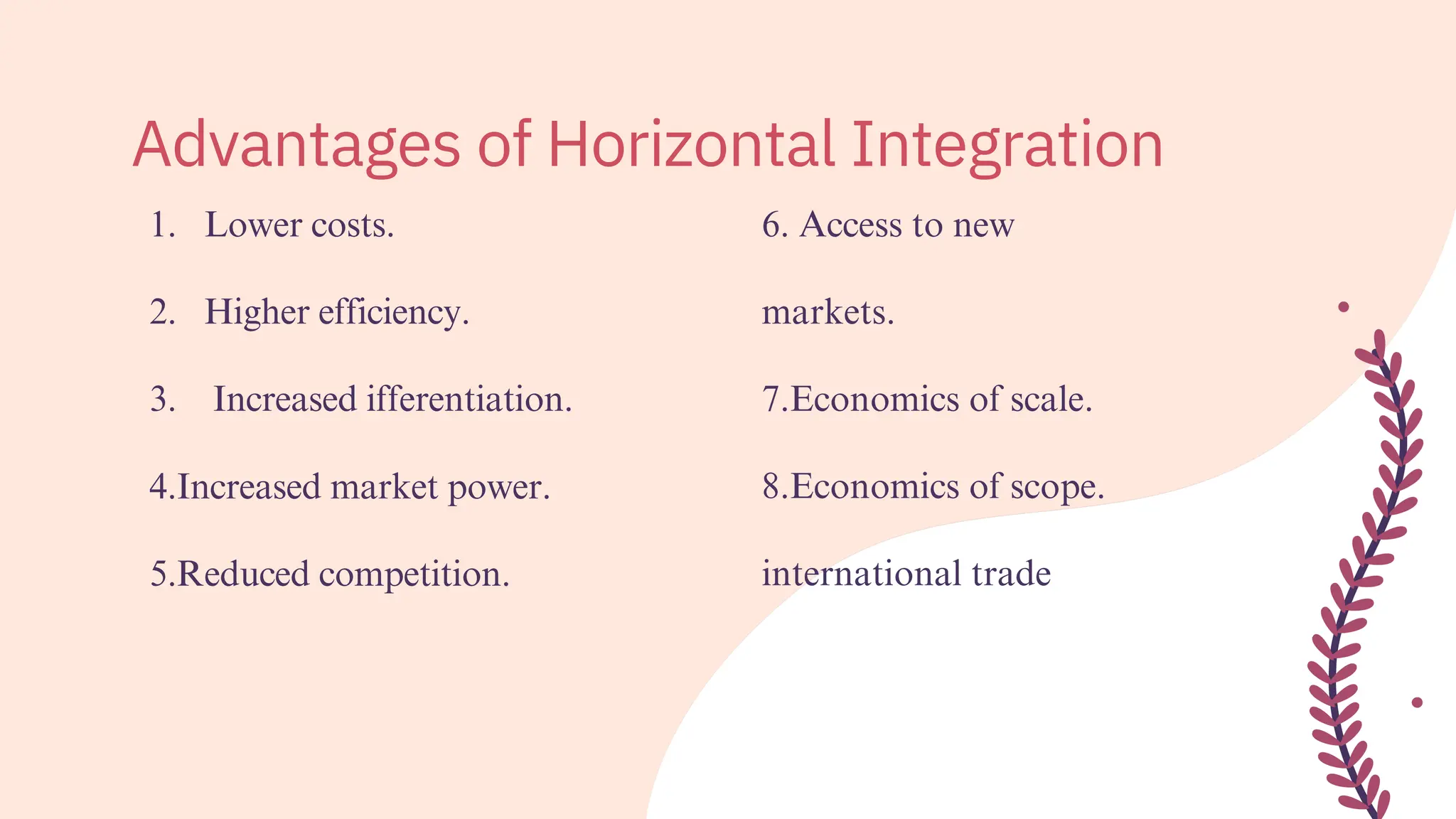

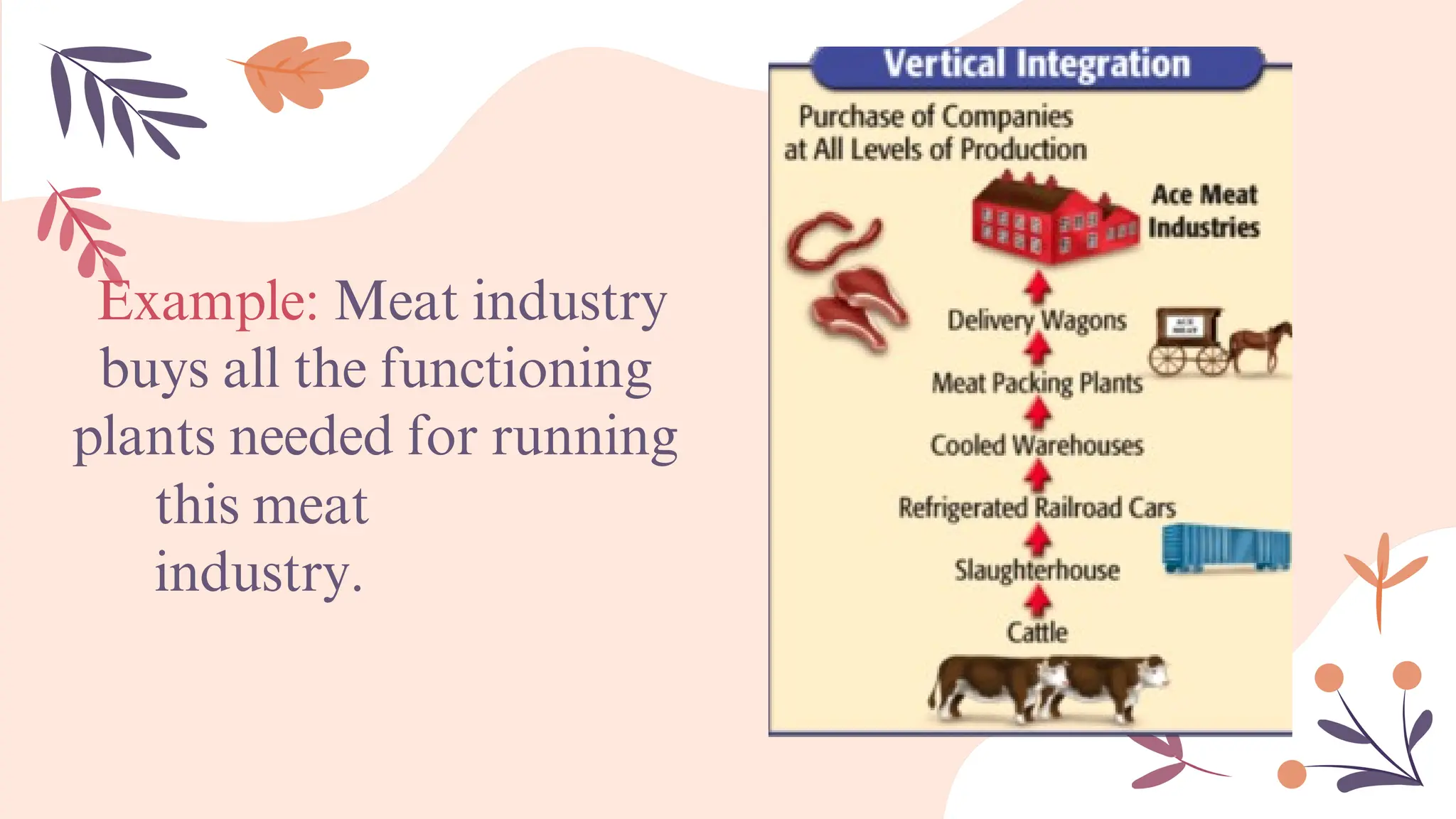

The document discusses market integration, emphasizing its importance for economic development through reduced trade barriers and harmonized regulations. It details the role of international financial institutions like the World Bank and IMF in promoting a global economy, and the historical context of market integration from the 20th century through the emergence of multinational corporations. Additionally, it explores different types of market integration including horizontal and vertical integration, along with their advantages and disadvantages.