Lightwave Logic Inc. is a development stage company that researches and develops organic polymer materials for use in data communications and telecommunications infrastructure to improve transmission speeds and reduce costs. Their organic polymers are designed to replace currently used inorganic polymers. If successful, Lightwave Logic's polymers could license their technology to large companies or produce and sell their own optical devices using the polymers. However, they currently only engage in research and development and have no commercial products.

![1

Daniel Yu

5/3/2016

Lightwave Logic Inc. (LWLG) [3643 words]

Summary

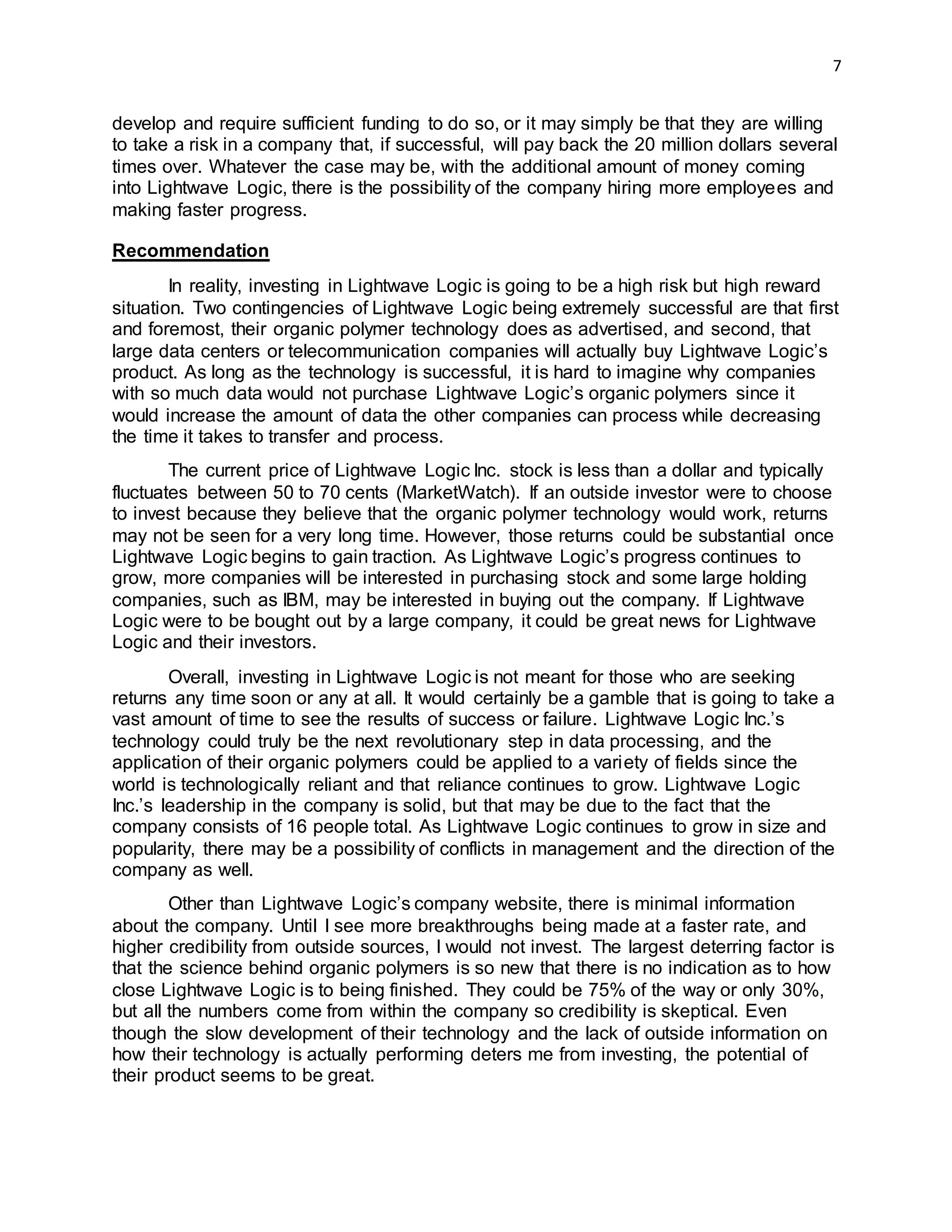

Lightwave Logic Inc. was founded based on the realization that silicon and

copper circuitry would soon reach their physical limits. Lightwave Logic is a

development stage company which exists to improve data communications and

telecommunication infrastructures with their organic polymer material based devices. It

engages primarily in the research and development of its electro-optic organic polymer

materials technologies and potential products using their organic polymers.

Lightwave Logic designed and built their organic polymers with the intention of

replacing the current inorganic polymers used in systems in order to drastically reduce

cost of production as well as significantly increasing the speed of data transferring.

Their polymer technology has solved the problem of melding high electro-optical activity

with thermal stability and can be applied to many devices that process data. They

market their technology around the fact that organic polymers have the potential to

exceed the physical limitations current inorganic polymers have, and that their organic

polymers are less expensive and more environmentally friendly. Lightwave Logic’s

polymer technology is meant to increase data speeds and expand bandwidth while

simultaneously lowering costs and power consumption. These improved polymers are

more environmentally friendly and have the ability to provide the dynamic needs of the

telecommunication, military, and high speed computing industries. The polymers are

also inexpensive to make and selling them for a higher price is possible since the

polymers have the ability to be changed for future developments instead of having to

buy entirely new polymers.

Business Model

Lightwave Logic’s objective is to be a leading supplier of exclusive technology

and knowledge in the electro-optic device market. Their business model includes a

combination of technology licensing for specific product application, joint venture

relationships with significant industry leaders, or the production and direct sale of

Lightwave Logic’s own electro-optic device components (Annual Report (10-K)).

By licensing their technology to potentially large companies who could use

similar technology to improve processing speeds, such as IBM, Lightwave Logic allows

themselves to potentially enter and even larger market. If Lightwave Logic were to focus

more on producing and selling their own electro-optic devices, they could work with a

larger variety of companies; however, it would be harder to market themselves

compared to a licensing deal. The problem with creating a joint venture with another

industry leader is the size of market in which Lightwave Logic operates. Currently, the

market for organic polymers is very small with little to no competition available. Even if

Lightwave Logic were to temporarily work with their competitors, the impact of that

would be minimal due to the lack of attention the market receives.](https://image.slidesharecdn.com/3268b2da-1792-49f5-9964-d58a1fb1d0bf-170202192032/75/LightwaveLogicAnalysis-1-2048.jpg)