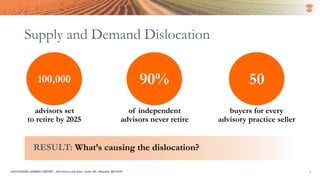

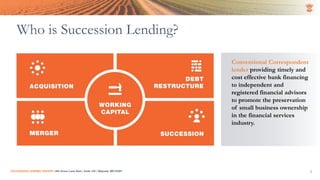

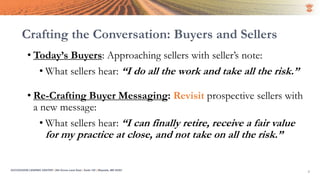

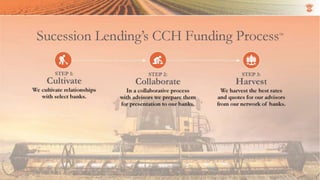

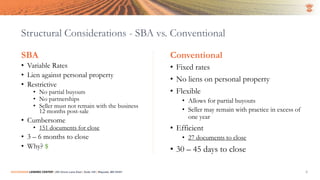

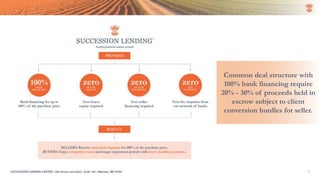

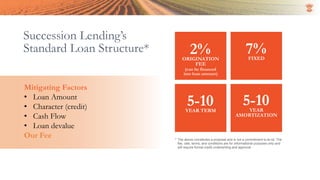

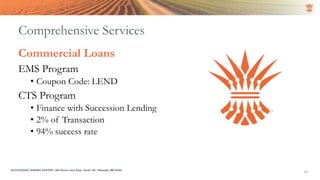

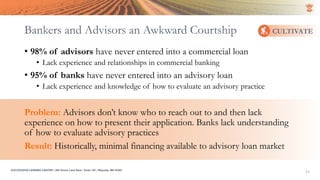

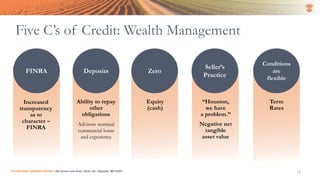

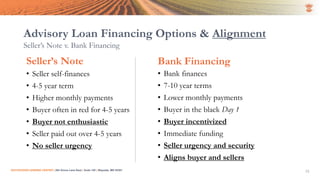

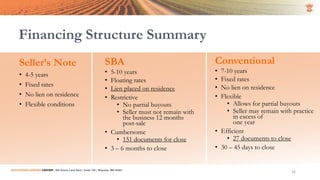

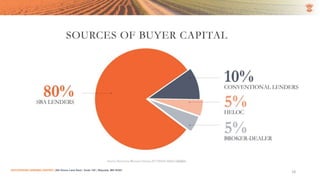

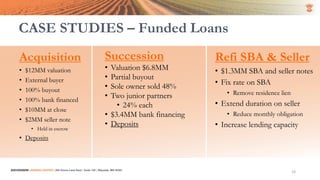

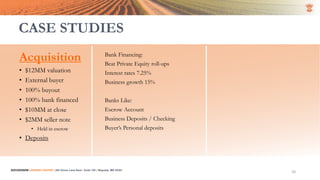

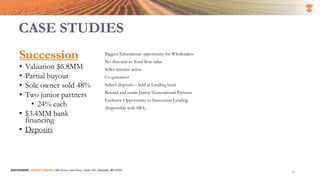

The document discusses the challenges and opportunities in succession lending for financial advisors, highlighting that 100,000 advisors are set to retire by 2025 while 90% of independent advisors never retire. It emphasizes the importance of bank financing over seller notes and SBA loans, presenting a more efficient and flexible approach for buyers and sellers in advisory practices. The document outlines structural considerations, common deal structures, and various case studies demonstrating successful financing strategies.