MASTER THE BOOKKEEPING METHODOLOGY FOR YOUR COMPANY | MERU ACCOUNTING

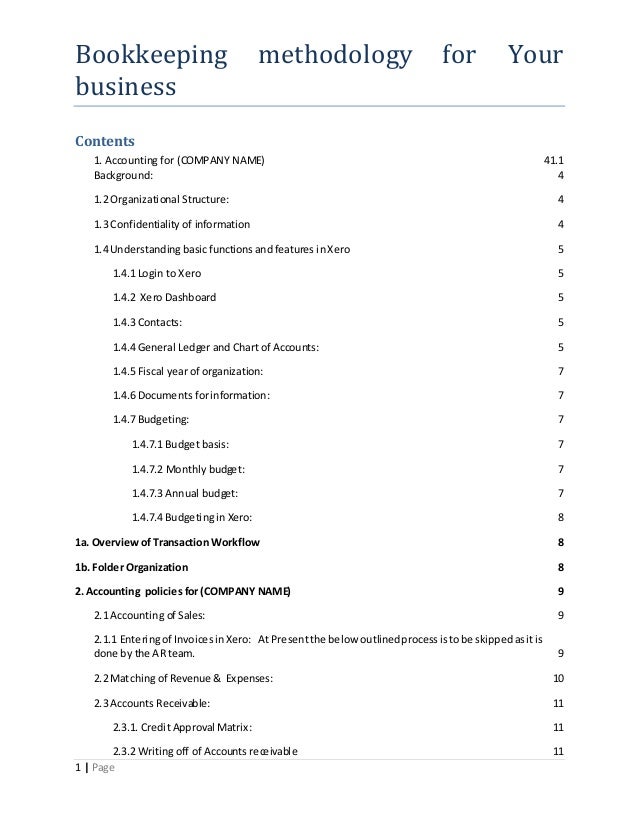

- 1. 1 | Page Bookkeeping methodology for Your business Contents 1. Accounting for (COMPANY NAME) 41.1 Background: 4 1.2 Organizational Structure: 4 1.3 Confidentiality of information 4 1.4 Understanding basic functions and features inXero 5 1.4.1 Login to Xero 5 1.4.2 Xero Dashboard 5 1.4.3 Contacts: 5 1.4.4 General Ledger and Chart of Accounts: 5 1.4.5 Fiscal year of organization: 7 1.4.6 Documents forinformation: 7 1.4.7 Budgeting: 7 1.4.7.1 Budget basis: 7 1.4.7.2 Monthly budget: 7 1.4.7.3 Annual budget: 7 1.4.7.4 Budgetingin Xero: 8 1a. Overview of Transaction Workflow 8 1b. Folder Organization 8 2. Accounting policies for (COMPANY NAME) 9 2.1 Accounting of Sales: 9 2.1.1 Enteringof InvoicesinXero: At Presentthe below outlinedprocessistobe skippedasitis done by the AR team. 9 2.2 Matching of Revenue & Expenses: 10 2.3 Accounts Receivable: 11 2.3.1. Credit Approval Matrix: 11 2.3.2 Writing off of Accounts receivable 11

- 2. 2 | Page 2.4 Accounting of COS: 12 2.5 Bank Reconciliations: 14 2.5.1 Auto Feeds in Xero for bank: Note: Just For bookkeeper’s Knowledge 15 2.5.2 PettyCash: Note:Atpresentthe Bookkeepercanskipthisprocessas we are not maintaining petty cash . 16 2.5.2.1 Petty Cash inXero: 16 2.5.2.1 Petty Cash inProcedures: 16 2.5.3 Credit Card reconciliation: 16 2.5.3.1 Credit Card usage policy 16 2.5.4 Payments by partners for company expense: 16 2.6 Month End journal: 17 2.6.1 Journals forVariable Amount : 17 2.6.2 Journals for FixedAmount : 18 2.6.1 Accounting for recurringexpenses : Note: Just For bookkeeper’s Knowledge 19 2.7 Accounting for Fixed Asset: 19 2.7.1.Depreciation on Assets 20 2.7.2 Impairment of Assets: 20 2.8 AccountingforInvestments:Note:Atpresentthe Bookkeepercanskipthisprocessasthere are no investments. 20 2.8.1 Investment Policy 21 2.8.2 Investment Procedures 21 2.8.3 Valuation of Investments 21 2.9 Month end closing journals: 21 2.10 Monthly Deliverables: 21 2.11 Additional reportsfrom Xero: 22 2.12 Deliverables timeline: 22 2.13 Sales Tax: 23 2.13.1 Sales return Preparation 23 2.13.2 SALES TAX return submission 23 2.13.3 SALES TAX reconciliation with accounts 23

- 3. 3 | Page 2.13.4 SALES TAX Annual return filing 23 2.13.5. Documents required for SALES TAX Audit. 23 2.15 Managing Payroll in Xero: 23 2.15.1Payroll processing: 24 2.15.2 Payroll Taxes: 24 2.16 Key Performance Indicators 25 2.17 Locking of Data in Xero: 25 2.18 Interim Audit: 25 3. Year End Procedures 253.1 Coordinatingwith CPA: 26 3.2 Reconciliation of SALES TAX Balances 26 3.3 Ensuring Depreciation is correct 26 3.4 Accounting for unearned revenue 27 3.5 Cut off for information recording 27 3.6 Accounting for Contingencies 27 3.7 Accounting for Taxes 27 3.7.1Accountingfor current Taxes: 27 3.7.2Accountingfor Deferred Taxes: 27 3.8 General things to check in Xerofor year end: 27 3.9 Signing of Financials: 27 3.9.1 Disclosure of Accounting policies 28 4. Maintenance of Accounting Policies and Procedures Manual 27

