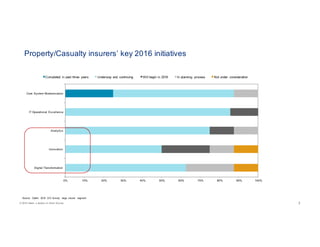

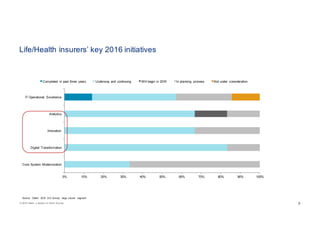

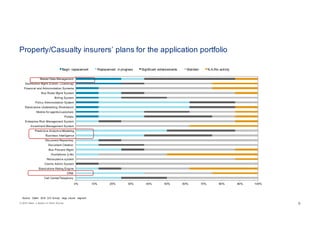

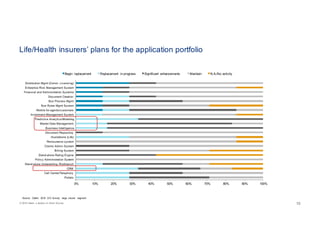

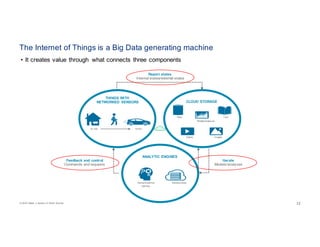

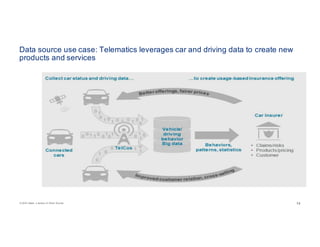

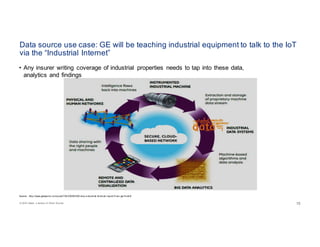

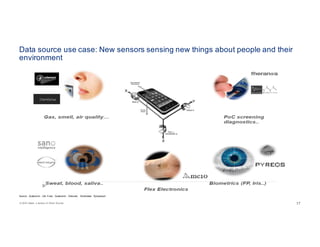

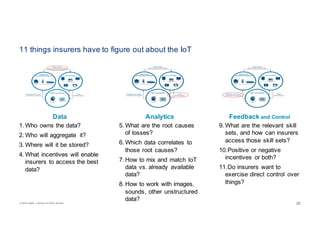

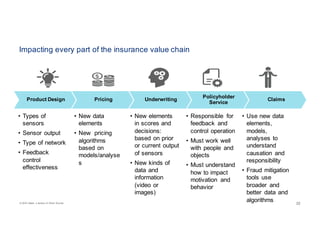

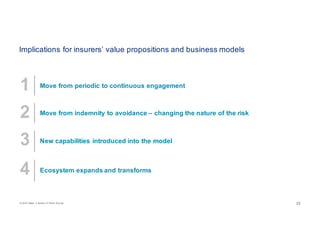

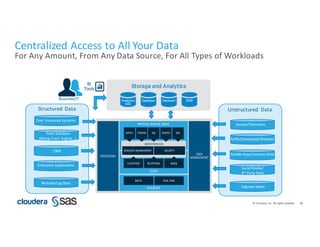

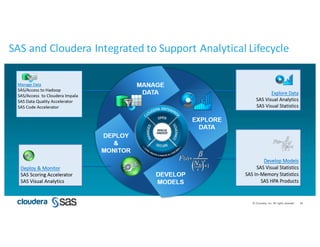

The webinar discusses the impact of big data analytics and Hadoop on the insurance industry, highlighting key trends for 2016 and beyond. Speakers include industry experts from Celent, MarkerStudy Group, and SAS Institute, who address data priorities and initiatives in property and casualty as well as life and health insurance sectors. The session emphasizes the role of the Internet of Things in generating data for new products and innovations, and outlines challenges insurers face in utilizing this big data.