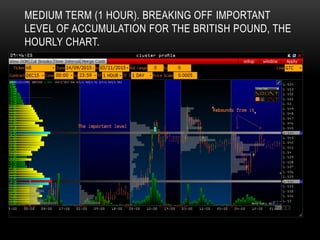

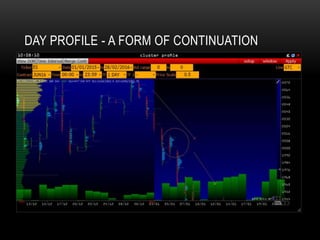

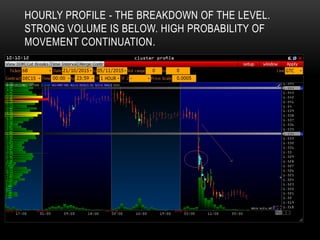

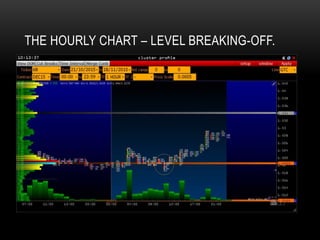

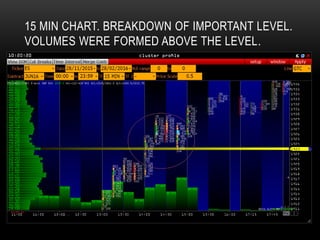

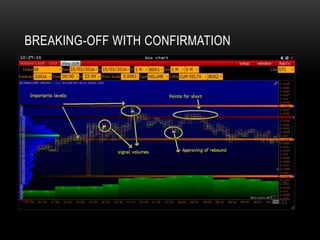

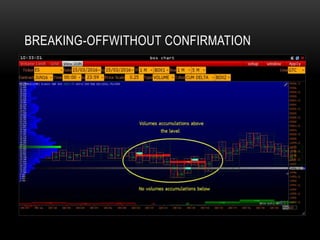

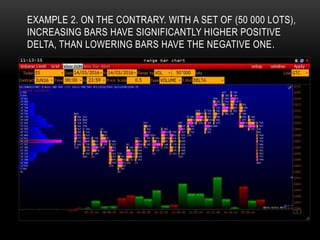

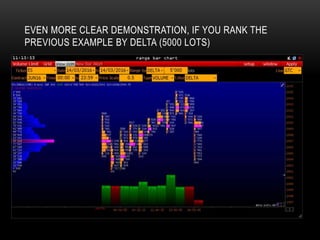

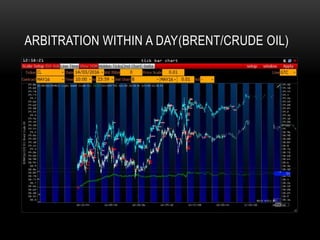

The document outlines various methods of volume analysis using the Volfix program, including horizontal and cluster volumes, local volume emissions, and chart types like range bar and combo bars. It emphasizes the importance of recognizing accumulation levels and their implications for trading strategies across different timeframes. Additionally, it discusses the significance of negative delta and market behavior for predicting price movements.