- 4. 4 | Page 1. Accounting for (COMPANY NAME) 1.1 Background: ● (COMPANY NAME) – Registration status (Partnership firm/ Sole proprietor/ any other) ● Address of the company ● Company’s principal business activity ● The nature of business of the company. ● Business code number ● Company’s Website ● Email address of the company. ● Phone number of the company ● Company’s Method of Accounting ● The Accounting Period that the company operates ● Date, Month and Year in which the company started its operations 1.2 Organizational Structure: ● Partners: ● Managing Partner: Director of Onboarding, Scheduling & Credentialing – responsible for interviewing, hiring and onboarding. ● Responsibilities ● Accounts manager ● Auditor 1.3 Confidentiality of information ● It is the responsibility of every employee to respect and maintain the security and confidentiality of Confidential Information. A violation of this policy may result in disciplinary action. ● During employment and after the termination of employment, an employee will hold all Confidential Information in trust and confidence, and will only use, access, store, or disclose Confidential Information, directly or indirectly, as appropriate in the performance of the employee’s duties

- 5. 5 | Page 1.4 Understanding basic functions and features in Xero About Xero: Xeroisa NewZealand-basedsoftware companythatdevelopscloud-basedaccountingsoftware forsmall and medium-sizedbusinesses. The company has officesin New Zealand,Australia, the United Kingdom, The United States and Singapore. 1.4.1 Login to Xero ● For login into Xero, Go to www.login.xero.com and just login with your Login details. 1.4.2 Xero Dashboard ● Once you login to Xero you shall be on the Homepage of Xero called “Xero Dashboard” ● It isyour keytobusinessreportsyourequiretosee ata glance.You can adjustthe thingsyou wish to see on your dashboard. ● You cansee a Quickviewof bankaccountbalance andgraphsshowingmoneycominginfrom customer invoices and money due to go out for supplier invoices. ● It can be customized on the go as per your reporting requirements. 1.4.3 Contacts: ● Xero does not differentiate between customer and supplier unless a sales invoice or a purchase Bill is entered. ● In Xeroyou needto add contacts and they wouldbe automaticallyclassifiedintocustomersand suppliers based on the entry of sales/purchase you enter with that contact. ● Xeroallowsyou to entera whole lotof informationyouwouldeverneedtoknow regardingthe contact. ● However,the compulsoryfeedsare justFirstname and Last name whichneedsto be enteredin order to create a contact in Xero. ● You canevencreate agroupof yourownsothat all the contactswouldbe assignedtothatgroup. ● Need to make sure there should be no duplication of contacts. 1.4.4 General Ledger and Chart of Accounts: (Company Name) shall maintain consistency of its financial reporting structure by utilizing a professionally developed chart of accounts structured alongside the Xero accounting software.

- 6. 6 | Page In the event that new accounts are required to be added to enhance financial reporting or meet specific requests, the accountant would notify the Manager for approval on the additions/modification. Below is a representation of (COMPANY NAME)’s Chart of Accounts that would be updated with additions and modifications whenever it becomes necessary to do so: CATEGORY CODES ASSETS 100000 to 199999 LIABILITIES 200000 to 299999 EQUITY 300000 to 399999 REVENUE 400000 to 499999 EXPENSES 500000 to 899999 Each account in the chart of Accounts should be numbered as per the same numbering method. Responsibilities: ● Every Year the Accountant shall initiate a comprehensive review of the adequacy of the chart of accounts and appropriateness of its format. ● He would communicate any updates on the chart of accounts to the rest of the finance team. ● He would also ensure that the approved budget appropriations are correctly processed and budget reports are produced. Process: ● Import Chart of Accounts (Xero > Accounting menu > Advanced > Chart of accounts> import) ● Review as per the set standards, if any discrepancies report to the manager. ● Make sure the Chart of Accounts are set in xero after review & discussion. ● Put the Report & Analysis here in the drop box folder: Dropbox(COMPANY NAME) -Accounting-SharedPolicies and ProceduresDesignChart of Accounts

- 7. 7 | Page 1.4.5 Fiscal year of organization: Fiscal year begins on January 1 and ends on December 31. Any changes to the fiscal year of the Organization must be ratified by partner decision. 1.4.6 Documents for information: A proper documentation should be maintained in the physical file as well as Xero accounting entry. All the accounting entries in Xero should be supported by relevant documentation. 1.4.7 Budgeting: Budgeting is Practice of regularly comparing actual results against expected results. Budgeting helps management to take timely action when there is any deviation from plan. It helps in achieving goals in a decided time frame. 1.4.7.1 Budget basis: Basis of budget would be flowing from management visions and practices. It would help to compare the expected and actual result and reasons for deviation. Budget time frame decided would be fixed as weekly, Monthly, Quarterly or Annually based on management assumptions. 1.4.7.2 Monthly budget: Purpose of Monthly budget to control where it is spent and where to receive income.Prepare Monthly Budget using following Steps: 1. Decide last month incoming and outgoing based on actual figures. 2. Decide on a budget for the budget month. 3. Confirm with the operations team that the budgeted goal is achievable. 4. Monthly budget variance reports will be completed and distributed to the Partners by the 15th day of the following month 1.4.7.3 Annual budget: ● Annually, the Accountant is responsible for developing a budget for the next fiscal year. The accountant shall prepare the Budget based on the cost factor information on past budget performance.

