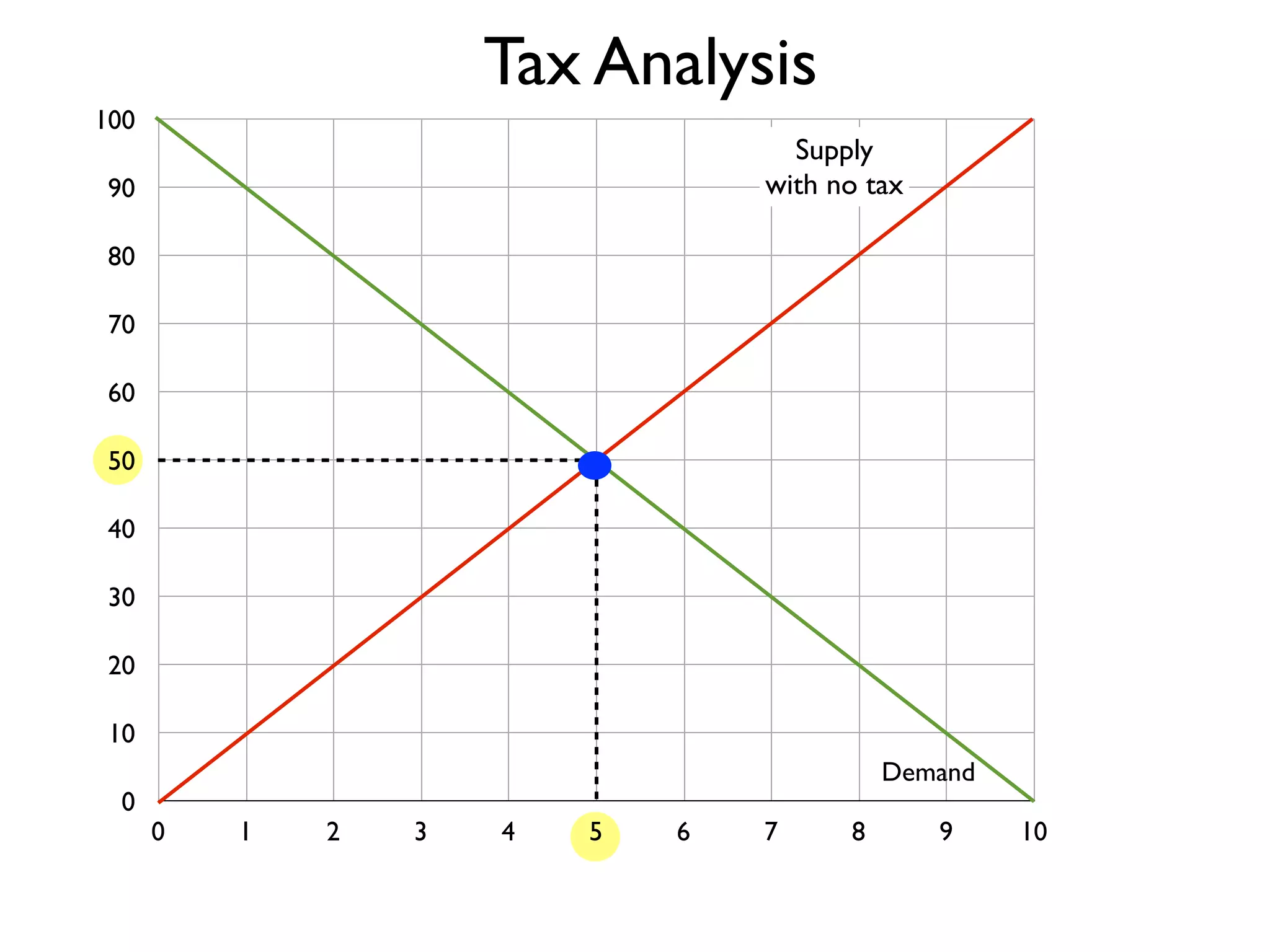

