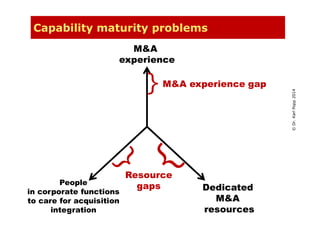

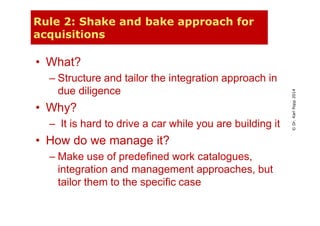

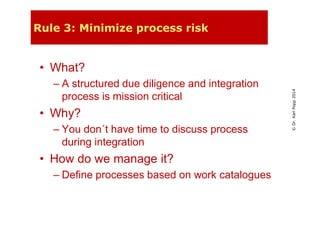

The document outlines eight key rules for successfully managing multiple mergers and acquisitions, emphasizing the need for careful analysis and tailored approaches during the integration process. It stresses minimizing risks through structured due diligence, recognizing the complexity of integrations, and planning for success from the outset. The author highlights the importance of adaptability, accurate resource assessment, and having a clear integration blueprint to ensure efficient execution.