- 8. 8 | Page ● The accountant will submit the budget to the Partners. The Partners will review, adjust and otherwise confirm the budgets. ● The Partners, in conjunction with the accountant, will oversee actual costs and expense allocations throughout the year to ensure adherence to budget(s). ● New initiatives, cost overruns, etc. identified during the year are to be brought to the attention of the Partners. Review efforts should identify either proposed revenue (support) coverage for these costs or budget reallocation opportunities. 1.4.7.4 Budgeting in Xero: ● Budget can be accessed from All reports>Budget Manager. ● Need to put in budgeted figures in Xero on a monthly basis ● Xero would give a report on deviations along with P&L reports. 1a. Overview of Transaction Workflow 1b. Folder Organization Reference file: Dropbox(COMPANYNAME) - AccountingPoliciesandProceduresDesignWorkflow - Accounting.xlsx

- 9. 9 | Page 2. Accounting policies for ABC Amazon Staffing LLC 2.1 Accounting of Sales: Saleswill be recordedasrevenue inthe periodsreceivedorthe periodinwhich salesare made.Anyand all accounts receivable will be closely reviewedeach month to determine whether the amount is still collectibleandwhetherthe balanceof the accountsreceivableisadequatelyreservedwiththe allowance for bad debt. Income will be recognized in the periods for which payment is received. Any account receivable will be reviewedmonthly to determine if the amounts are collectible and to review what collectionactions are being taken. 2.1.1 Entering of Invoices in Xero: At Present the below outlined process is tobe skipped as it is done by the AR team. 1. Accounts Receivable Team shall furnish a copy of Invoice File to the Bookkeeping Team. The invoice file can be accessed at this path in the drop box folder: C:UsersRushabh.ShahDropbox (COMPANY NAME)-Accounting-SharedReceivables20211-To be Processed. The Invoice file shall contain all Invoices pertaining to revenue items as follows; Locum Tenens: Accommodations Locum Tenens: Other Income Locum Tenens: Per Diem Fees Locum Tenens: Professional Fees Locum Tenens: Transportation Permanent Placement: Placement Fee 2. The Accounts Receivable Team shall also save all the Supporting Documents pertaining to the above items in the following. (Timesheets, expense sheets & any other relevant document) 3. The Bookkeeping Team shall match the supporting documents with each of the Invoice in the Invoice File (Timesheets, expense sheets & invoice)

- 10. 10 | Page 4. After performing Procedure no. 3, Bookkeeping Team shall Import the Invoices with supporting Documents to Xero and furnish a list of items without supporting documents to Accounts Receivable Team for their action. 5. For the following COS Items, supporting documents should be uploaded to the Accounting Software used. 6. The imported Invoices shall then be reconciled with the corresponding Bank or Credit Card Account. Once the invoices are imported & reconciled, put the invoices in their respective client folders in drop box : Dropbox (COMPANY NAME)-Accounting-SharedReceivables2021 Folder Renaming should be done accordingly: Dropbox (COMPANY NAME)-Accounting-SharedReceivables2021Client NameAMS-Invoice Number Also the Document in the folders should be renamed accordingly: Service provider name_Client name_Date of invoice_Due date of Invoice_Document type with Invoice number . 7. The Bookkeeping Team shall furnish a listof all Unreconciled Invoices as Well as Unreconciled Bank or Credit Card charges pertaining to revenue to the Accounts Receivable team for their Action. Folder path: DropboxAdelphi-Accounting-SharedReceivables2021Receivable_data_2021 8. Clarifications on items with no Supporting Documents and Unreconciled Items should be cleared on or before the 10th of the following month with the management. 2.2 Matching of Revenue & Expenses: In order to present accurate and consistent financial statements, the revenues and expenses attributable to each period will be reflected in that period to the degree possible. The sections in month end and year end procedures will review this in greater detail. Generally, all entries required to accurately reflect the revenues and expenses of each period will be made in that period.

- 11. 11 | Page 2.3 Accounts Receivable: ● The accountant shall be responsible for monitoring the timely collection of accounts receivable balances ● Remittance statements will be mailed to all Customers so they will be received by the 1st of the month. ● An aged Accounts Receivable Report will be prepared and distributed to the Partners by the 15th of the month. ● The Partners and the Accountant will review the report and determine those receivable balances which should be collected during the month. ● The following procedures will be followed for all Customers with delinquent balances of 60 days or more: o The accountant will send reminder letters to the delinquent Customers, as discussed with the Partners. o Customers' responses to the notice of delinquency will be brought to the Partner's attention, including reasons for delinquency and payment commitments obtained from the Customers. ● The accountant will note the Customer's commitment date and amount. If the Customer does not uphold the payment commitment or if there are any material discrepancies in the payment amount, the Customer will be telephoned in an attempt to resolve the matter. All problems experienced will immediately be reported to the Partners for resolution. 2.3.1. Credit Approval Matrix: ● Sales on Credit should be approved by the Senior officer of the company. ● Salesshouldbe agreedupon bythe salesmanonlyafterconfirmationhasbeenreceived fromthe Accounts department. ● In case of overdue account further sales should be stopped. 2.3.2 Writing off of Accounts receivable Writingoff of Accountsreceivableshouldbedoneonlyafterproperapprovalforthe samehasbeentaken. Amount Authorized in writing by Less than $500 Accounting Manager More than $500 Chief Financial Officer If write-off procedures have been initiated, the following accounting treatment applies: 1. Current year invoices that are written off will either be charged against an appropriate revenue or revenue adjustment account, or against the original account credited. 2. Invoices written off that are dated prior to the current year will be written off against net assets.

