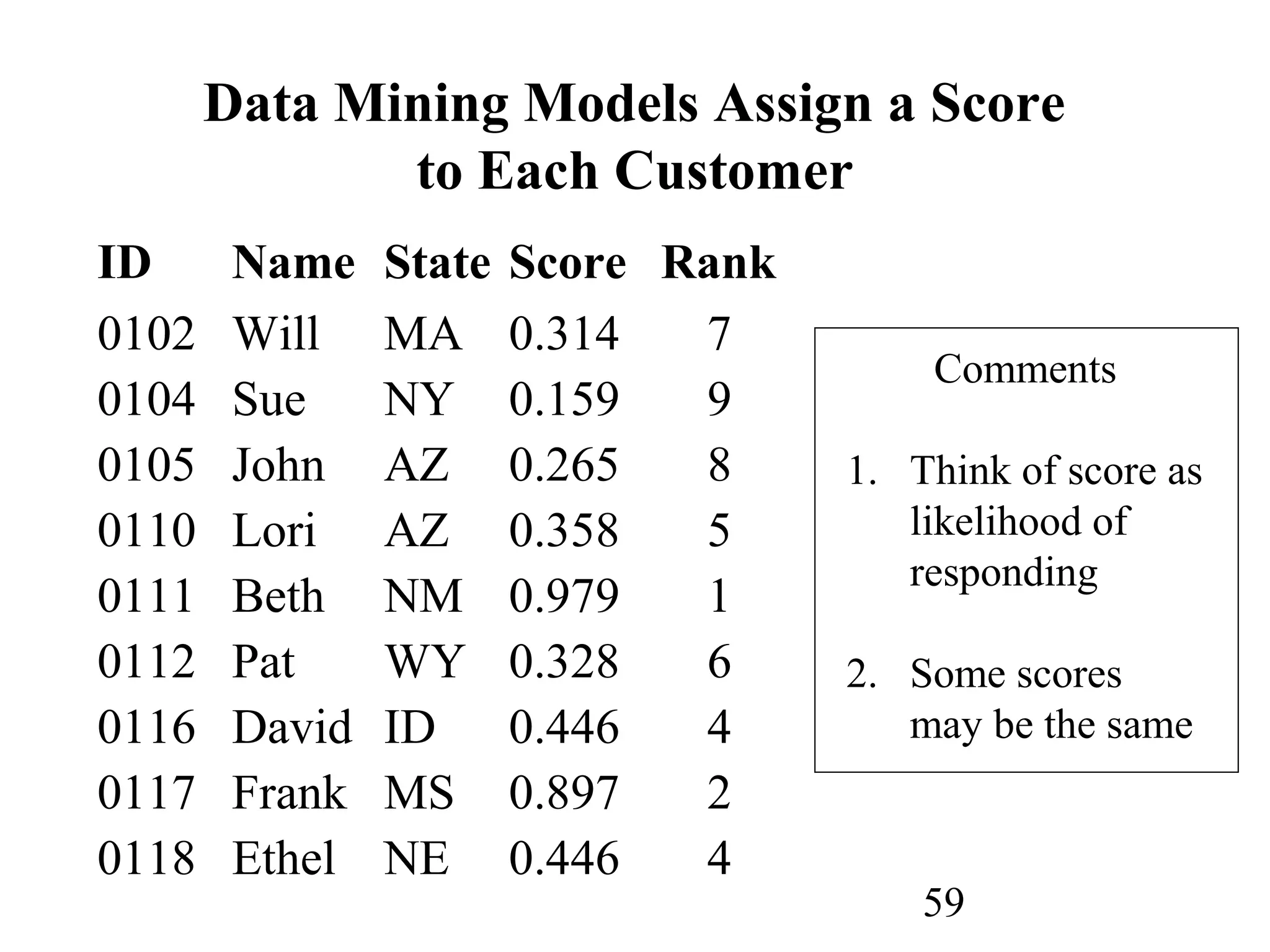

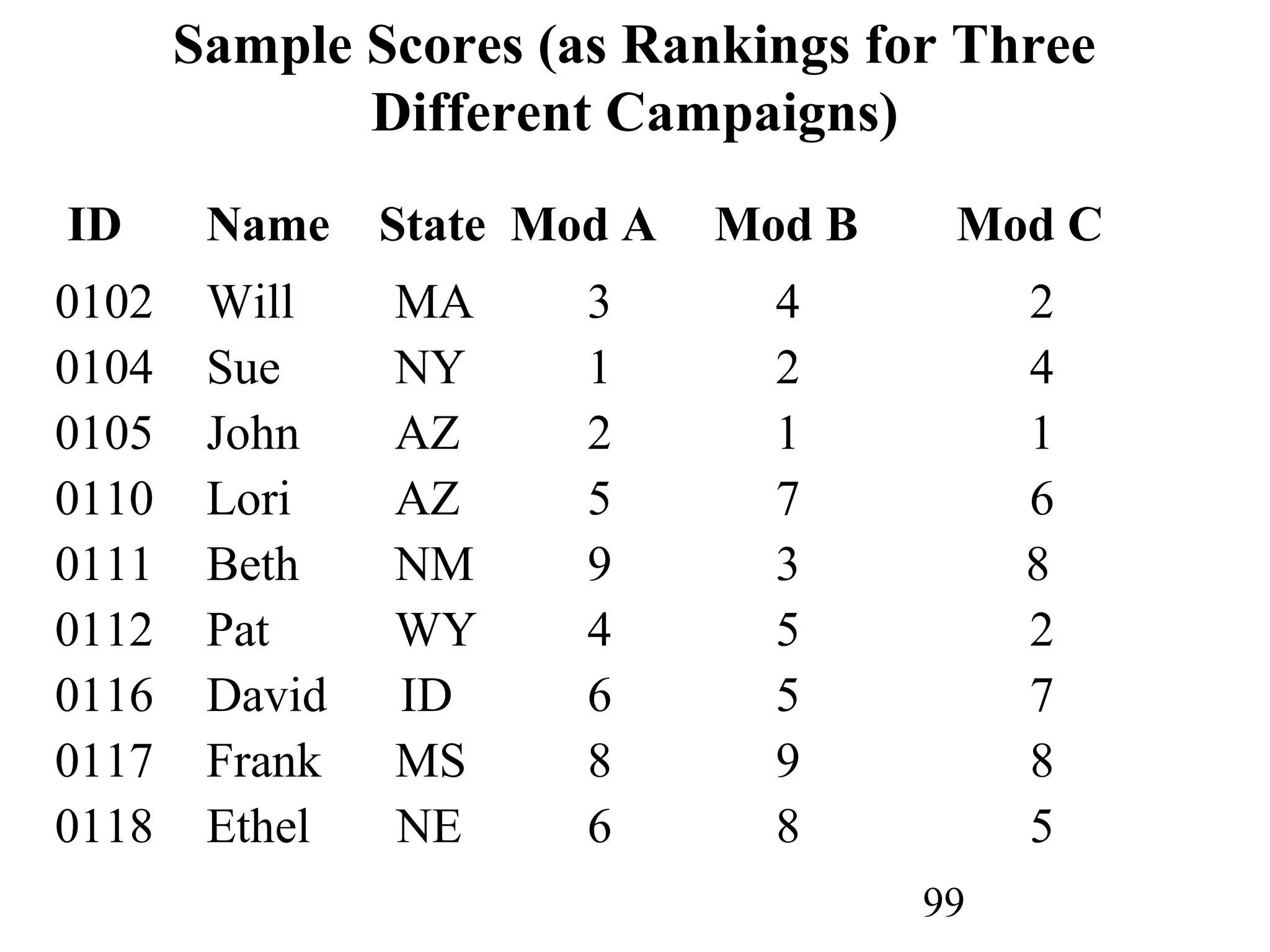

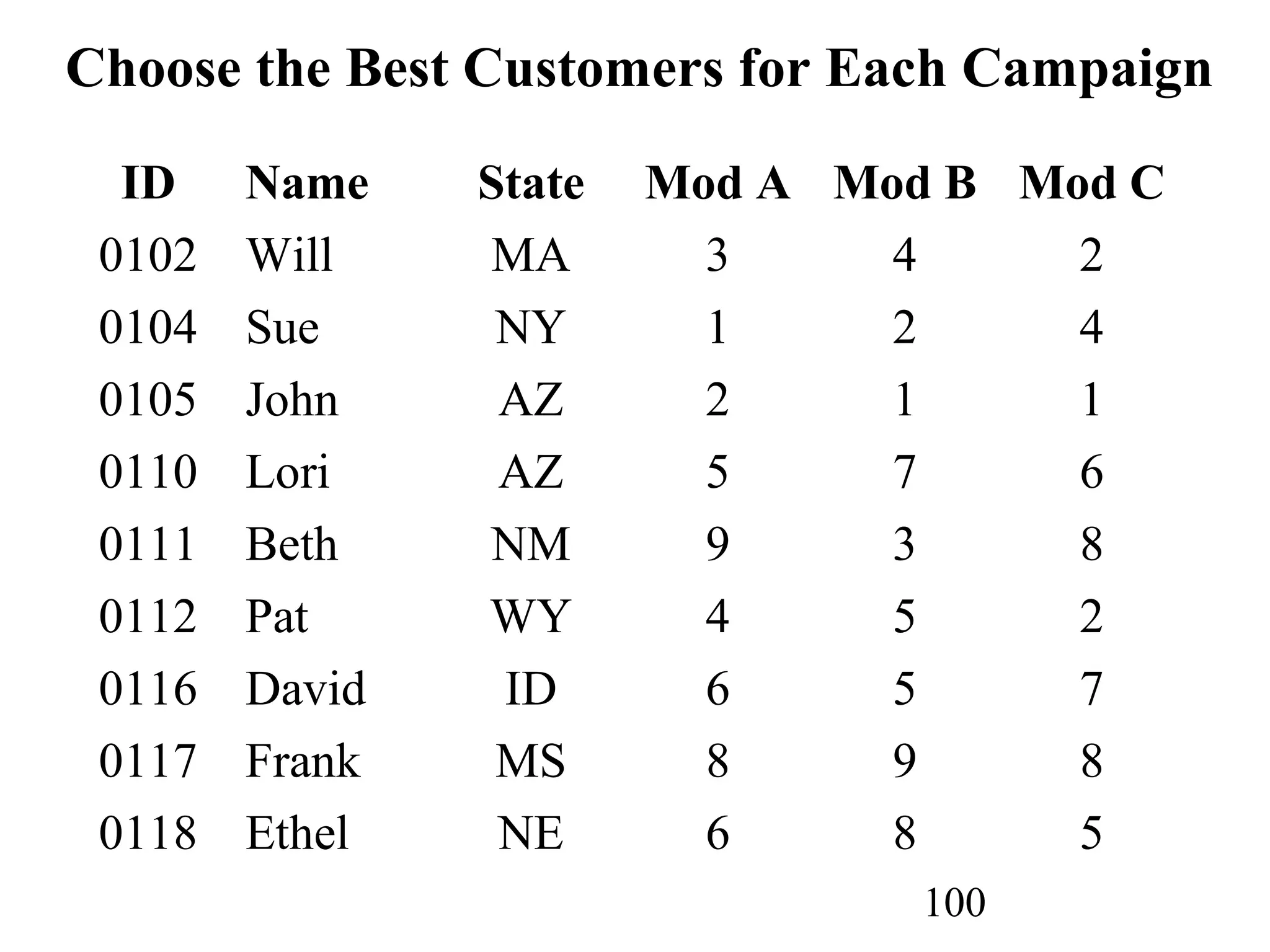

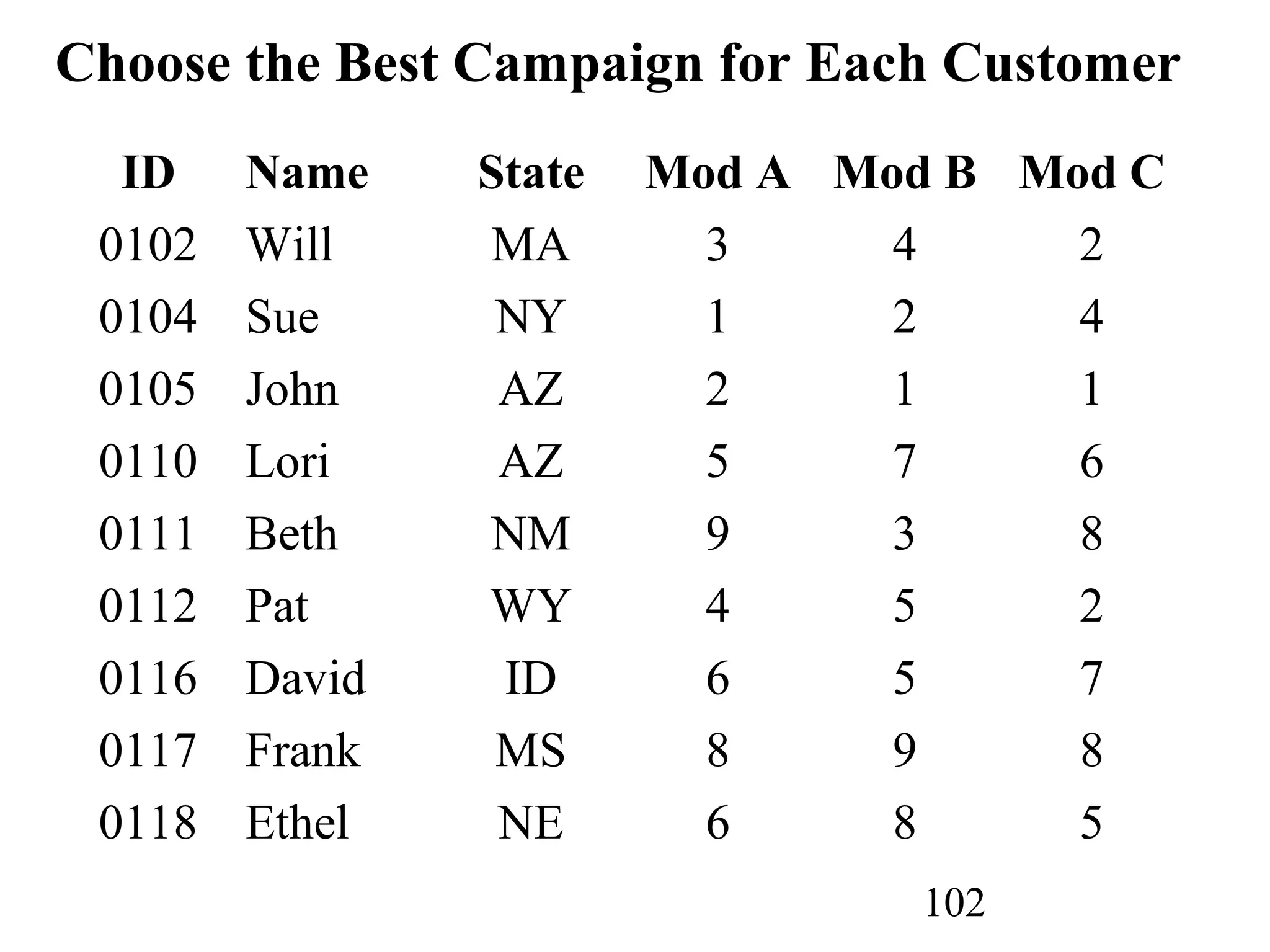

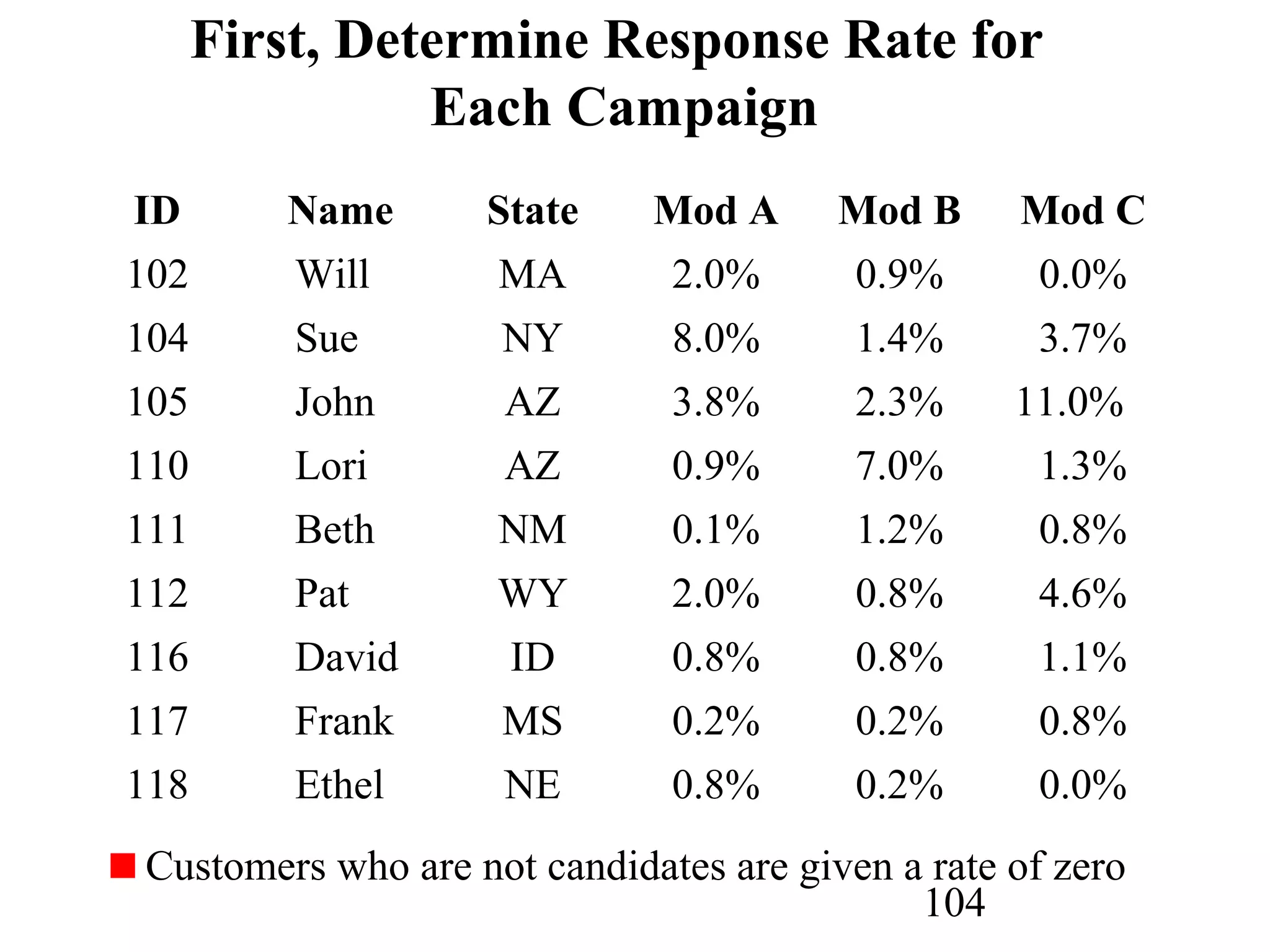

