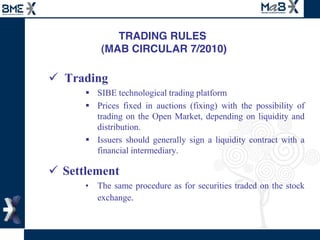

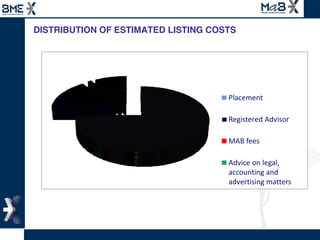

The document discusses the Alternative Equity Market (MAB) in Spain, which provides a market for low-capitalization companies seeking financing for growth. The MAB has customized regulations and processes tailored for small companies. It offers these companies access to financing through public listings, increased visibility, liquidity for shareholders, and a market valuation of the business. The document outlines the requirements for companies to list on the MAB, the information they must disclose, and the role of registered advisors in ensuring transparency.