- 12. 12 | Page 2.4 Accounting of COS: Two - Three times a week, Accounts Payable Team shall furnish Cost of service items to the Bookkeeping Team. The Bill File can be accessed at this path in the drop box folder : Dropbox (COMPANY NAME)-Accounting-SharedPayablesYYYYTo Be Processed The Bill file shall containall billspertainingtothese costsandothersrelateditems,the AccountsPayable Team shall alsosave all the SupportingDocumentspertainingtothe above itemsinthe To Be Processed folder. Background Check Fees COS: LOCUM TENENS ACCOMMODATION COS: LOCUM TENENS Amazon LICENSE EXPENSE COS: LOCUM TENENS OTHERS COS: LOCUM TENENS PROFESSIONAL FEES COS: LOCUM TENENS TRANSPORTATION 9. The BookkeepingTeamshall matchthe supportingdocumentswitheachof theBillsintheBillFile. 10. Once Confirmed in point no 9, the Bookkeeping Team shall Import the Bills with supporting Documents to Xero. 11. Once imported, the categorizations have to be reviewedthoroughly. Go to Business > Billsto Pay > Drafts. The supporting documents are to be referred for the correct Service provider /Client name. 12. For the following COS Items, supporting documents should be uploaded to xero: Background Check Fees COS: LOCUM TENENS ACCOMMODATION COS: LOCUM TENENS Amazon LICENSE EXPENSE COS: LOCUM TENENS OTHERS COS: LOCUM TENENS PROFESSIONAL FEES COS: LOCUM TENENS TRANSPORTATION

- 13. 13 | Page 13. If there are any missing documents in the cost of service items, furnish a listof items without supporting documents to the Accounts Payable Team for their action and keep the bills in draft until we have all the supporting documents to attach. 14. Once this is done, Approve the bills in draft. 15. The Approved bills shall then be reconciled with the corresponding Bank or Credit Card Account. Once the bills are imported & reconciled, put the bills in their respective vendor or service providers folders in drop box: Dropbox (COMPANY NAME)-Accounting-SharedPayablesYYYY Folder Renaming should be done vendor wise / service provider wise, if no previous folder found, create one in the name of vendor or service provider & put all the documents related there. C:UsersRushabh.ShahDropbox (COMPANY NAME)-Accounting-SharedPayables2021 Also, the Document in the folders should be renamed accordingly: Time sheets: {last name}, {first name} _ {facility abbr.} _ {coverage start date} _ {coverage end date} _{*MULTIPLE*} _timesheet. Direct Provider expenses: Service provider name_Client name_Date of bill_Due date of bill_Nature of Expense_Amount of expense. Vendor Specific: Hotel- {last name}, {first name} _ {facility abbr.} _ {check-in date} _ {check-out date} _{vendor}_hotel_${charge amount} Auto- {last name}, {first name} _ {facility abbr.} _ {pick-up date} _ {drop-off date} _{vendor}_auto_${charge amount} Air Travel- {last name}, {first name} _ {facility abbr.} _ {departure date} _ {return date} _{vendor}_air travel_${charge amount}

- 14. 14 | Page Mileage- {last name}, {first name} _ {facility abbr.} _ {driving start date} _ {driving end date} _mileage_${charge amount} Gas- {last name}, {first name} _ {facility abbr.} _ {driving start date} _ {driving end date} _gas_${charge amount} Other - {last name}, {first name} _ {facility abbr.} _{receipt}_other_${charge amount} Vendor - where the receipt came from (ex. American Airlines, Hilton, etc.) Amount - the total amount for the receipt The Bookkeeping Team shall furnish a list of all Unreconciled bills as Well as Unreconciled Bank or Credit Card charges pertaining to revenue to the Accounts Payable team for their Action. Folder path: Dropbox (COMPANY NAME)-Accounting-SharedBanking2021Banking_2021 16. Clarifications on items with no Supporting Documents and Unreconciled Items should be cleared on or before the 10th of the following month with the management. 2.5 Bank Reconciliations: The bank statements are to be reconciled by the accountant on a monthly basis no more than 2 days after receipt of the statement. Statements can be accessed here: Dropbox (COMPANY NAME)-Accounting-SharedBanking2021Statements Things to check while reconciling: ● The general ledger and the reconciled bank statements will be adjusted to agree monthly. ● Upon gathering of the Bank and Credit Card statements the accountant will prepare the monthly reconciliations. The bank reconciliations will reconcile the bank balance to the general ledger balance. A journal entry will need to be posted each month for items on the bank statements which are not already recorded in the general ledger. These reconciling items may include: interest earned, service charges, checks, direct deposits and other debit or credit memos. ●

