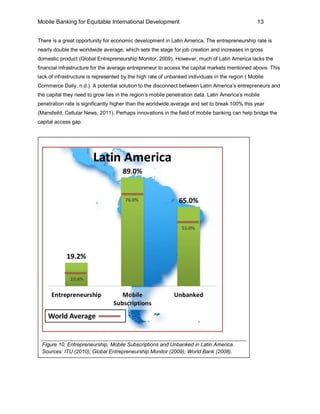

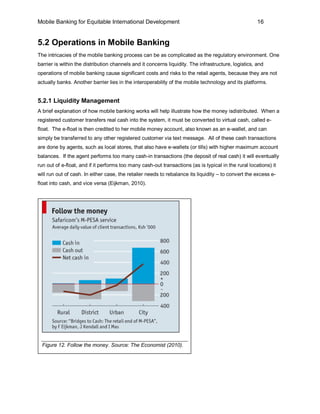

This document discusses how mobile banking can improve access to capital markets in developing countries and promote more equitable international development. It finds that while entrepreneurship and mobile phone usage are high in Africa, Asia, and Latin America, access to financial services is low. Mobile banking has the potential to increase access, but faces barriers related to regulations, operations, and fraud. The document recommends governments embrace innovative regulations and standardize platforms to address these issues. It also recommends mobile banking providers partner with other organizations to penetrate new markets and educate customers to make mobile banking exceptionally successful at alleviating poverty.