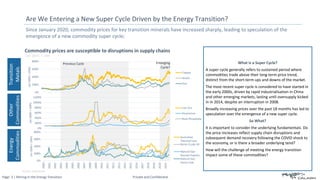

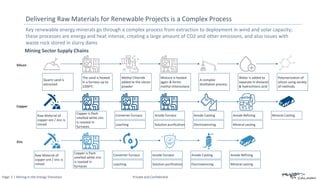

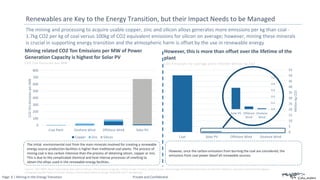

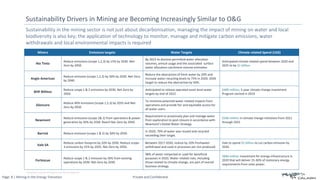

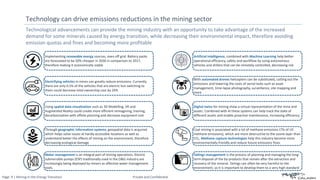

The report discusses the vital role of the mining sector in the energy transition, emphasizing the growing demand for key commodities like copper and lithium, which are essential for renewable energy technologies. It highlights the environmental challenges associated with mining, including high carbon emissions and water usage, and the need for innovative technologies to address these issues. Additionally, the document speculates on the potential for a new commodity super cycle driven by the energy transition, given the complexities of the supply chains and regulatory scrutiny following recent mining incidents.