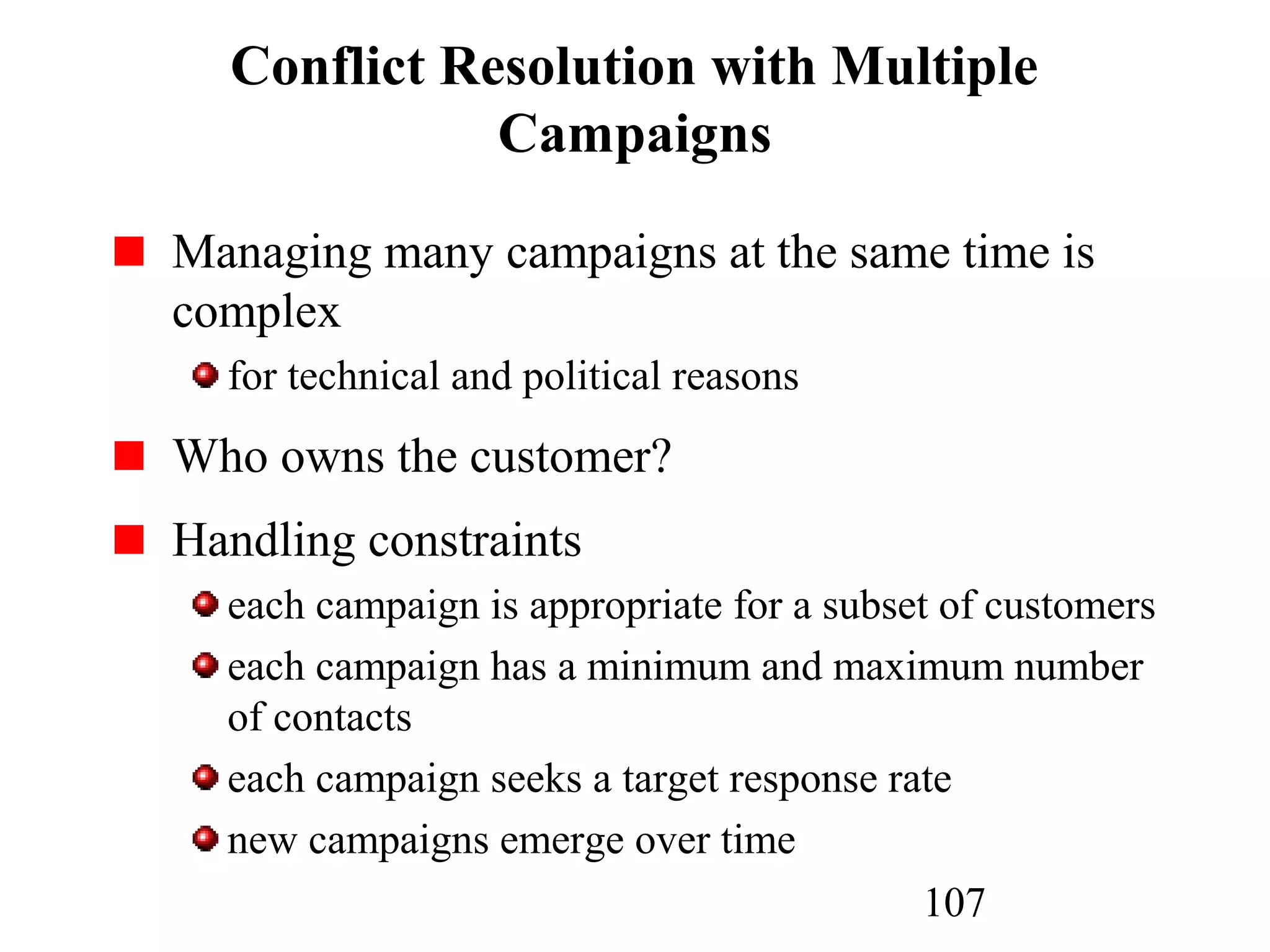

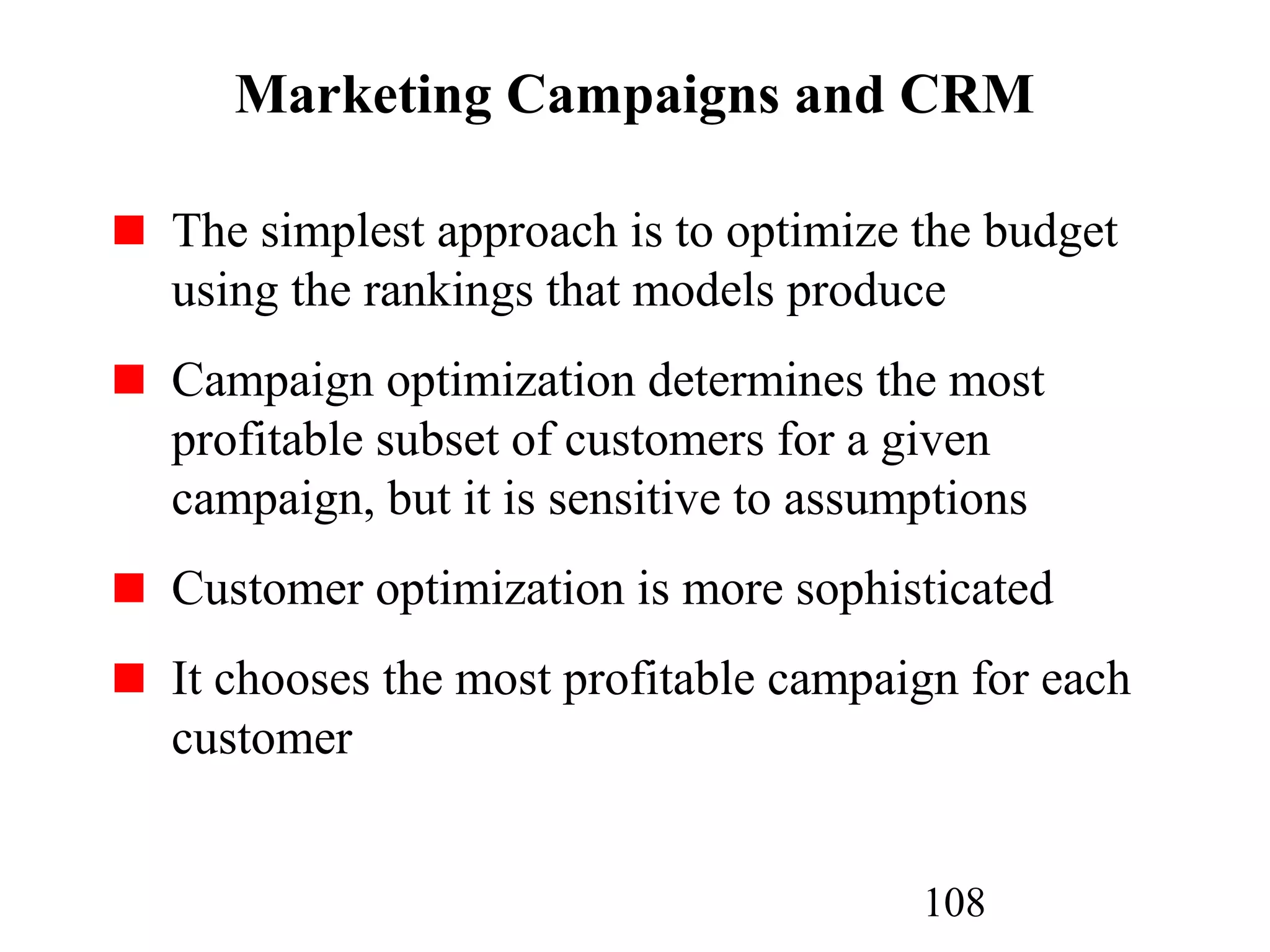

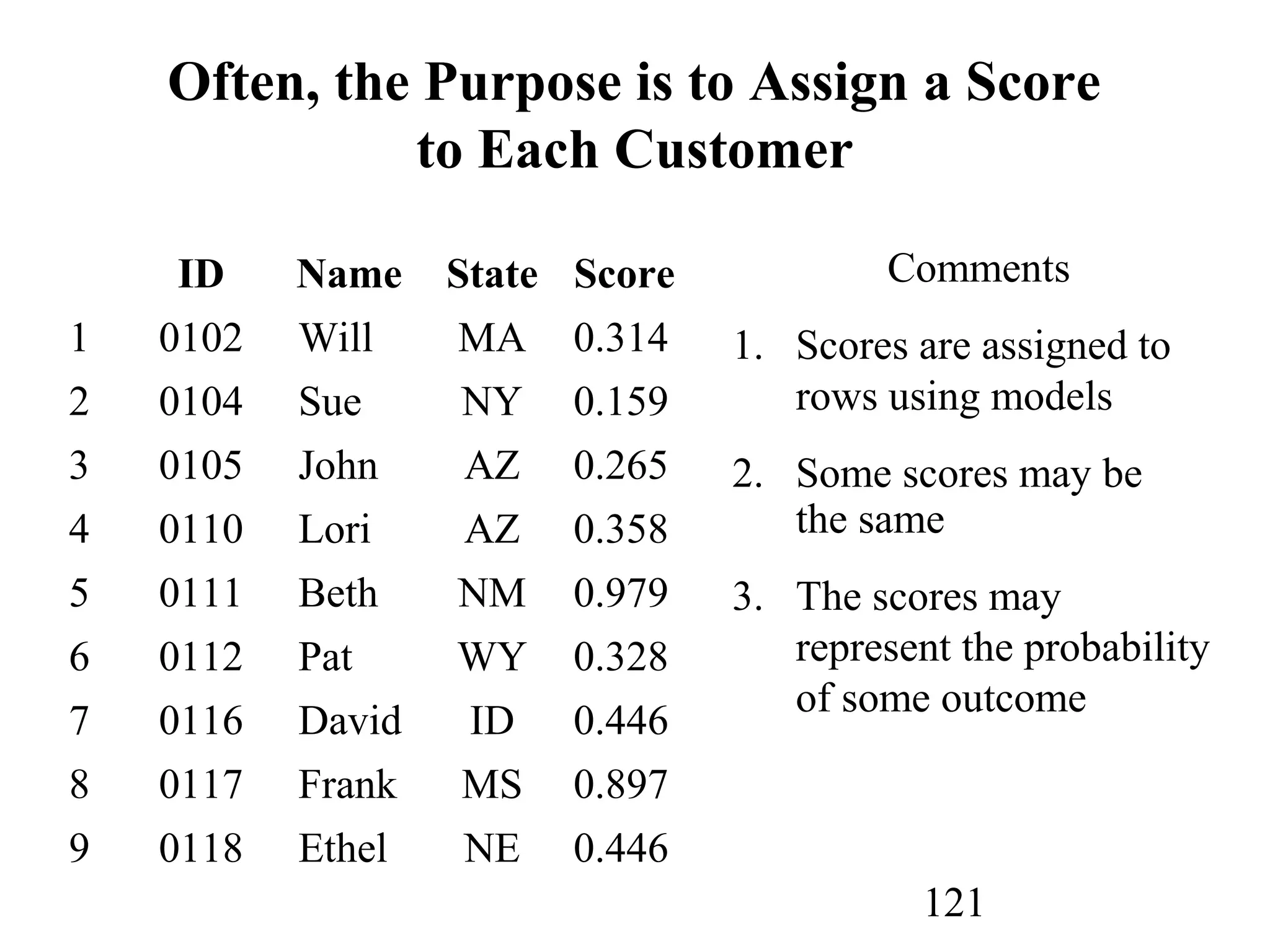

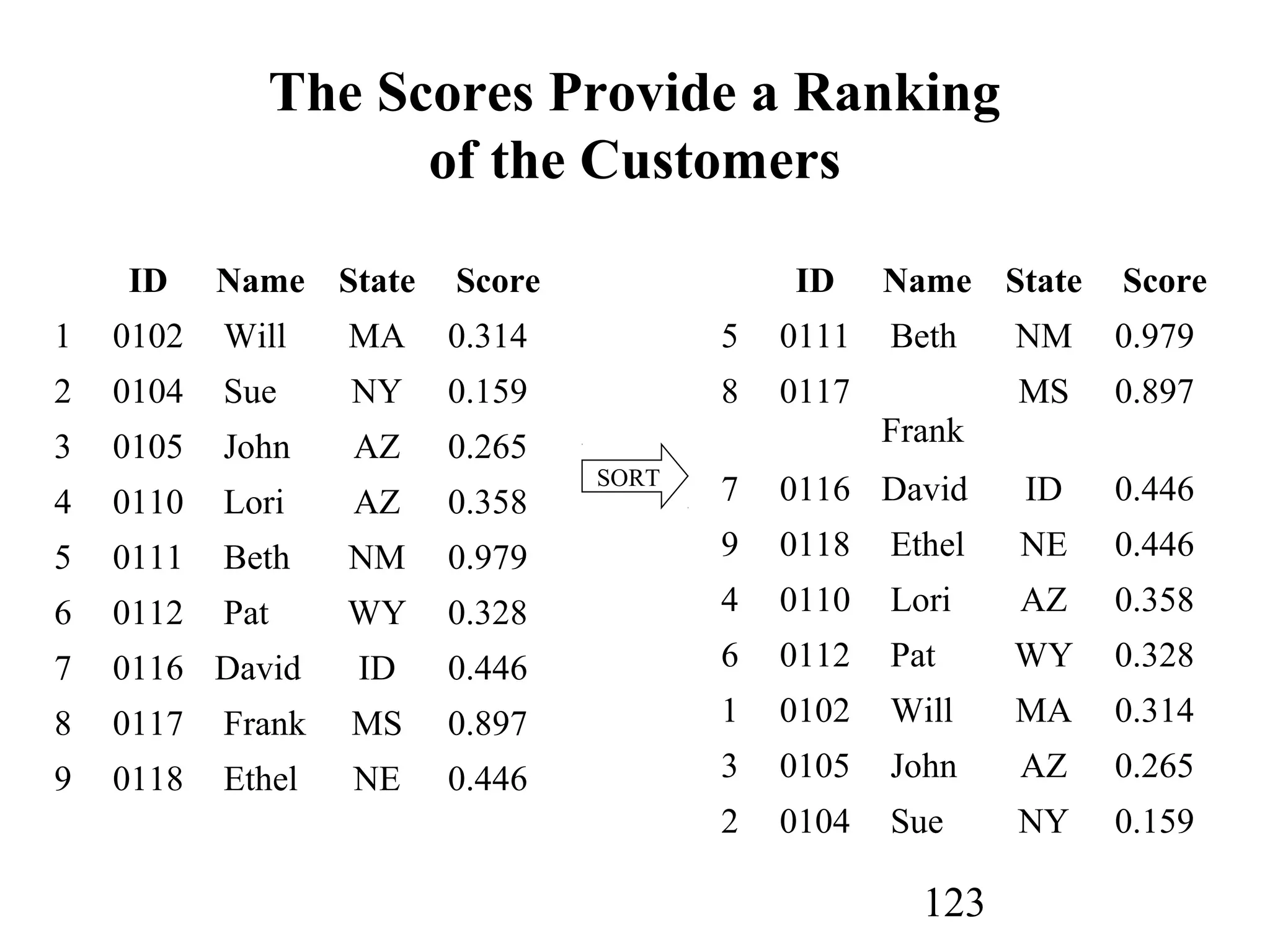