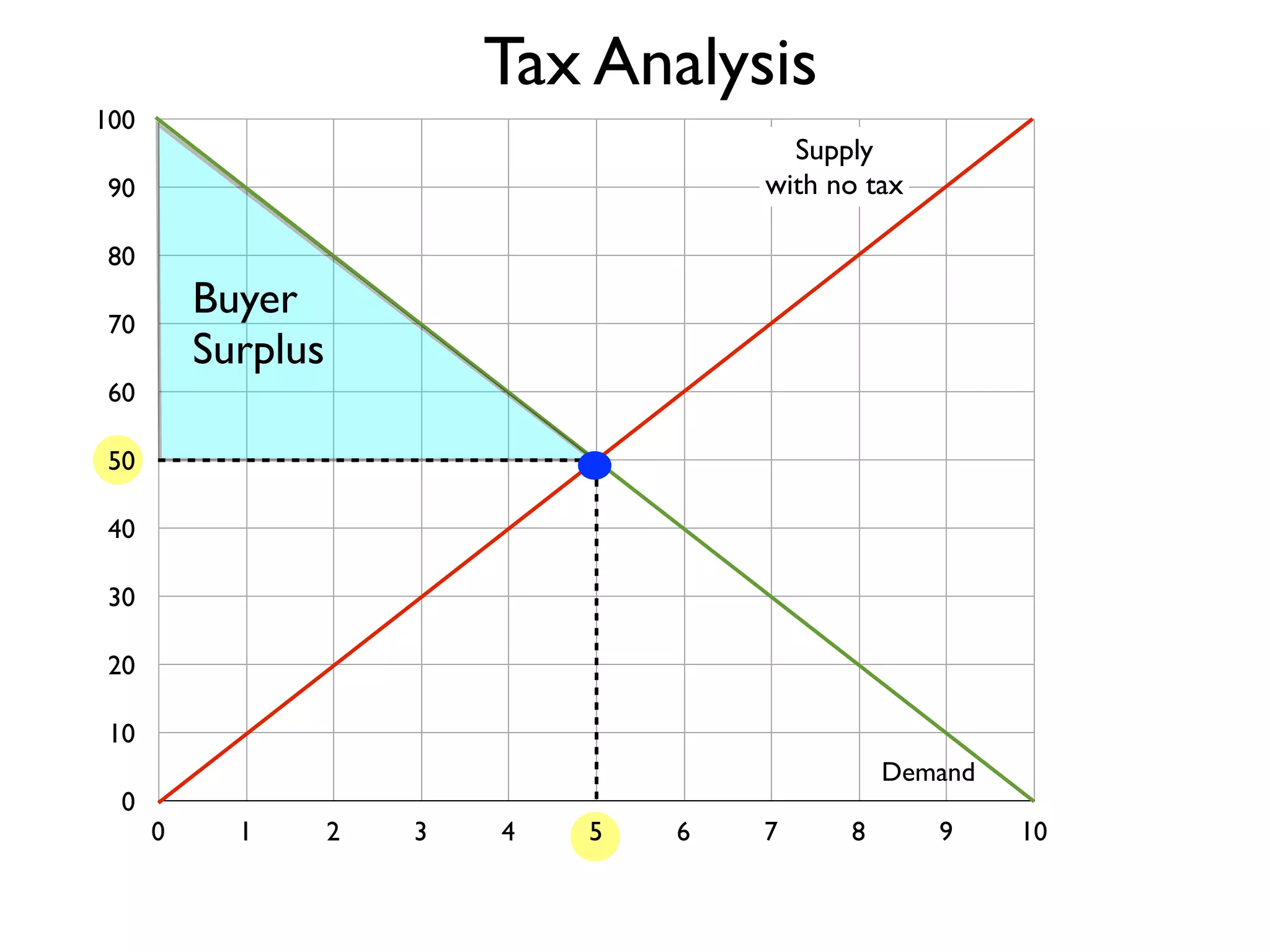

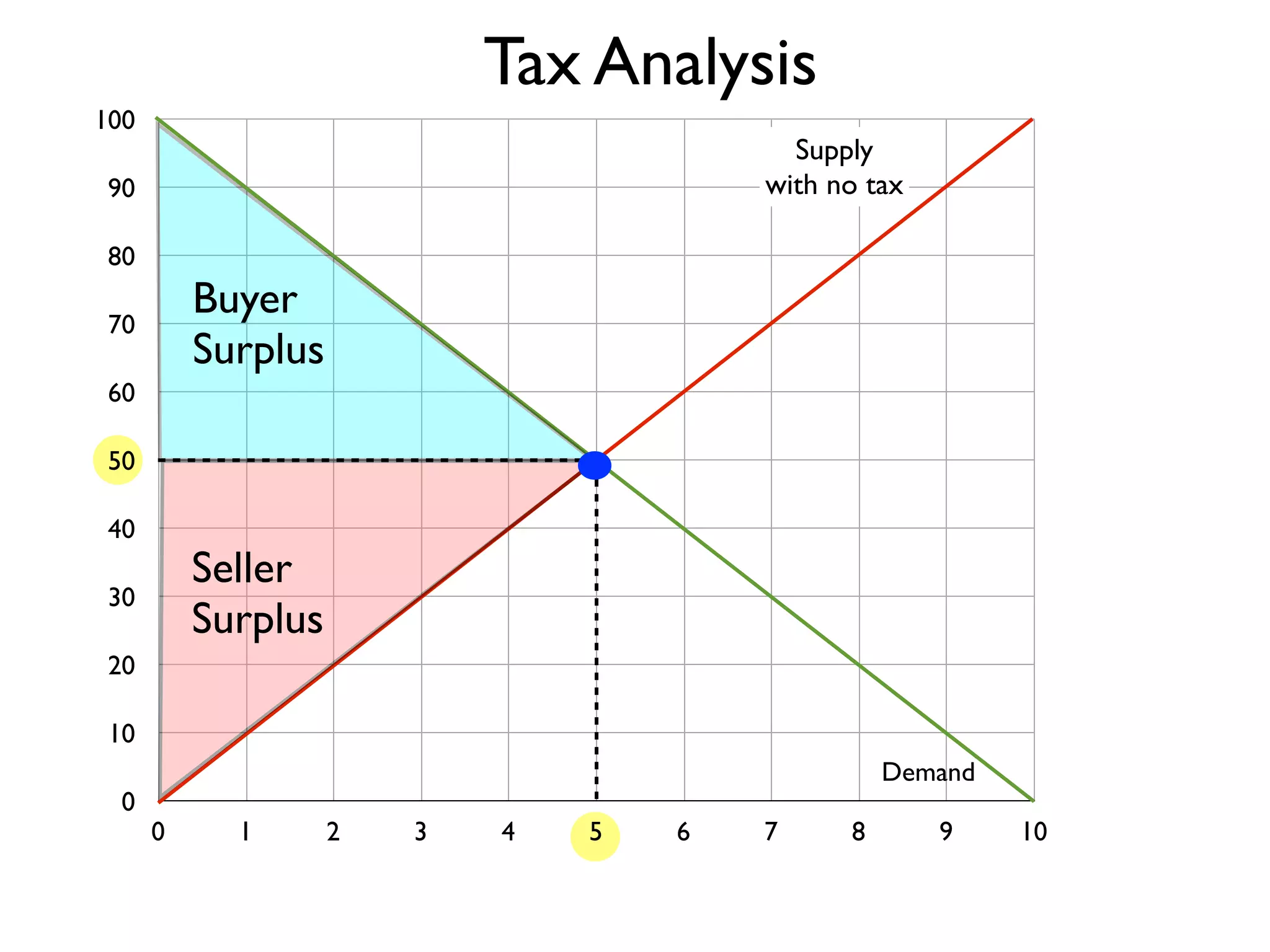

