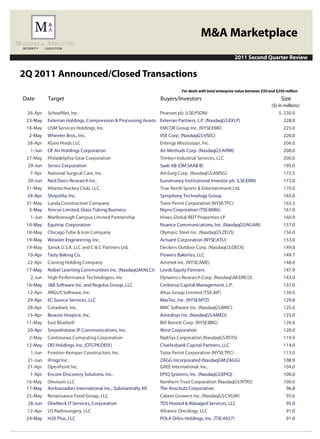

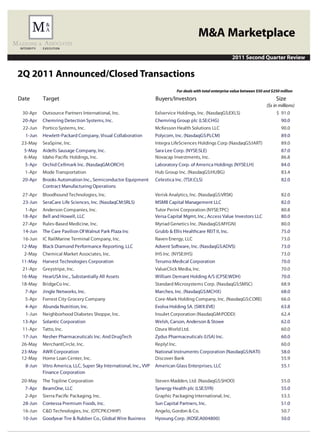

The document summarizes M&A activity in the second quarter of 2011. Some key points:

- Total deal value in the first half of 2011 increased 61% compared to the same period in 2010.

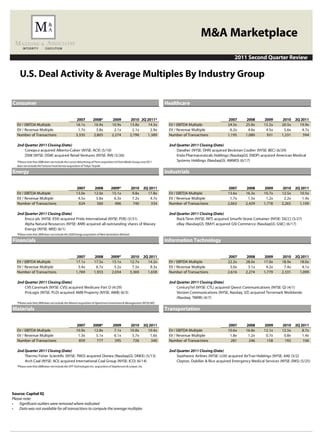

- Deal activity has picked up but valuations remain lower than peaks in 2006-2007 as leverage remains low.

- There was increased activity from strategic buyers and private equity seeking to deploy cash.

- The top three industries for mid-market M&A deals were industrials, consumer discretionary, and healthcare.