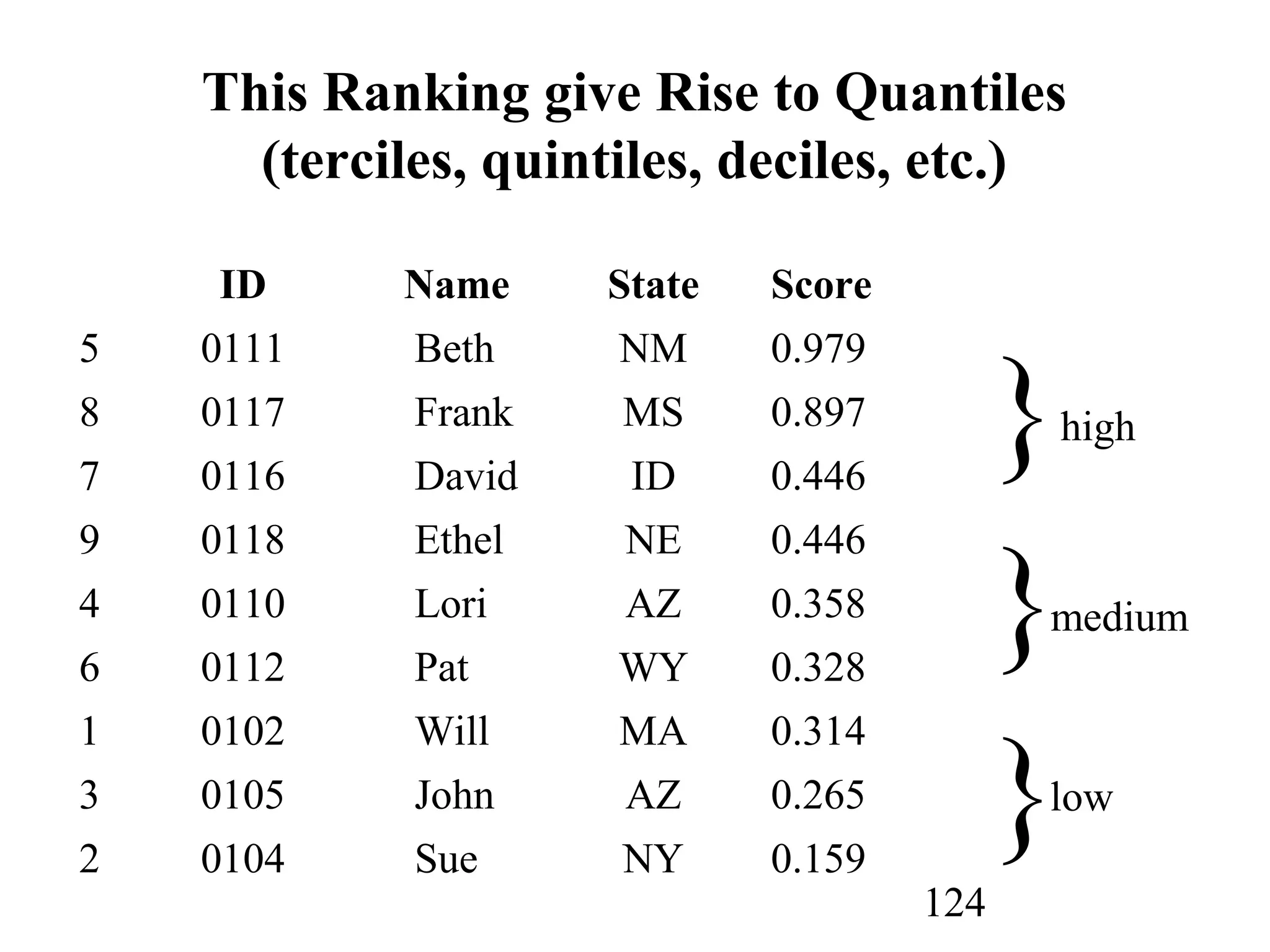

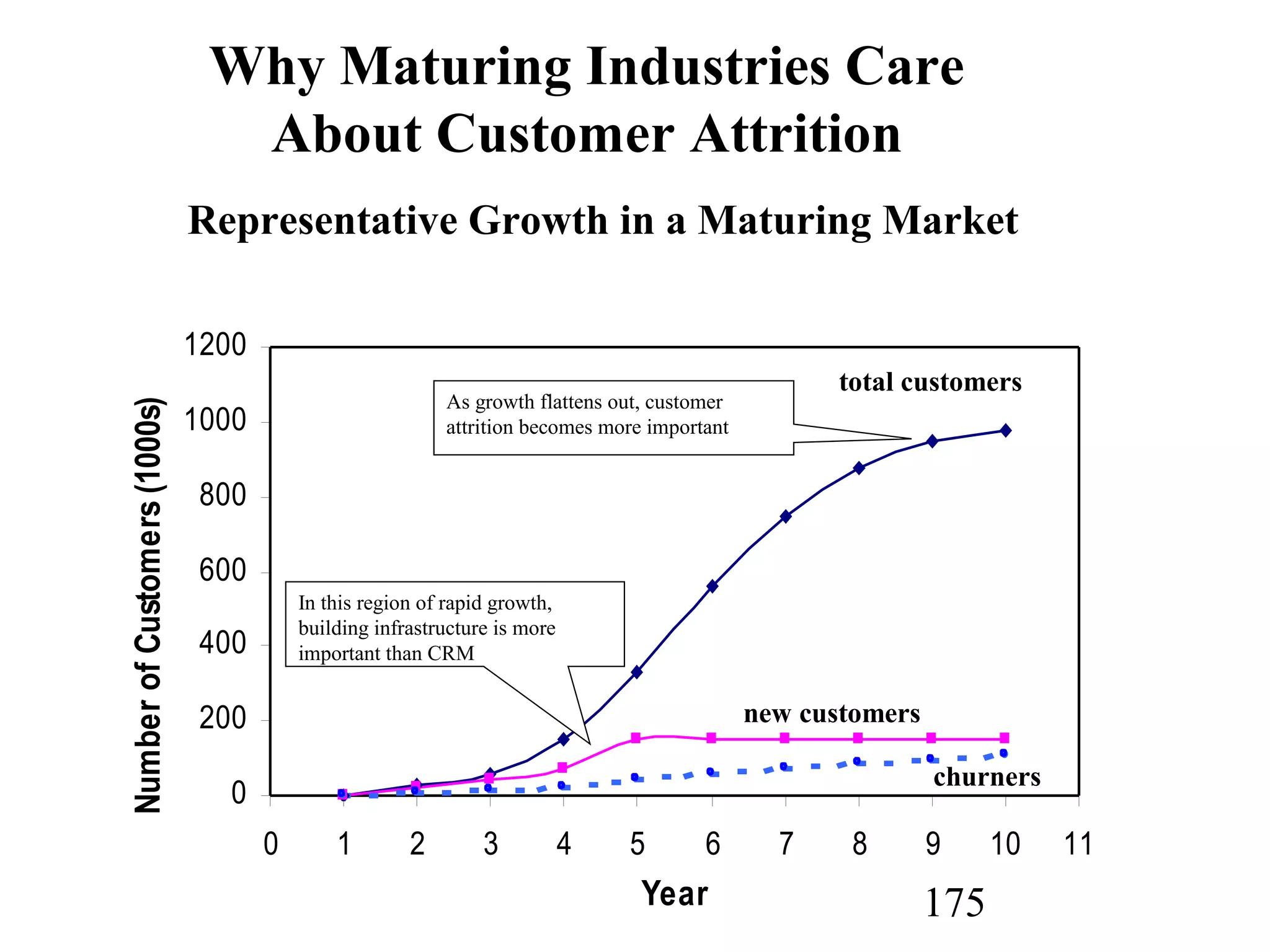

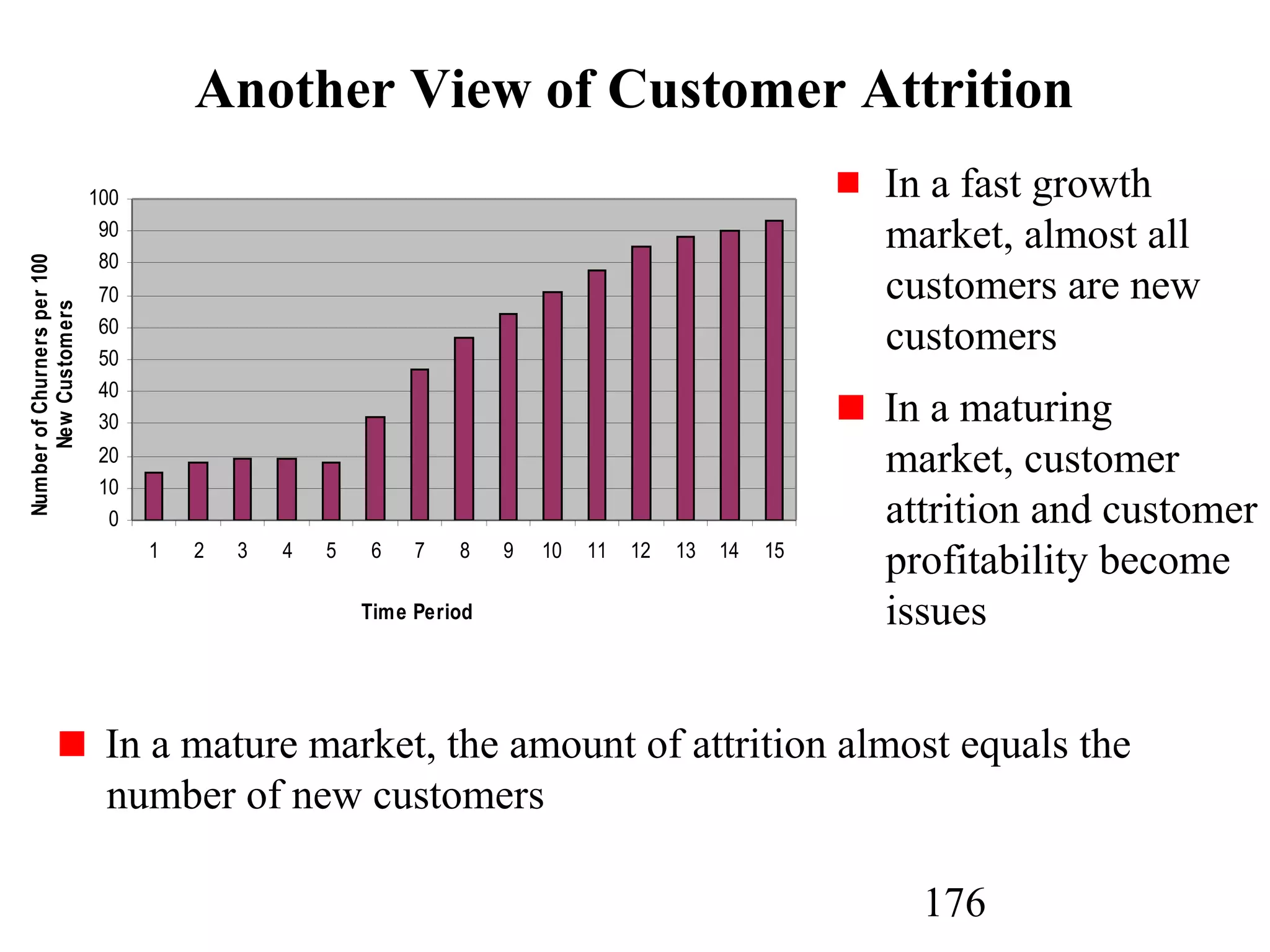

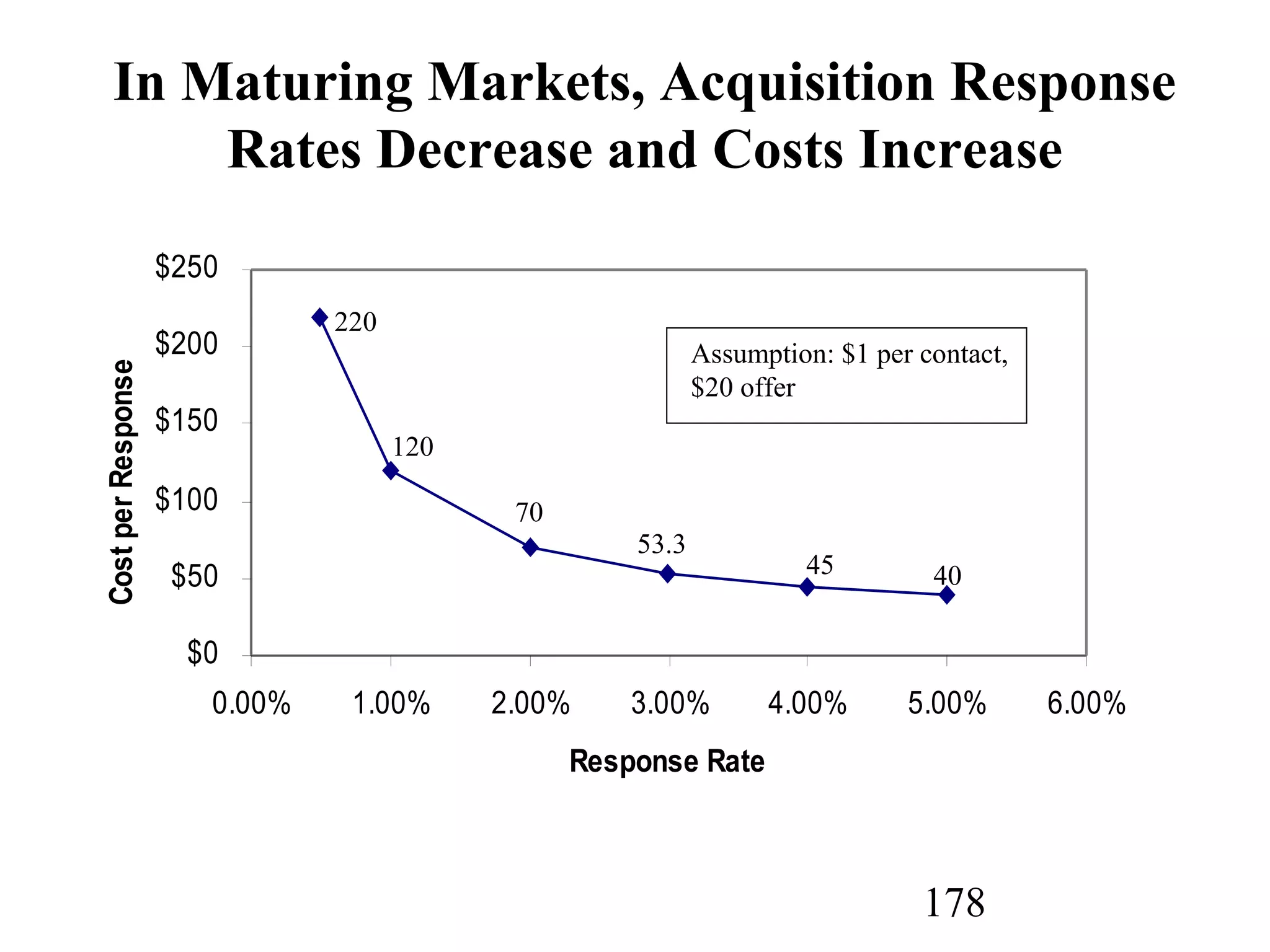

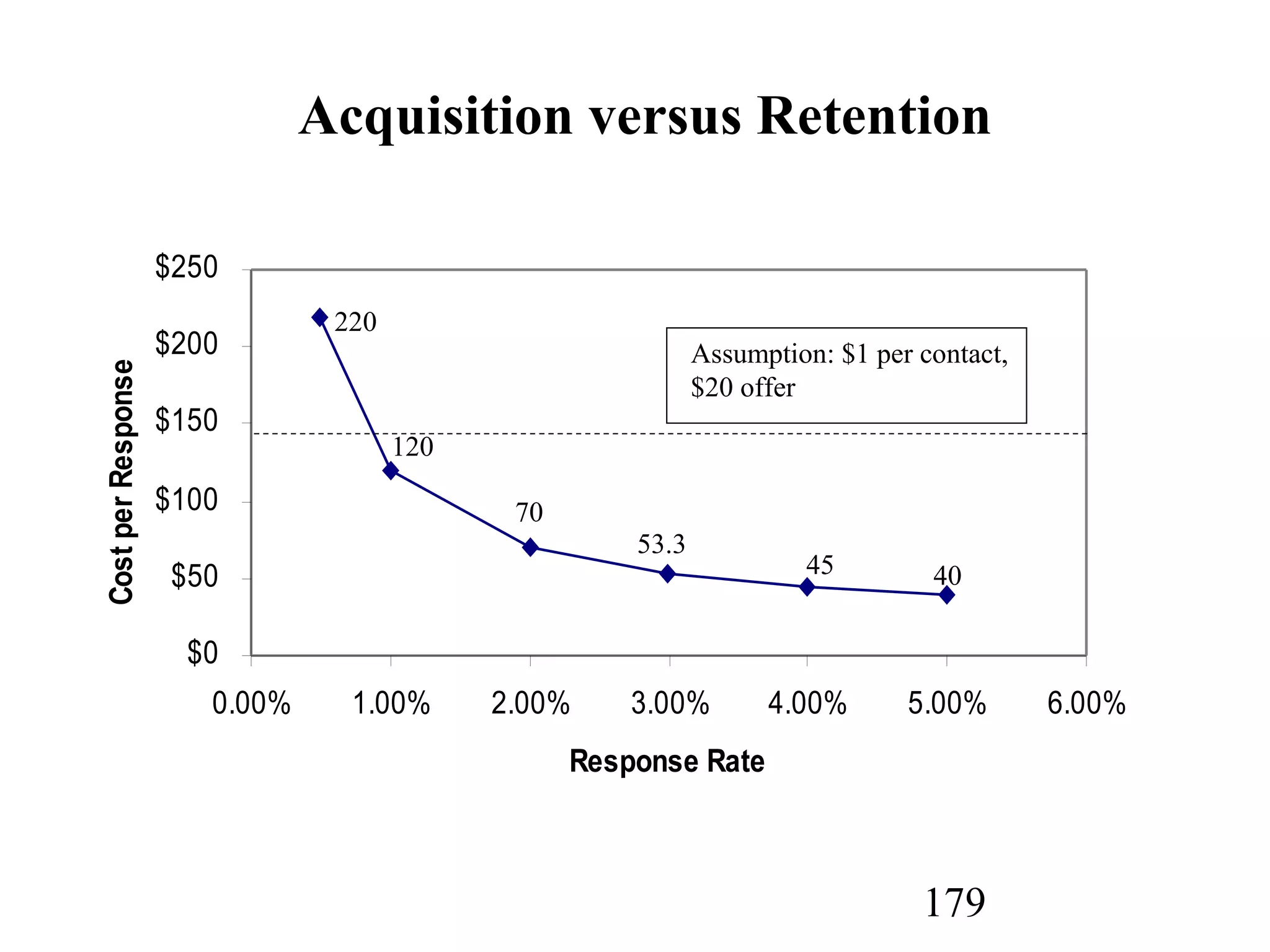

