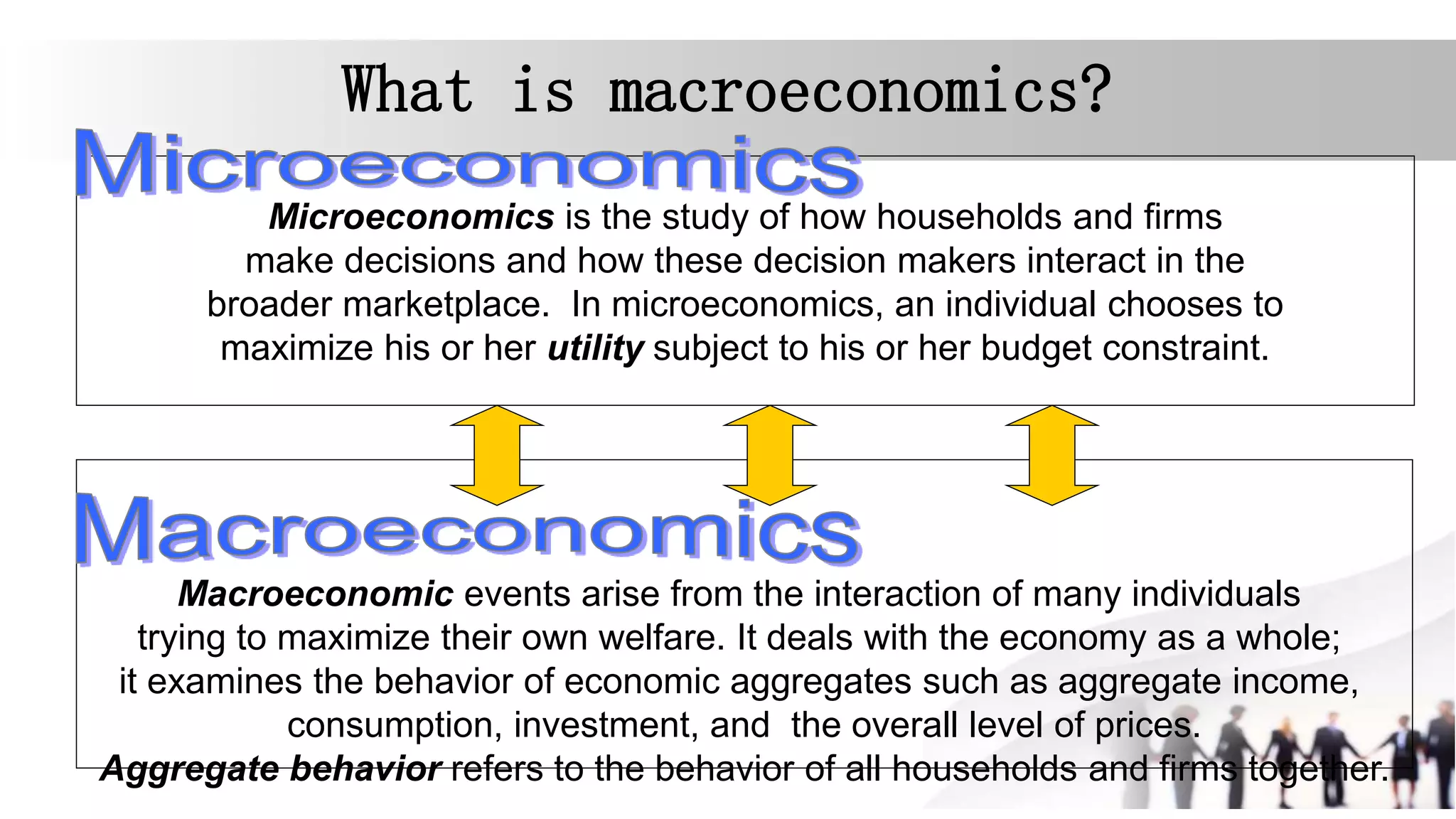

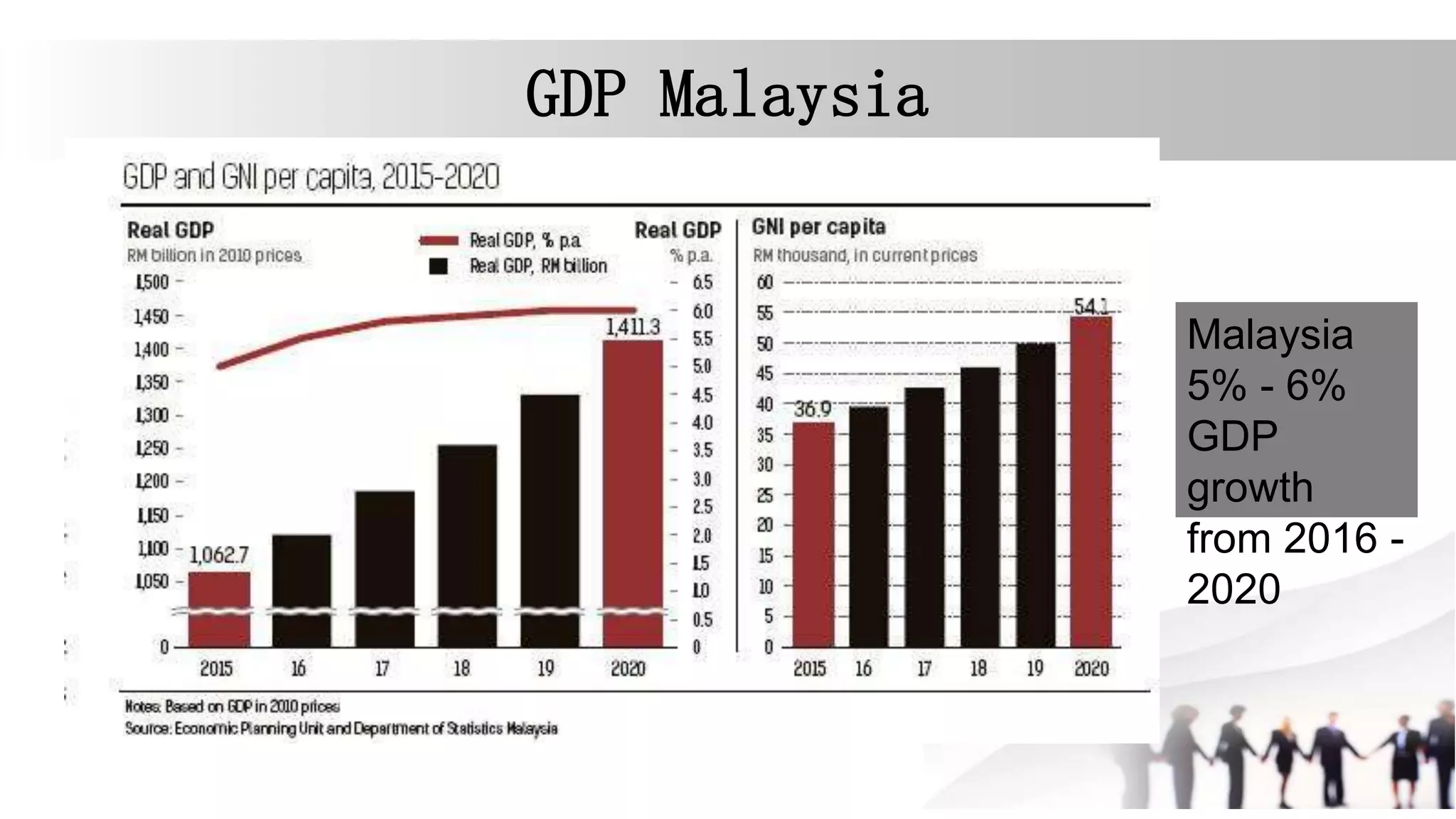

