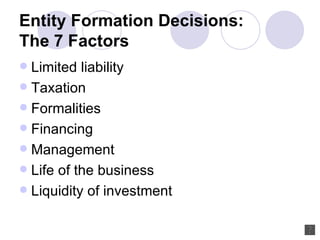

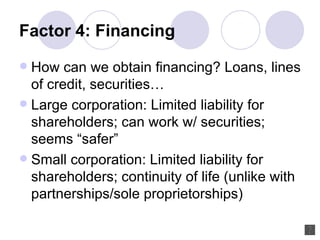

The document discusses several factors to consider when choosing a business entity structure, including limited liability, taxation, formalities, financing, management, life of the business, and liquidity of investment. It provides an overview of the characteristics of sole proprietorships, general partnerships, limited partnerships, S-corporations and C-corporations based on these factors. For example, it notes that corporations provide the strongest continuity of life but double taxation, while LLCs provide liability protection but may dissolve upon a member's retirement.