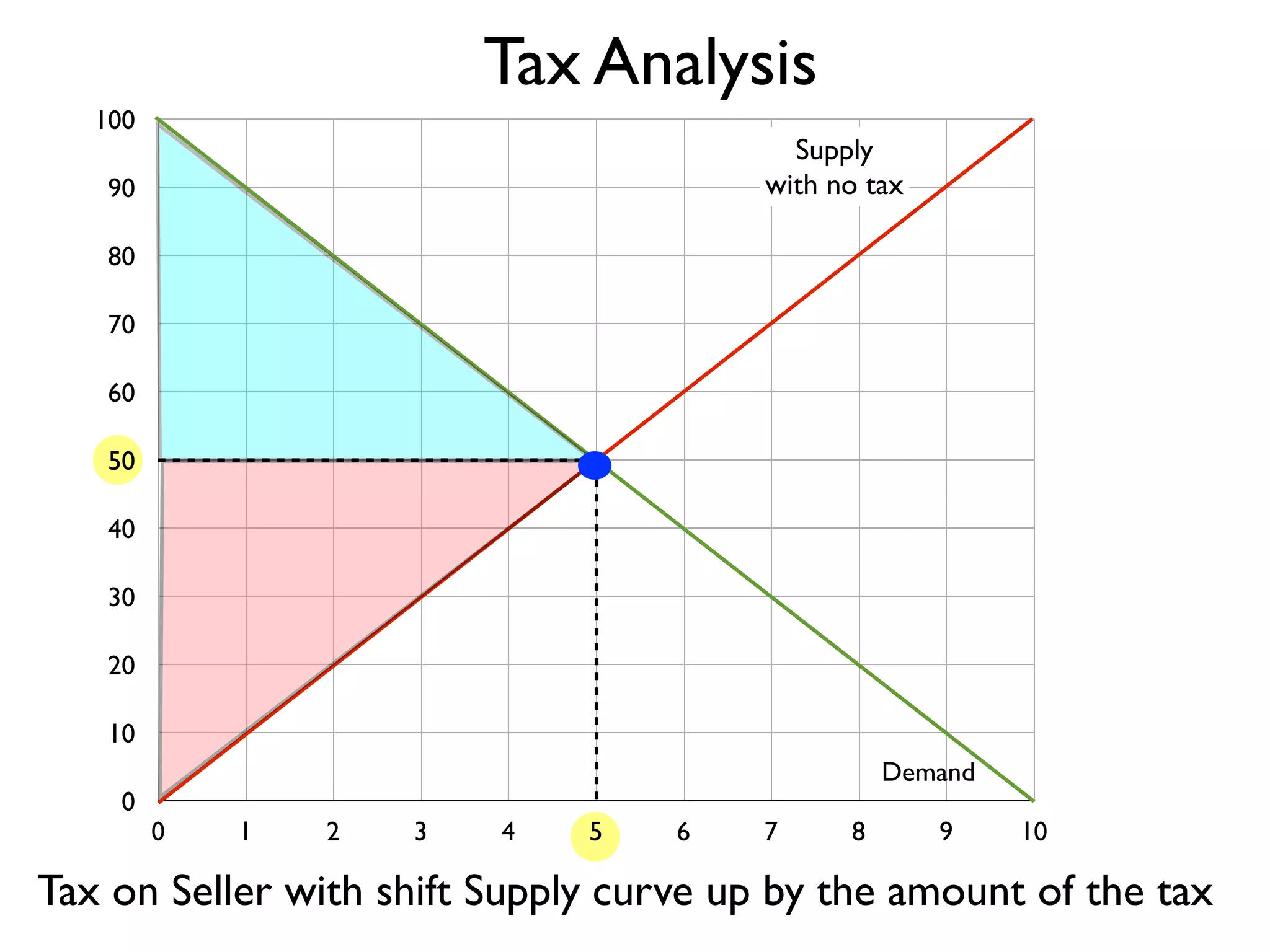

