This document summarizes swine and pork industry data in the Philippines from 2006-2008. Some key points:

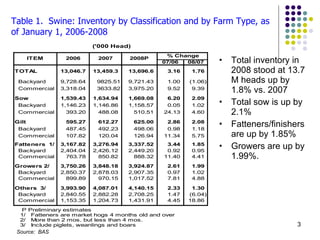

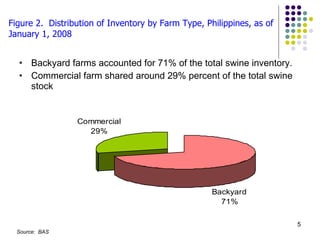

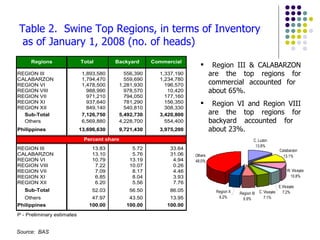

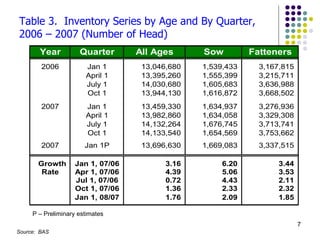

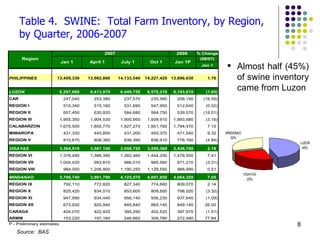

- Total swine inventory in the Philippines was 13.7 million heads in 2008, up 1.8% from 2007. The majority (71%) were in backyard farms.

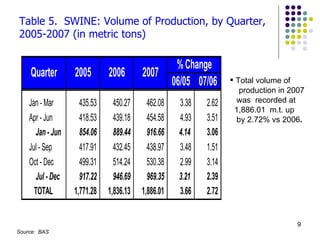

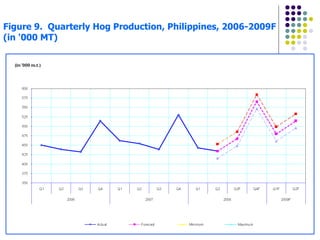

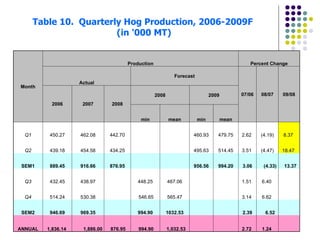

- Total pork production in 2007 was 1,886 thousand metric tons, up 2.72% from 2006. The top producing regions were Region III and CALABARZON.

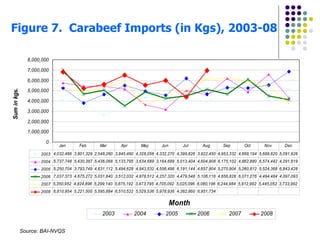

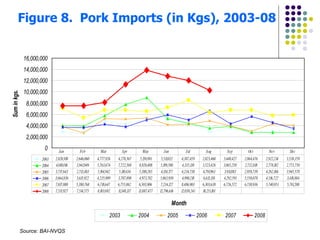

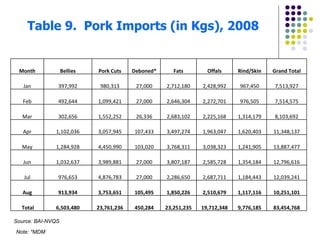

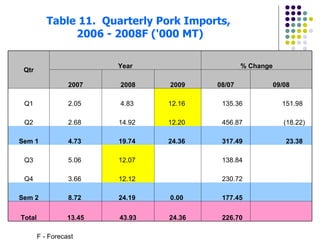

- Total pork imports in 2007 were 43,936 thousand kilograms. Bellies and pork cuts made up the majority of imports.

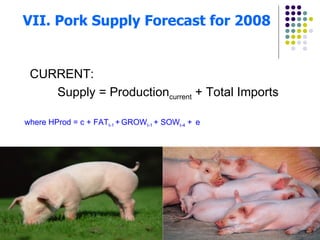

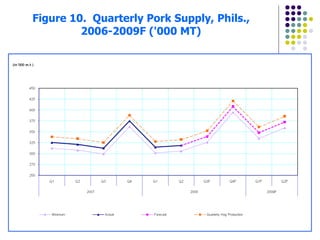

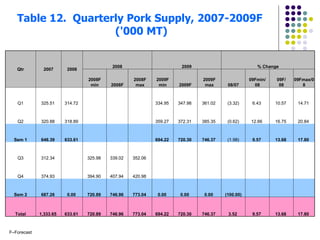

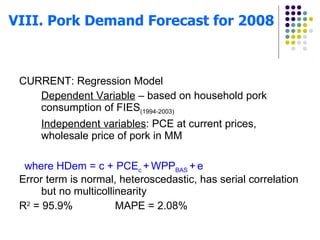

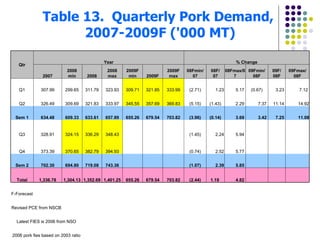

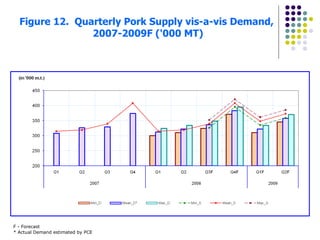

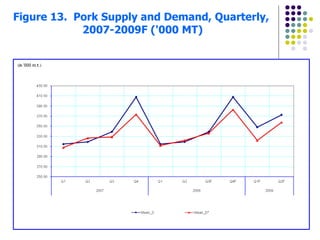

- Pork supply and demand were forecasted for 2008 using regression models. Supply was projected to