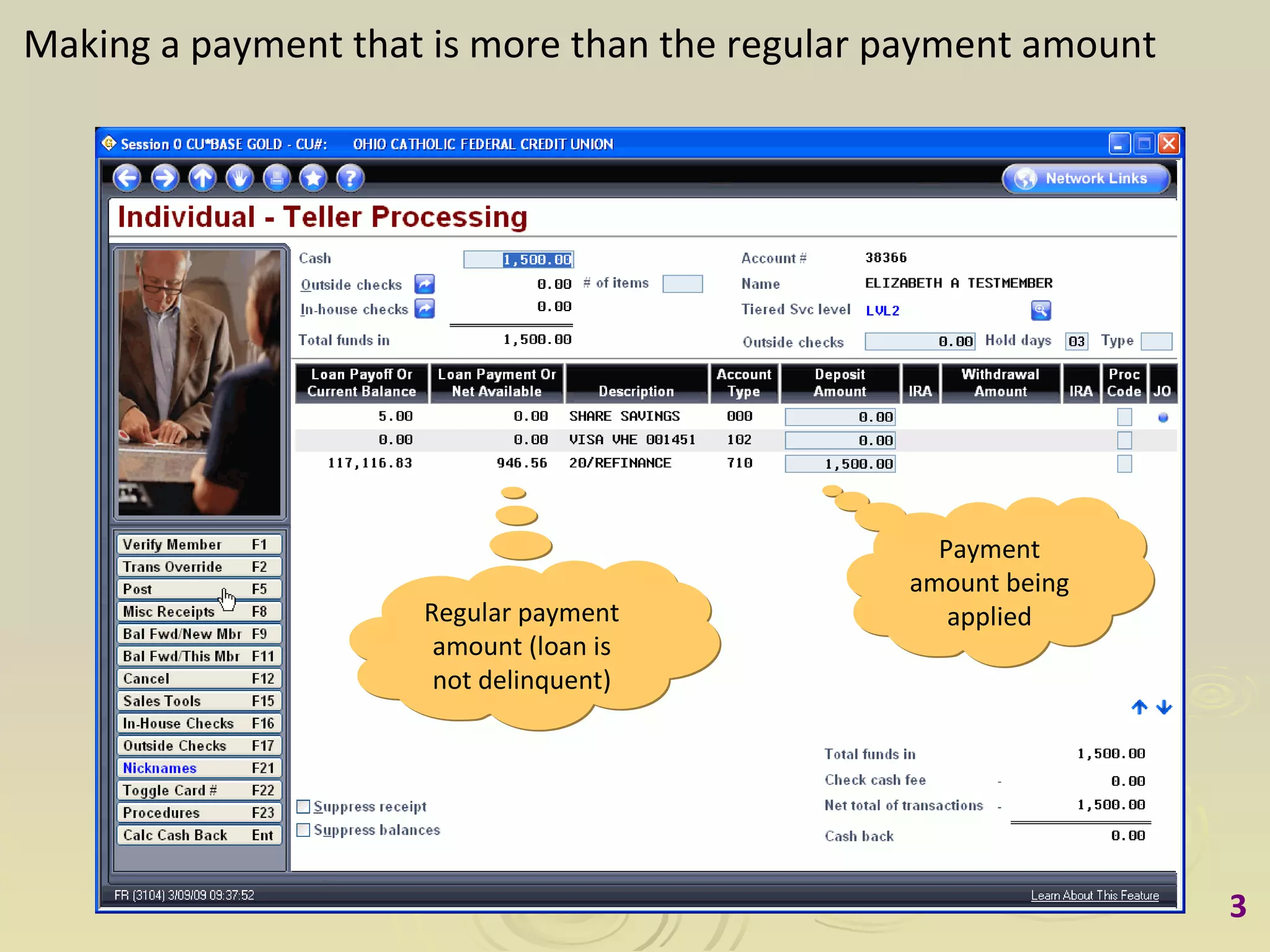

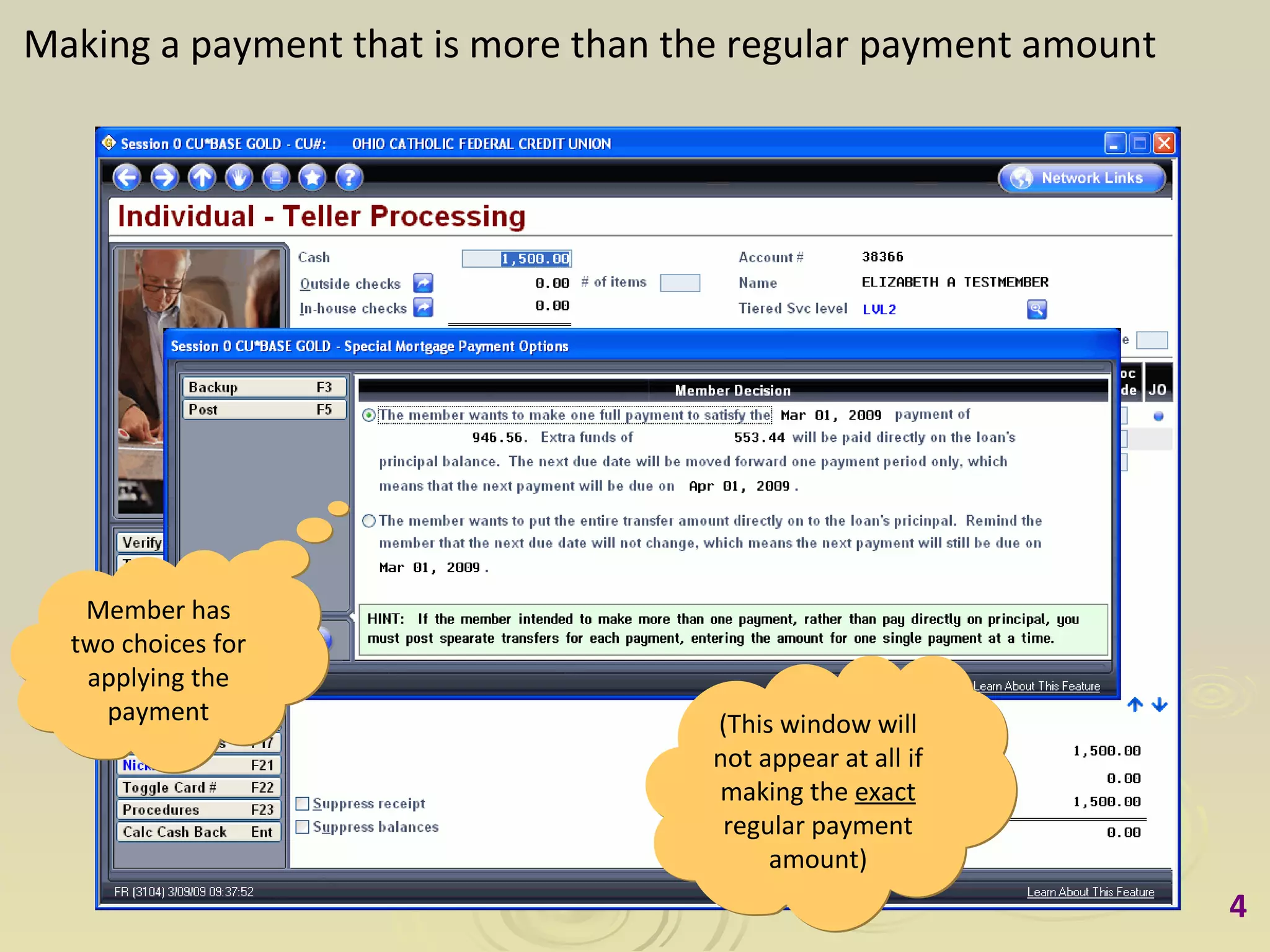

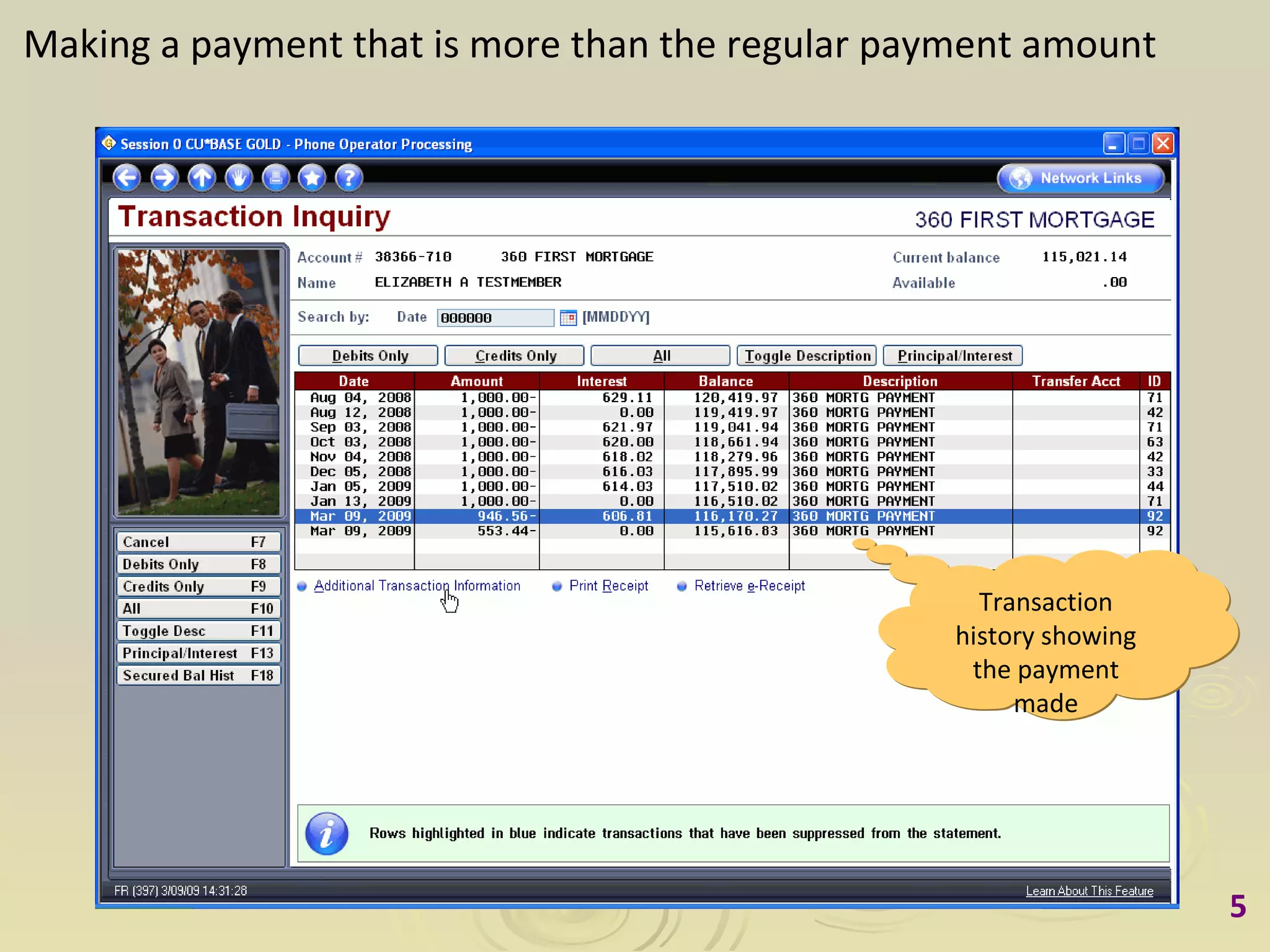

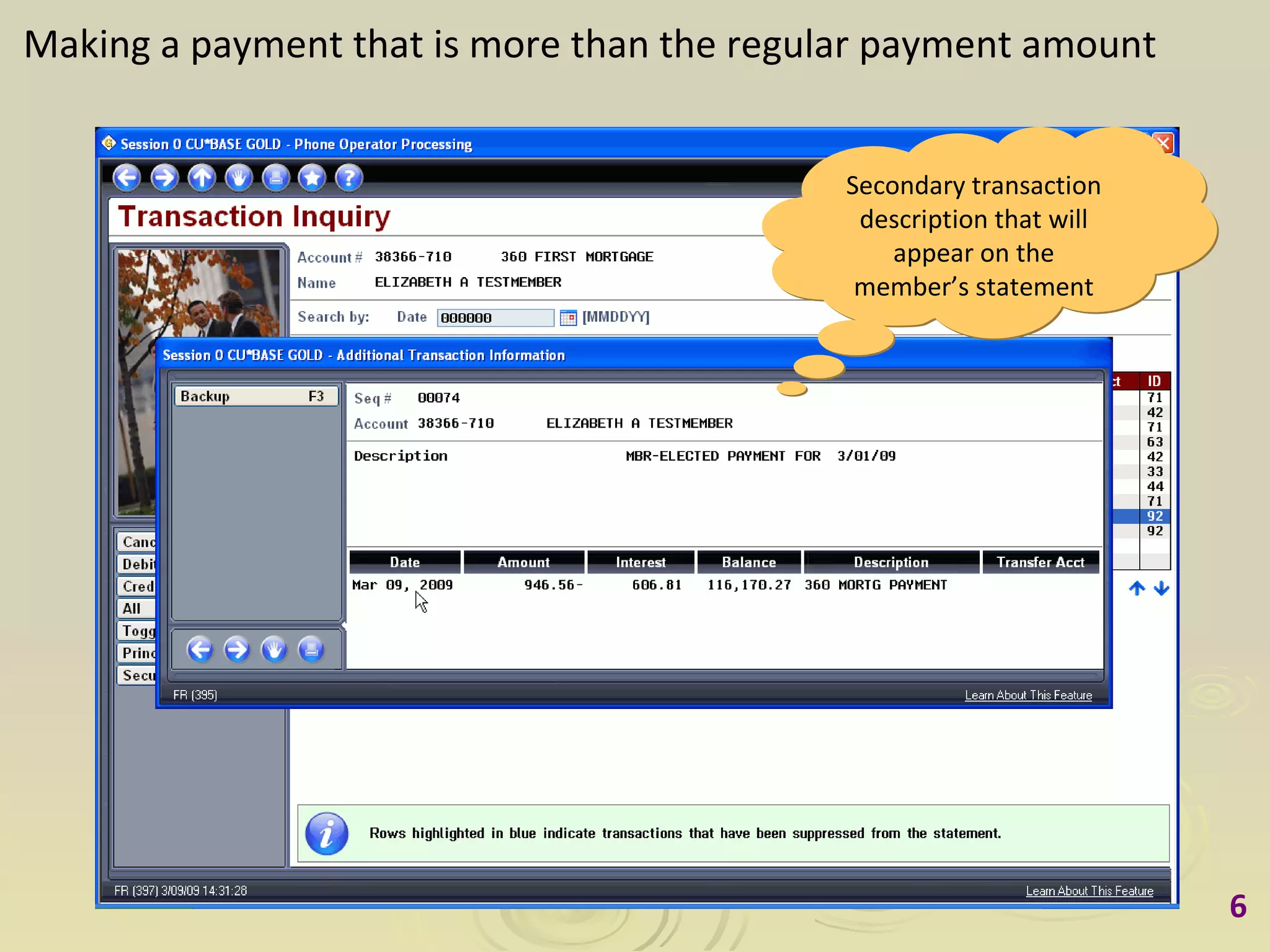

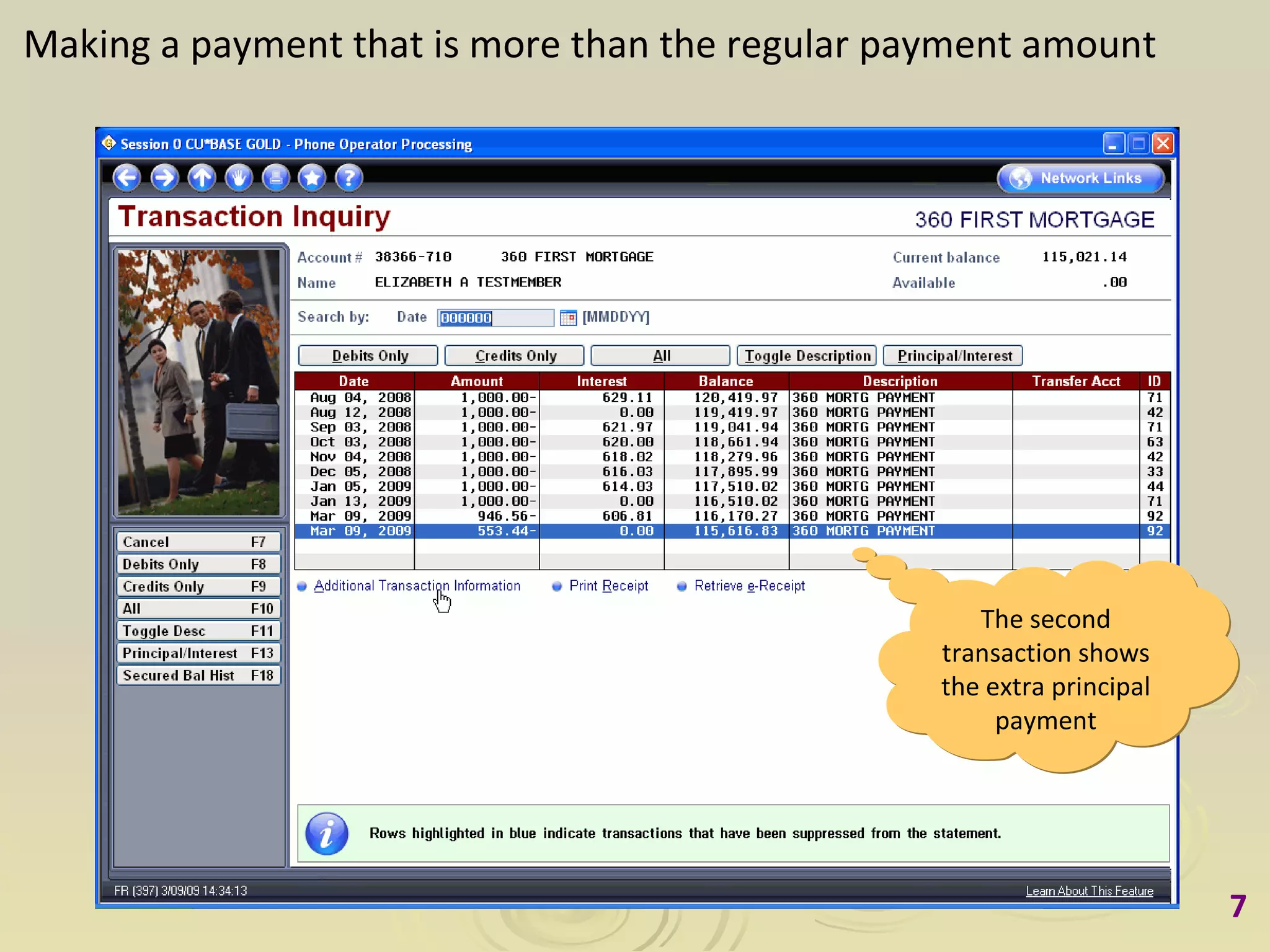

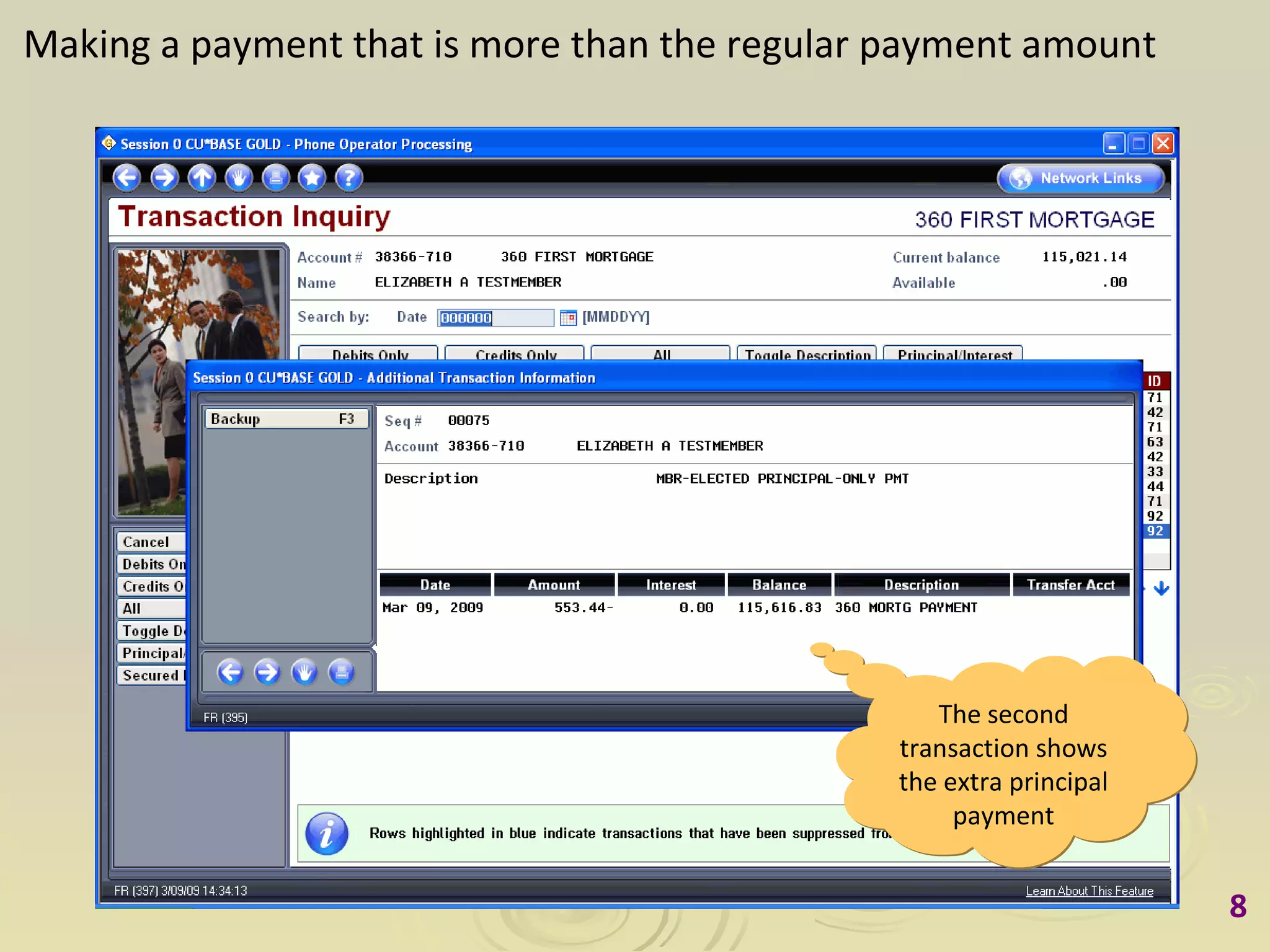