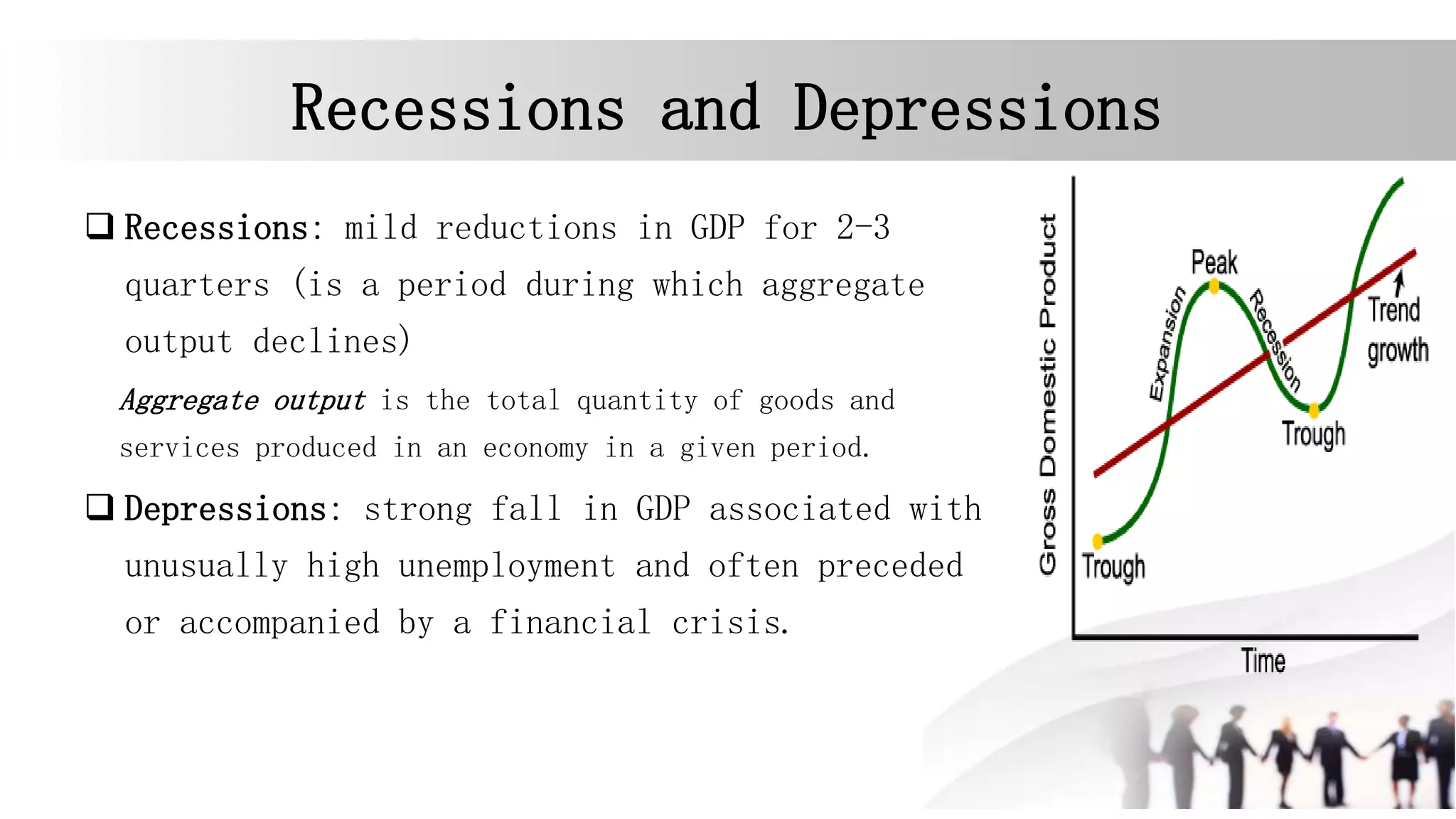

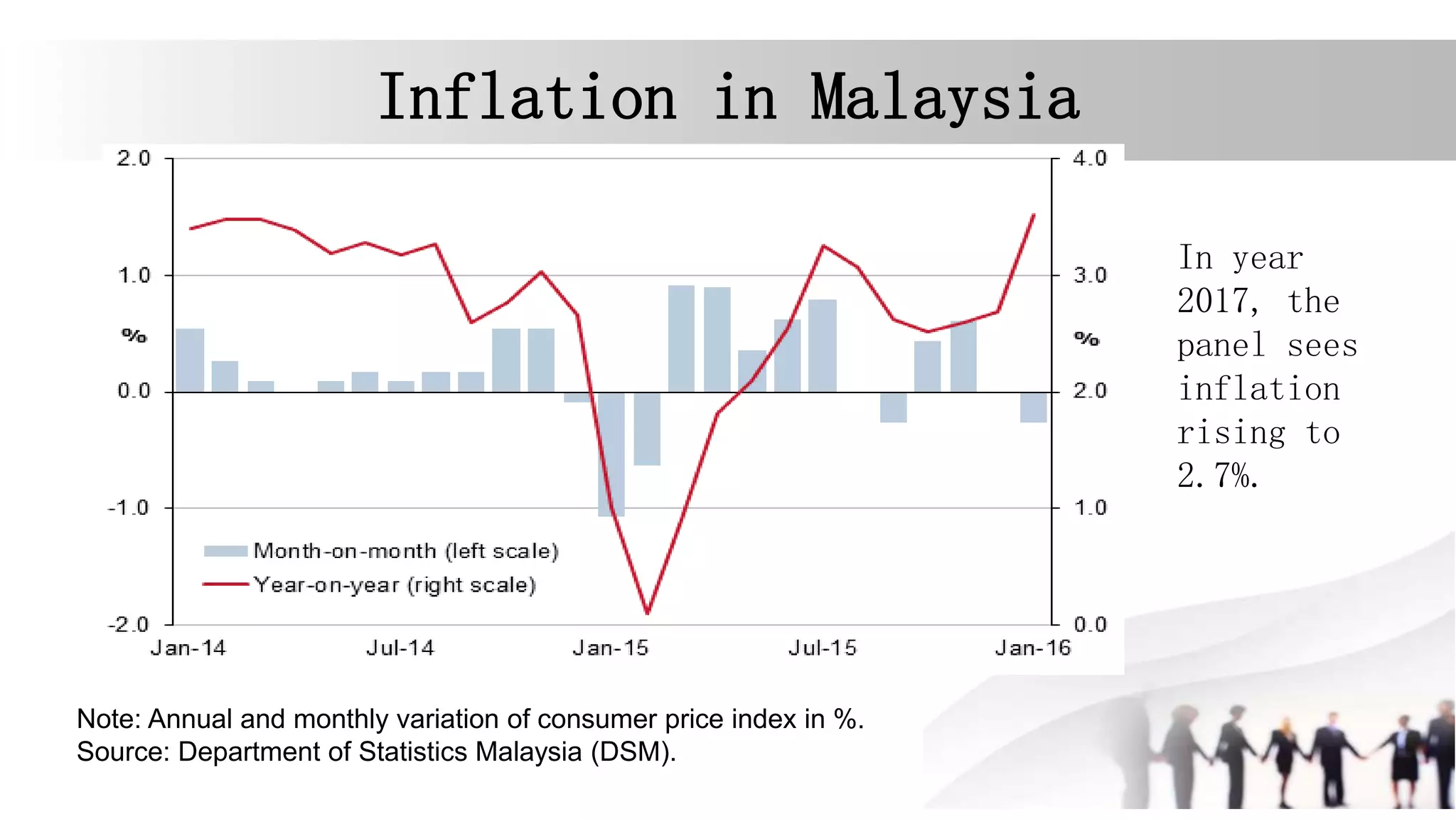

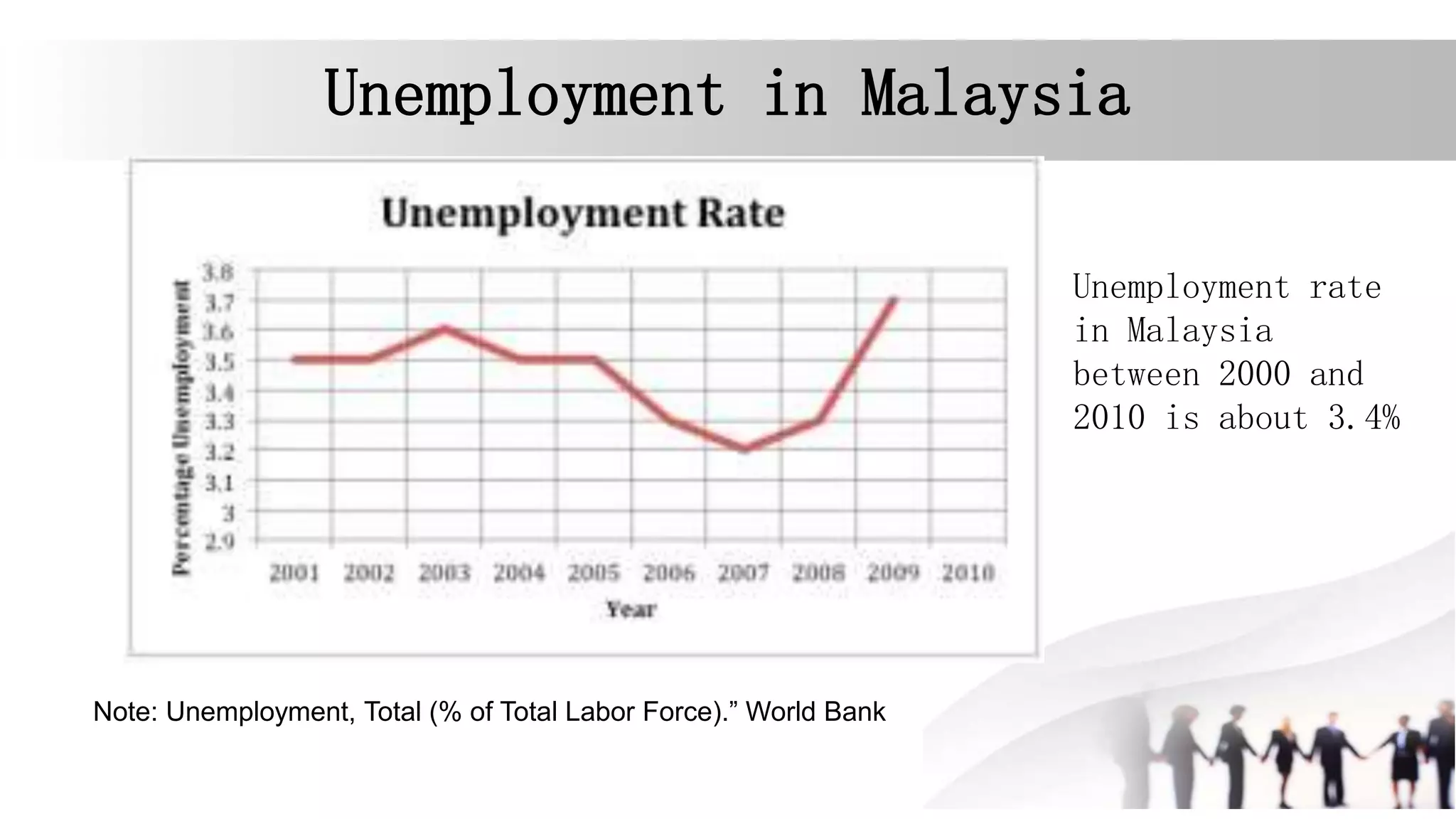

