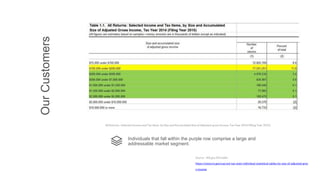

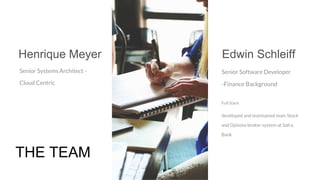

This document provides an overview of a product called Leyline that aims to connect accredited investors to private investment opportunities. It summarizes that currently less than 5% of accredited investors participate in private markets due to barriers like a lack of education, access, and transparency. Leyline's solution is to build an investor-centric platform that provides a single point of access to opportunities, education resources, and community tools to help more accredited investors participate in private markets. It outlines Leyline's team, marketing strategy, revenue model, competitive landscape, and potential exit strategies for investors.