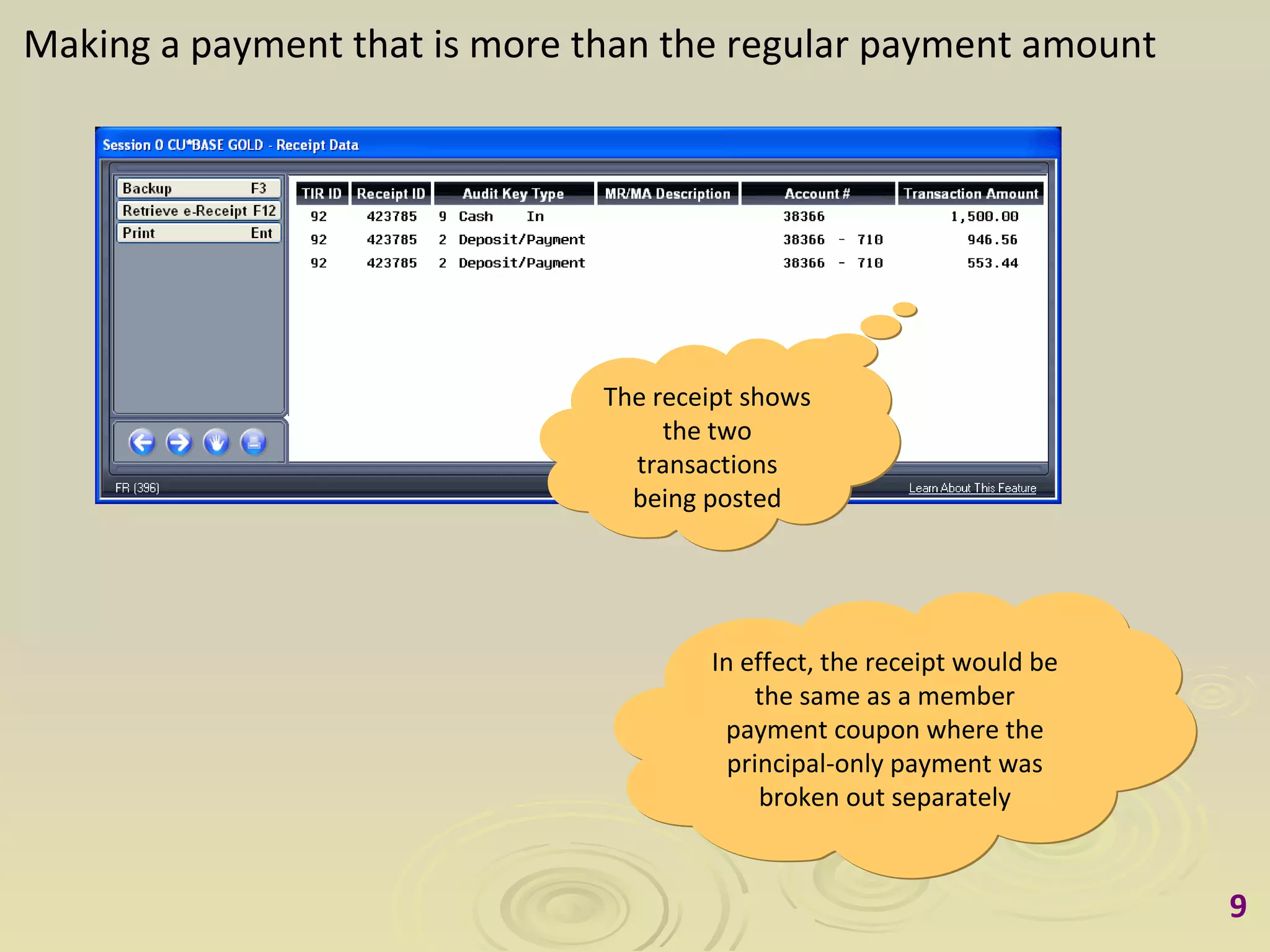

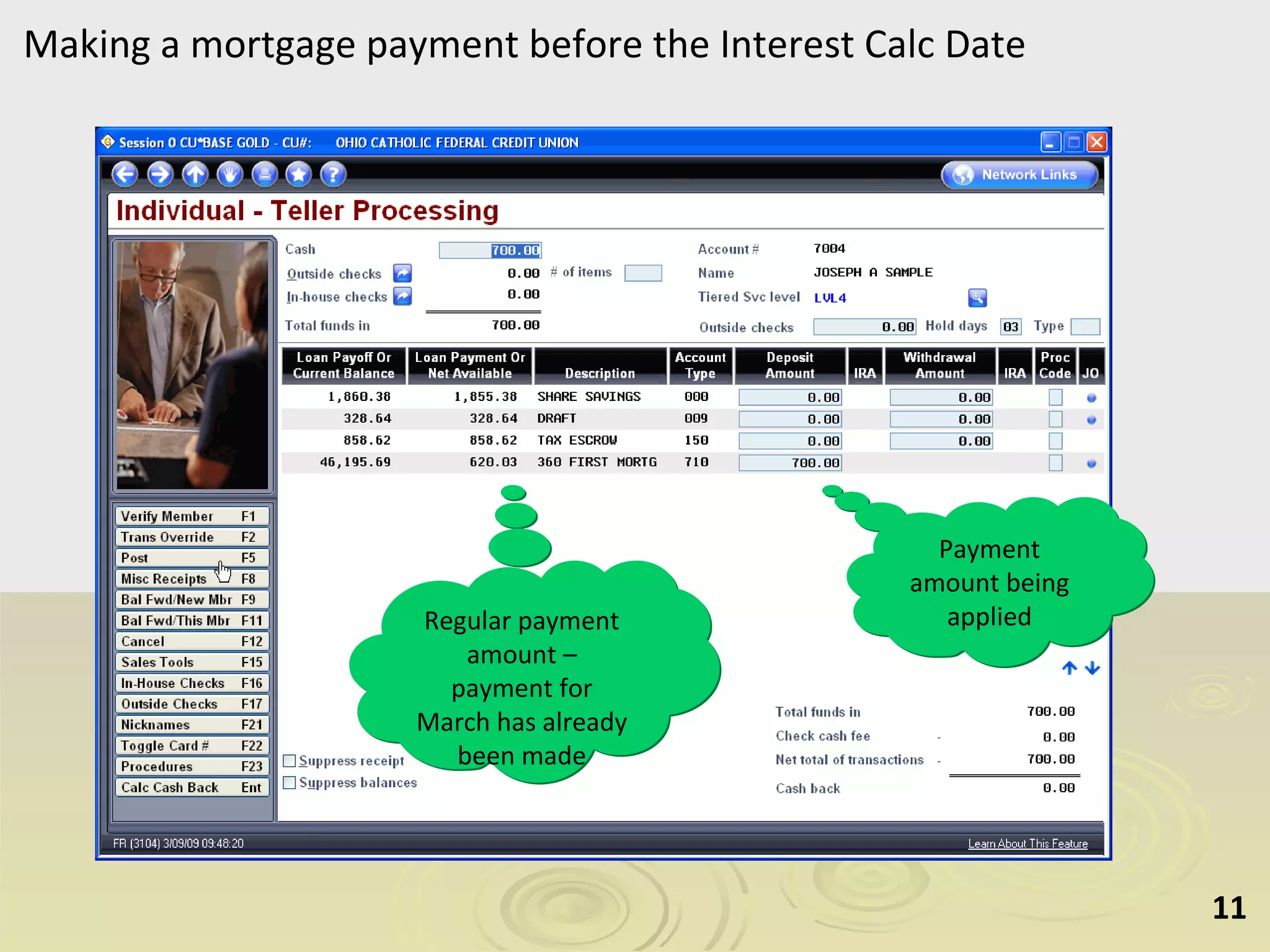

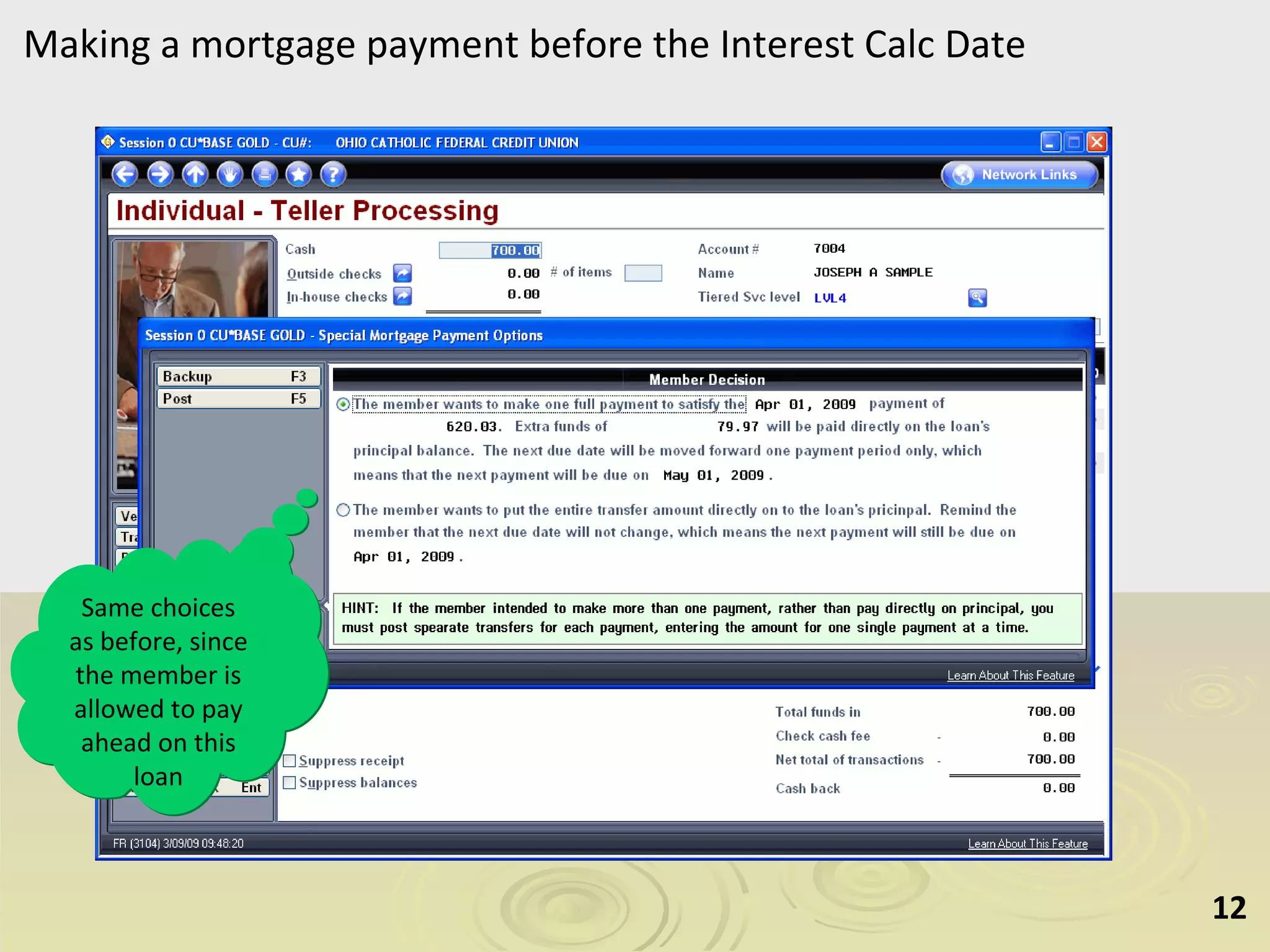

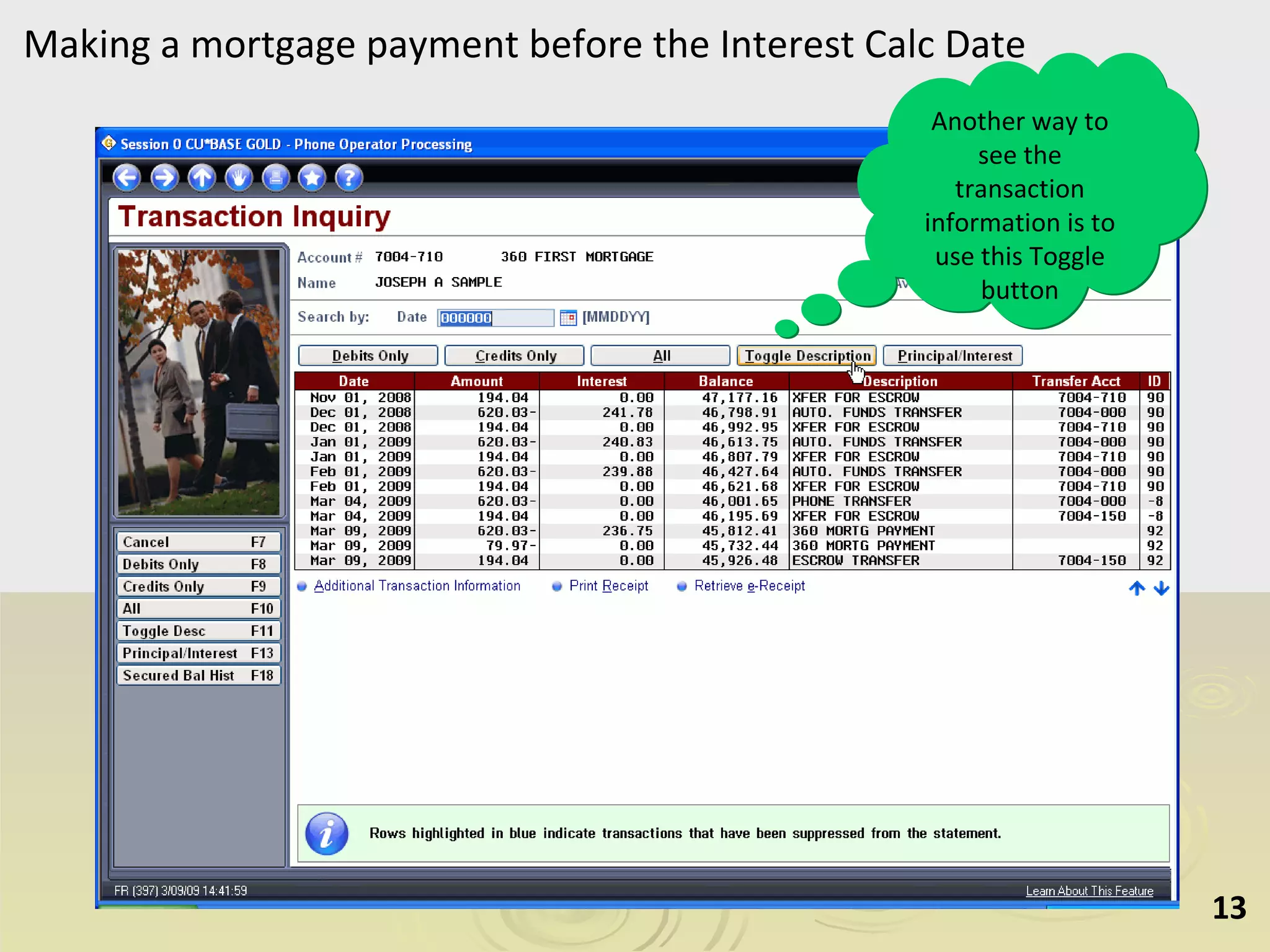

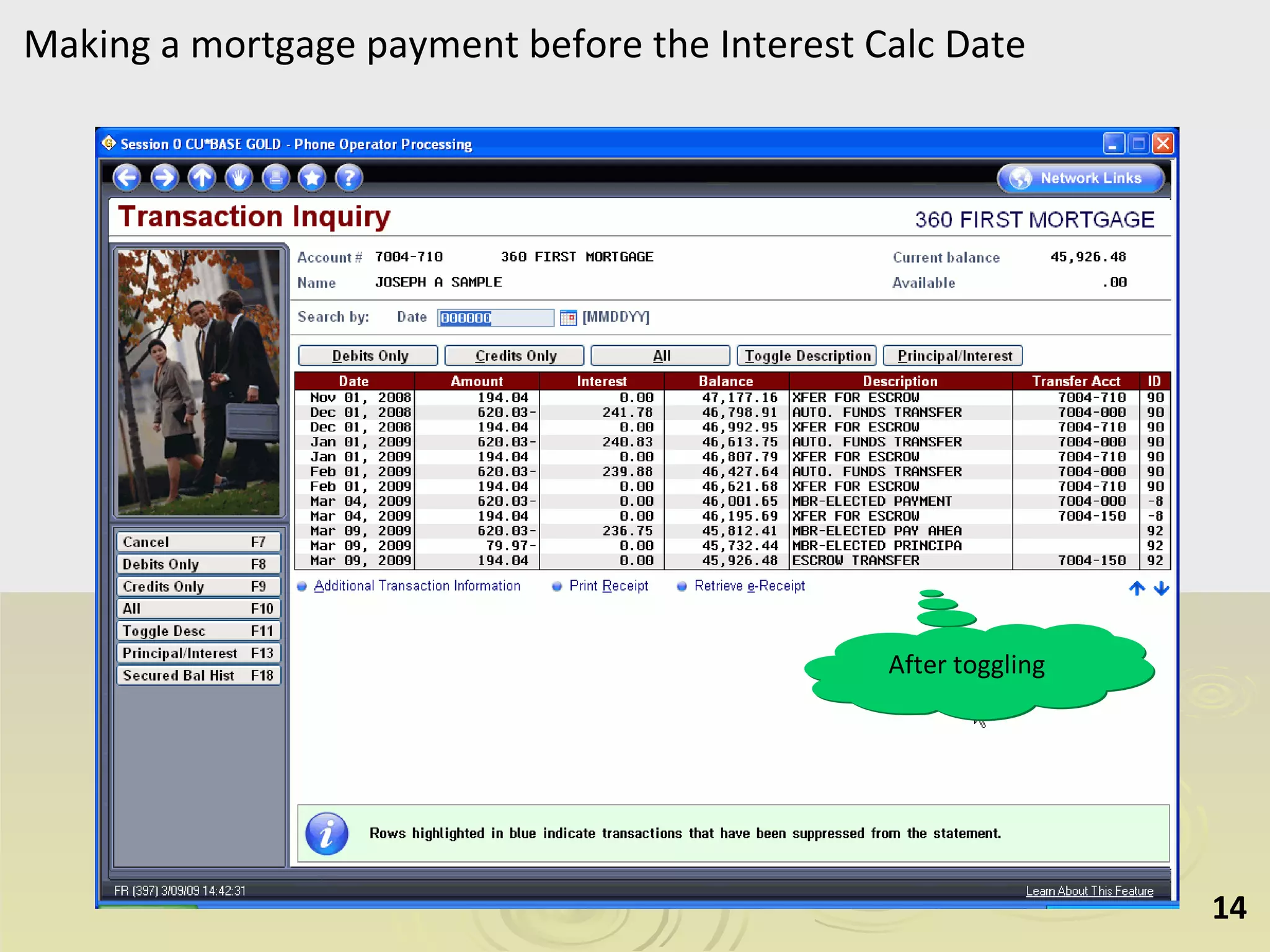

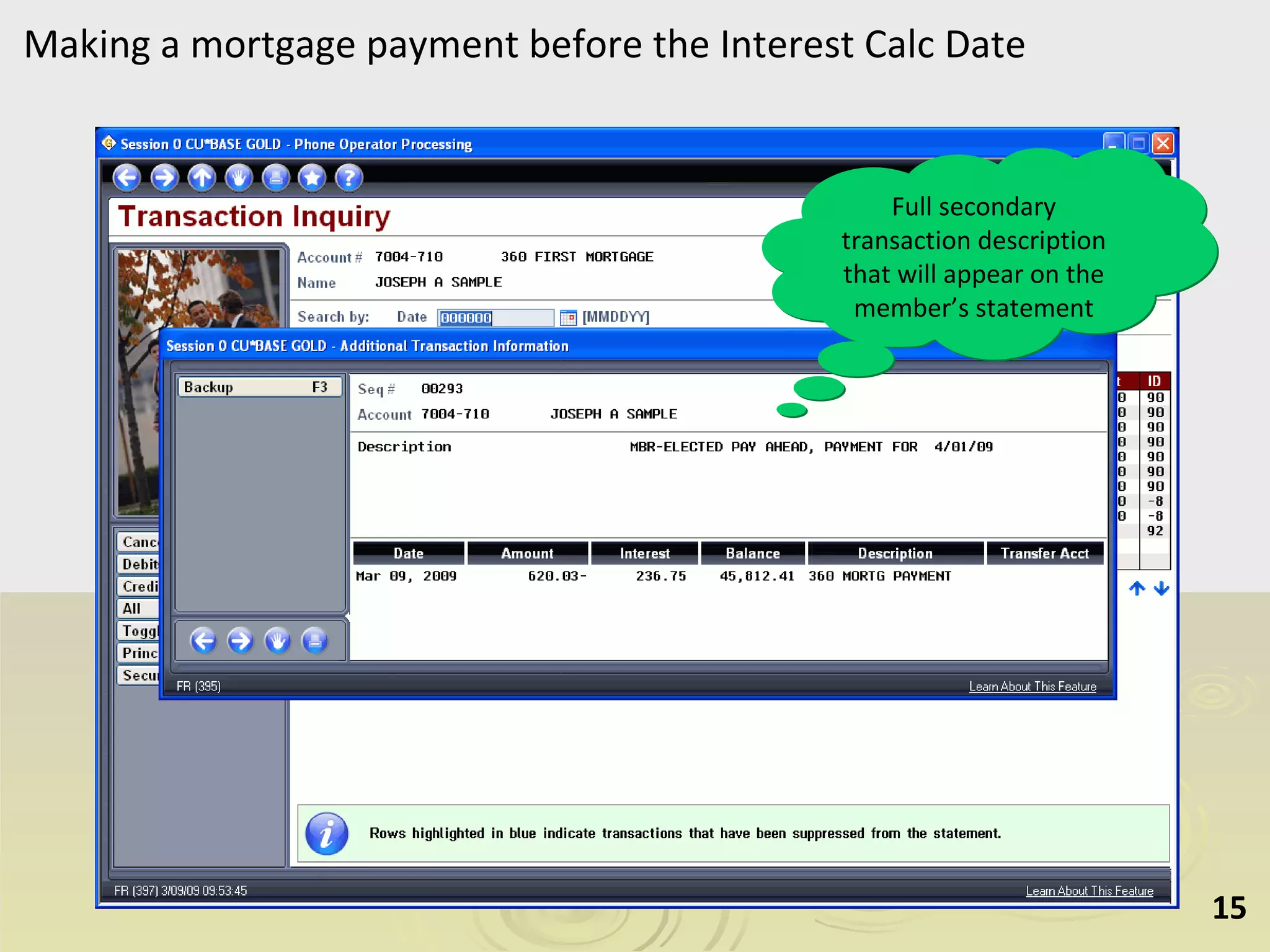