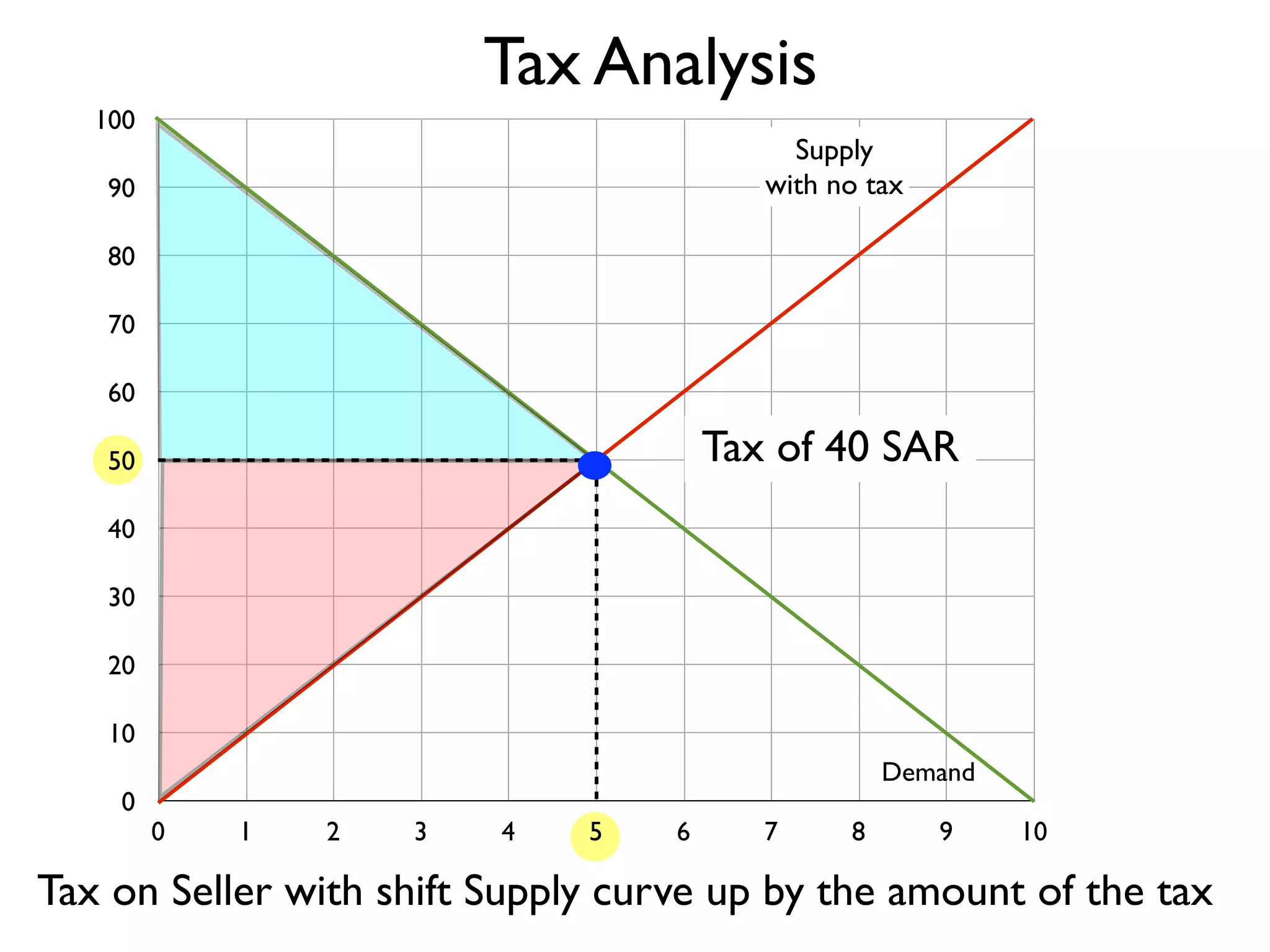

