Embed presentation

Download to read offline

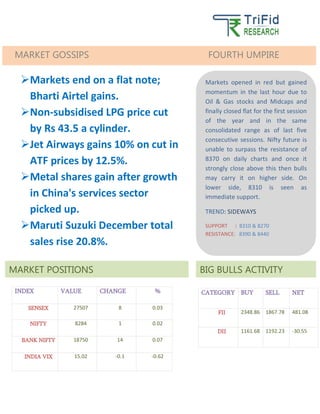

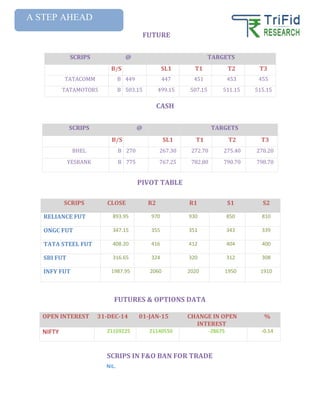

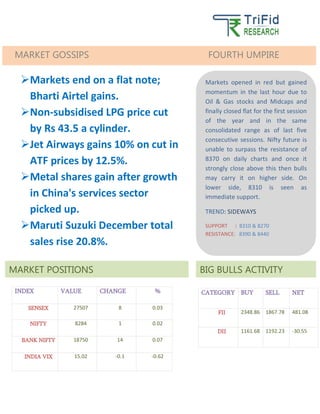

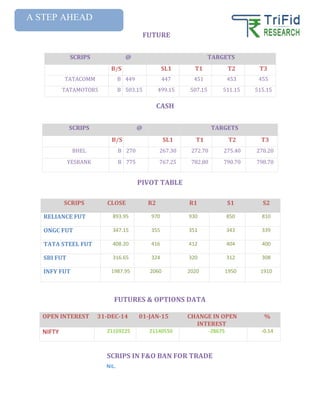

On January 2, 2015, Indian markets opened lower but gained momentum towards the end, influenced by oil, gas stocks, and midcaps, resulting in a flat close. Key resistance for Nifty is at 8370, with immediate support at 8310, and market activity includes gains by Bharti Airtel and Jet Airways following price adjustments. Overall, the market trend remains sideways with notable movements in metal shares due to China's services sector growth.