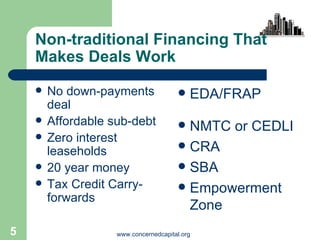

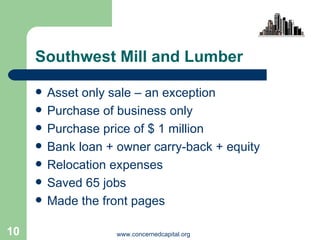

The document discusses using government sponsored credit to facilitate the sale of a company to keep jobs in the local community. It describes how Concerned Capital helps owners sell their companies using financing supports like loans, tax credits, and low interest rates to make the deals affordable for buyers. This allows new owners to continue operating the business and maintaining local employment, rather than relocating after an acquisition. Examples are provided of successful sales to new owners or existing management that preserved dozens of jobs in each case.