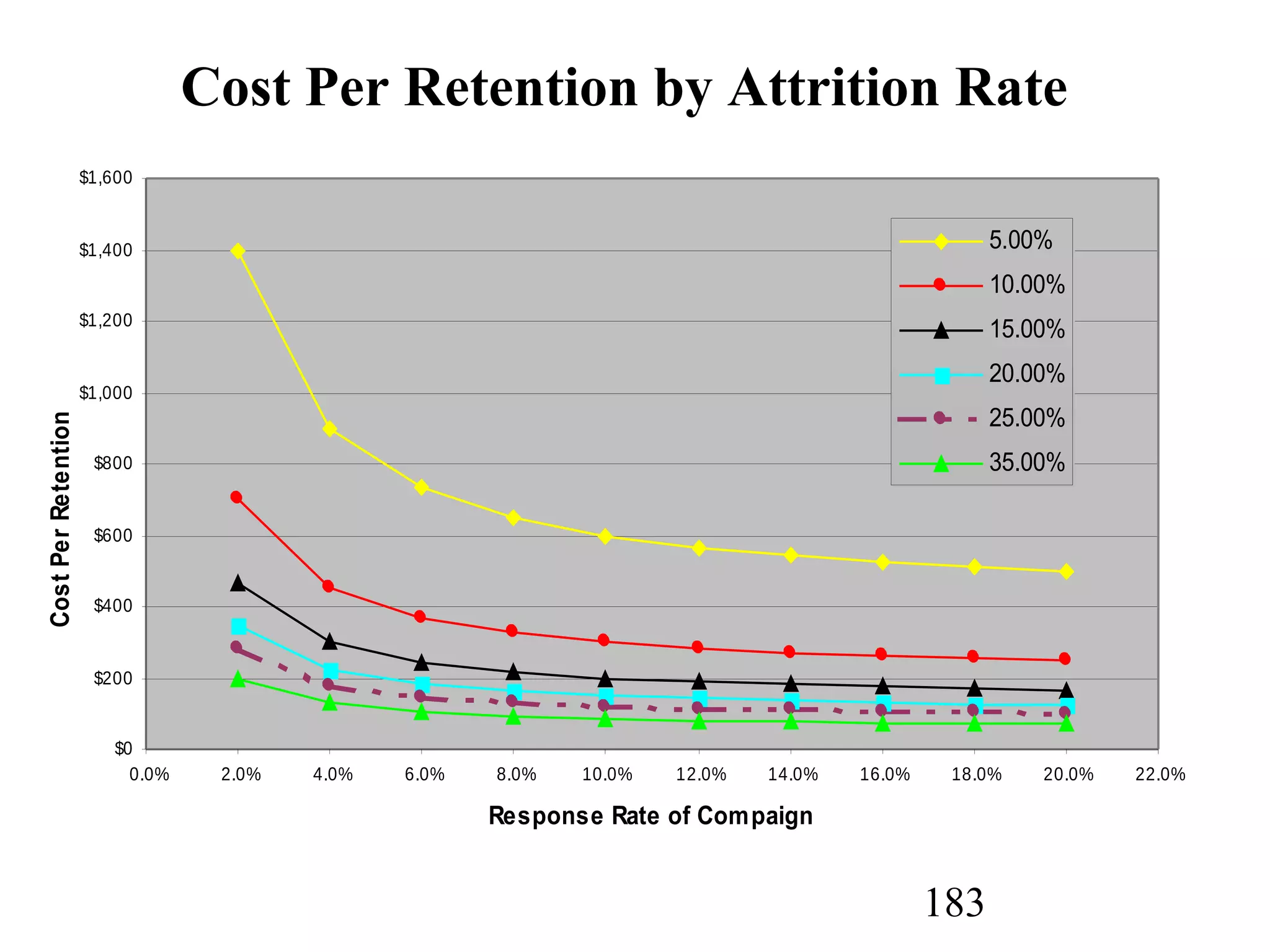

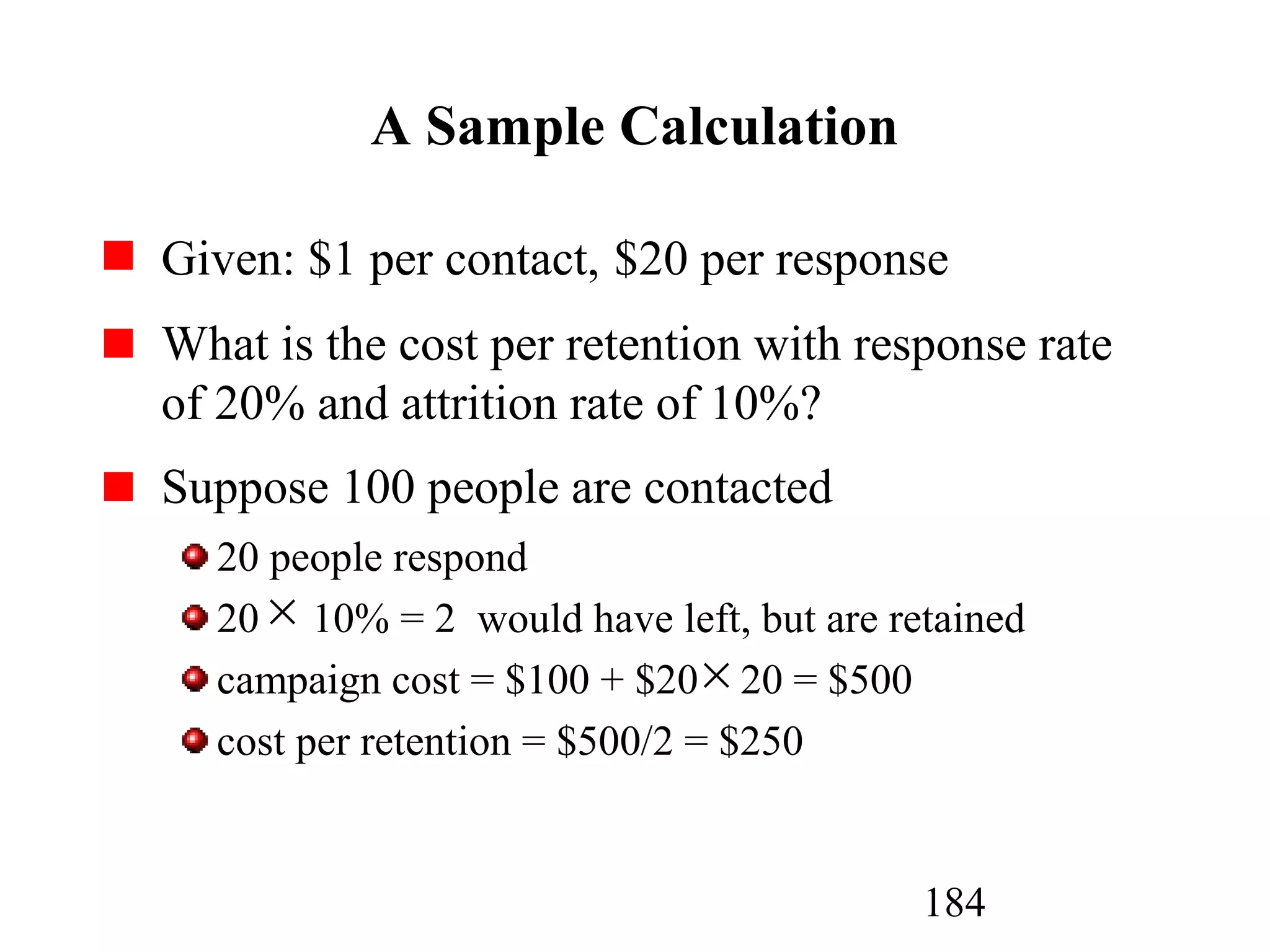

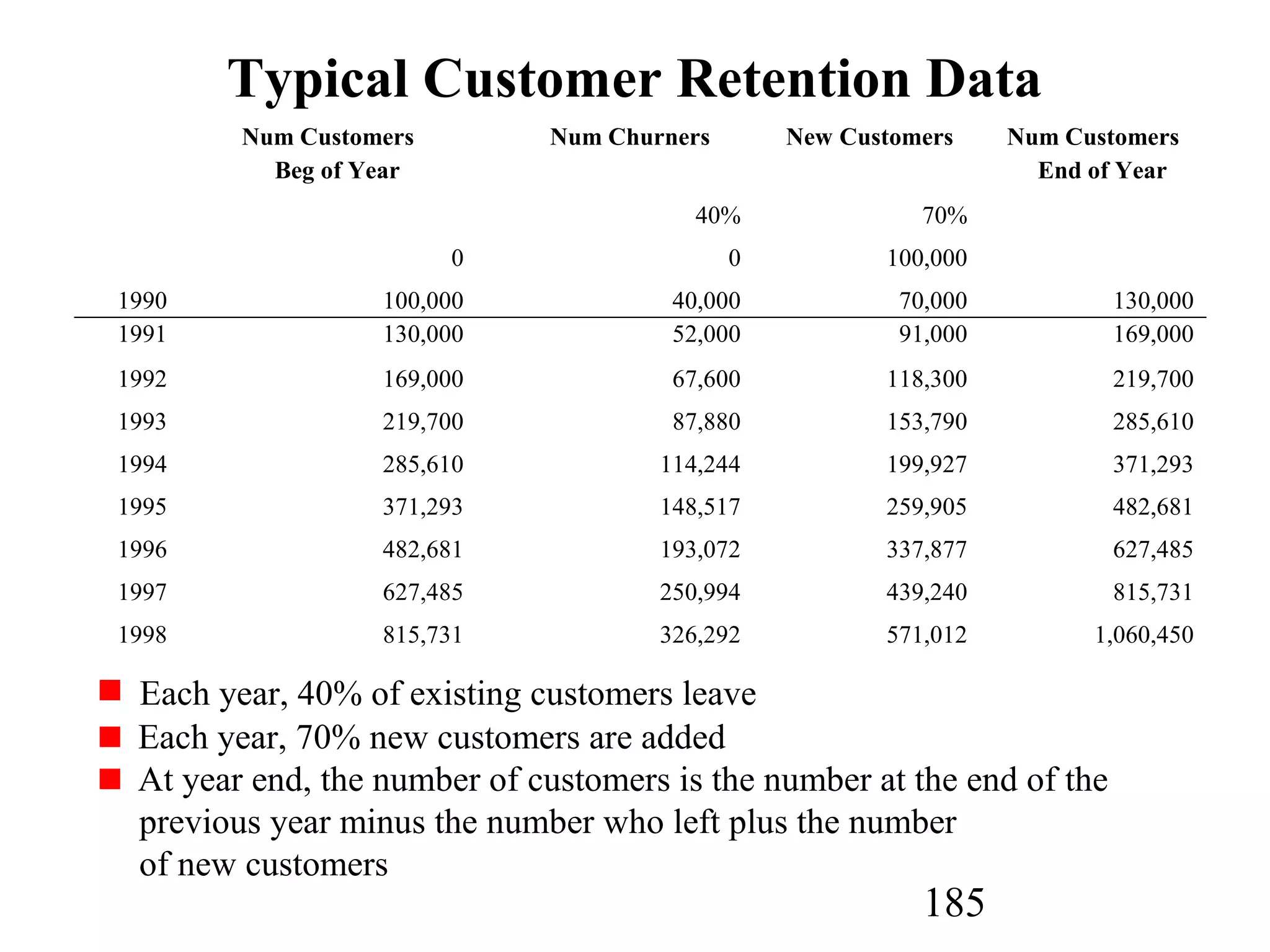

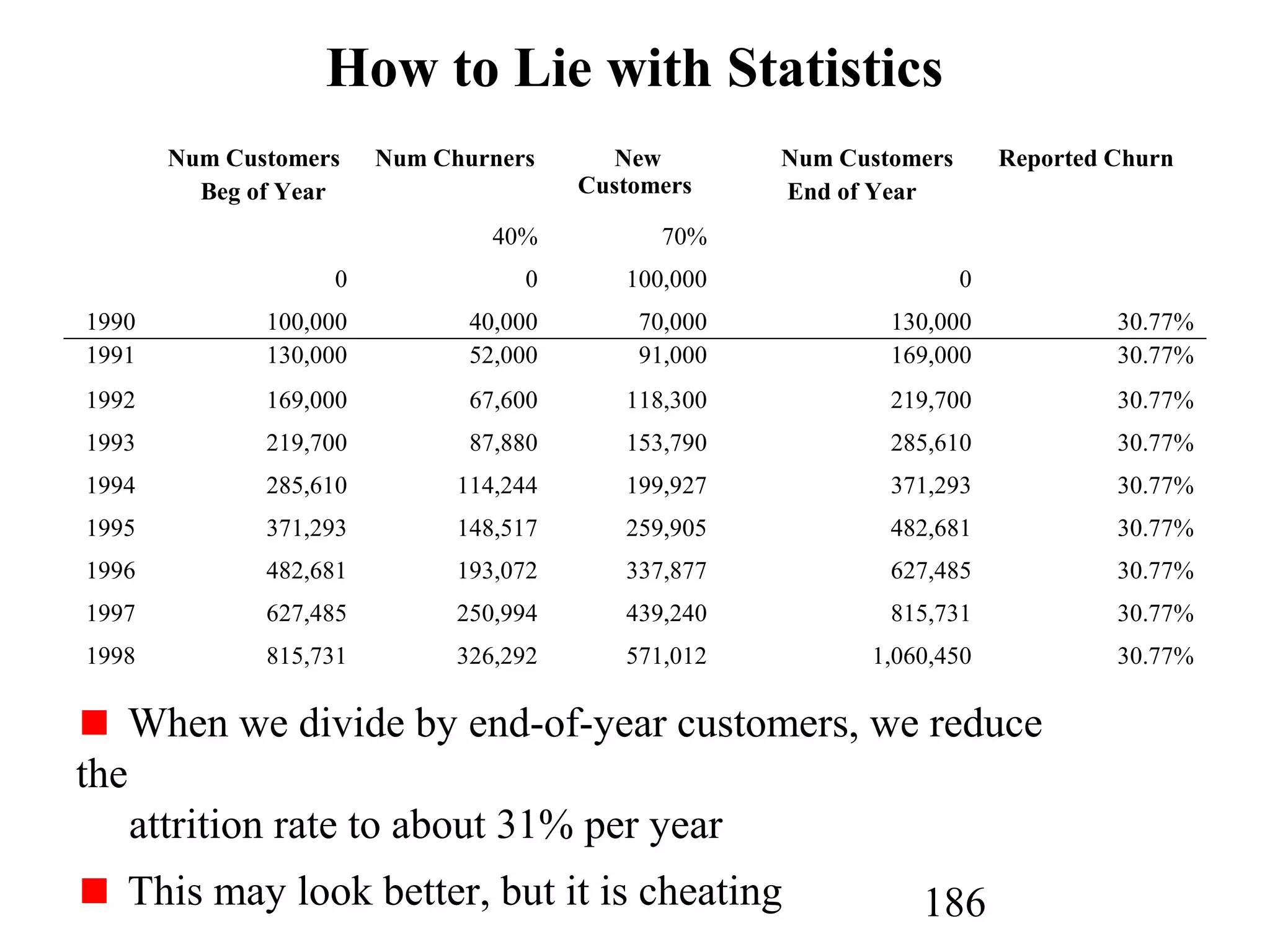

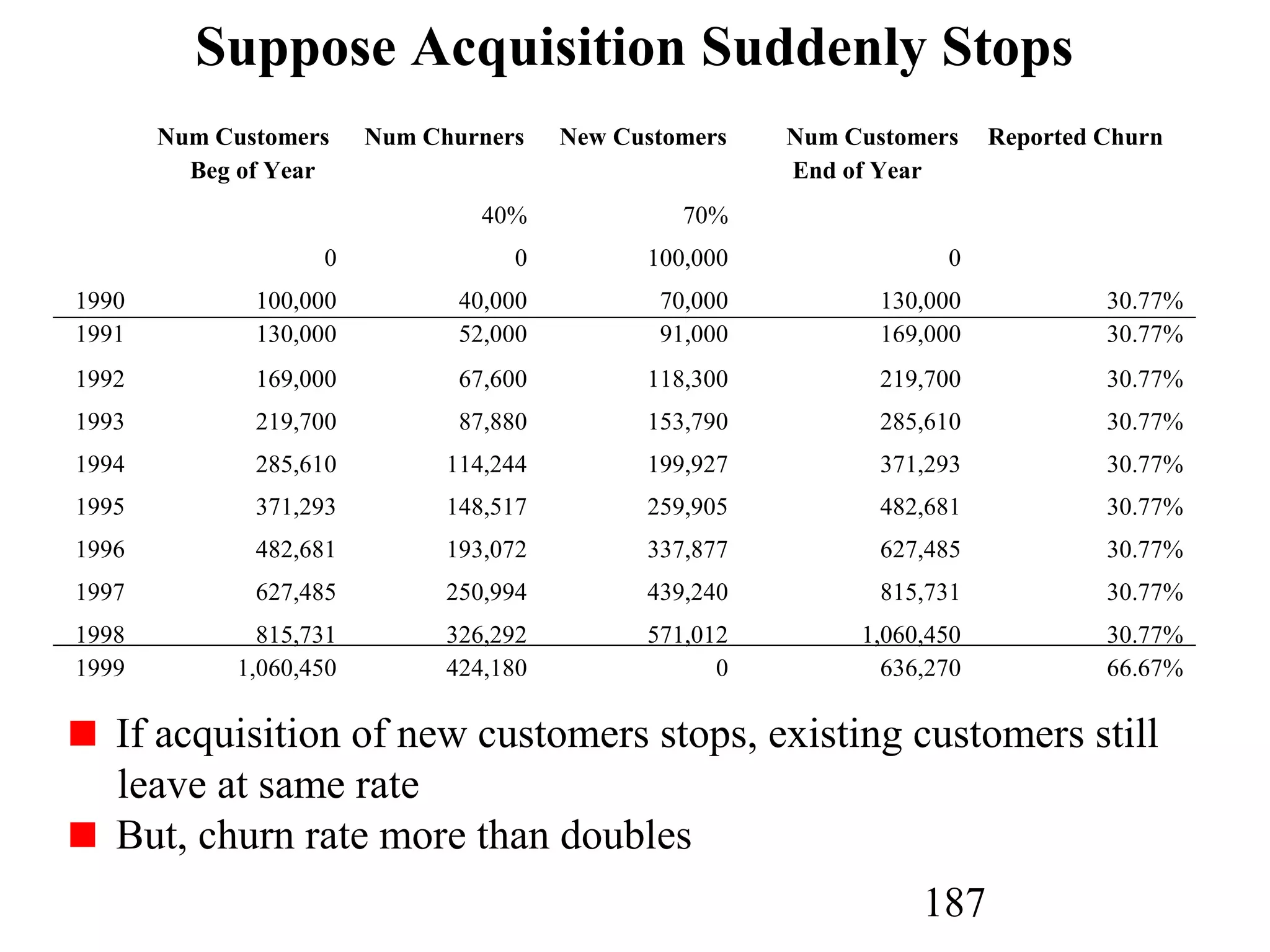