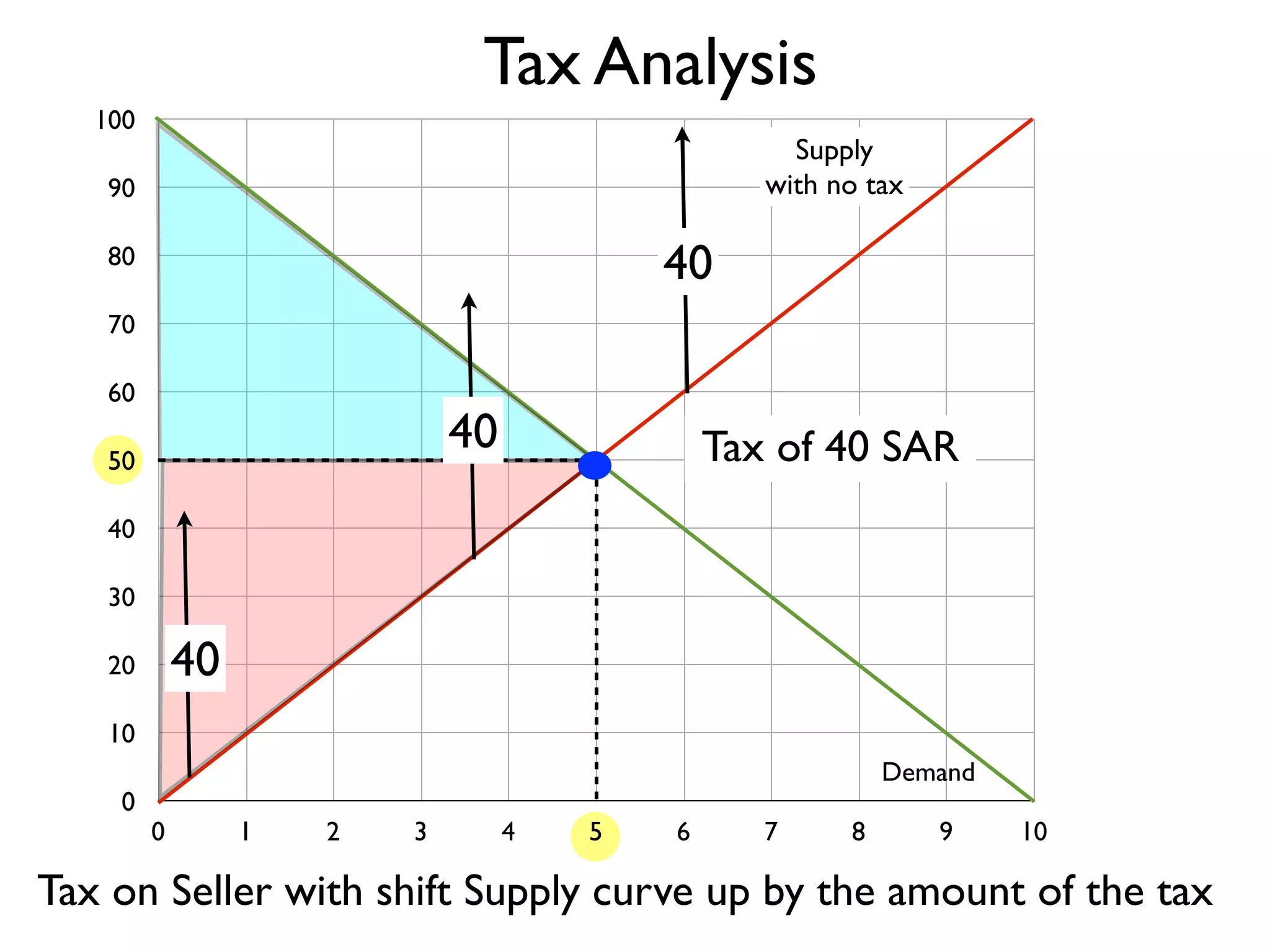