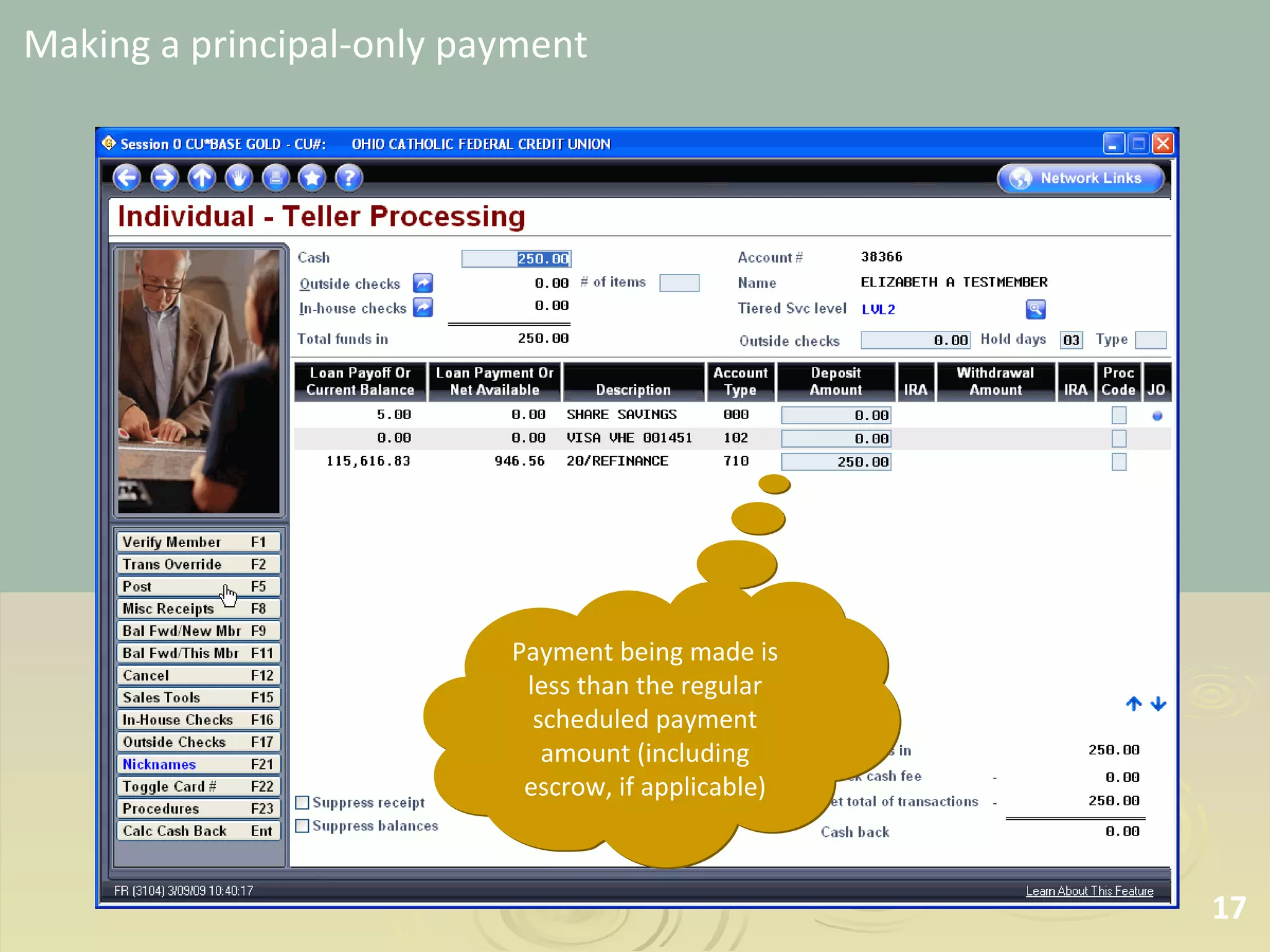

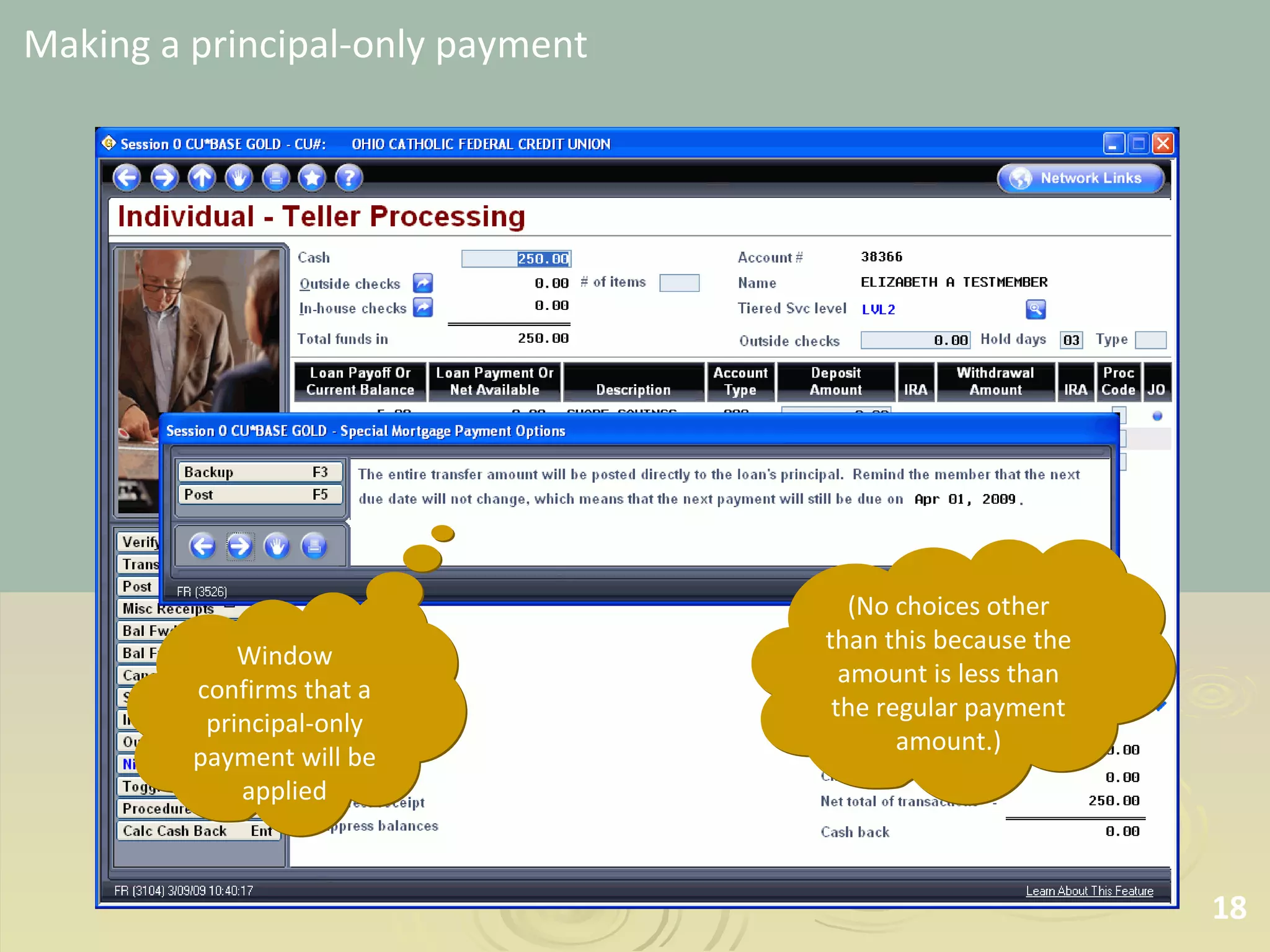

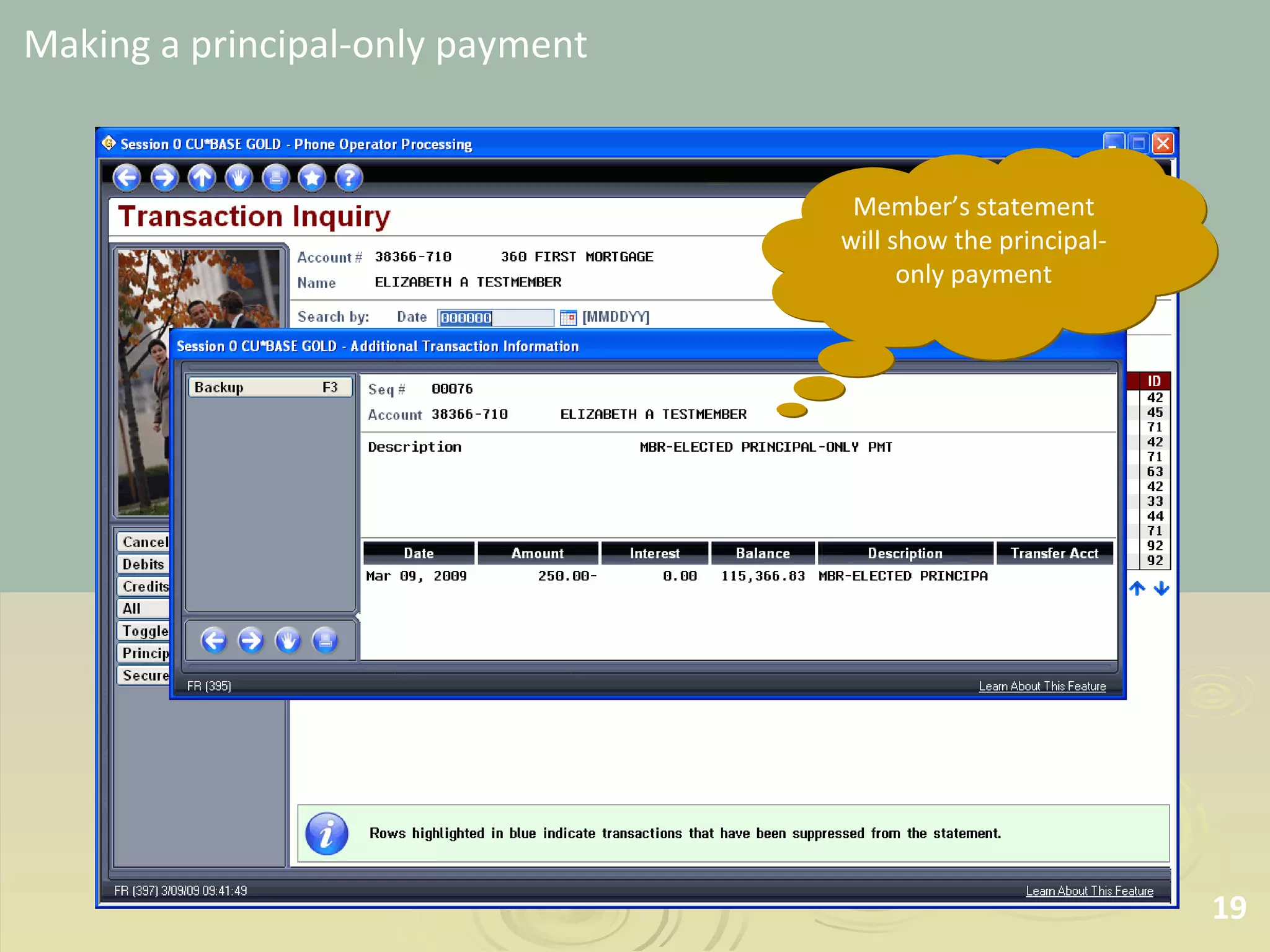

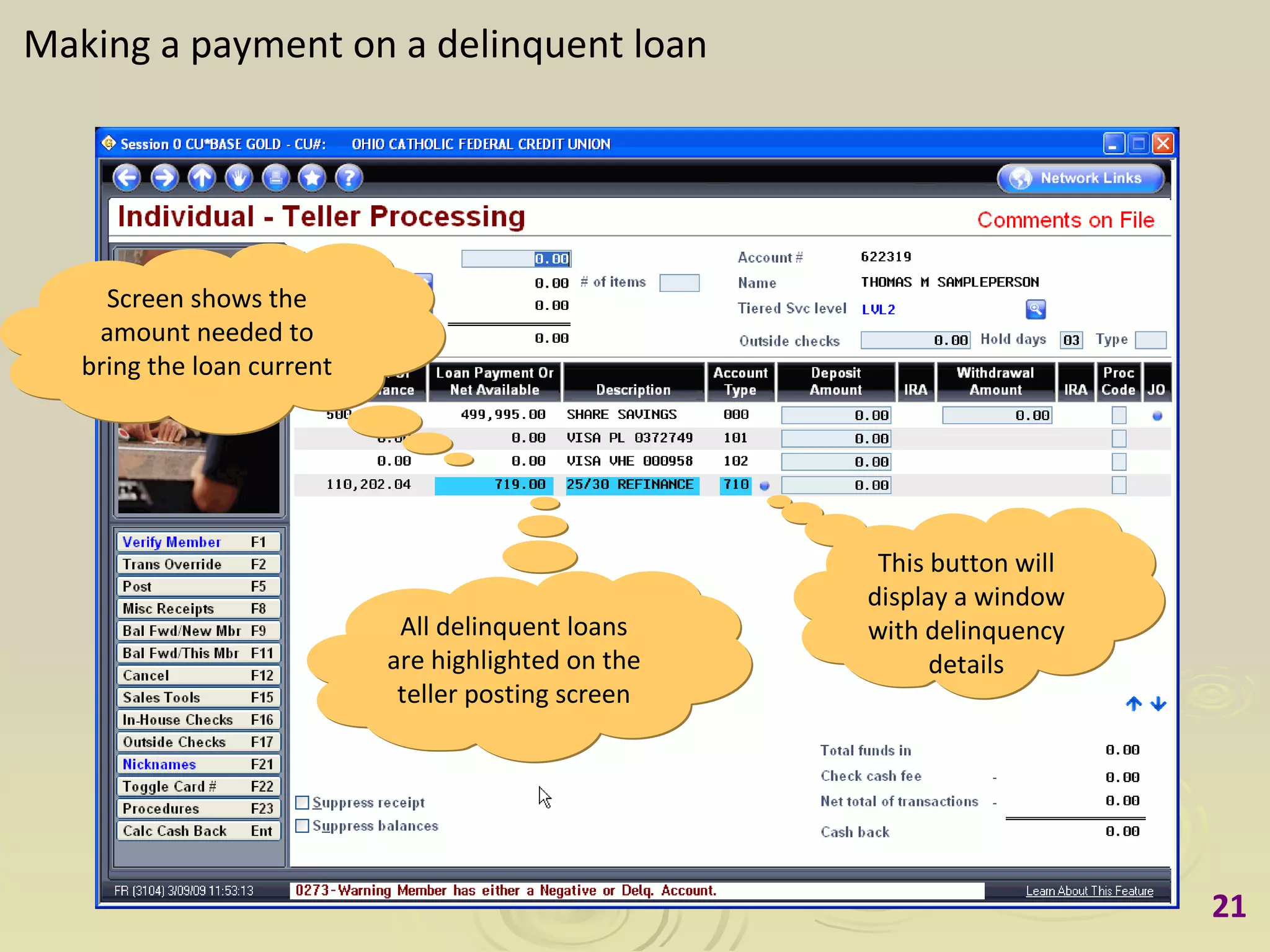

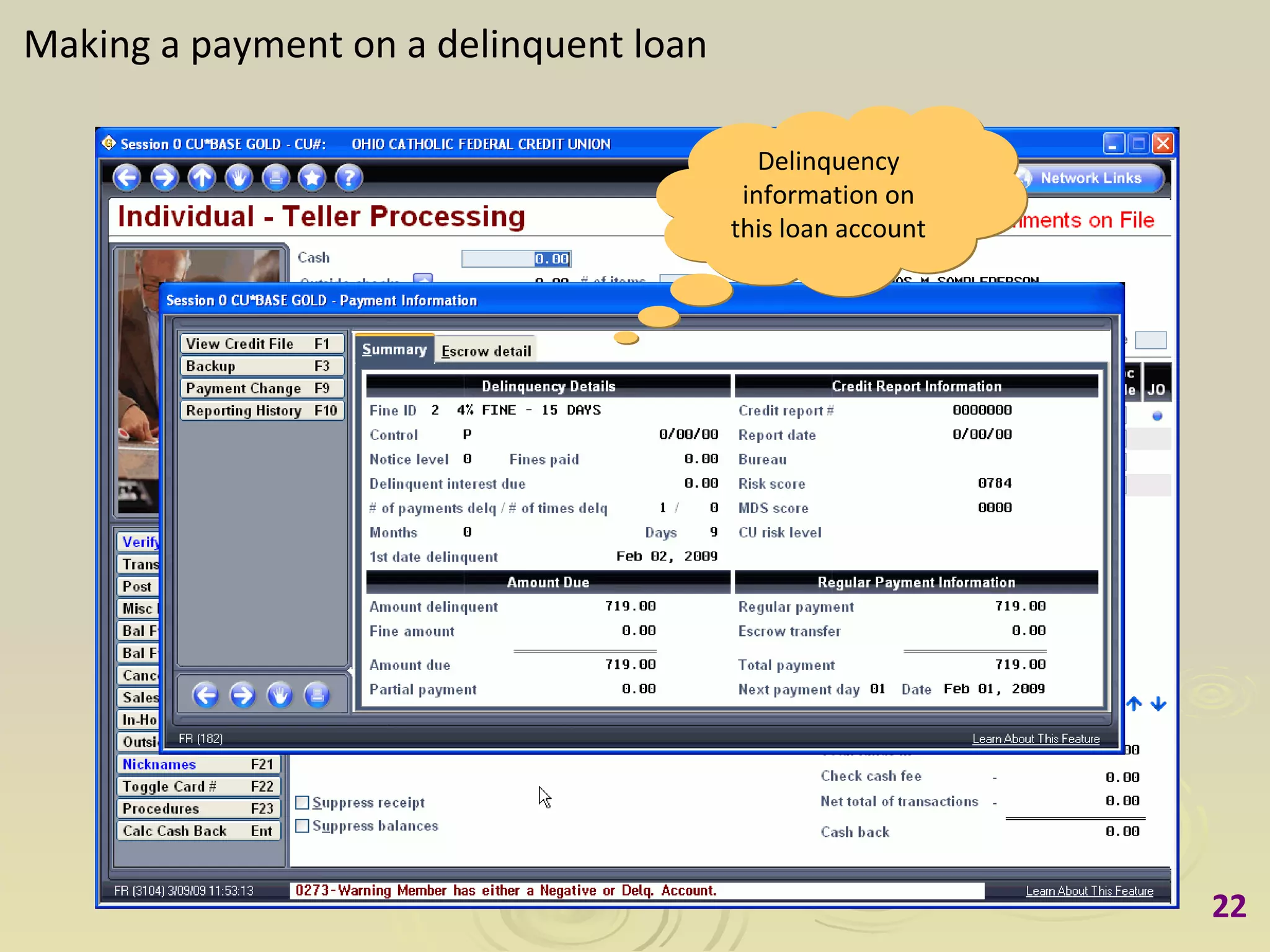

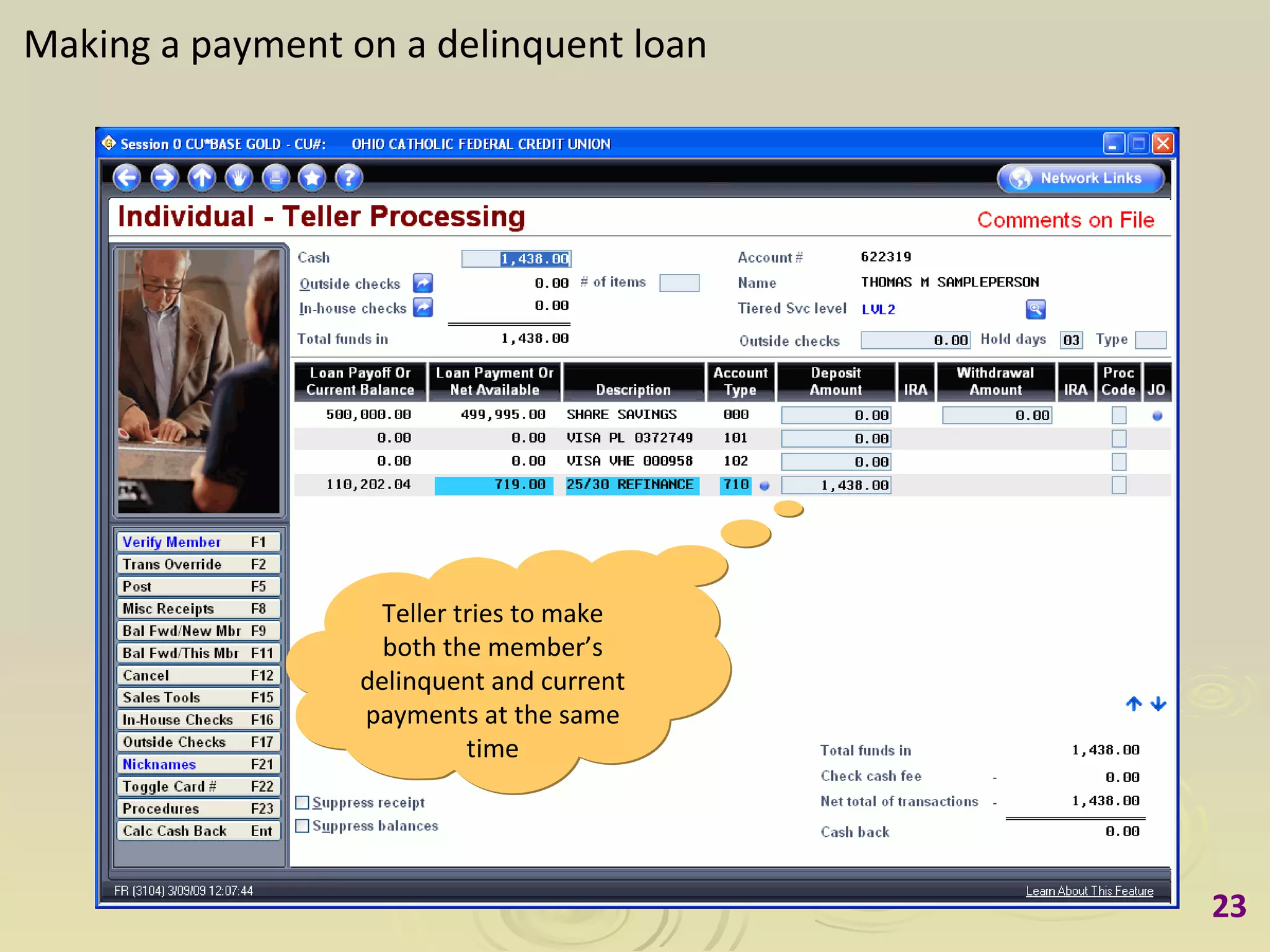

