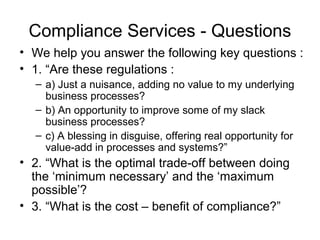

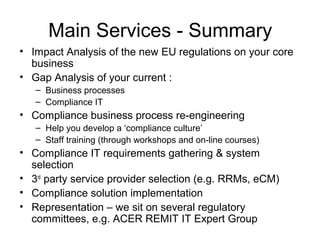

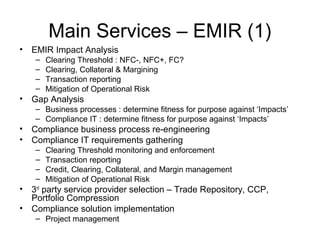

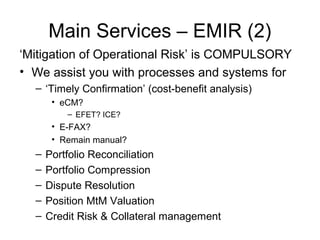

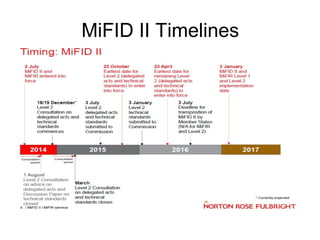

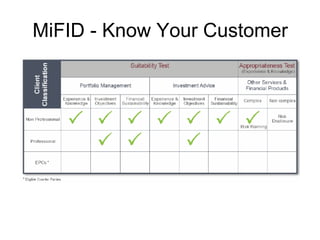

This document summarizes the regulatory compliance services offered by Maitland Energy Consulting Ltd regarding key European energy market regulations. They help clients understand the impacts of EMIR, MiFID I & II, and REMIT regulations, identify gaps in business processes and IT systems, and implement optimized compliance solutions. Their services include impact and gap analyses, process reengineering, provider selection, implementation support, and representation on regulatory committees. Timelines for compliance under each regulation are also presented.