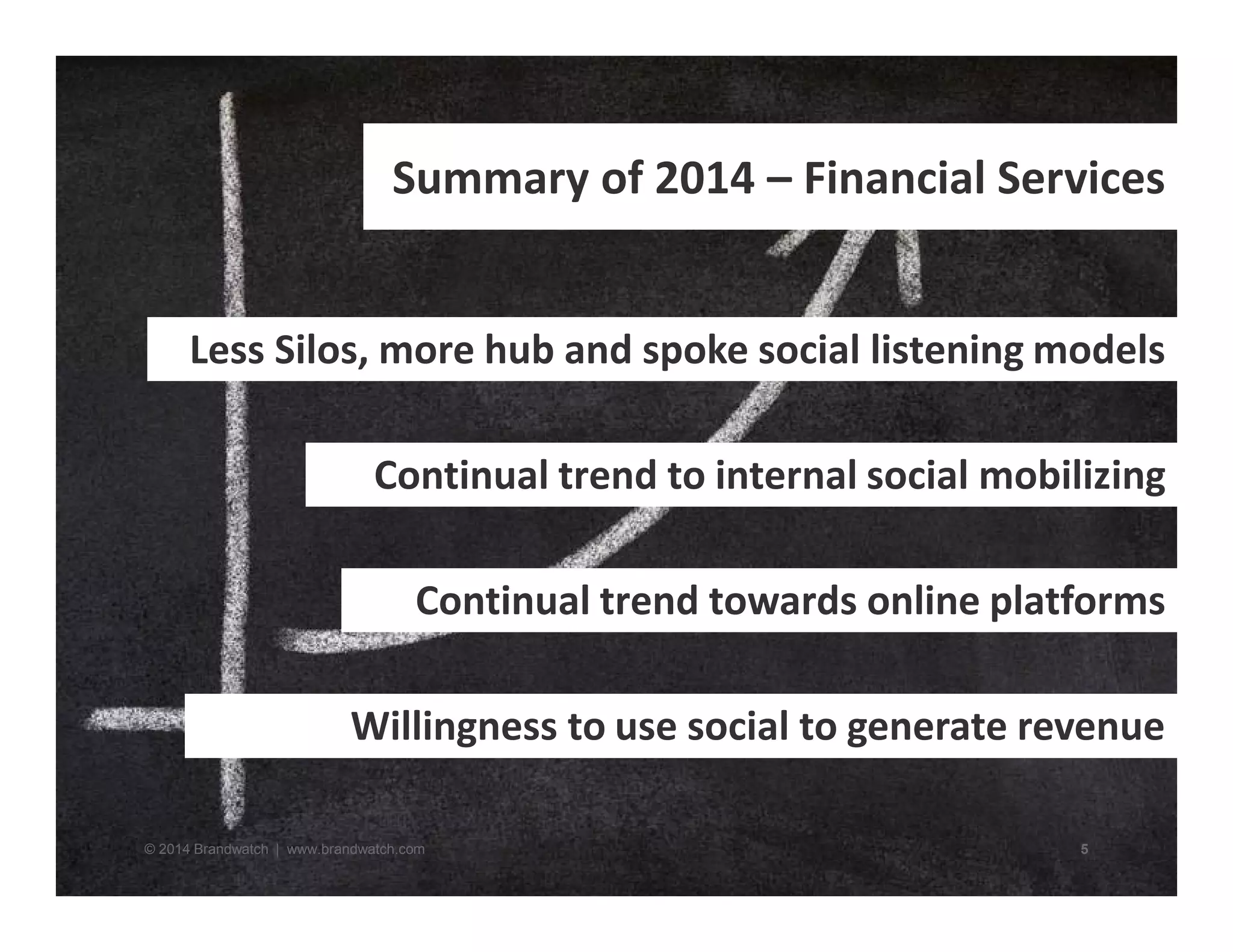

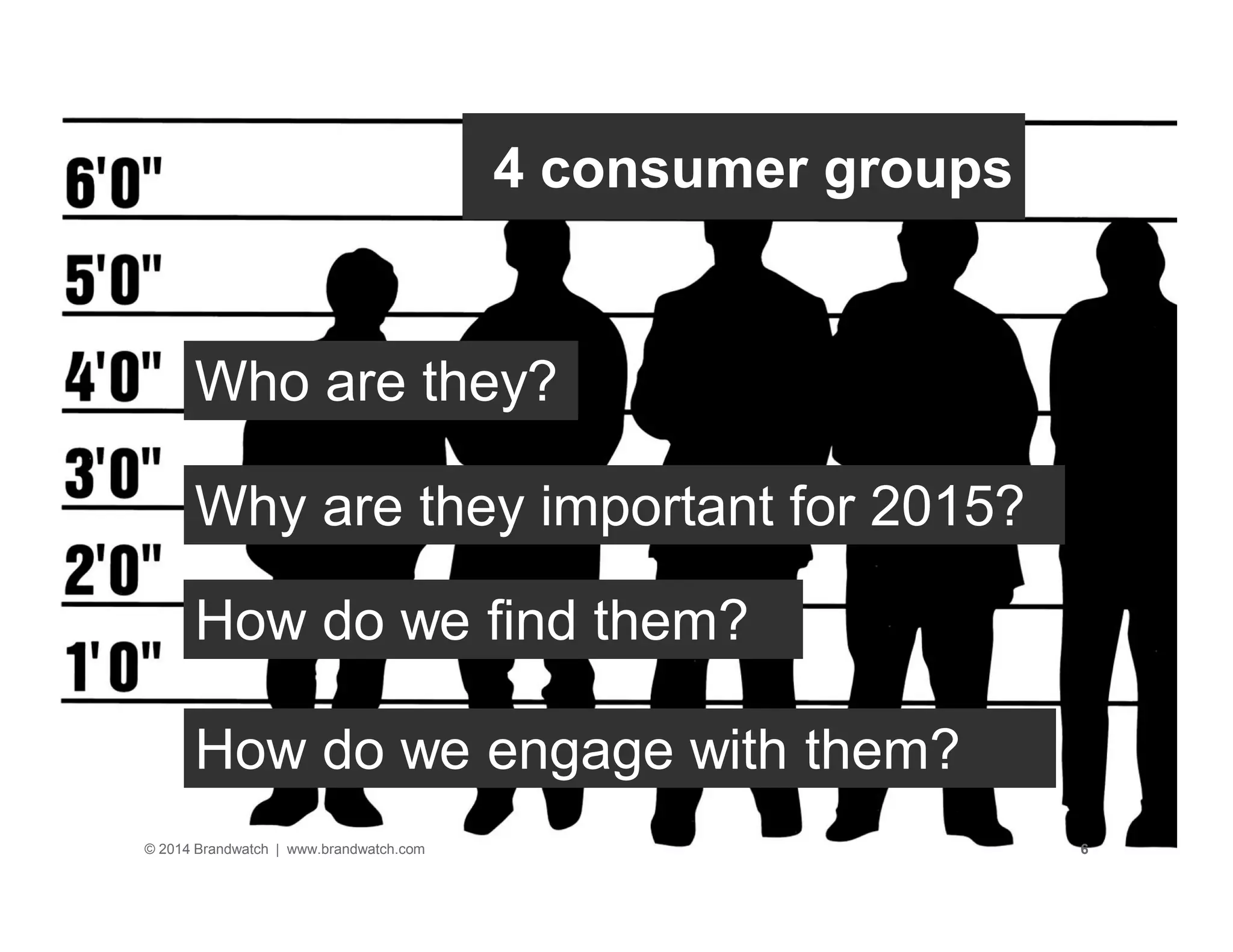

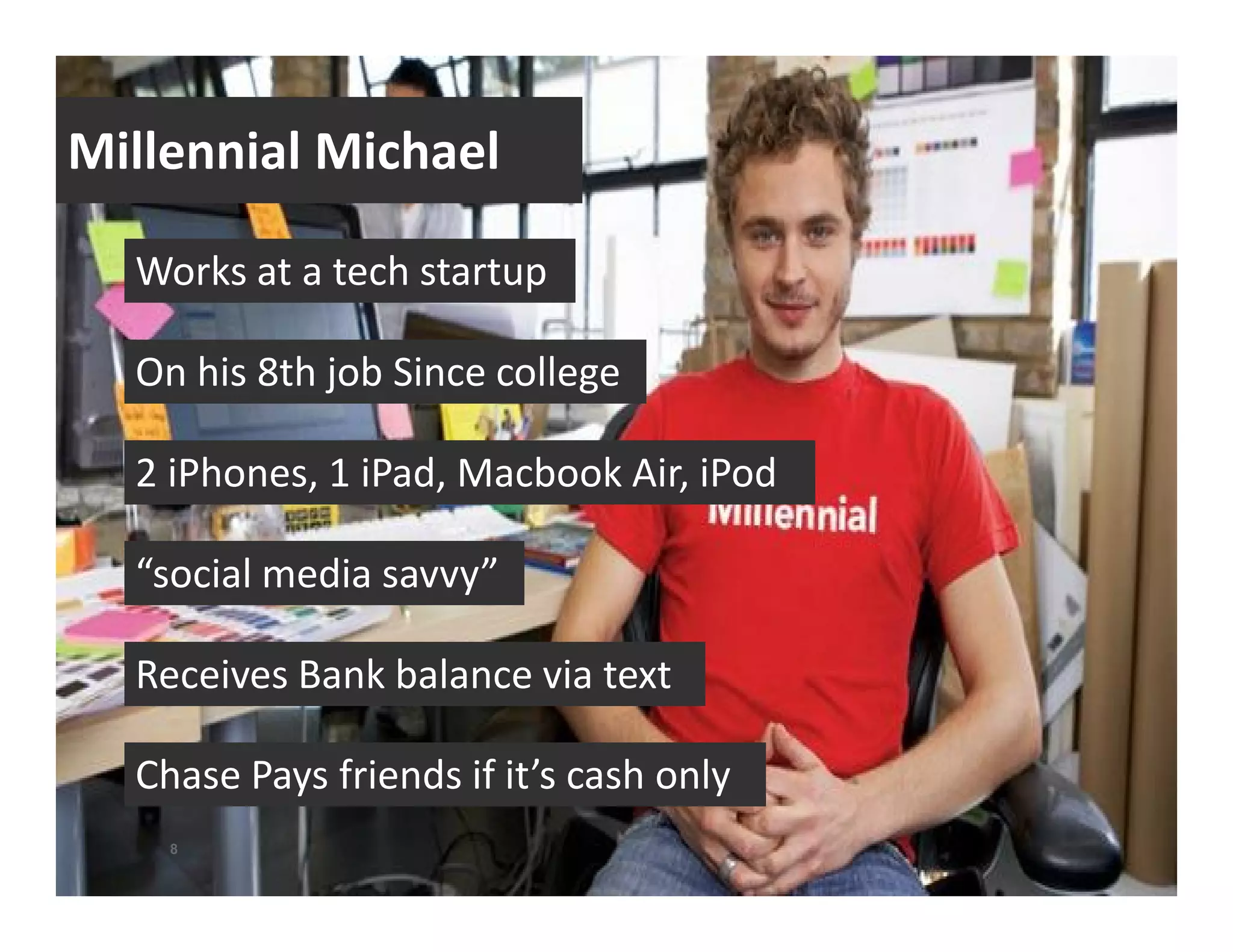

