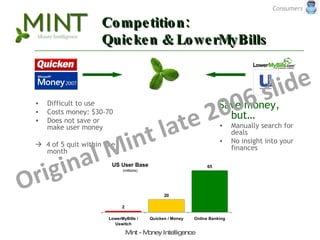

The document outlines different phases and financial considerations for startups:

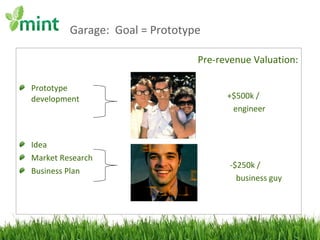

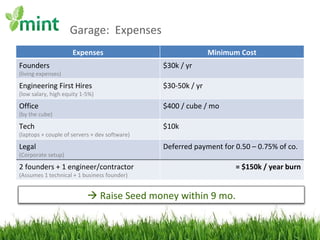

1) The "Garage" phase for prototyping with less than $100k in funding and a small founding team focusing on minimum viable product development.

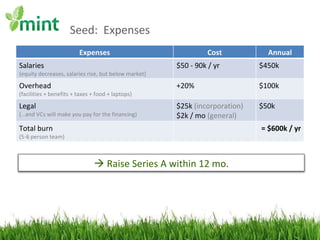

2) The "Seed" phase with under $1M in funding to build an alpha product and hire 5-6 employees focusing on product launch and revenue projections.

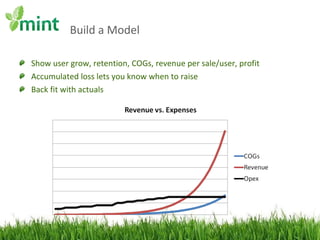

3) The "Funded" phase with over $1M in funding to scale the business with 30 employees, focusing on product growth and becoming profitable within 2 years.