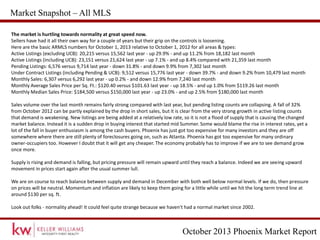

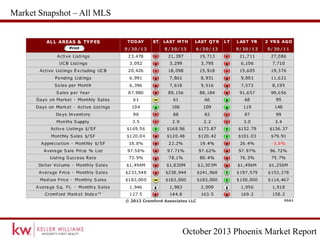

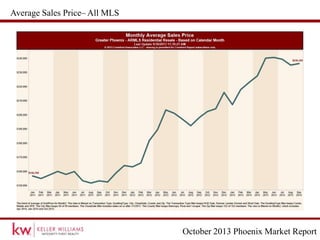

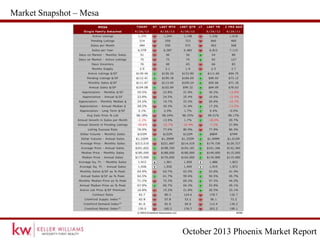

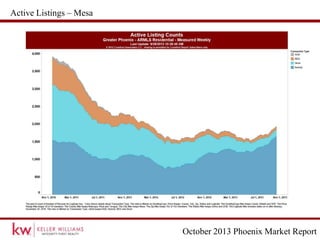

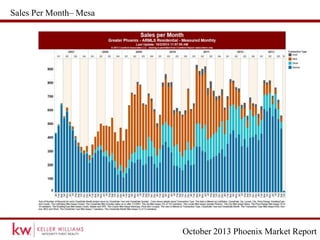

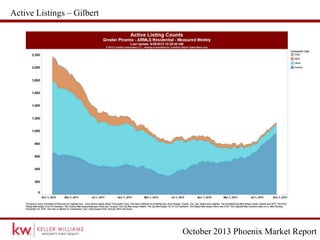

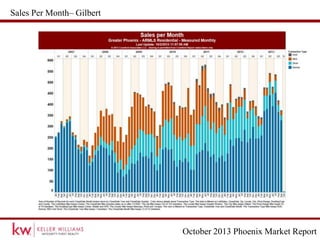

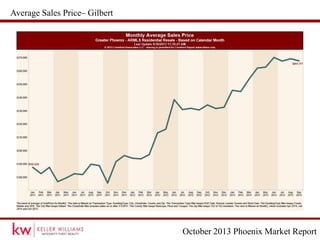

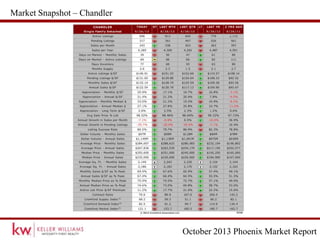

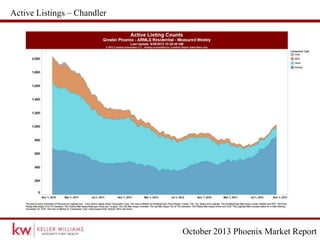

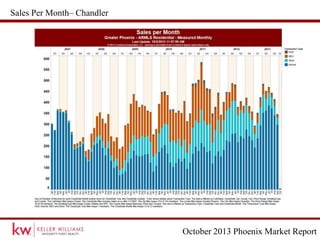

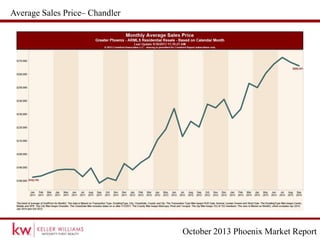

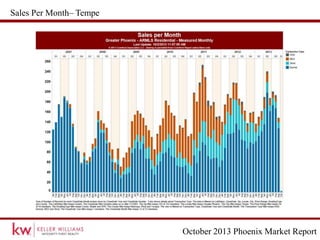

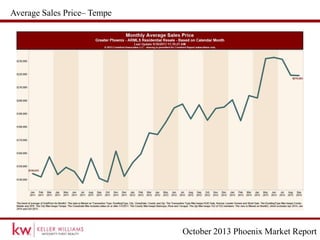

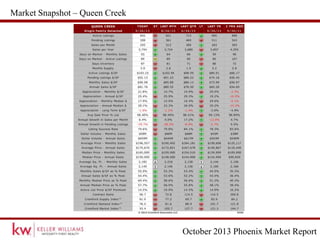

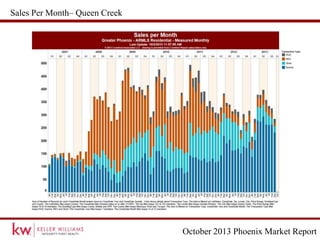

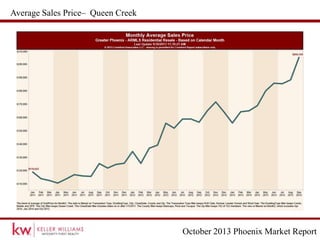

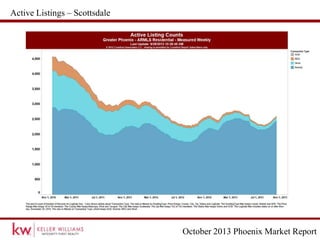

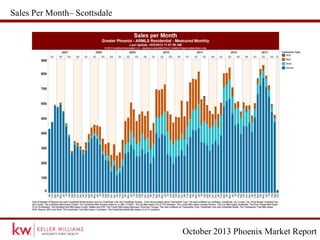

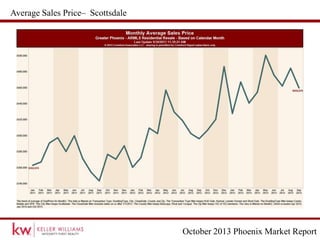

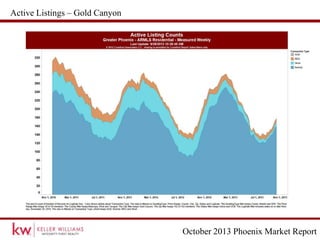

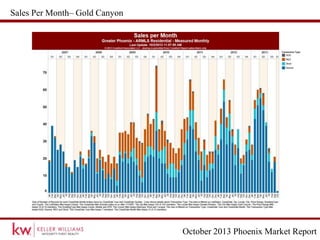

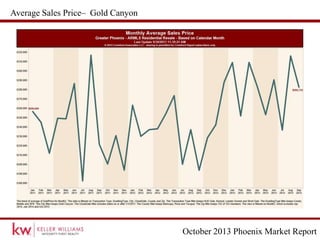

The real estate market in Phoenix is moving towards normality after years of sellers having an advantage. According to the October 2013 report, active listings are up 29.9% from the previous year while pending listings are down 31.8% and sales volume has remained steady. Demand appears to be weakening as new listings are added at a low rate rather than an influx of supply. Prices continue rising but the market is expected to reach a balanced state in December with supply and demand both below normal levels.