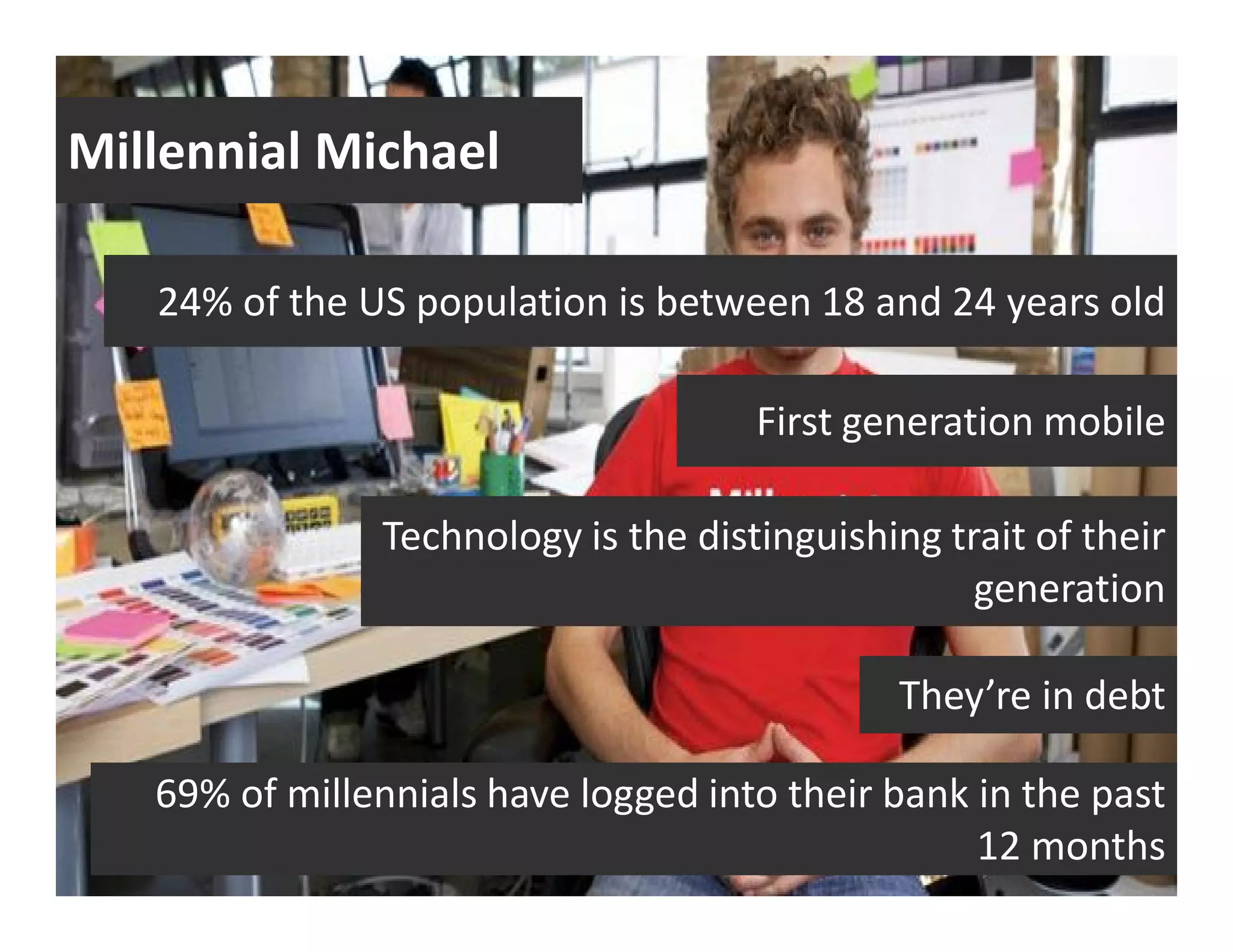

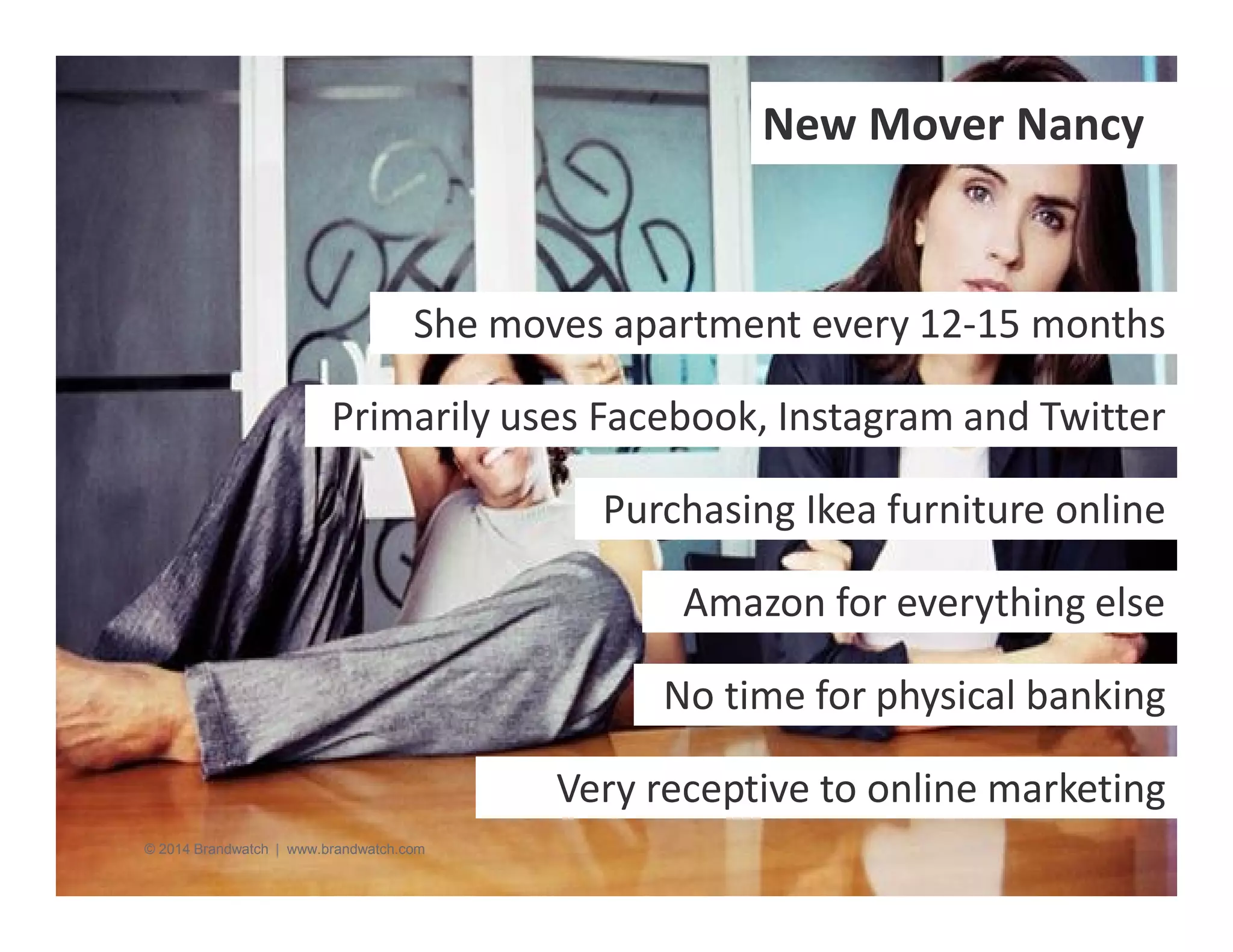

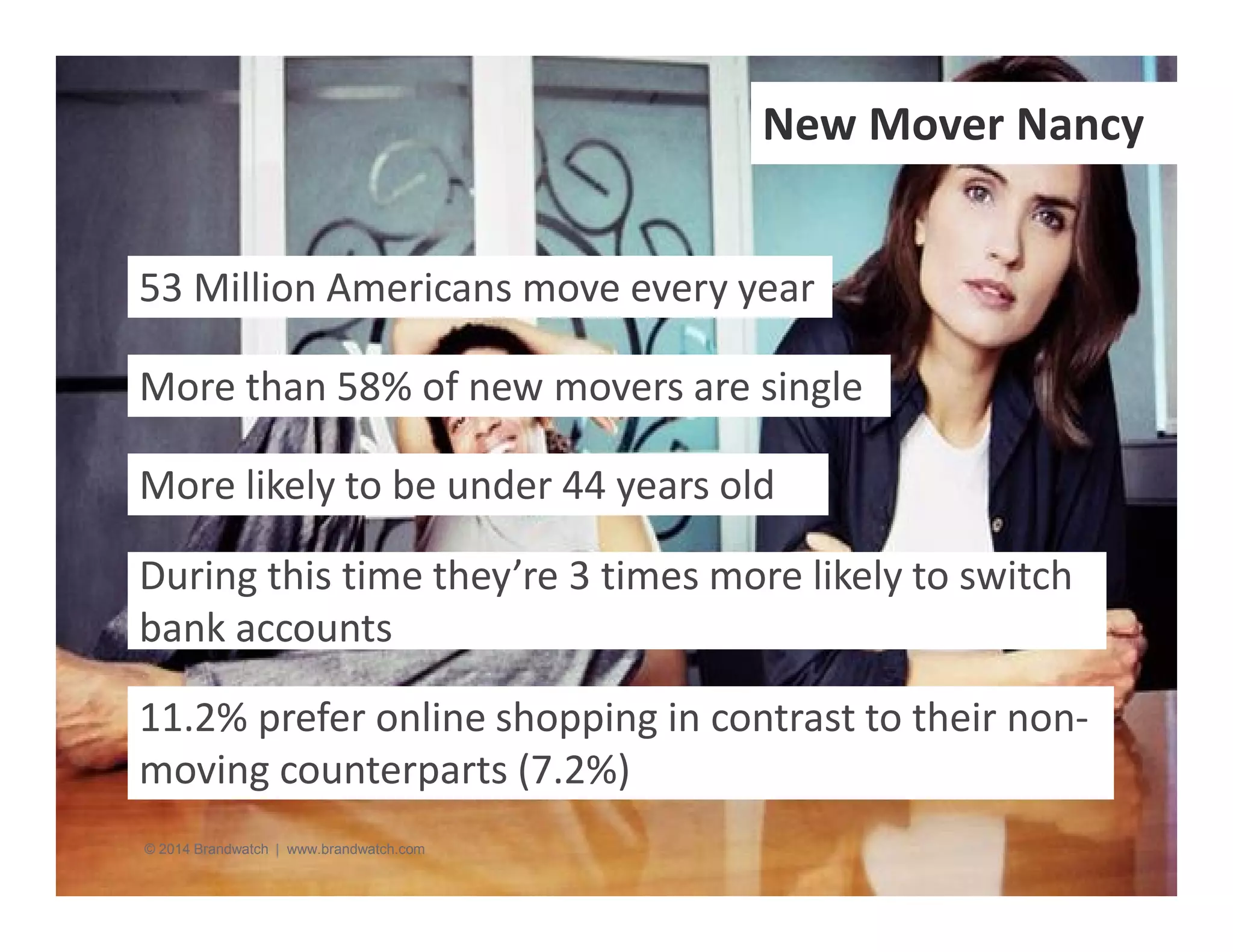