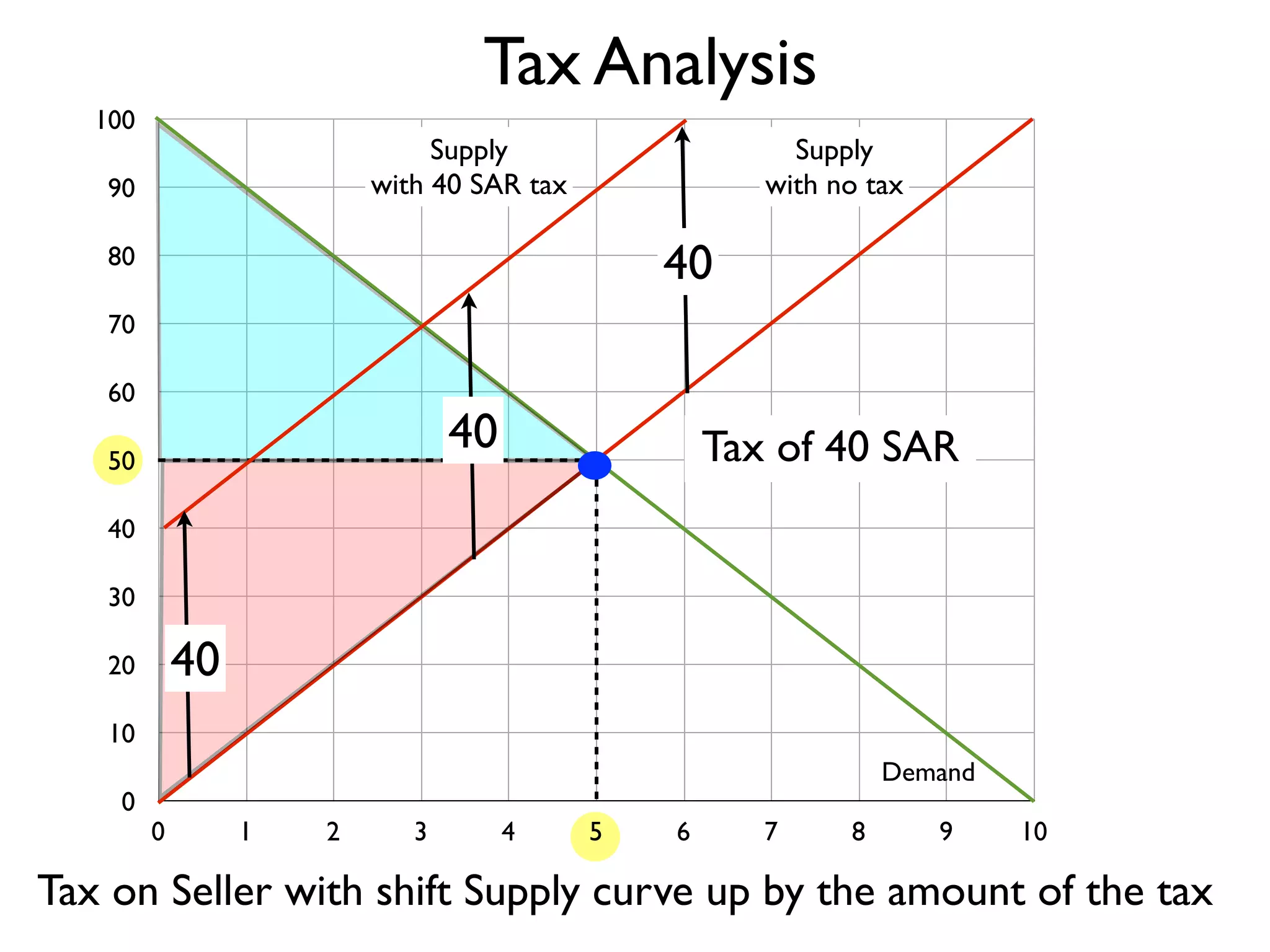

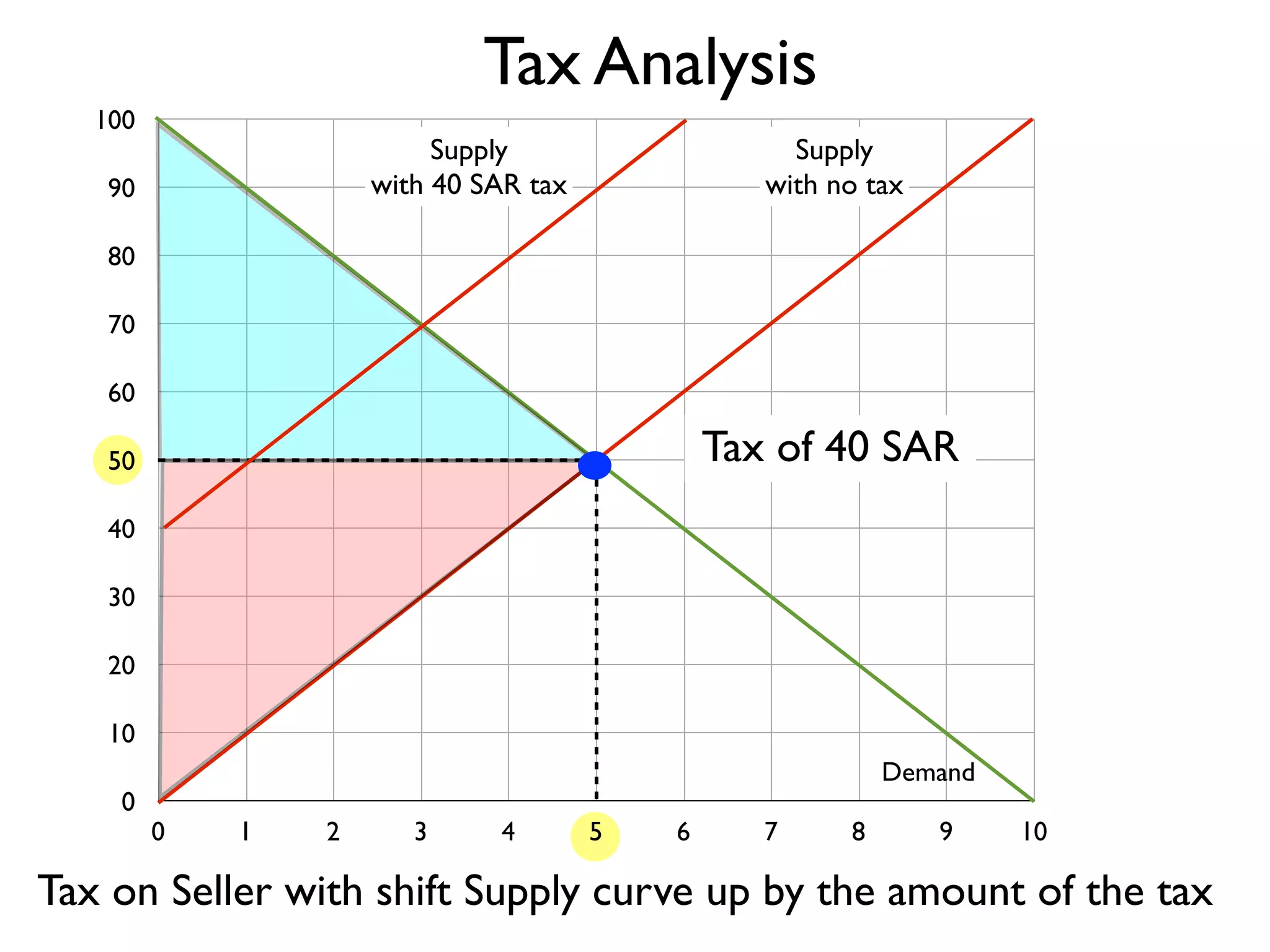

