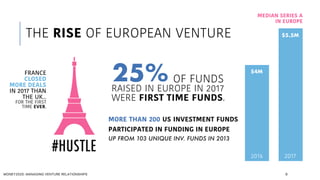

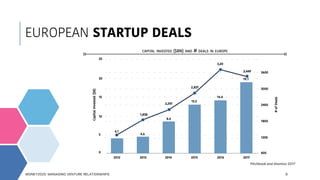

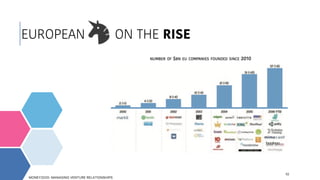

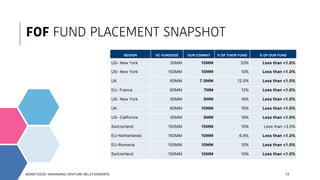

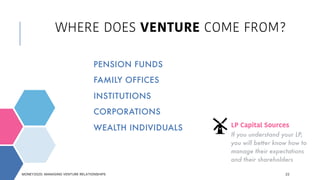

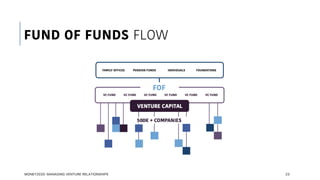

The document discusses managing relationships with venture capital funds. It provides tips for fundraising meetings, including being organized, treating potential investors as colleagues, and focusing on how the fund can outperform others. It also discusses trends in the venture capital market, such as more funds raising money in Europe and the rise of pension funds as a source of capital. Pension funds in countries that invest more in venture capital, like the Netherlands, have seen higher returns than those investing more in bonds.