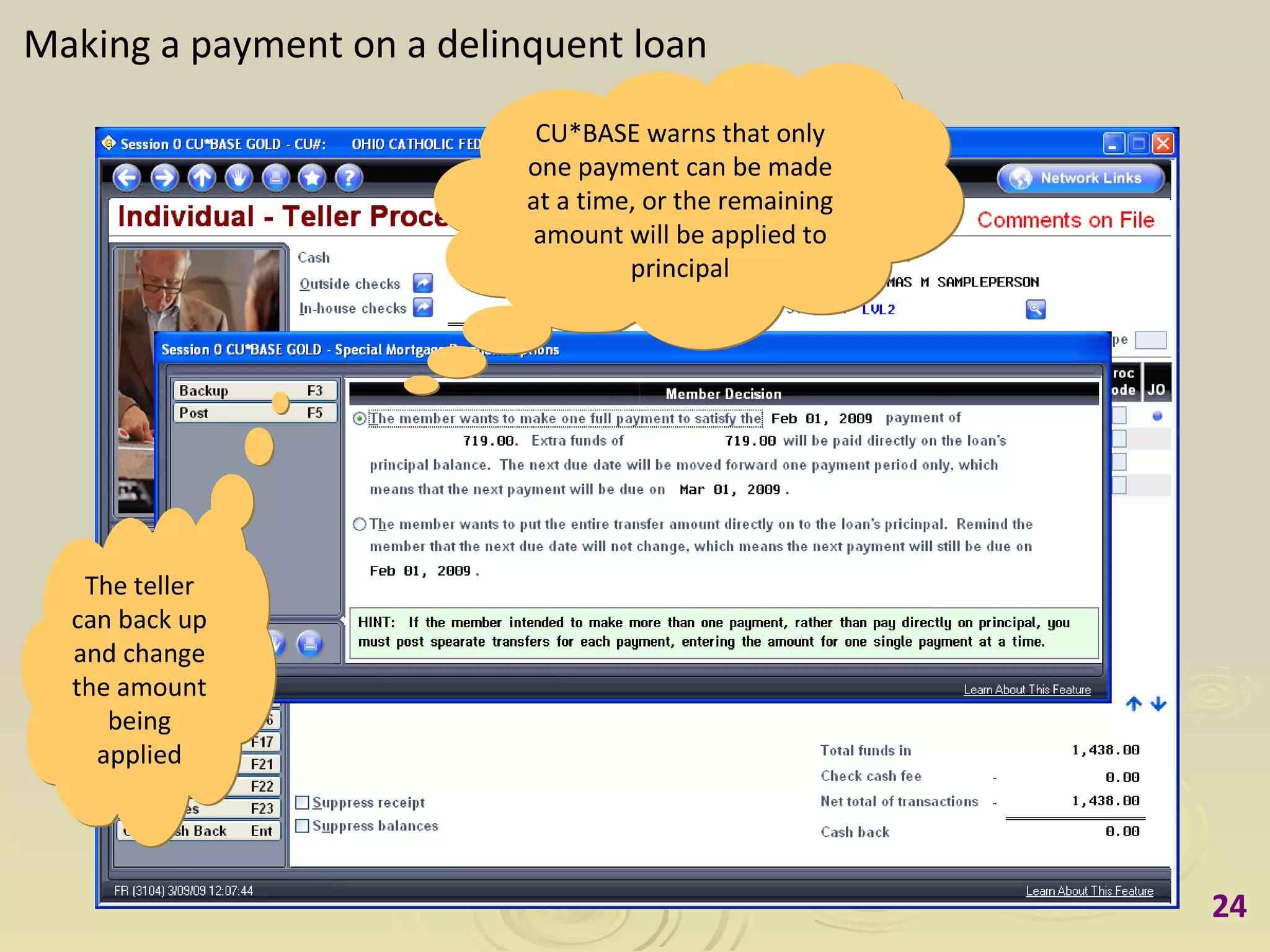

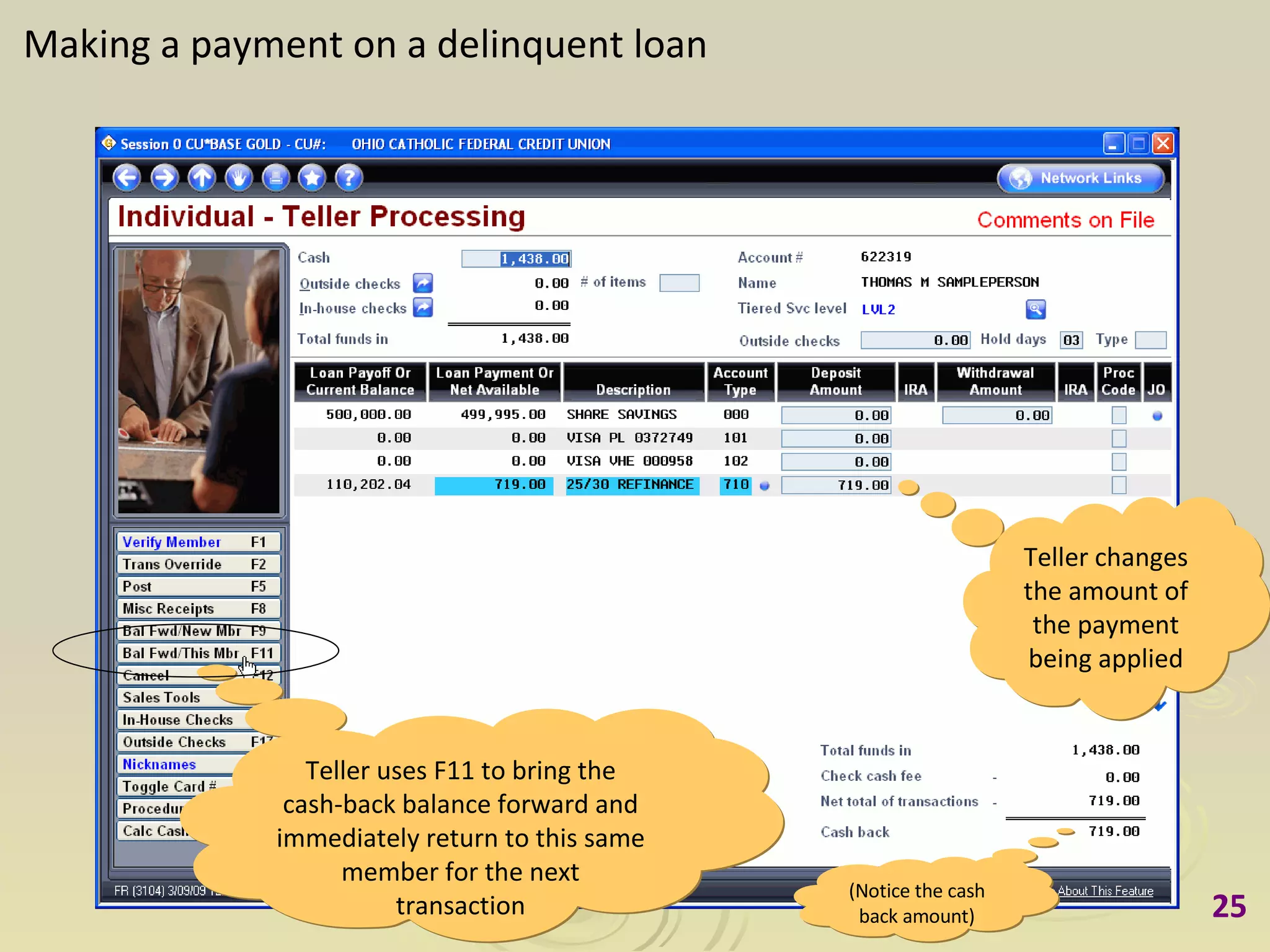

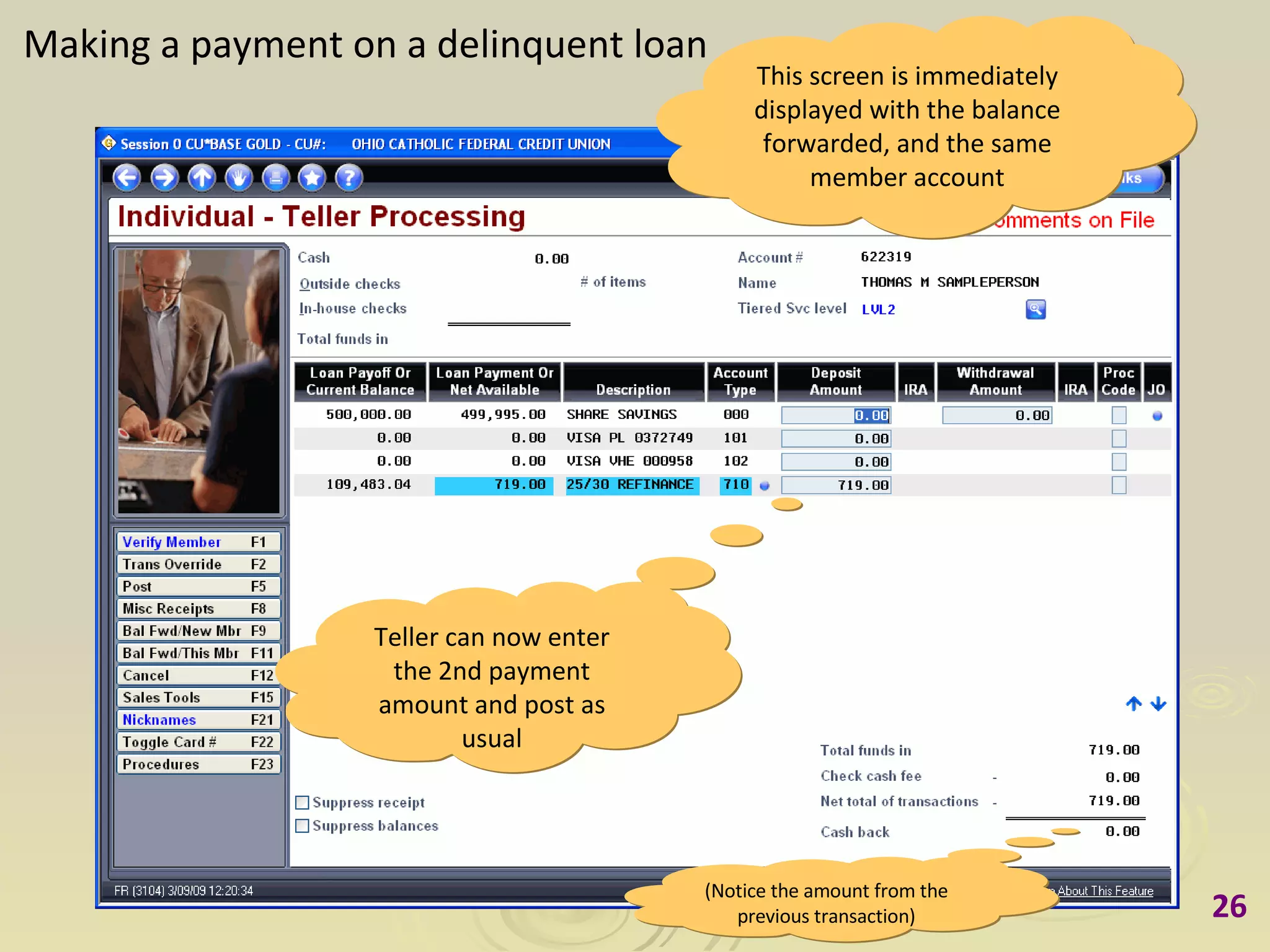

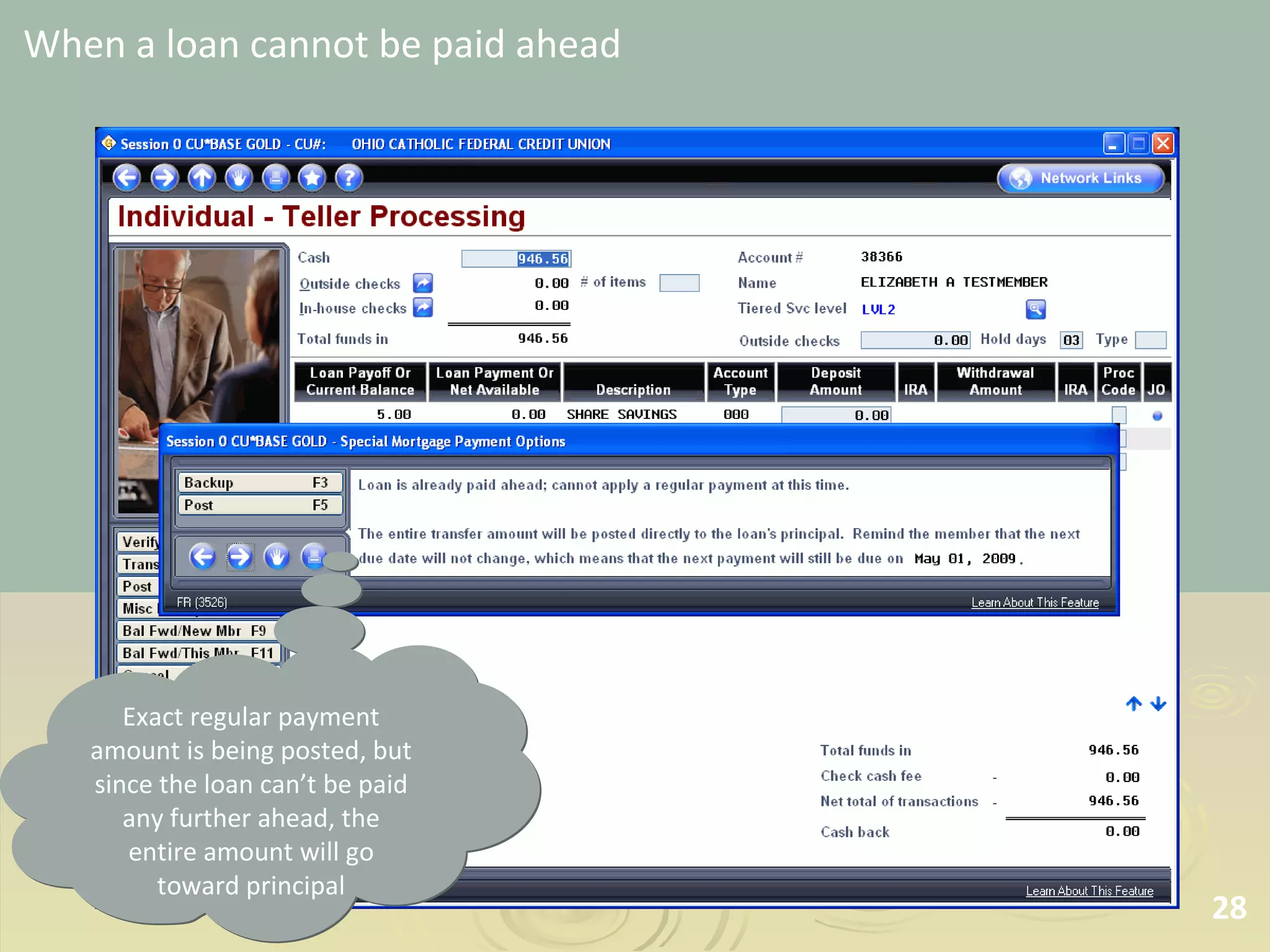

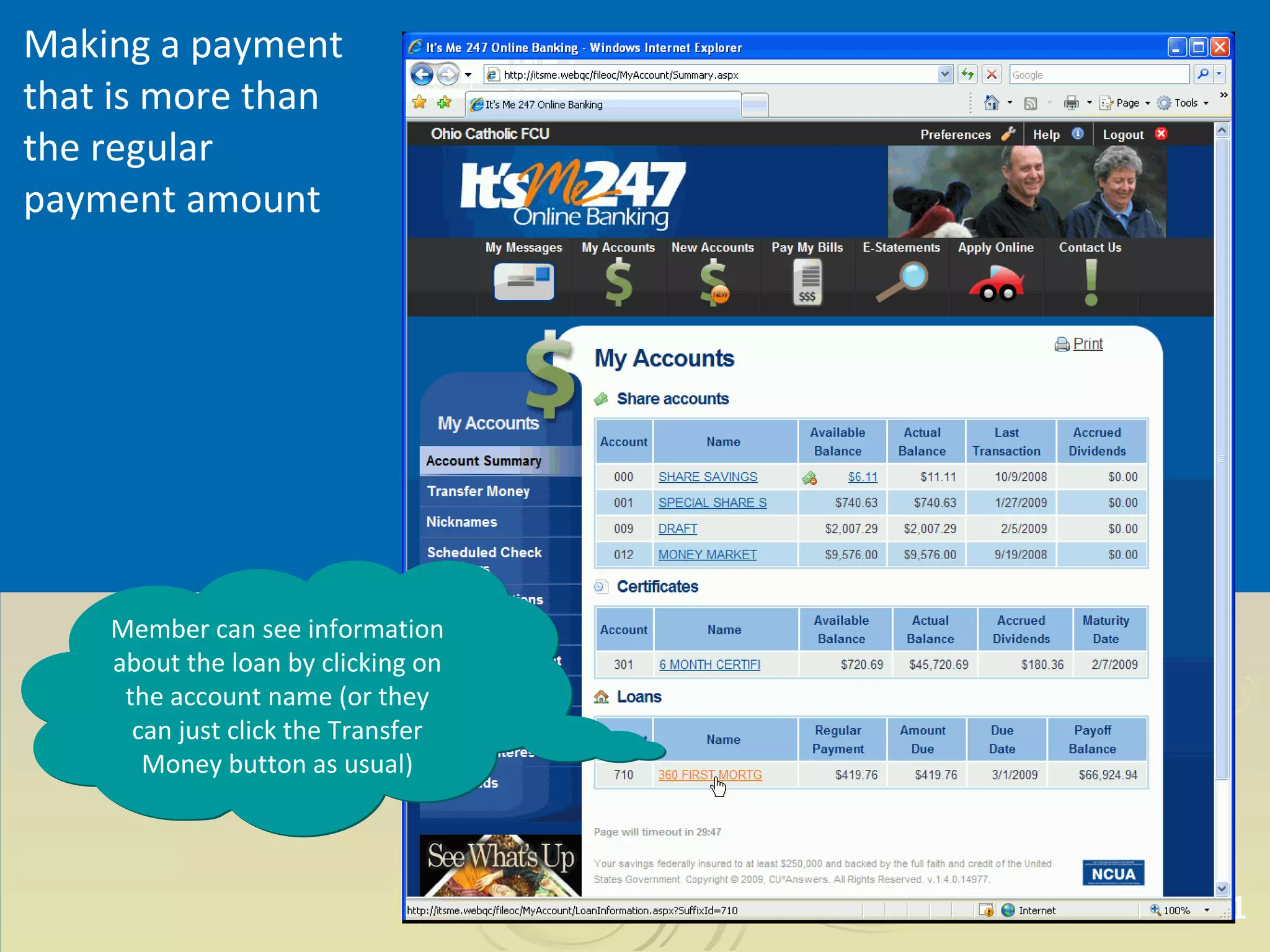

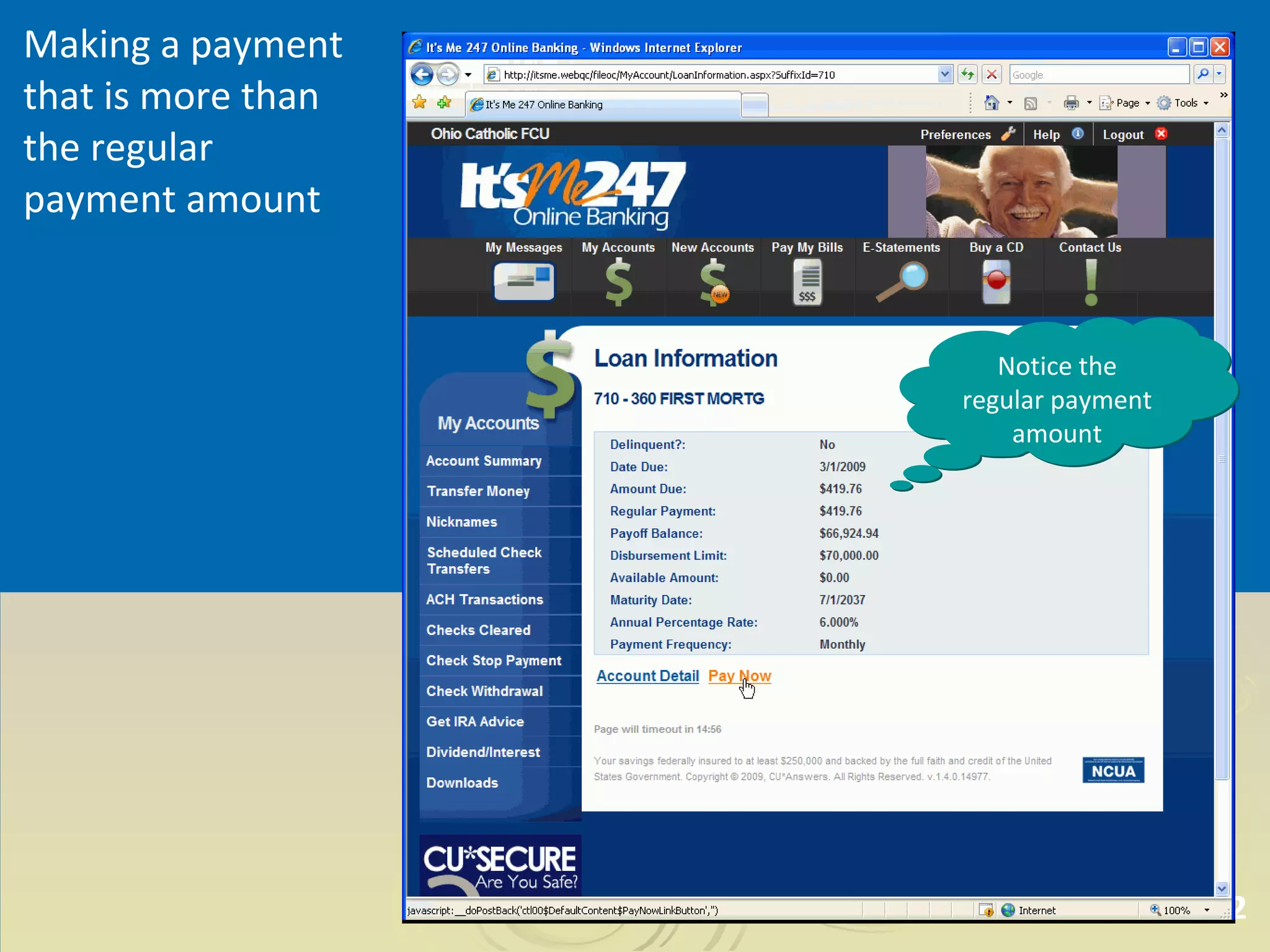