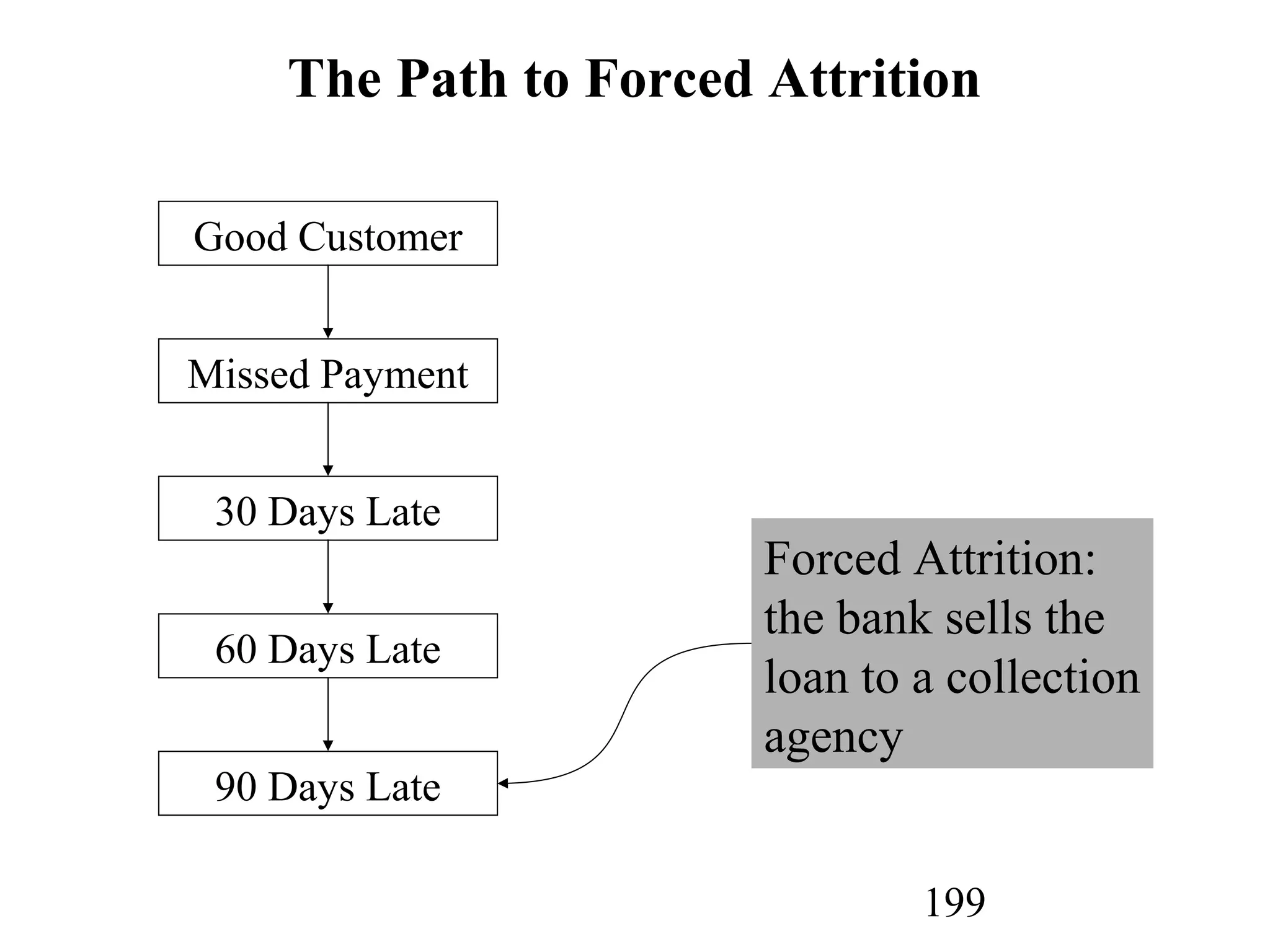

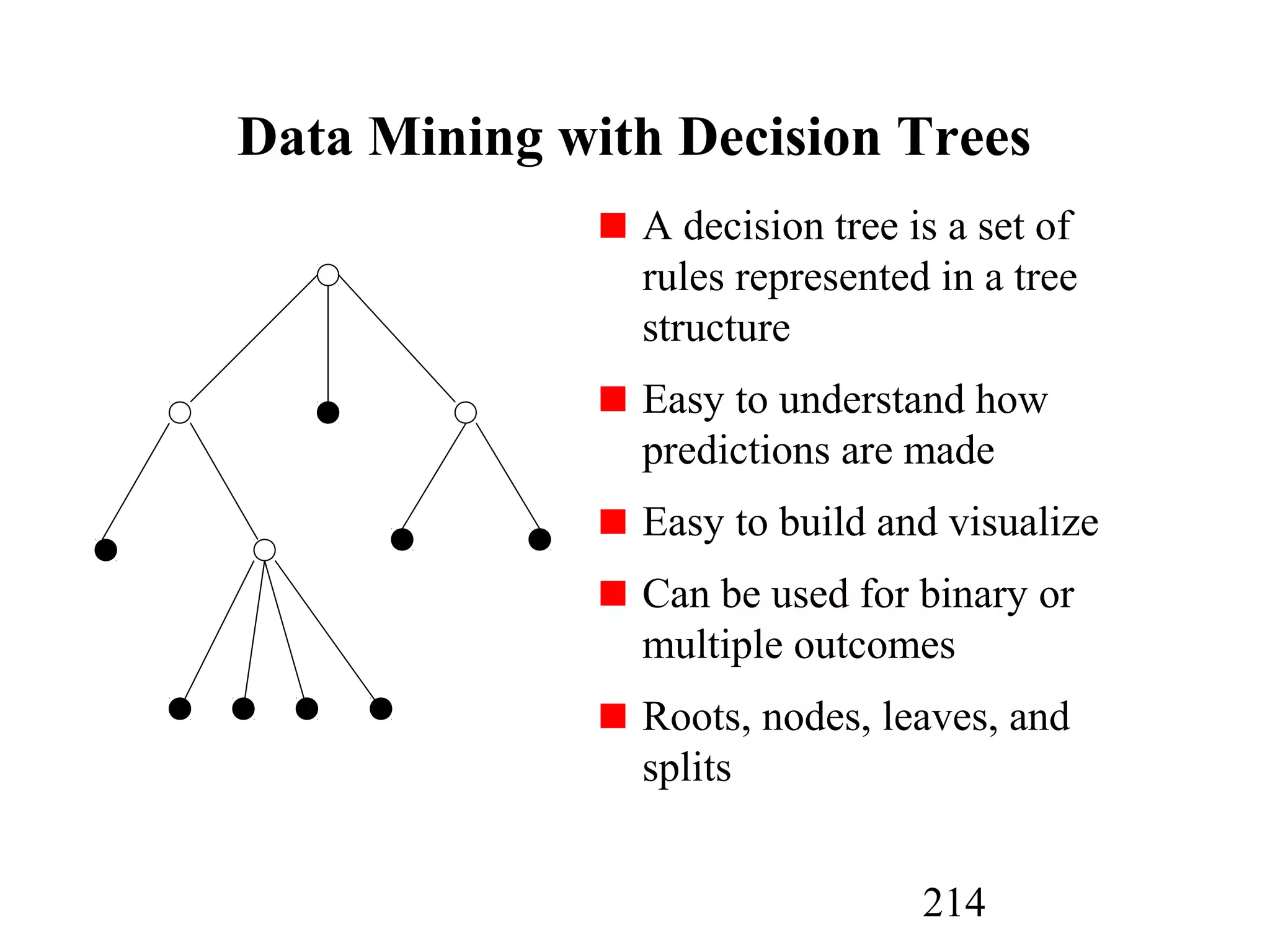

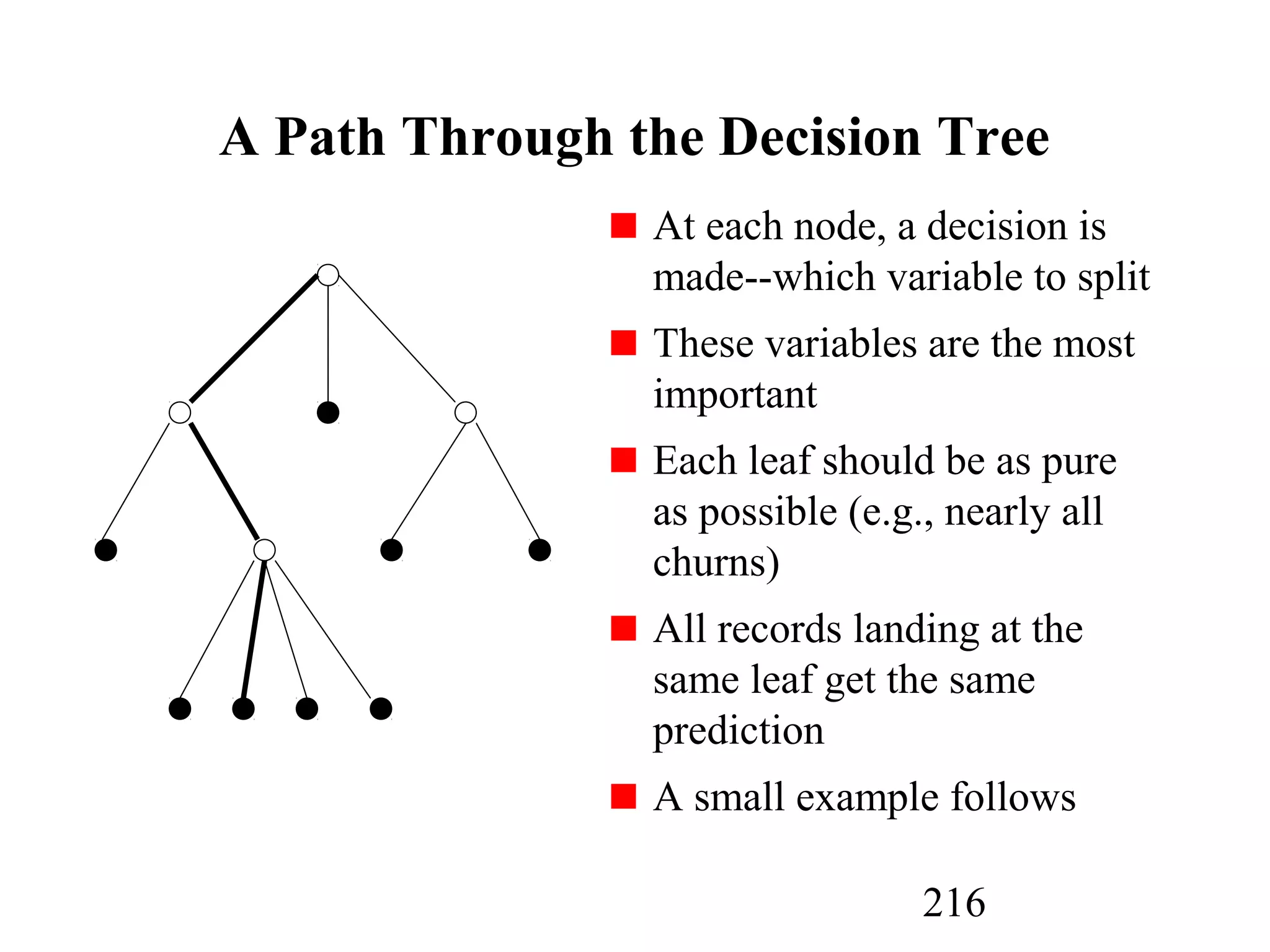

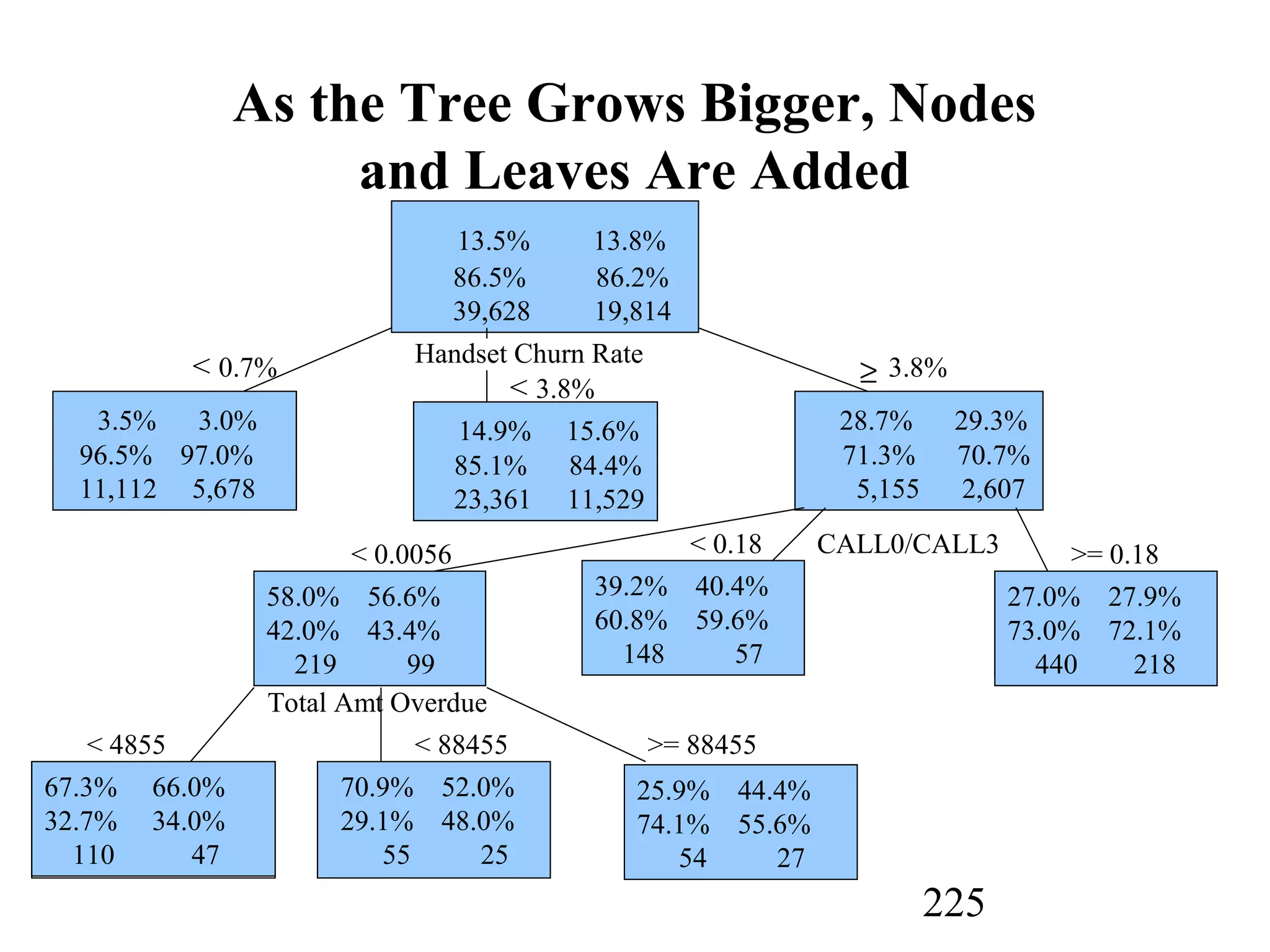

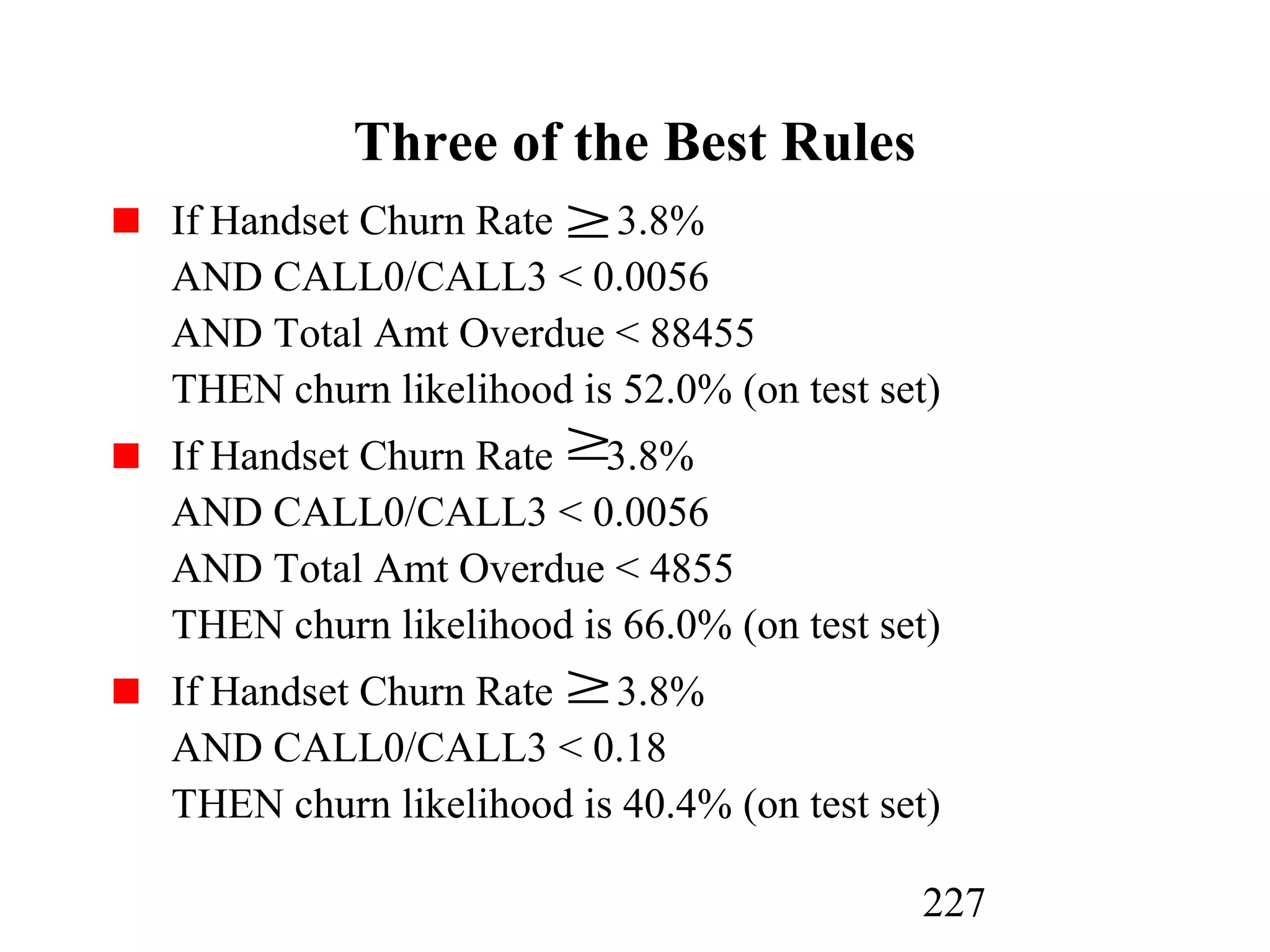