- 15. 15 | Page ● After the general ledger is reconciled to the bank statement, the monthly bank statement and cancelled checks and other forms and the actual reconciliation form are filed in the bank reconciliation file. ● A comparison of dates and amounts of deposits as shown in the accounting system and on the statement, a comparison of inter-account transfers, an investigation of any rejected items, a comparison of cleared checks with the accounting record including amount, payee, and sequential check numbers. ● The Bookkeeper will verify that voided checks, if returned, are appropriately defaced and filed. ● The Bookkeeper will investigate any checks that are outstanding over six months. ● The Bookkeeper will attach the completed bank reconciliation to the applicable bank statement, along with all documentation. For Any Queries: The bookkeeper shall extract Bank reconciliation summary & highlight the unreconciled transactions to the Partners for their comments: The report can be put here: Dropbox (COMPANY NAME) -Accounting-SharedBanking2021Banking_2021_V2.xlsx After the comments & clarifications for queries, the bookkeeper shall go ahead reconciling the unreconciled as advised & reconcile the bank accounts. Types of account: ● Current Account ● Payroll Account ● Line of Credit 2.5.1 Auto Feeds inXero forbank: Note: JustFor bookkeeper’s Knowledge ● You can importbankfeedsintoXerobyfollowingtwomethods: o Manual import:Youcan manuallyimportthe transactionsinXerobyaCSV templateprovided byXero.We have notdealt withthe Manual importfeatureinthisfile.Youcanimportabank. However, you can follow the following steps for importing a bank statement. ▪ Log intoyouronline bankingwebsiteandsave abankstatementineither.QIFformat (Quicken) or. OFX format (MS Money) to your computer. ▪ From Xero’sDashboardselect Manage Account>Import a Statement fromyourown bank account that you added in the step above. ▪ Locate and select the file downloaded from your bank and click Import. o AutomaticBankFeeds:You can use Automaticbankfeedsfeature inXerowhere Xerowould automaticallyimportthe transactionson a dailybasis.In this manual we have explained the Automatic Bank Feeds in detail. ● Auto feeds can be set up in Xero so that it can reduce time taken in manual entry. ● You Just needto enterthe name of the Bank, your account number.Xerowouldprompt youin case bank feeds are available for the said bank account. ● Xero would give you different options for selecting a bank account.

- 16. 16 | Page 2.5.2 Petty Cash: Note: At present the Bookkeeper can skip this process as we are not maintaining petty cash. 2.5.2.1 Petty Cash in Xero: ● Petty cash accounts should be set up in the same manner we have prepared a bank account. ● All the transactions need to be manually entered via import in petty cash. 2.5.2.1 Petty Cash in Procedures: ● Petty cash should be verified by management at regular intervals of time ● Petty cash should be deposited by the cashier into the bank at the end of every month. 2.5.3 Credit Card reconciliation: ● Credit card reconciliation is to be done on the same basis as cash reconciliation. 2.5.3.1 Credit Card usage policy ● All staff members who are authorized to carry an organization credit card will be held personally responsible in the event that any charge is deemed personal or unauthorized. Unauthorized use of the credit card includes: personal expenditures of any kind; expenditures which have not been properly authorized; meals, entertainment, gifts, or other expenditures which are prohibited by budgets, laws, and regulations, and the entities from which (Organization) receives funds. ● The receiptsforall creditcard charges will be giventothe OperationsManagerwithintwo(2) weeks of the purchase alongwithproperdocumentation.The OperationsManagerwill verifyall creditcard charges with the monthly statements. A record of all charges will be given to the Bookkeeper with applicable allocation information for posting. A copy of all charges will be attached to the monthly credit card statement when submitted to the Executive Director for approval and signing. ● The Executive Director'screditcardusage willbe providedtothe BoardChairandtheBoardTreasurer. 2.5.4 Payments by partners for company expense: ● Partners should claim all the expensesdone fromtheir personal accounts by submittingan expense claim. ● A receipt should be taken from Partners for such claims & duly attached in xero. 2.6 Month End journal: Journal to be passed at end of month Particulars Debit Credit

- 17. 17 | Page 2.6.1 Journals for Variable Amount: ● Depreciation: Computer and Accessories Transactions Depreciation Expense Computation procedure can be accessed here: Dropbox (COMPANY NAME)-Accounting-SharedPolicies and ProceduresProceduresDepreciation Expense Computation Procedure.xlsx Depreciation Expense Computation can be accessed here: Dropbox (COMPANY NAME)-Accounting-SharedFixed Assets2019Fixed Assets_YYYY ● Interest Expense: Partners Interest Expense Calculation can be accessed here: Dropbox (COMPANY NAME)-Accounting- SharedPayablesYYYYLoans (COMPANY NAME) - Investment Calculator-Dayne

- 18. 18 | Page Dropbox (COMPANY NAME)-Accounting- SharedPayablesYYYYLoans (COMPANY NAME)- Investment Calculator-Megel Dropbox (COMPANY NAME)-Accounting- SharedPayablesYYYYLoans (COMPANY NAME)- Investment Calculator-Tanya 2.6.2 Journals for Fixed Amount: Note: There should be one monthly Journal for all the utilities combined ● Other Cable and Telephone (Comcast Business) ● Internet & Communication (AT&T Mobility) ● Utilities - Water (Fulton County Finance Department) ● Utilities-Gas (Natural Gas Service)- One journal for all utilities ● Utilities - Electricity (Sawnee EMC) ● Utilities - Garbage Disposal (Republic - Garbage Collection) ● Utilities - Water (Cobb County) All Calculations can be accessed here: Dropbox (COMPANY NAME)-Accounting-SharedPolicies and ProceduresProceduresMonthly Journal Entries Monitoring.xlsx 2.6.1 Accounting for recurring expenses: Note: Just For bookkeeper’s Knowledge ● Repeating journals can be saved in Xero for all recurring expenses. 2.7 Accounting for Fixed Asset: Policy- 1. (COMPANY NAME) will capitalize all fixed assets ("equipment") with an acquisition cost of $5000.00 or more and a useful life of more than three years 2. (COMPANY NAME) will record all transactions involving property and equipment ("fixed assets”) acquired during the year (at cost) as well as depreciation expense for the year. Procedures- ● All capitalized equipment will be properly marked with a specific identification number.

