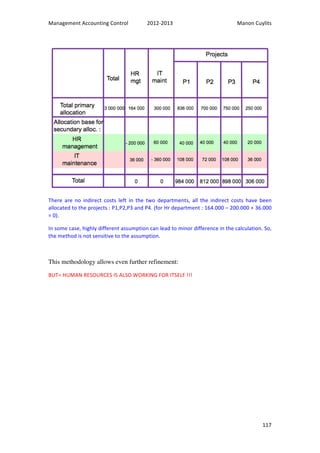

This document appears to be a course syllabus and textbook on management accounting and control. It covers several topics related to the subject including a history of management accounting approaches, the role of management controllers and how it is changing, budgeting, capital budgeting, cash flow analysis, cost accounting techniques, and performance measurement. The document contains chapter summaries and outlines for each topic, exam information, and case studies.