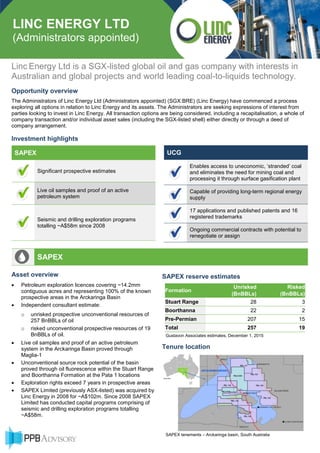

The administrators of Linc Energy Ltd are seeking expressions of interest for investing in the company or acquiring its assets following its entry into administration. Key assets include:

- Petroleum exploration licenses in the Arckaringa Basin covering 14.2 million acres, with estimated unconventional oil resources of 257 billion barrels. Drilling programs have proven an active petroleum system.

- Underground coal gasification technology and intellectual property, with commercial contracts and joint ventures. The technology enables access to uneconomic coal reserves.

- Other assets include a listed shell on the Singapore stock exchange and Queensland coal tenements. Parties have the option to acquire all rights and interests in Linc Energy and its assets.