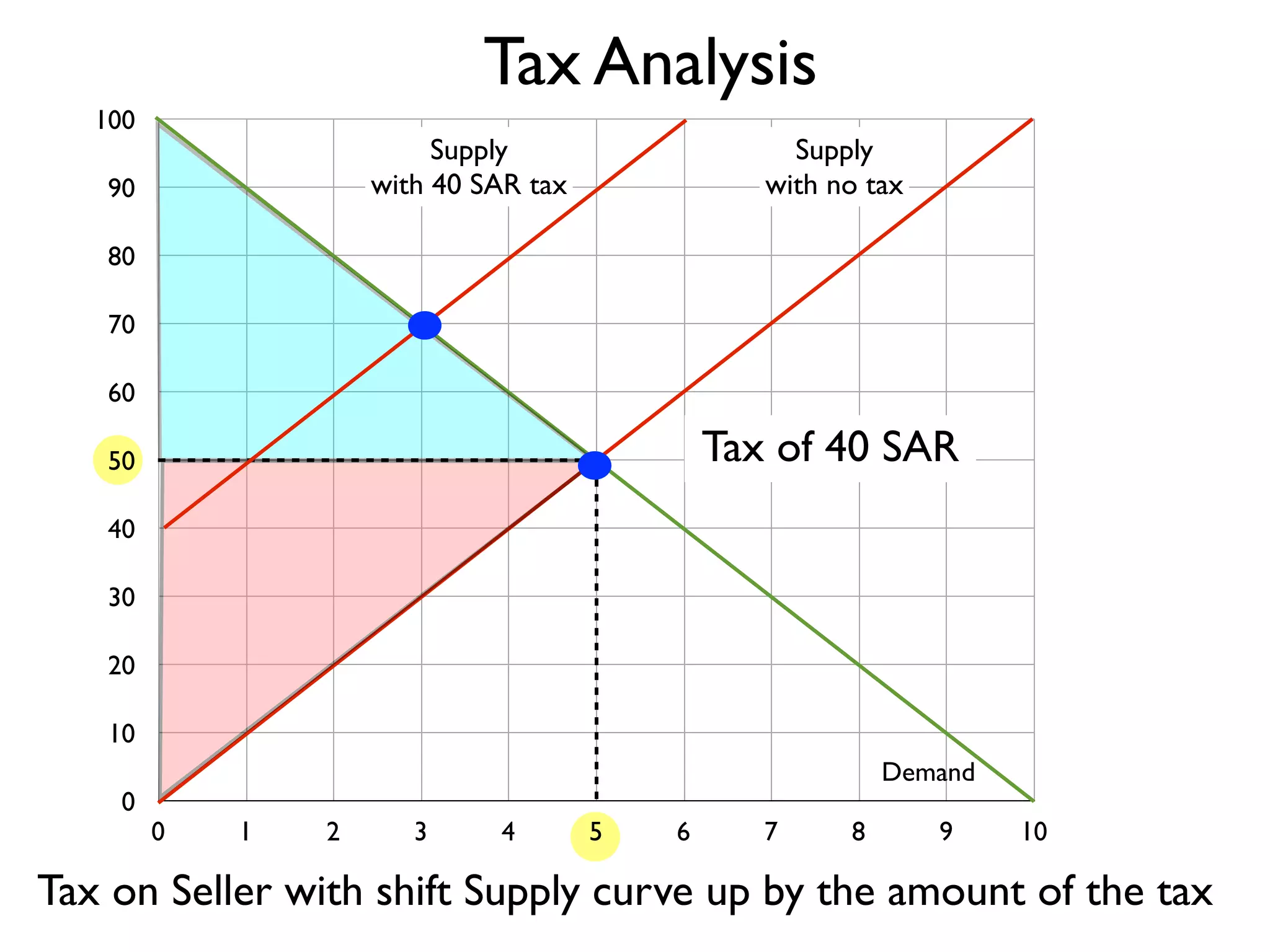

