Embed presentation

Download to read offline

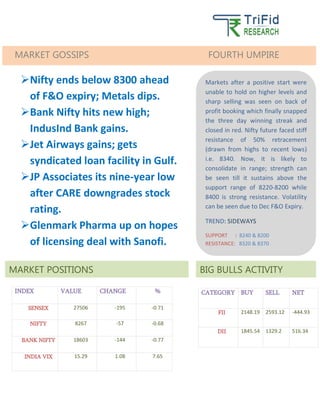

On December 24, 2014, Indian markets experienced a downturn with the Sensex and Nifty closing lower due to profit booking after a three-day winning streak. Nifty faces resistance at 8340 and is likely to consolidate in a range, with support levels at 8220-8200. Key market movements include gains in IndusInd Bank and Jet Airways but a decline for JP Associates following a rating downgrade.