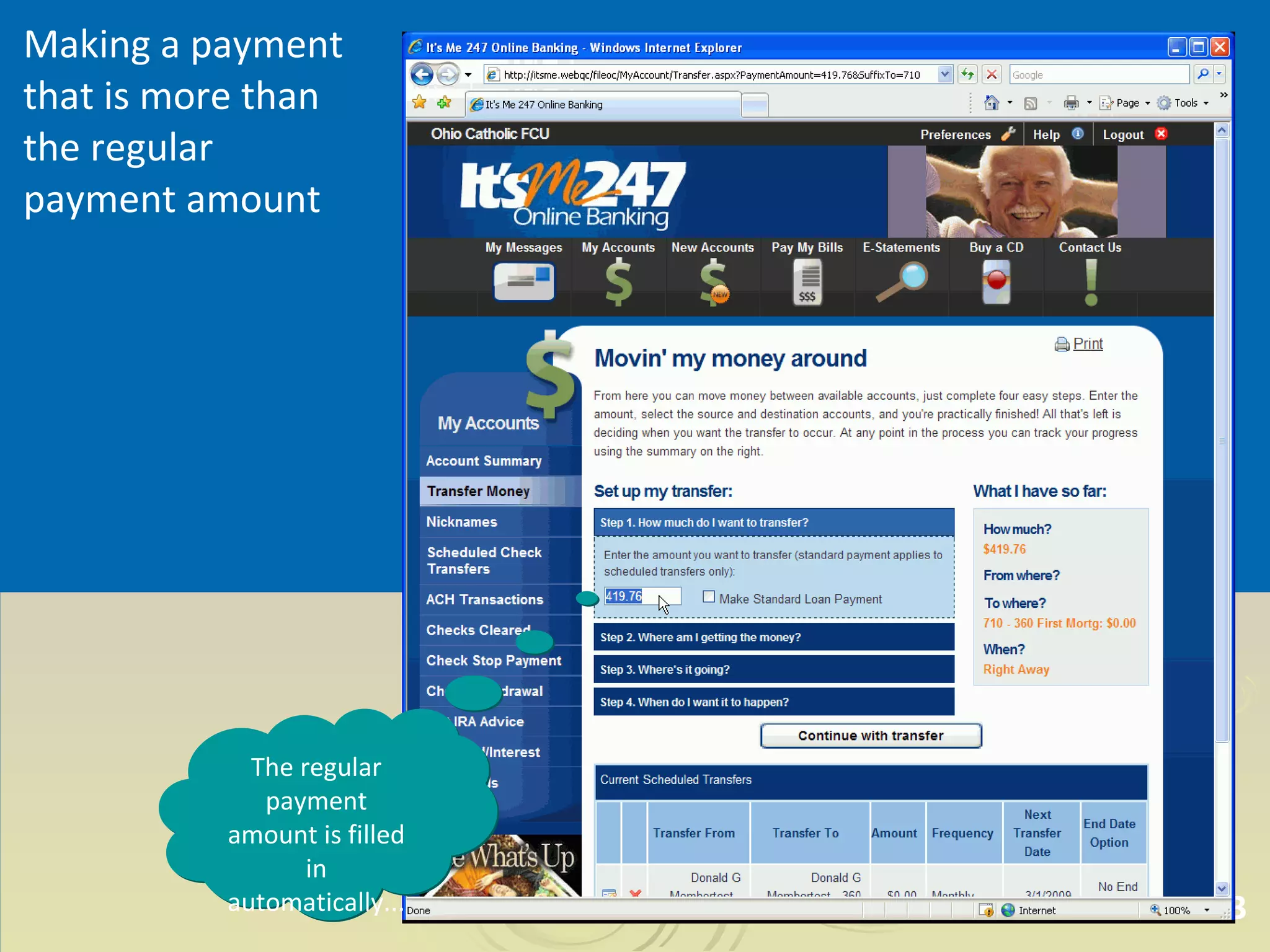

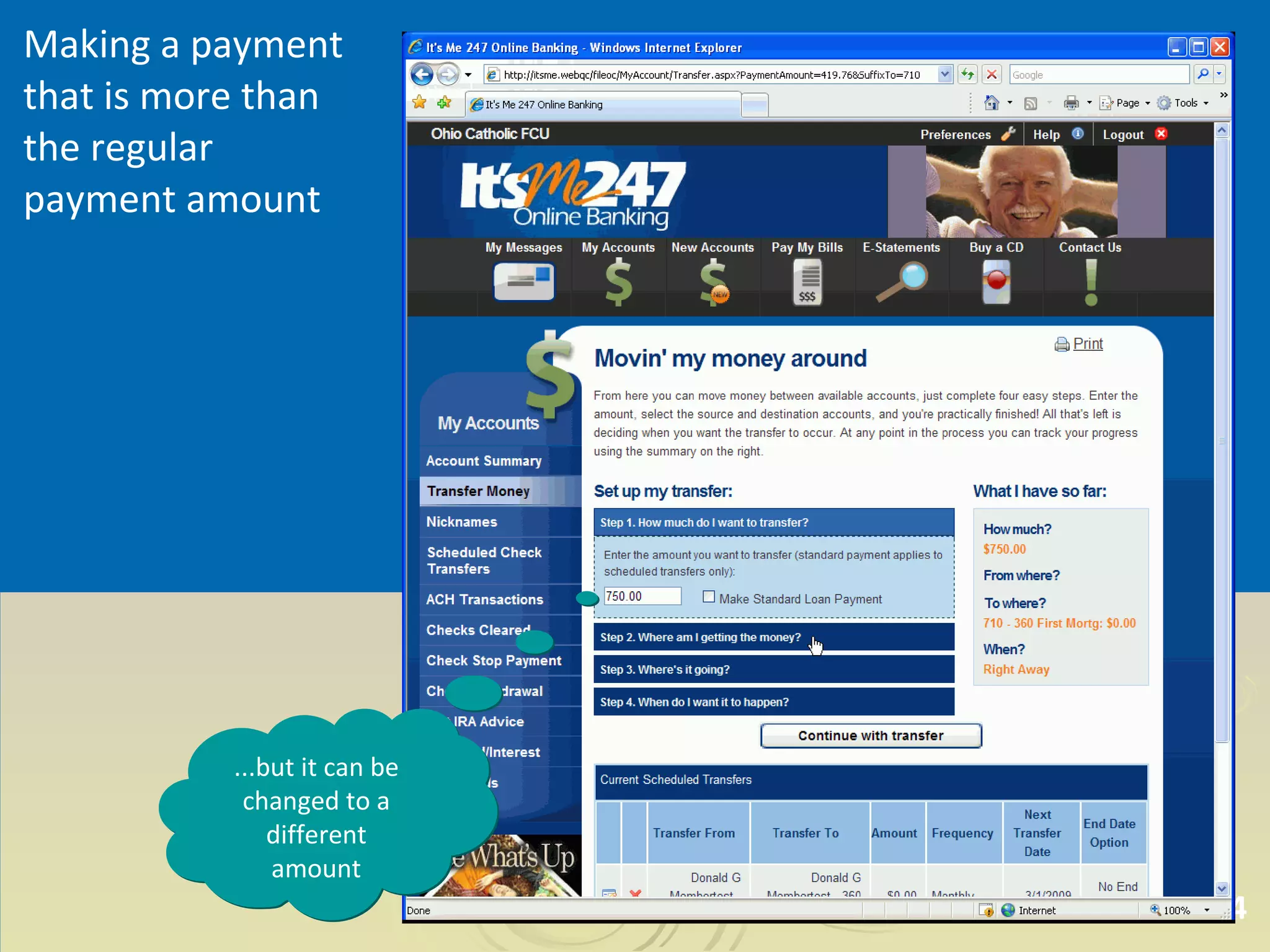

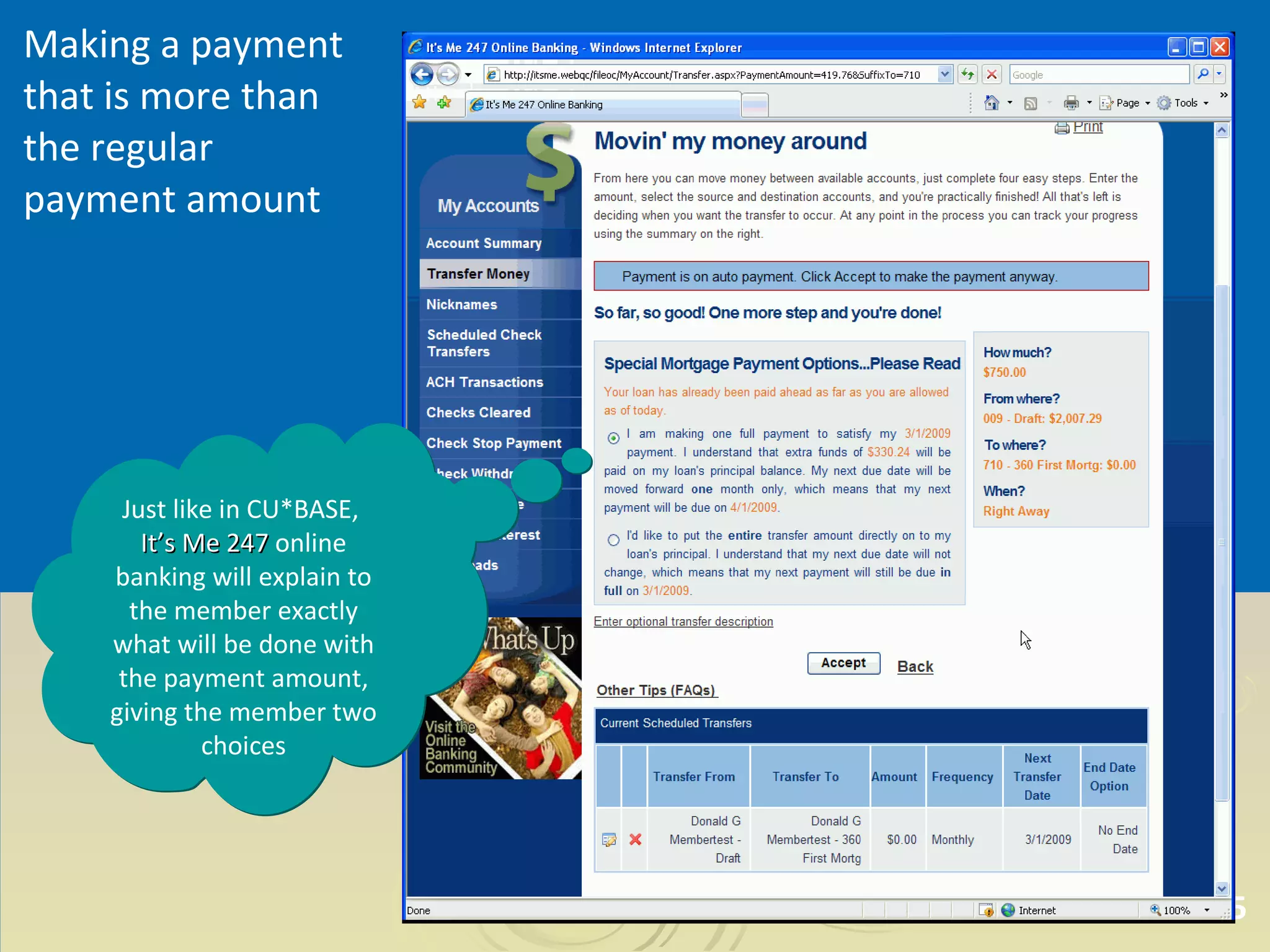

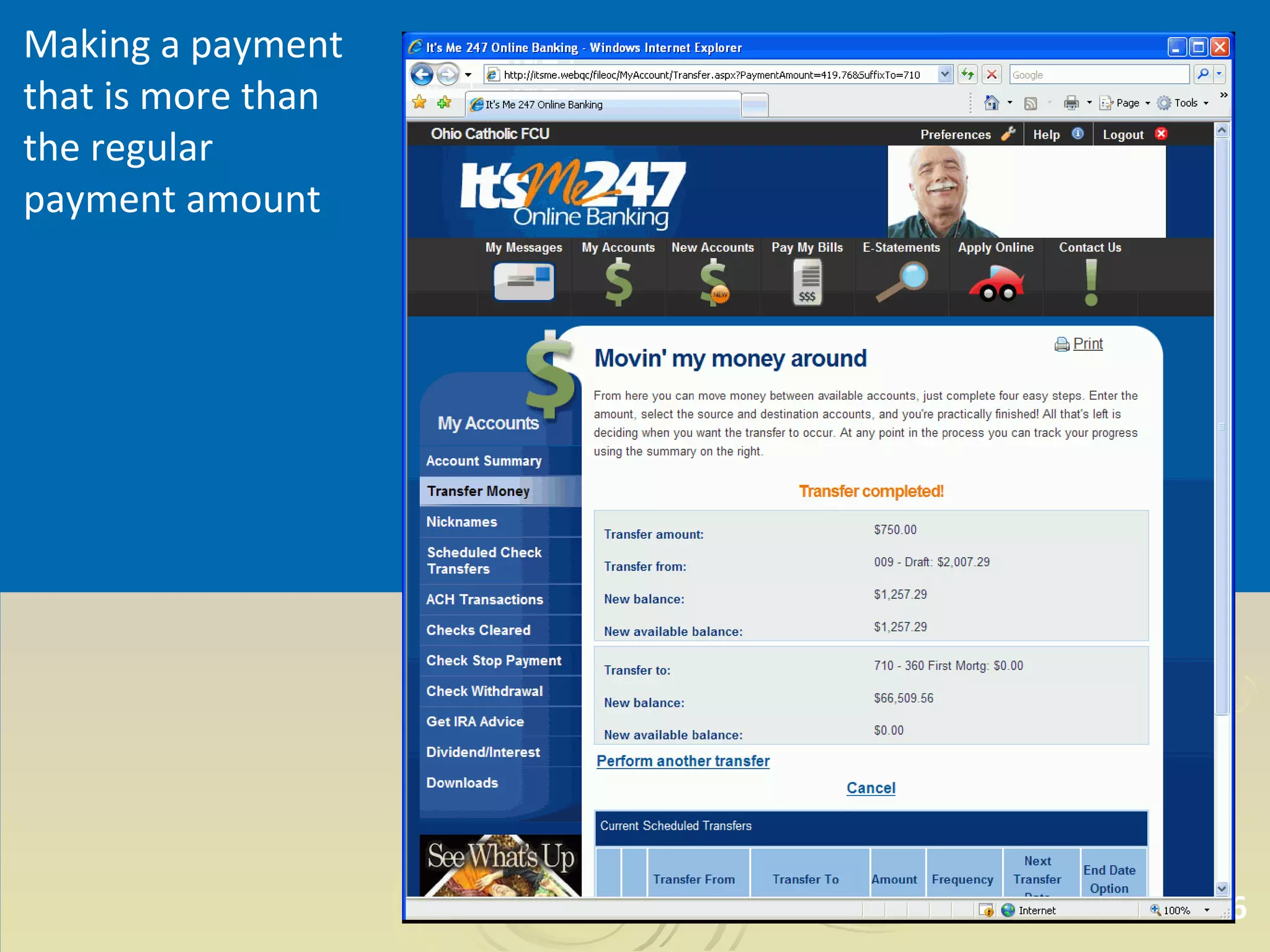

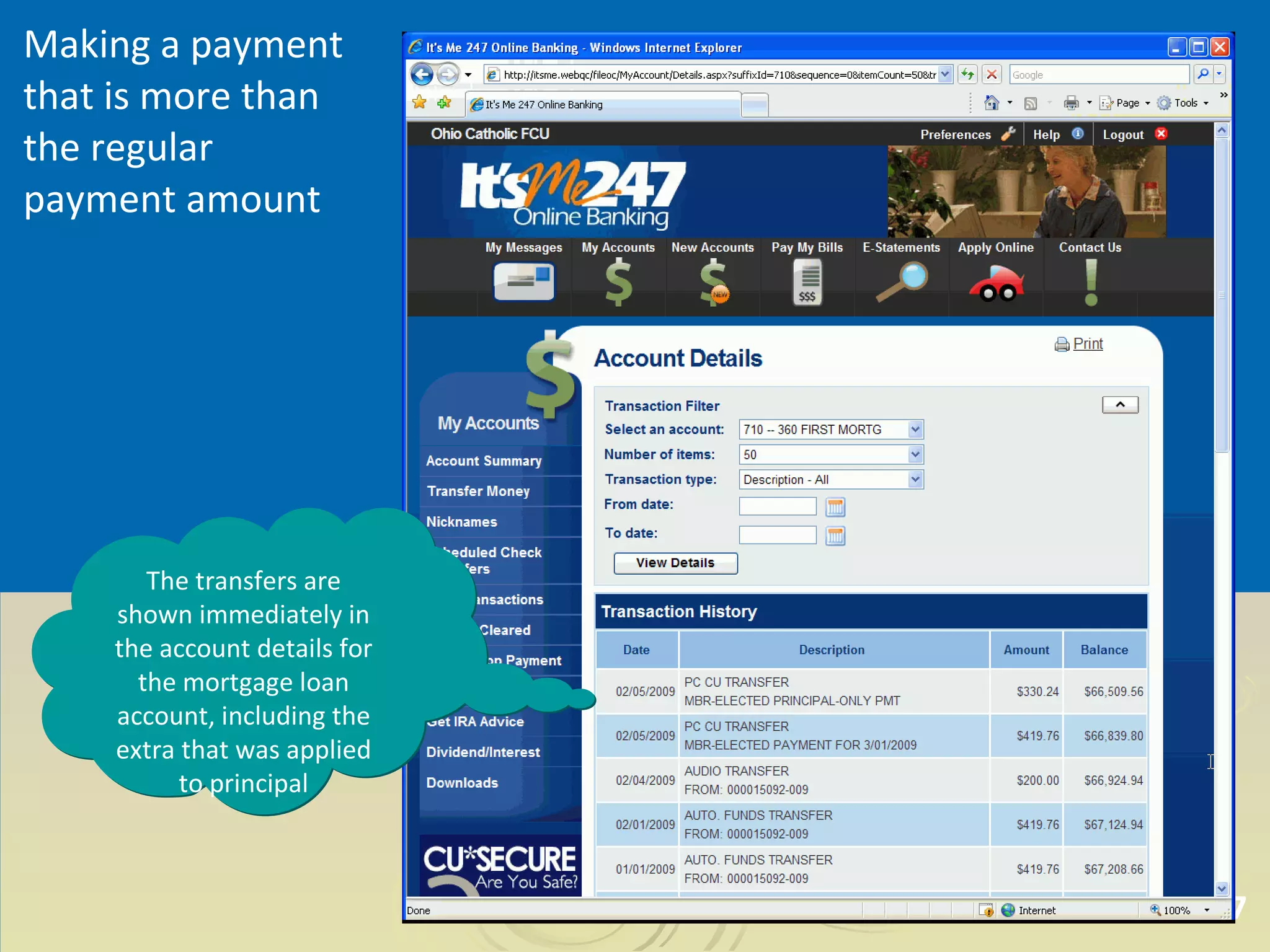

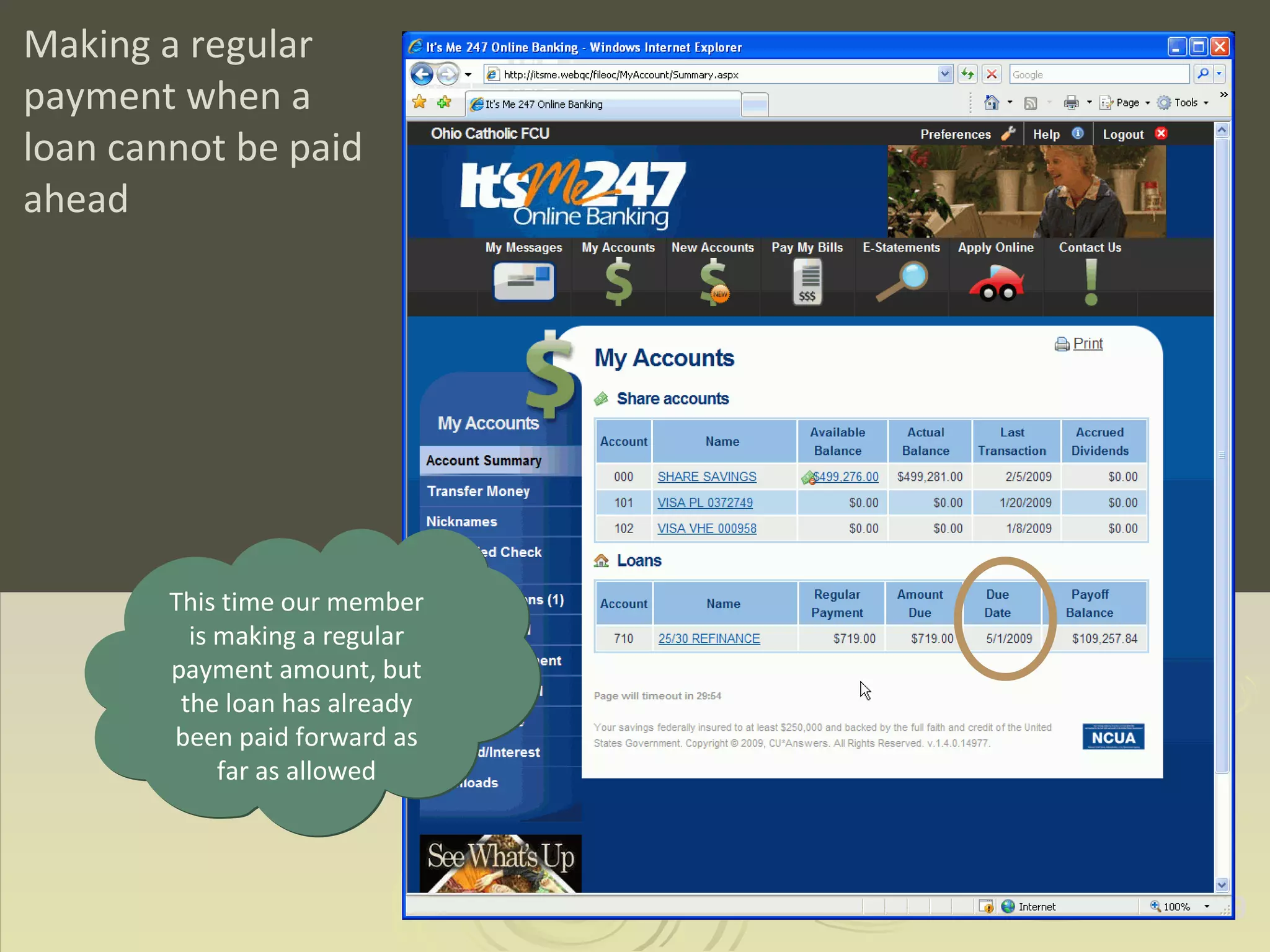