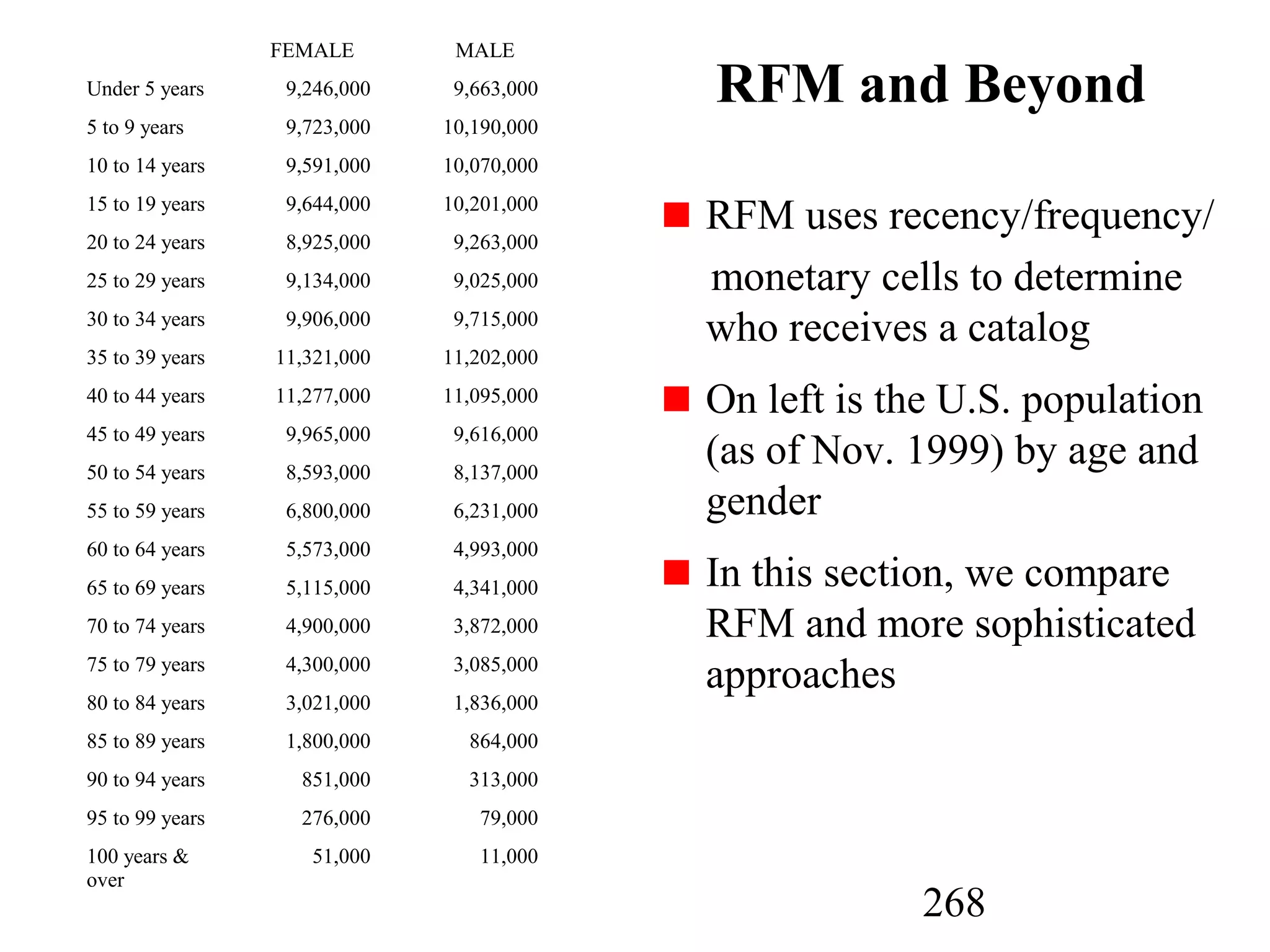

The document discusses customer relationship management (CRM) through data mining. It describes how CRM focuses on viewing customers as a company's primary asset and knowing customers across all business units and channels. CRM aims to learn from customer data generated through interactions over various channels to continuously improve the customer experience and identify opportunities. Data mining plays a key role in CRM by providing insights into customer behavior and needs to help companies better acquire, serve, and retain customers.