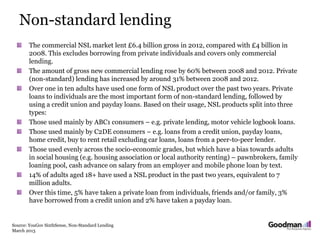

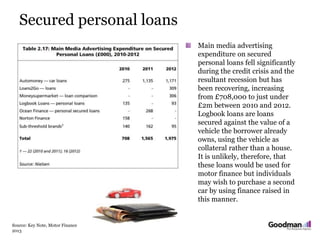

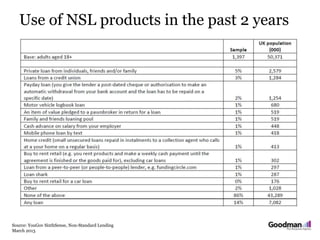

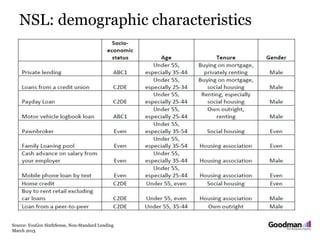

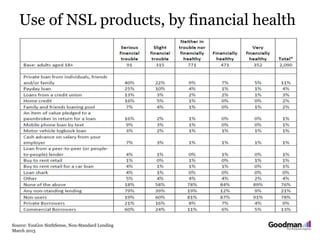

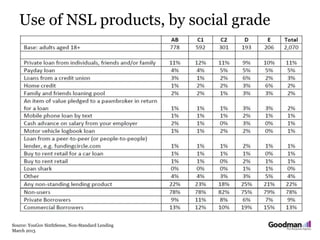

The document analyzes the non-standard lending market in the UK. It finds that the commercial non-standard lending market lent £6.4 billion in 2012, up from £4 billion in 2008. Over 10% of UK adults have used some form of non-standard lending in the past two years, with private loans being the most common. Non-standard lending is viewed as convenient but can also lead to financial problems. The document also examines advertising expenditures for secured personal loans and the use of various non-standard lending products among different demographic groups.