- 19. 19 | Page ● Property records shall be maintained accurately and shall include: a.) A description of the property. b.) Manufacturer's serial number, model number, Federal stock number, national stock number, or other identification number. c.) Source of the property, d.) Whether title vests in the recipient or the Federal Government. e.) Acquisition date and cost. f.) Location, use and condition of the property and the date the information was reported. g.) Unit acquisition cost. h.) Ultimate disposition data, including date of disposal and sales price or the method used to determine the current fair market. ● A physical inventory of all fixed assets shall be taken annually. ● The results of the inventory will be reconciled to the general ledger and the "fixed asset" property records. Any discrepancies will be thoroughly investigated and explained. ● Fixed asset acquisitions will be the result of a capital planning process conducted in conjunction with the annual budgeting process. The Partners will review and approve all capital acquisitions via the annual budgeting cycle. It is possible that additional asset needs will be identified during the year. Such acquisitions need to be justified and approved by the Partners prior to acquisition. 2.7.1. Depreciation on Assets ● Depreciation on all fixed assets will be calculated using the straight-line method over the expected useful lives of the assets (3-10 years). ● Depreciation expenses will be recorded in the Books. 1.Straight line Method: Note: Just For bookkeeper’s Knowledge ● Thismethod isthe simplestmethodof all.Itinvolvessimpleallocationof assets toa useful life of assets. ● Annual Depreciation=Assets Cost-Residual Value/Useful life of asset. ● Residual value:Residual Valueisknownassalvage value.The residualvalue istheremainingvalue of assets after fully depreciated value. 2.Unit of Production Method: Note: Just For bookkeeper’s Knowledge This is two-step Process ● Step: 1 Calculate per unit depreciation: ● Per unit Depreciation= Asset Cost-Residual Value/Useful life of Production ● Step: 2 Calculate the total depreciation of actual units produced: ● Total Depreciation Expense = Per Unit Depreciation*Unit Produced 3. Declining Balance Method: Note: Just For bookkeeper’s Knowledge

- 20. 20 | Page ● This is one of the two common methods a company uses to account for the Expenses of a fixed asset. ● This is an accelerated depreciation method. As the name suggests, it counts expenses twice as much as the book value of the asset every year. 2.7.2 Impairment of Assets: Impairment of assets is unexpected loss due to damage, obsolescence etc. ABC Amazon StaffingLLC needstovalue assetsat end of each accountingperiodto check if there is any impairment on value of assets 2.8 Accounting for Investments: Note: At presentthe Bookkeeper canskip this process as there are no investments. Investmentsare assetsheldbyanenterprise forearningincome bywayof dividend,interestandrentals for capital appreciation, or for other benefits to the investing enterprise. Classification of Investment: 1. CurrentInvestment:A currentinvestmentisaninvestmentthatisby its nature readilyrealizable and not held for more than one year from the date investment made. 2. Long term Investment: A Long-term investment that is other than current assets. It is held for more than one year and is not readily realizable. 2.8.1 Investment Policy ● All investments of (COMPANY NAME) 's shall be in (COMPANY NAME) 's and recorded in conformity with generally accepted accounting principles. 2.8.2 Investment Procedures ● (COMPANY NAME) 's investment portfolio will be diversified and managed by professional investment advisors selected by the Partners in order to maximize return on investment and minimize the risk of any serious losses. ● The Partners will be responsible for the periodic review of the portfolio in order to maximize (COMPANY NAME) 's return and avoid any potential loss. ● All security instruments (stocks, bonds, etc.) shall be maintained by the custodian appointed by the Partners. ● Each month the investment portfolio reports received from the investment advisors will be reconciled to the general ledger by the accountant. 2.8.3 Valuation of Investments Investment valuation should be done in below manner: For Current Investment: Valuation at cost or fair value, whichever is lower. For Long Term Investment: At cost.

- 21. 21 | Page 2.9 Month end closing journals: Upon completion of the monthly bank reconciliations, the accountant will formulate the monthly journal entries. There are two types of monthly journal entries, those that remain consistent from month to month (recurring) and those that are specific to that month. ● The recurring journal entries are mentioned above with the process defined. ● Specific entries: depends on case to case. Once the final general journal entries are posted, the monthly financial statements are printed along with a variance analysis report. 2.10 Monthly Deliverables: The adjusted financial statements are to be delivered to the Management teams within three weeks after the end of the month. Below are some of the deliverables that needs to be prepared: SN Particulars 1 P&L for month of XXX 2021- Cash Basis 2 P&L for month of XXX 2021 3 Cash Flow Statement for Month of XXX 2021 4 Cash On Hand in Various Months in 2021 5 Expenses By Vendor for January to XXX 2021 6 Accounts Payable Ageing Summary 7 Revenue by customer YTD- March 8 Revenue Growth in Last 5 years 9 Accounts Receivable Summary 10 KPI Report - Revenue, Expense and Profit Performance

