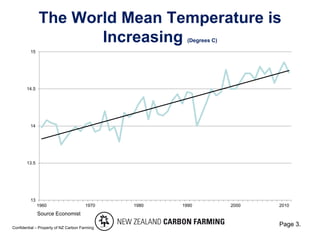

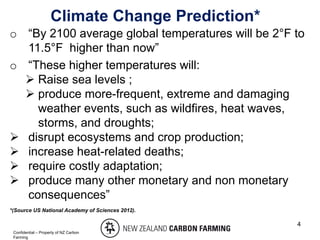

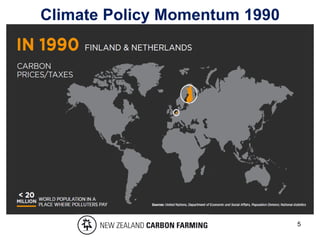

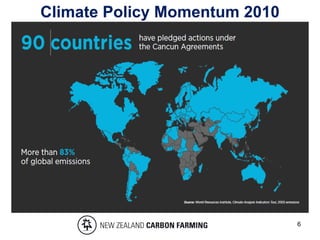

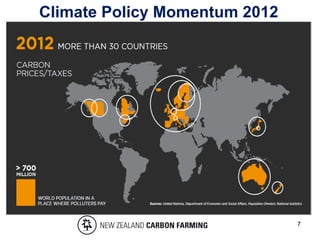

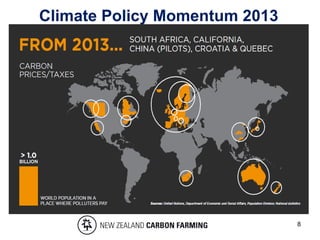

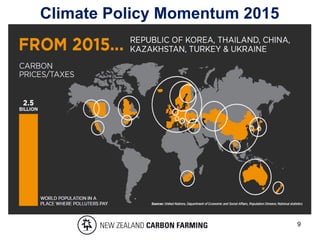

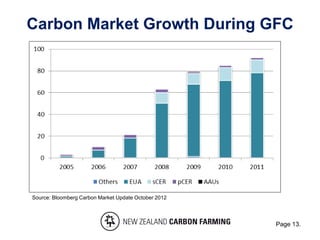

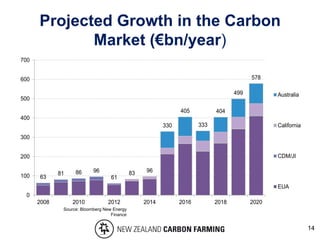

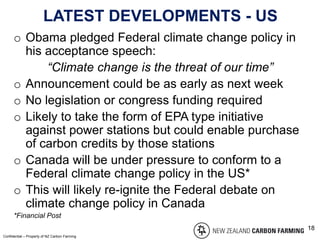

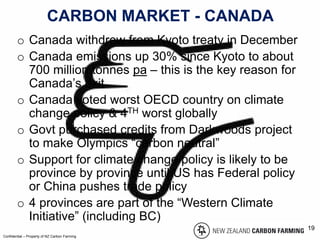

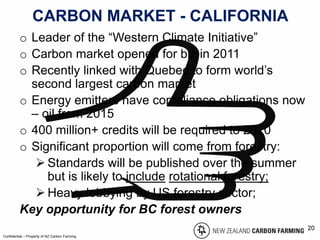

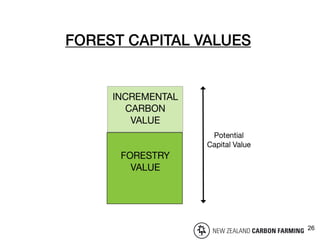

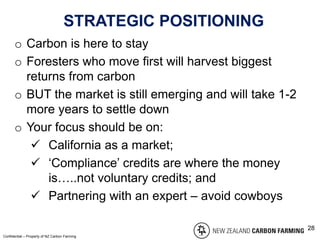

The document discusses the impacts of climate change and how it has led to significant developments in carbon trading, including international trends and market movements. It emphasizes the role of carbon credits, with insights into how different regions, particularly Canada and California, are navigating carbon markets amid evolving policies. Key trends to watch include US federal policy on climate change, California's carbon market standards, and the economic implications for forestry sectors.