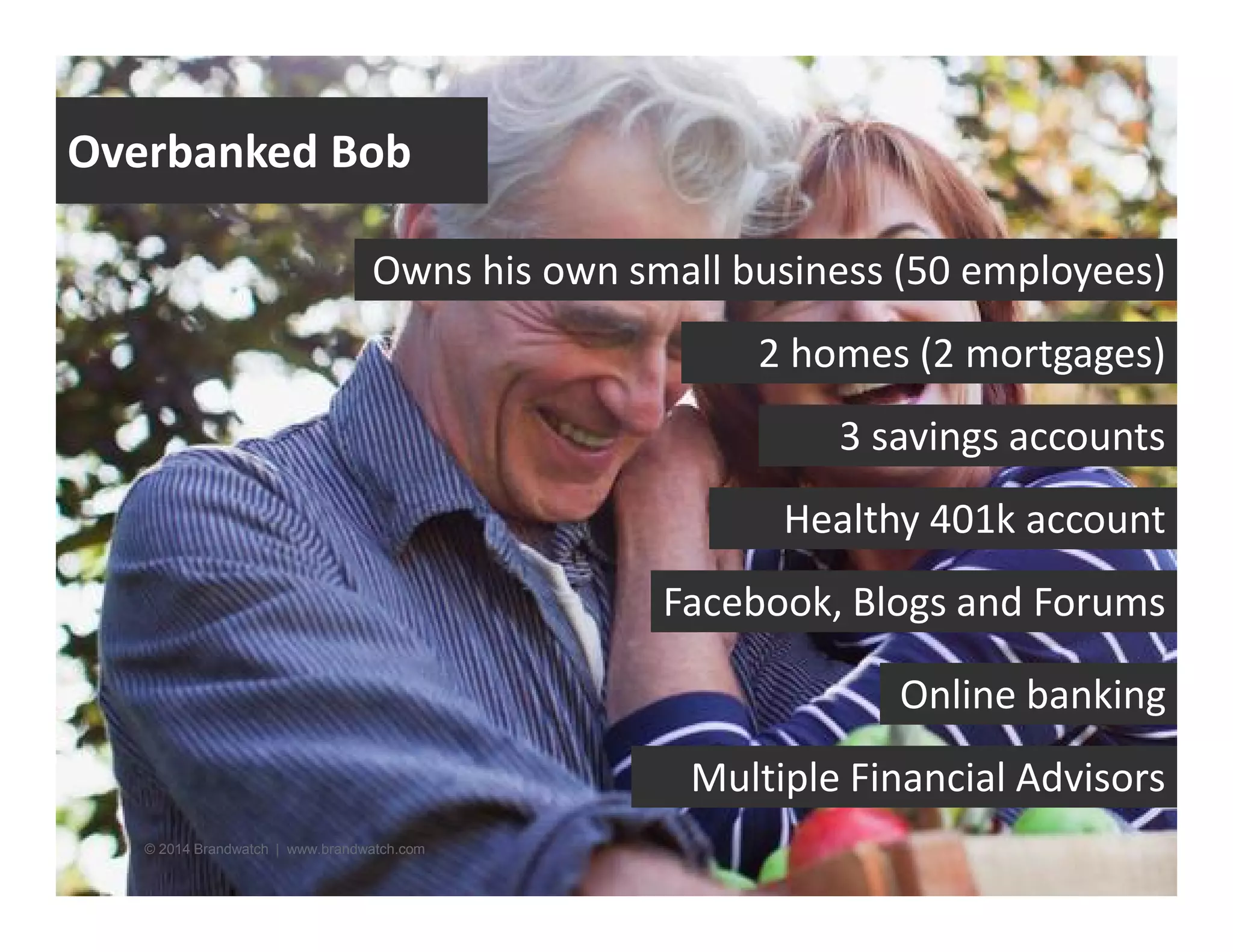

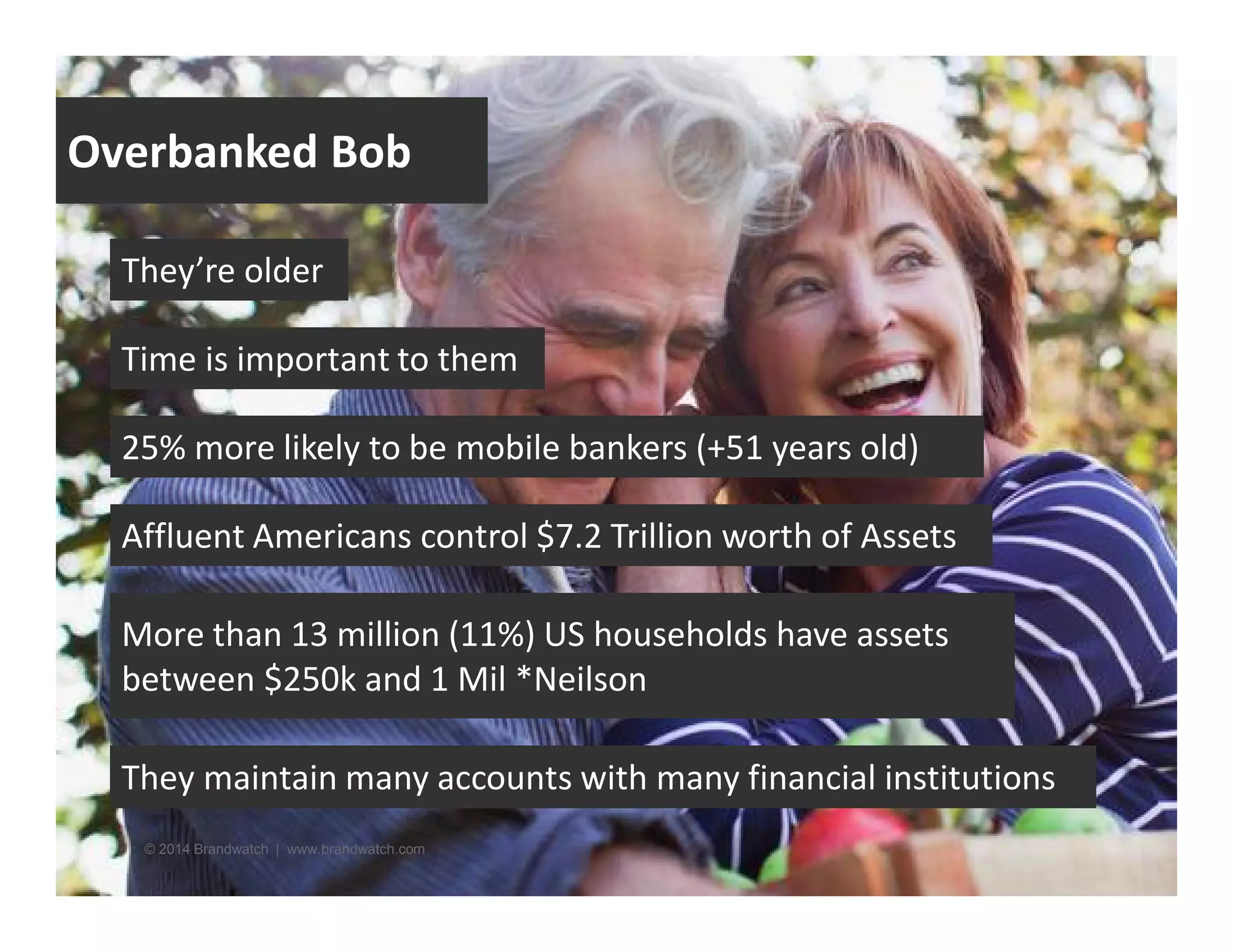

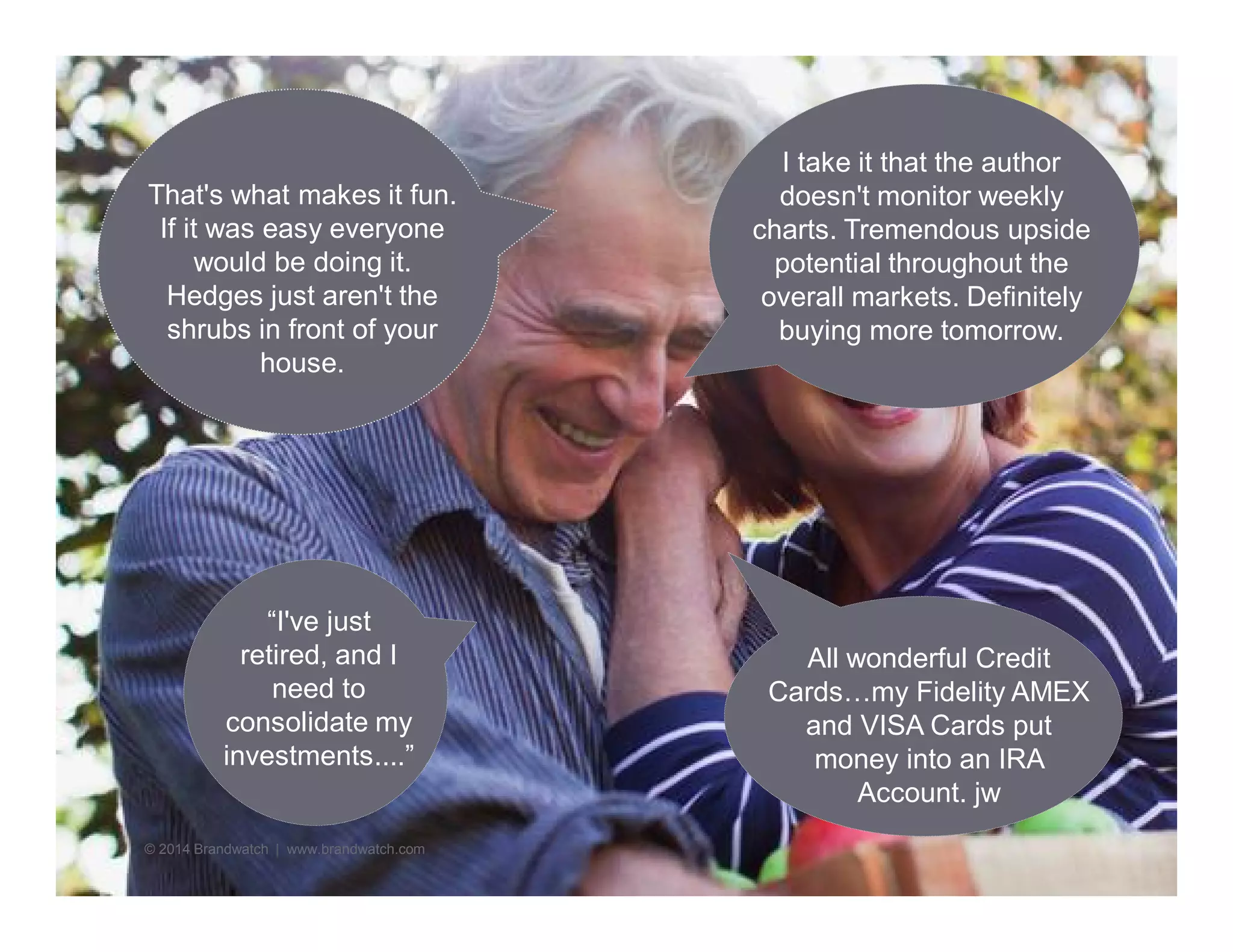