- 22. 22 | Page 11 Net Profit Ratio 12 Variance Analysis 13 Payroll and Contractors 14 Balance Sheet for XXX 2021 15 Balance Sheet for XXX 2016- Cash Basis 2.11 Additional reports from Xero: Below are some of performance reports that can be extracted from Xero: Following are important performance reports: 1. Budget Summary: It provides a summary of the budget figures added by you. 2. Budget Variance: It shows the budget variance against the actual. 3. Executive Summary:Itprovidesanexecutivesummaryof the deviations for year-on-year basis. 4. VAT Return: It gives the details of VAT collected and paid for a particular period. 5. Income by contact: It provides the income received from a particular customer 6. Profit and Loss 7. Sales by service providers 2.12 Deliverables timeline: a. 1stBusiness Day - Request bank statements & other information b. 8th Business Day – Month end Reconciliations are to be complete and internal review meetings scheduled c. 10th Business Day – In office Review meeting with Management 2.13 Sales Tax: Sales tax payments are made monthly as per management request. The accountant at month end should inform management of the Monthly sales tax collected. Sales Tax returns are filed monthly as per the due dates issued by Authority. Prior to filing Sales Tax, sales tax liability and payments should be reviewed for accuracy. 2.13.1 Sales return Preparation Sales Tax reports can be automatically prepared in Xero. Need to set up in Xero in below manner:

- 23. 23 | Page ● Financial setting: In this setting add company Sales Tax detail add as requirement.like Sales Tax Number. SALES TAX Scheme, SALES TAX Number Tax Rates: In this setting add applicable SALES TAX rate for Purchase and Sale. Thisfuture helps to track Sales Tax of purchase and sale of companies. After this when purchase or Sale enter that time select whatever SALES TAX applicable. XeroautomaticallycalculatesSALESTAXonall Purchase-saleusingdifferentSalesTax rate Category.This can helpto more easilyprepare SALESTAXreturnforQuarterbasisas well asyearlybasis.Thisalsohelps to track SALES TAX liability. 2.13.2 SALES TAX return submission SALES TAX return needs to be done manually to the Authorities based on decided timelines. 2.13.3 SALES TAX reconciliation with accounts The liabilityappearingasperaccountsshouldmatchwiththepayablebalanceappearingasperSALESTAX Authorities Ledger 2.13.4 SALES TAX Annual return filing Need to prepare an annual tax return by _________ and file it with the tax Authority. 2.13.5. Documents required for SALES TAX Audit. ● Bank Statement ● Tax Invoice & Bills ● Sales Tax Registration Number ● Sales Tax Registration Certificate 2.15 Managing Payroll in Xero: Role needs to be defined for payroll process: ● Calculation of payroll ● Reimbursement of Expenses for employees. ● Filing for withholding taxes can be easily done with Xero ● Email Pay-Slip 2.15.1Payroll processing: Payroll would be processed on an hourly basis or retainer basis. Policy: 1. Employees and contractors are paid bi-weekly using a third-party vendor, Paychex. The payroll is processed using (COMPANY NAME) 's in-house computer system.

- 24. 24 | Page 2. Payroll is disbursed on a Friday, submitted to the third-party vendor by Wednesday the latest. The cut-off is the Saturday prior to Friday's disbursement. 3. All employees who have access to any payroll information will be required to sign a "Payroll Confidentiality Form". Procedures: 1. Employees are paid bi-weekly. 2. Employees must submit signed timesheets to the Payroll Department for approval. 3. Approved timesheets will be submitted to the accountant. 4. The Federal payroll tax deposits are calculated and paid by the Payroll Manager by the15 working days after the prior month end. State payroll taxes are remitted monthly. 5. Allfederal and statepayroll reports are prepared by the accountant and submitted to the appropriate Federal and State tax authorities by the due date of the return. 6. At the close of the calendar year, W-2 and 1099 Forms are processed by the third- party payroll vendor. 7. The W-2 Forms are reviewed by the accountant and compared to the appropriate payroll tax returns (Forms ____) for accuracy. 8. W-2 Forms are distributed to all employees before January 31. 9. W-2 Forms and all other required information will be submitted to Federal and State Agencies by the Accountant in accordance with the appropriate regulations. 10. All employees who have access to any payroll information will be required to sign a "Payroll Confidentiality Form". Bookkeeper is required to save all the monthly Payroll reports in the respective folders: Path is here: Dropbox (COMPANY NAME) -Accounting-SharedPayroll2021MMReports 2.15.2 Payroll Taxes: Policy: ● All payroll tax withholdings, expenses, filings and related payments will be made in accordance with applicable Federal and State regulatory requirements. Procedures- ● The payroll taxes for which ORGANIZATION NAME is responsible for paying and the applicable payroll tax forms are as follows: ___________________________ ● Payroll Tax Payments and Form Filings: __________________________ ● The accountant shall be responsible for making sure that all payroll taxes are paid and all payroll tax forms are prepared and filed in a timely manner. ● INFORMATION RETURNS ______________________