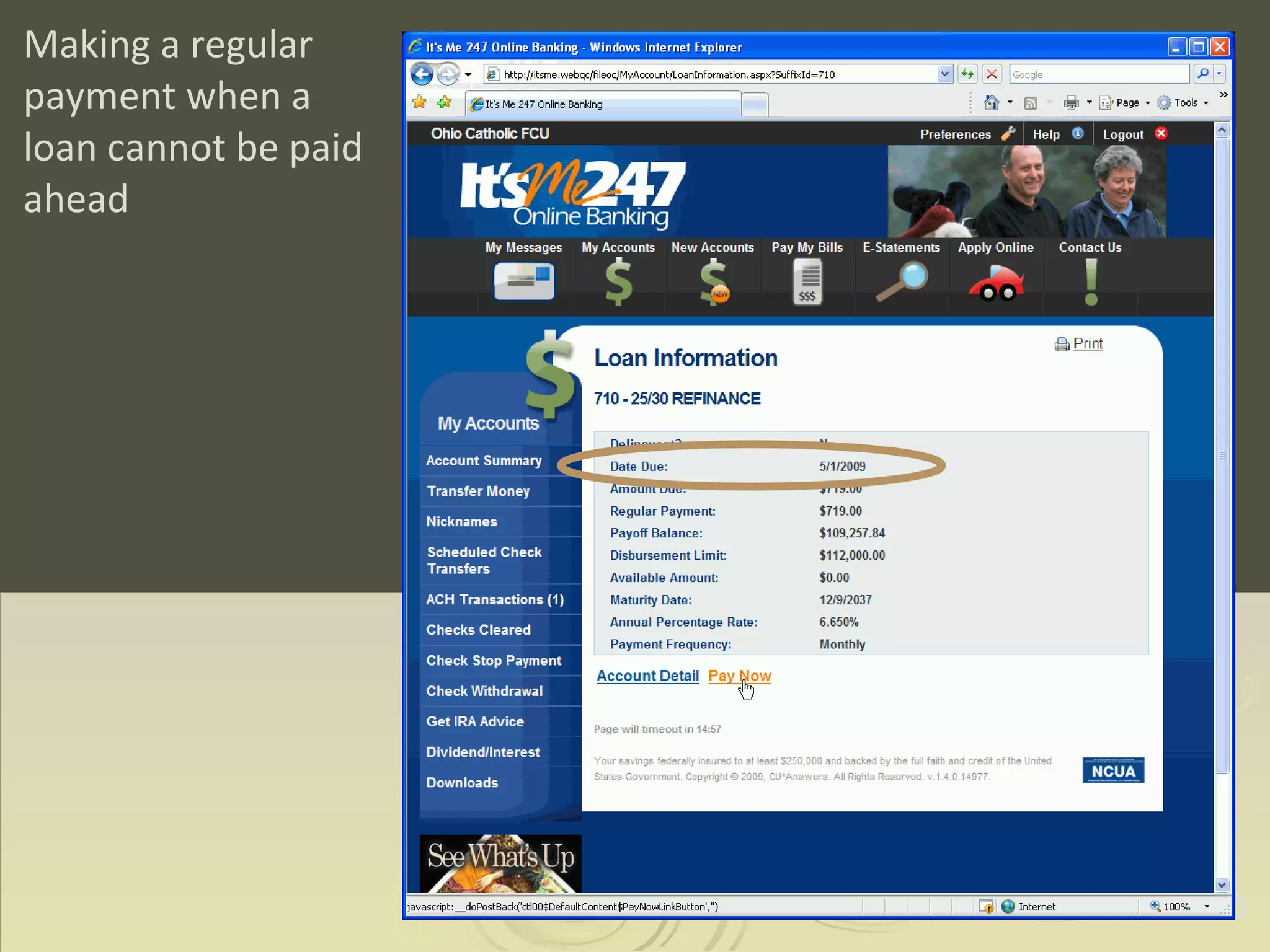

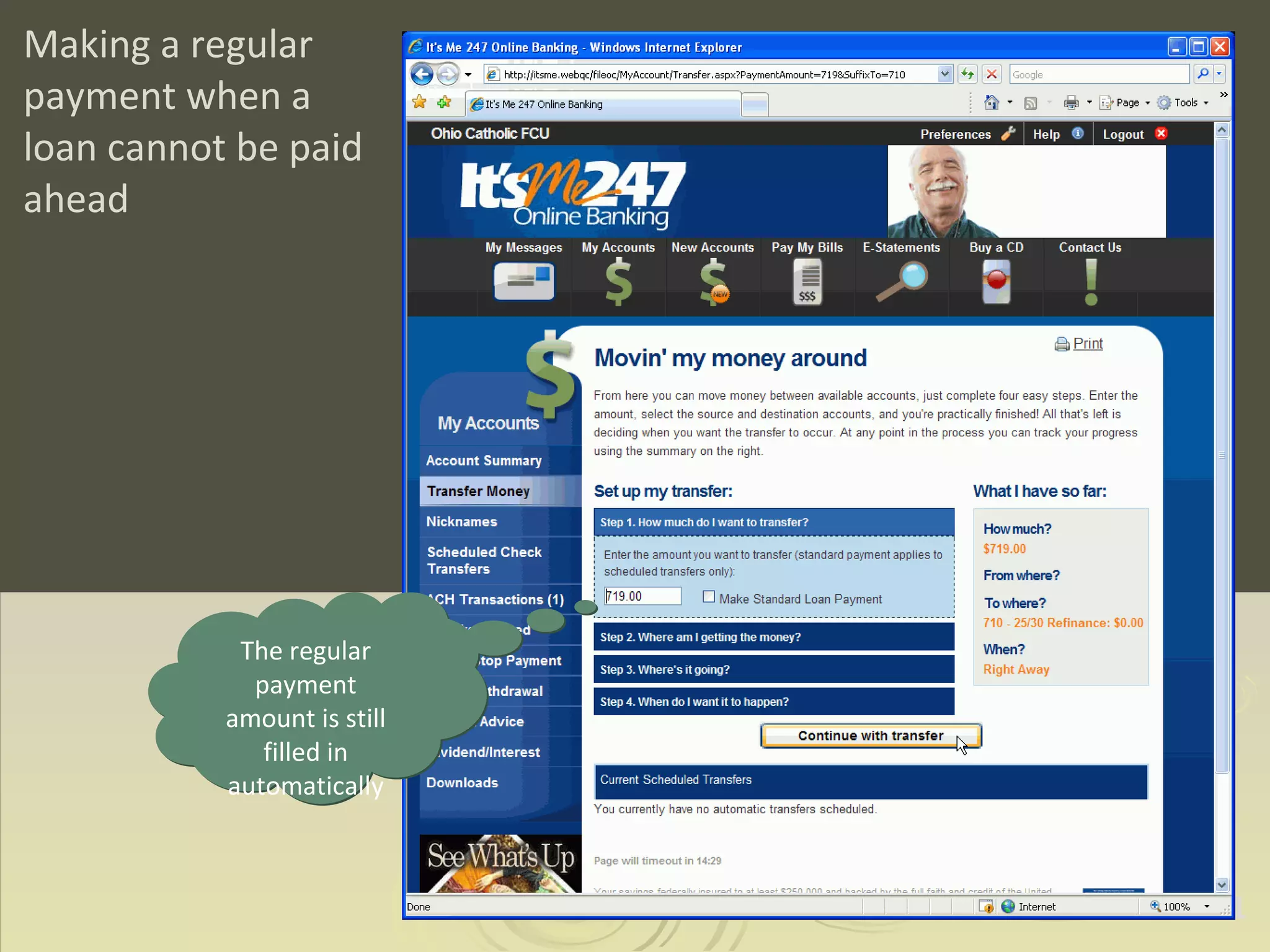

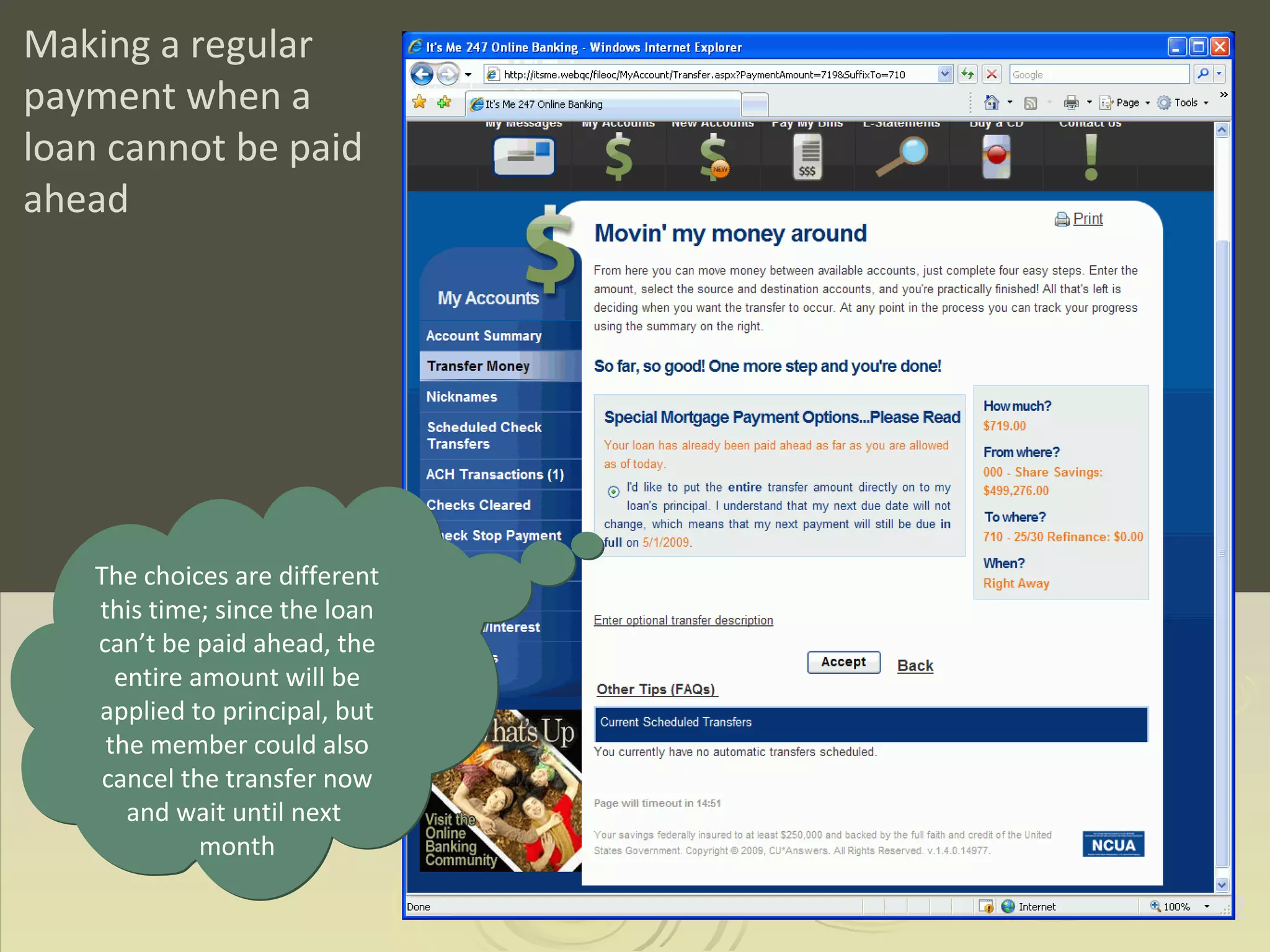

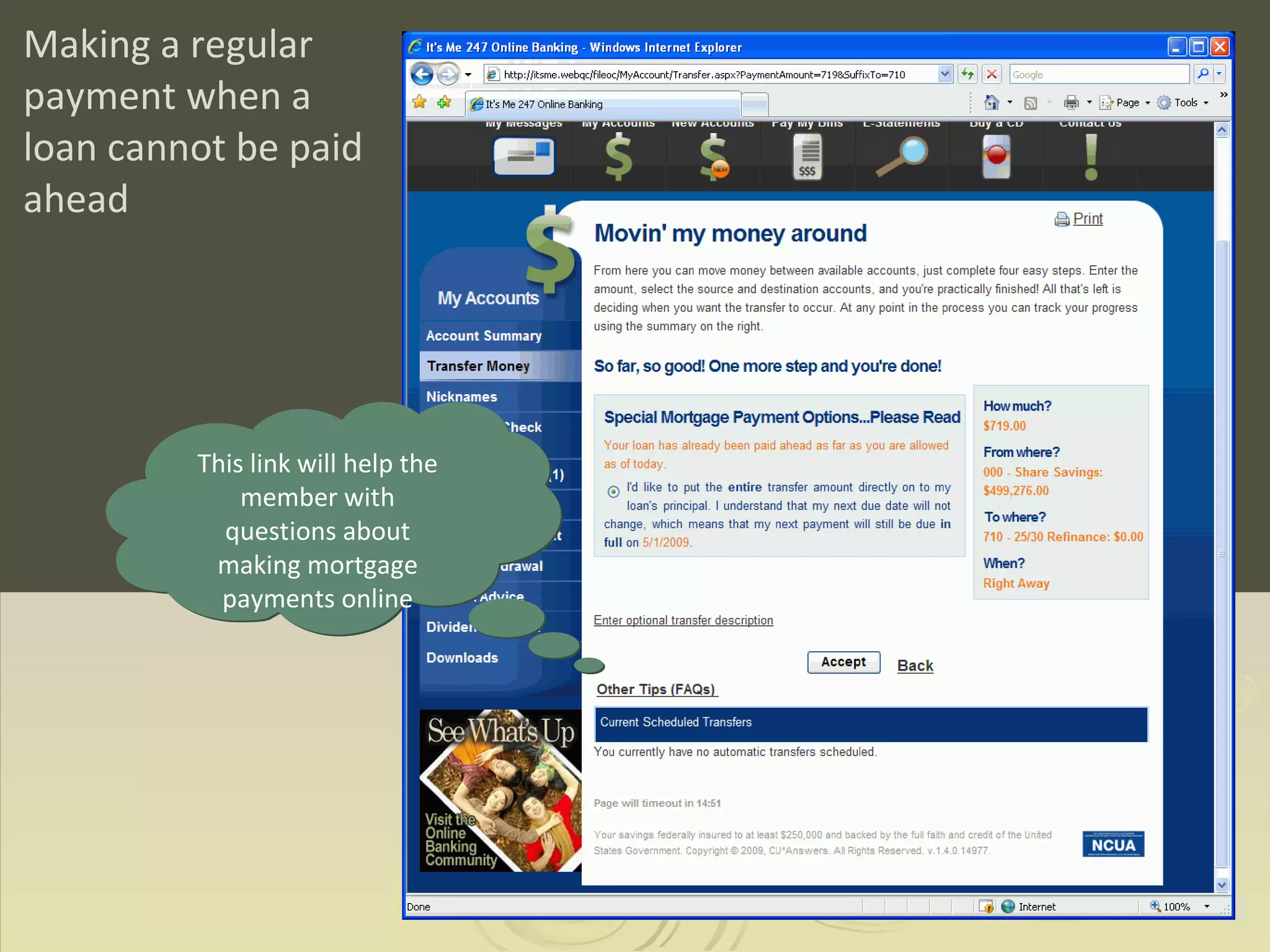

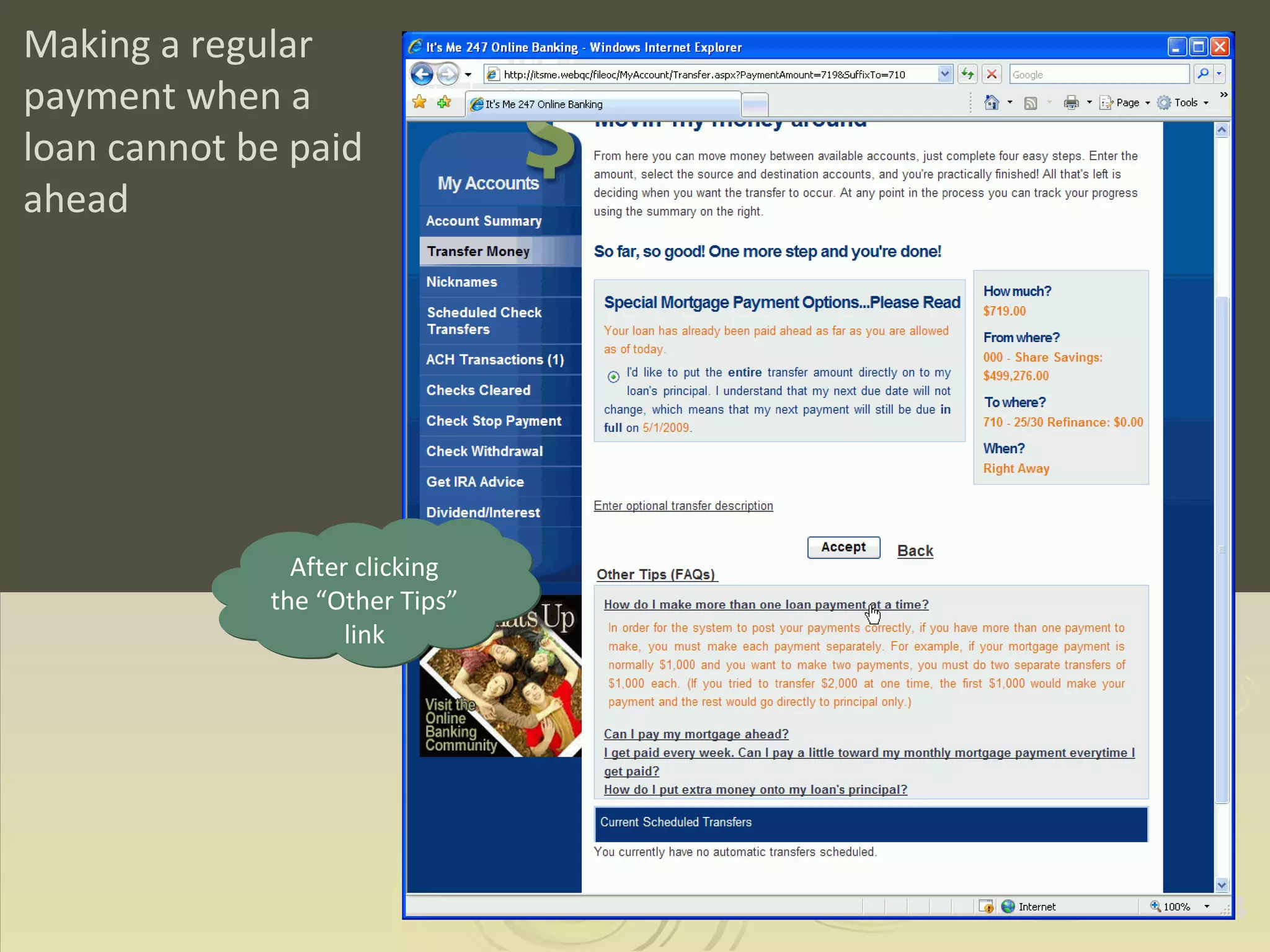

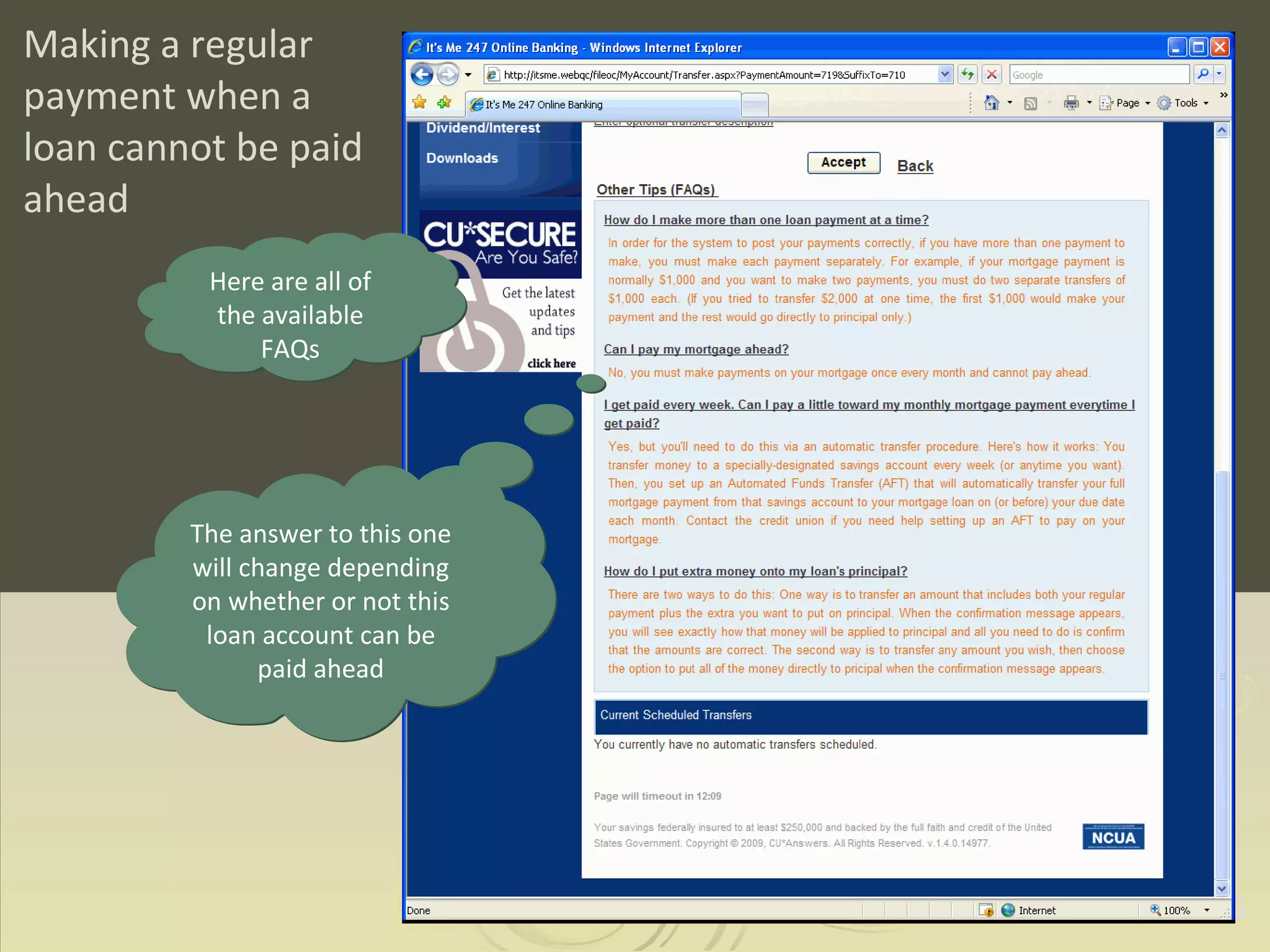