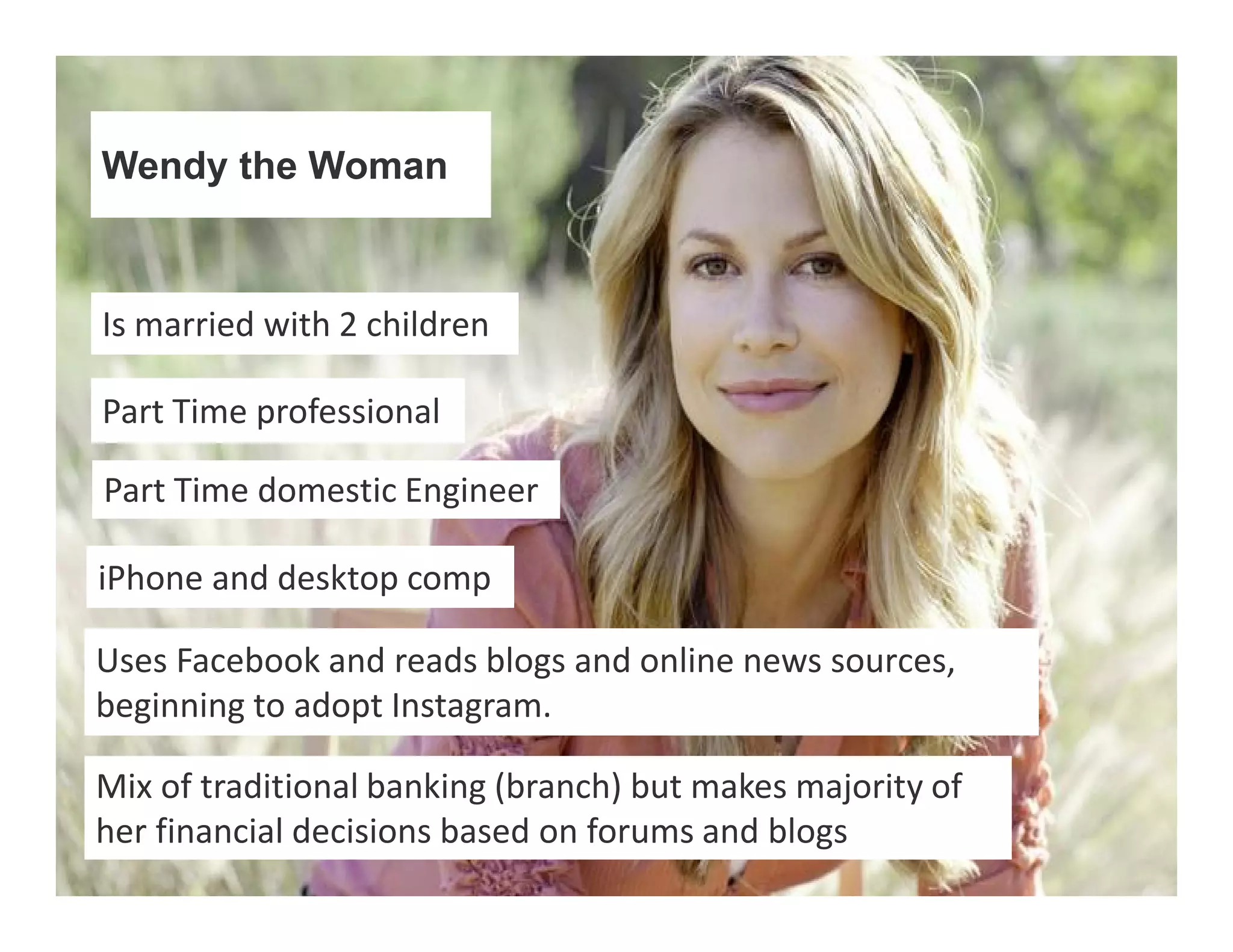

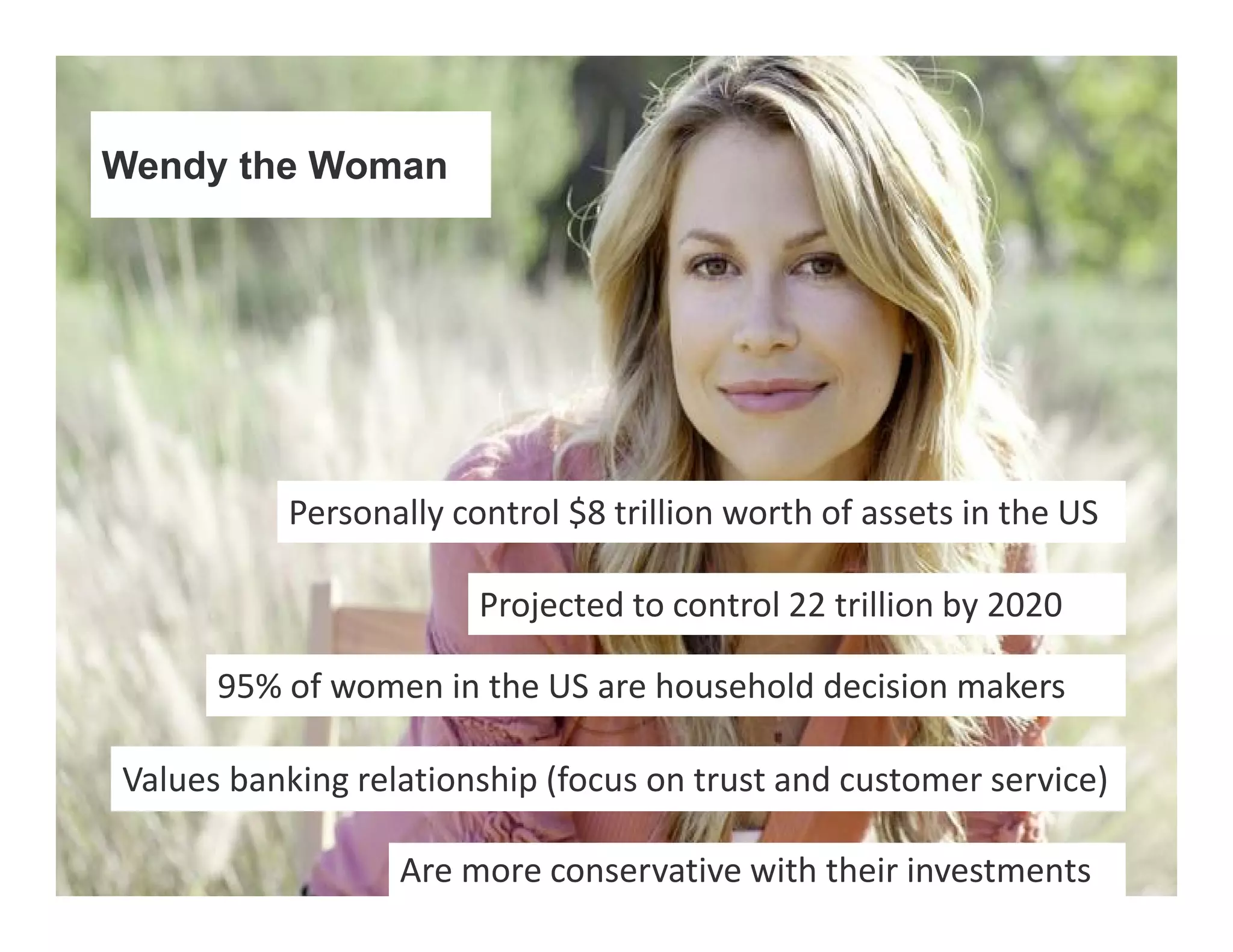

The document discusses trends in the financial services industry and identifies four key consumer groups: millennials, new movers, the overbanked, and women. It notes that millennials are heavily influenced by mobile technology, new movers are likely to switch banks during a move, the overbanked have many accounts and assets, and women control a large portion of household spending. The document advocates understanding these groups through social listening and customizing engagement on social media to attract customers.