- 25. 25 | Page ● OTHER FORMS: _____________________ ● The accountant will be responsible for making sure that Federal Forms ___________ are properly prepared, filed and distributed to the appropriate recipients and Federal and State tax authorities in a timely manner. 2.16 Key Performance Indicators Below are some of Key performance indicators that should be incorporated in management report: ● Net Profit ratio ● Aged receivable collection ratio ● Working Capital Ratio Quick Ratio ● Earnings per Share. ● Price-Earnings Ratio. ● Debt-Equity Ratio. ● Return on Equity 2.17 Locking of Data in Xero: If you have the Advisor user role, you can set a lock date to stop changes being made to transactions during a past period. After you set a lockdate, users can't add or edit transactions in Xeroif the transaction date is earlier than the lock date. Lock date needstobe appliedonce monthlyproceduresare complete sothatthere are nochangesafter management reports are generated. 2.18 Interim Audit: Interim Audit is shorter than the fiscal year. Interim audits are generally quarterly basis. Interim audit conduct during fiscal year because it minimizes the work and time after fiscal year. Objectives of Interim Audit: ● To know Company financial for interim period. ● To distribute dividend to interim period ● To get loan on the basis of interim account ● To know profit and loss of interim period 3. Year End Procedures The accountant prepares the year-end financial statements. The accountant is responsible for preparing for the annual financial internal audit and for working with the Account Manager to complete the audit. The Account Manager approves the financial statements before being sent to the CPA.

- 26. 26 | Page The cutoff for December financial statements is extended to four weeks after year end. Upon completion of the December financial statements, the preliminary year-end report is run by the accountant and given to the Internal Management Team for review. The accountant calculates the recurring entries (with the help of the CPA firm if needed) for the New Year. 3.1 Coordinating with CPA: The accountant will also work with the independent accountants (CPA) to determine what confirmations will be required. This process will be completed as soon after year end as possible. The accountant will oversee typing the confirmations. The accountant will be responsible for preparing as many of the schedules which the CPA’s will use as possible. The completed monthly reconciliations for December will partially fulfill this requirement. Some of the information which needs to be organized and made available includes: the complete general ledger for the year, chart of accounts, all bank statements and cancelled checks, all paid invoices, all cash receipts logs, all payroll records, payroll summaries for each pay period 3.2 Reconciliation of SALES TAX Balances SALES TAX payable tracks how much A/P SALES TAX you require the state to pay. After figuring out the tax bill for the state A/P sales tax, you have to make a journal entry, which credits sales tax pay able and debits sales tax expenses. It increases your payable SALES TAX account. After paying your SALES TAX payable, you have to debit cash and credit SALES TAX payable. It reduces the account amount. These two journal entries should be worked out to reconcile your account. 3.3 Ensuring Depreciation is correct A depreciationschedule shouldbe giventoCPA forensuringcorrectnessasapartof the yearendprocess. 3.4 Accounting for unearned revenue Accountantshouldask managementonwhichsalesinvoicesare such that the workis yet to be done on which projects and the same should be reduced from sales and booked to unearned revenue 3.5 Cut off for information recording The cutoff for information in the monthly statements is 1 week after the month ends. 3.6 Accounting for Contingencies The accounting for a contingency is essentially to recognize only those losses that are probable and for which loss amount can be reasonably estimated. A contingency arises when there is a situation for which the outcome is uncertain, and which shouldbe resolved in the future, possibly creating a loss. 3.7 Accounting for Taxes 3.7.1Accounting for current Taxes: Current tax is the amount of income tax determined to payable in respect of total taxable income.

- 27. 27 | Page In Accounting for a period that originated in one period and do not reverse subsequently. Income tax payable relatedtorevenue thatisrecognizedtodaybutwhichshallbe taxedinfuture periods should be included in current period’s tax expenses. 3.7.2Accounting for Deferred Taxes: Deferredtaxationisthe processof transferringtax expensesbetweendifferentperiodsinordertobetter match revenues with expenses through a process called deferred taxation. In Order to better understand this process of deferred taxation and calculate current income tax, we need to define a few income statements and balance sheet accounts. 3.8 General things to check in Xero for year-end: Before you start, make sure you do these things for the financial period being closed: ● Bank account - Fully reconcile your account and ensure it agrees with your actual bank statement balance. ● Invoices - Enter and approve all invoices. ● Bills - Enter and approve all bills. ● Expense claims - Enter and approve all expense claims. ● Payments received - Bank all payments received. 3.9 Signing of Financials: The financial statementshall be approvedbythe Board of Directorsbefore theyare signedon behalf of the Board at leastby the chairpersonof the company.At leasttwo directorssignedfinancial statements on behalf of the Board of Directors. 3.9.1 Disclosure of Accounting policies The Disclosure of Accounting policies followed the preparation and presentation of the financial statement. Following are assumption of Accounting Disclosure: ● Going concern ● Consistency ● Accrual 4. Maintenance of Accounting Policies and Procedures Manual

- 28. 28 | Page The accountingpoliciesandproceduresmanual iscritical to the accounting function of (COMPANY NAME) The Accountant is responsible for maintaining the manual. All proposed changes must be approved by the accountant The policies and procedure manual will be dated with the date of each approved revision. Each Month the Accountantwill reviewthe manual andformulateproposedchanges. Thisupdate willbe completednolaterthan EOD after the conclusionof the review meeting. All changesmustbe approved in writing by the Management Whenever changes to the accounting procedures are made, a review of the accounting policies and procedures manual will be made by the accountant to determine if a revision is required. Any minor revisions to the manual which are not reflected in the manual immediatelyshould be kept on file to incorporate into the formal annual update.