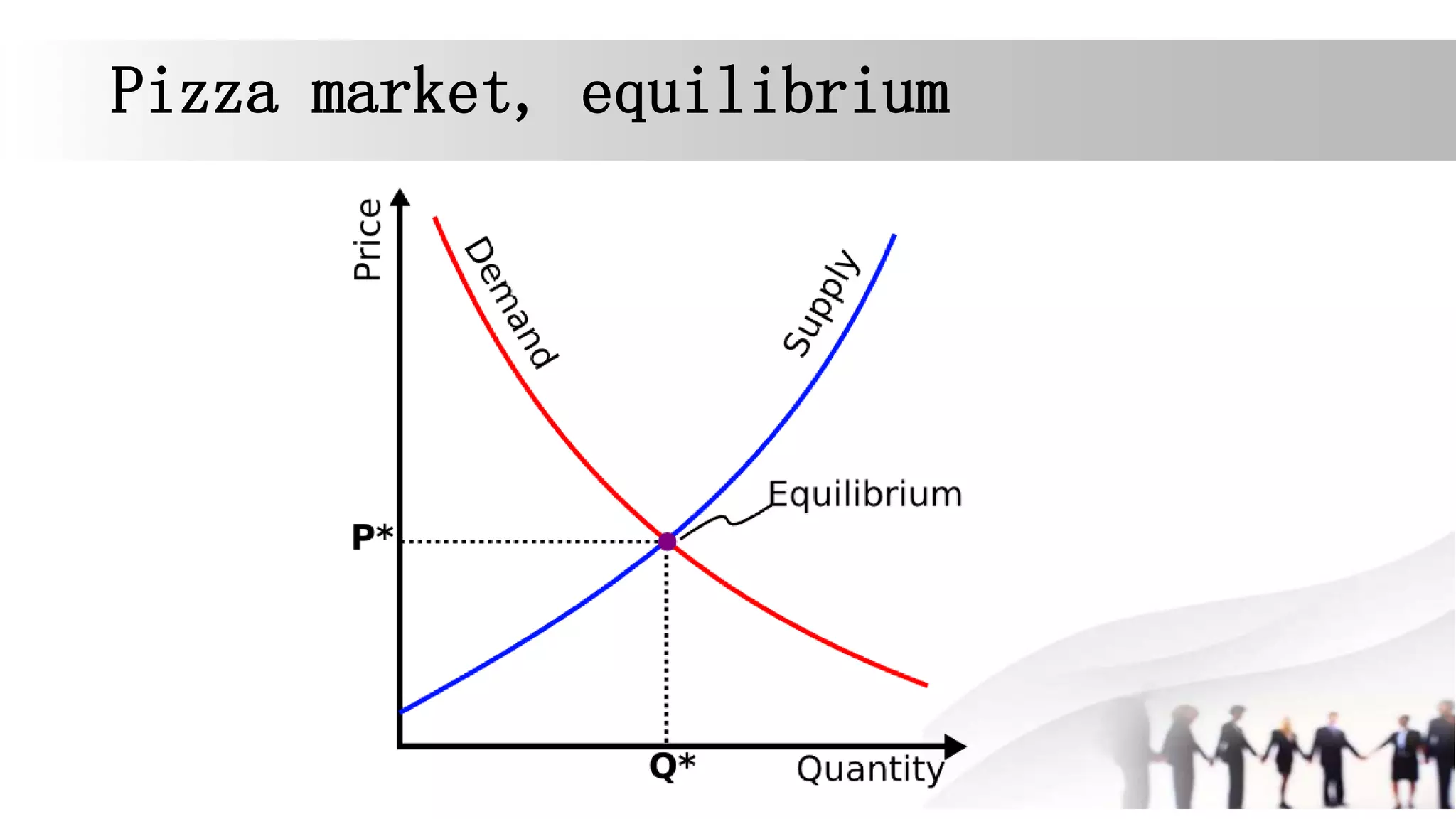

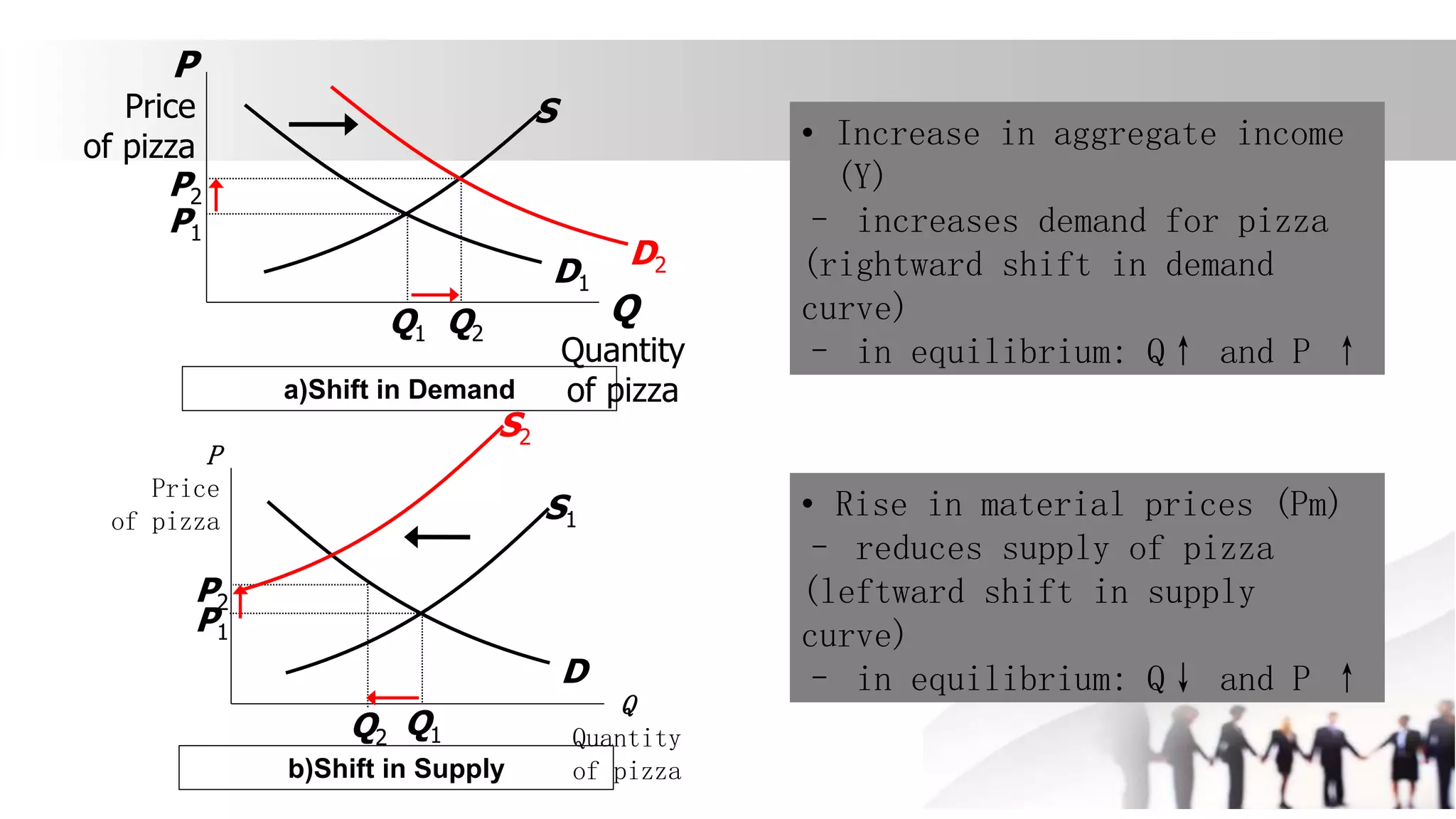

Macroeconomics examines economies at a large scale by studying aggregate variables such as output, inflation, and unemployment. It analyzes differences between the micro and macro levels. Economists use models to understand relationships between endogenous and exogenous variables in both the short-run, where prices are sticky, and long-run, where prices are flexible and technology evolves.