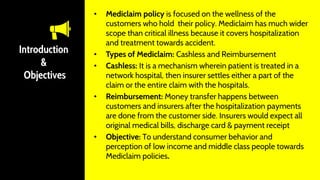

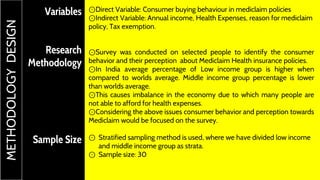

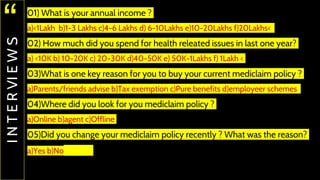

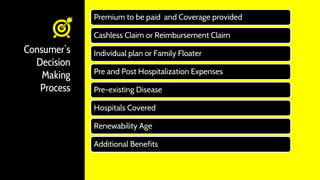

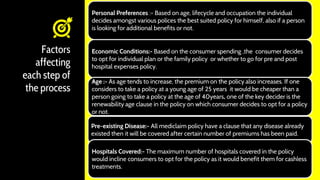

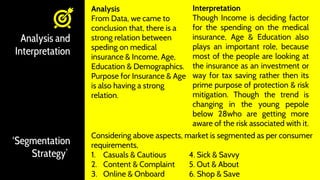

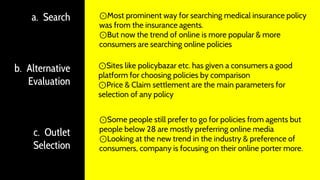

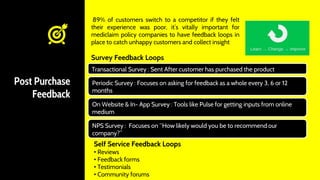

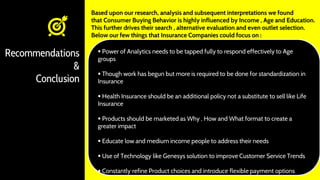

The document analyzes consumer behavior and perceptions of low and middle-income individuals towards mediclaim policies in India, highlighting the differences in income and health expenditure. A survey was conducted to understand factors affecting buying decisions, revealing that income, age, and education significantly influence choices in mediclaim policies. Recommendations include enhancing online presence, utilizing analytics, and educating consumers about health insurance options.