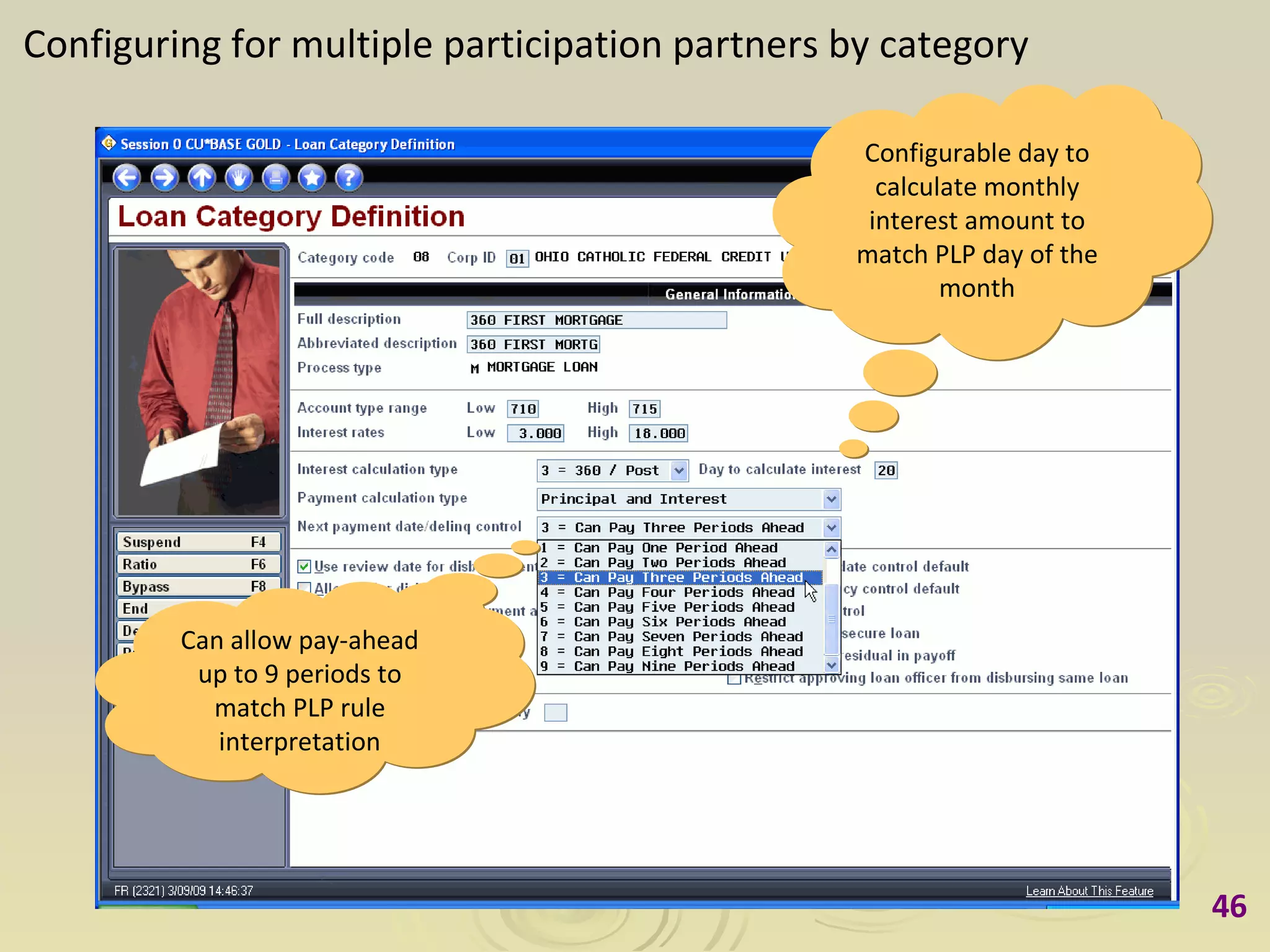

The document outlines various scenarios for making mortgage loan payments in the CU*BASE system, highlighting enhancements to payment processing and interest calculations. It details options for members making payments greater than the regular amount, principal-only payments, and payments on delinquent loans. Additionally, it includes information on system warnings about payment limits and provides guidance for online banking transactions related to mortgage payments.