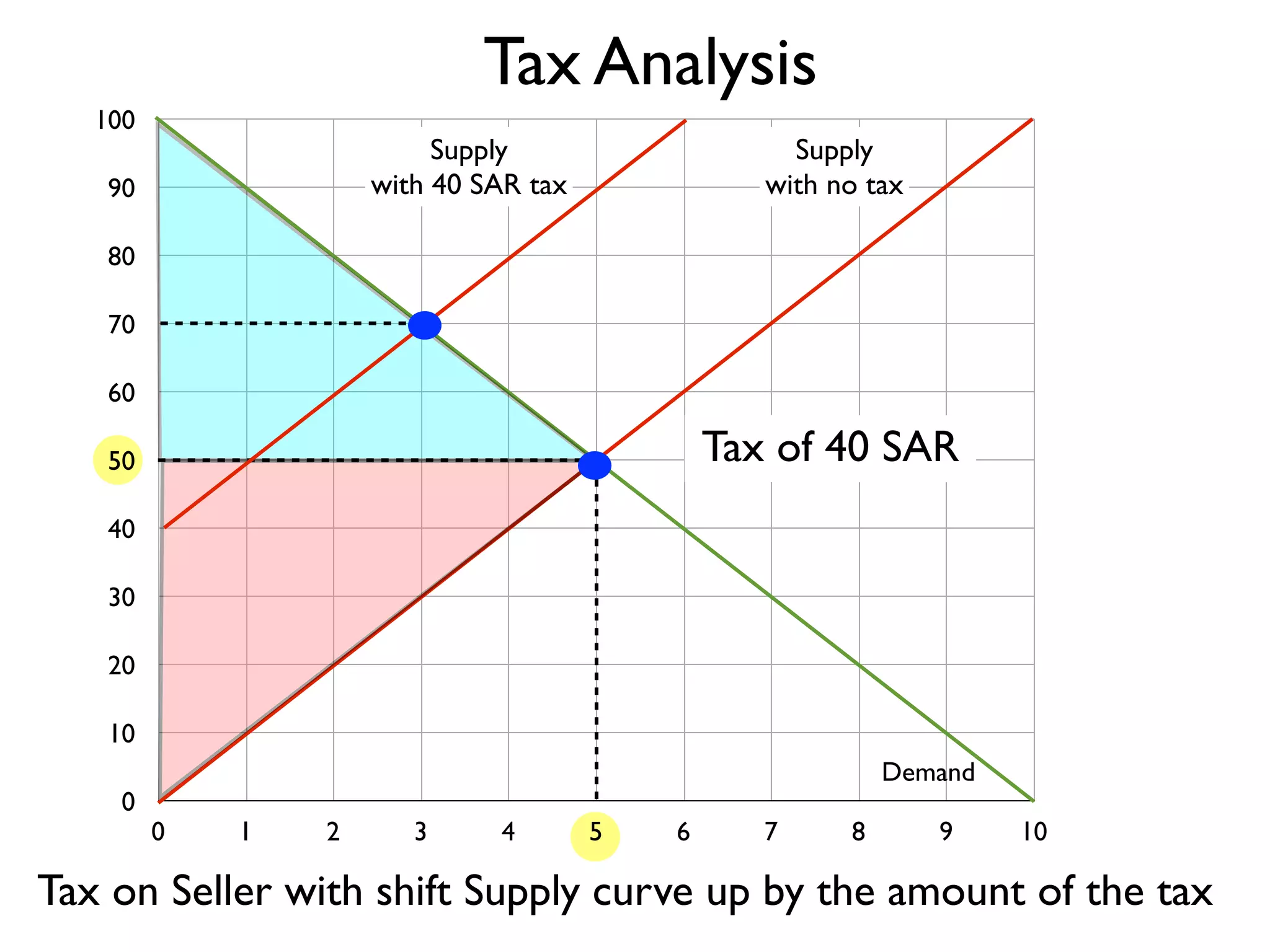

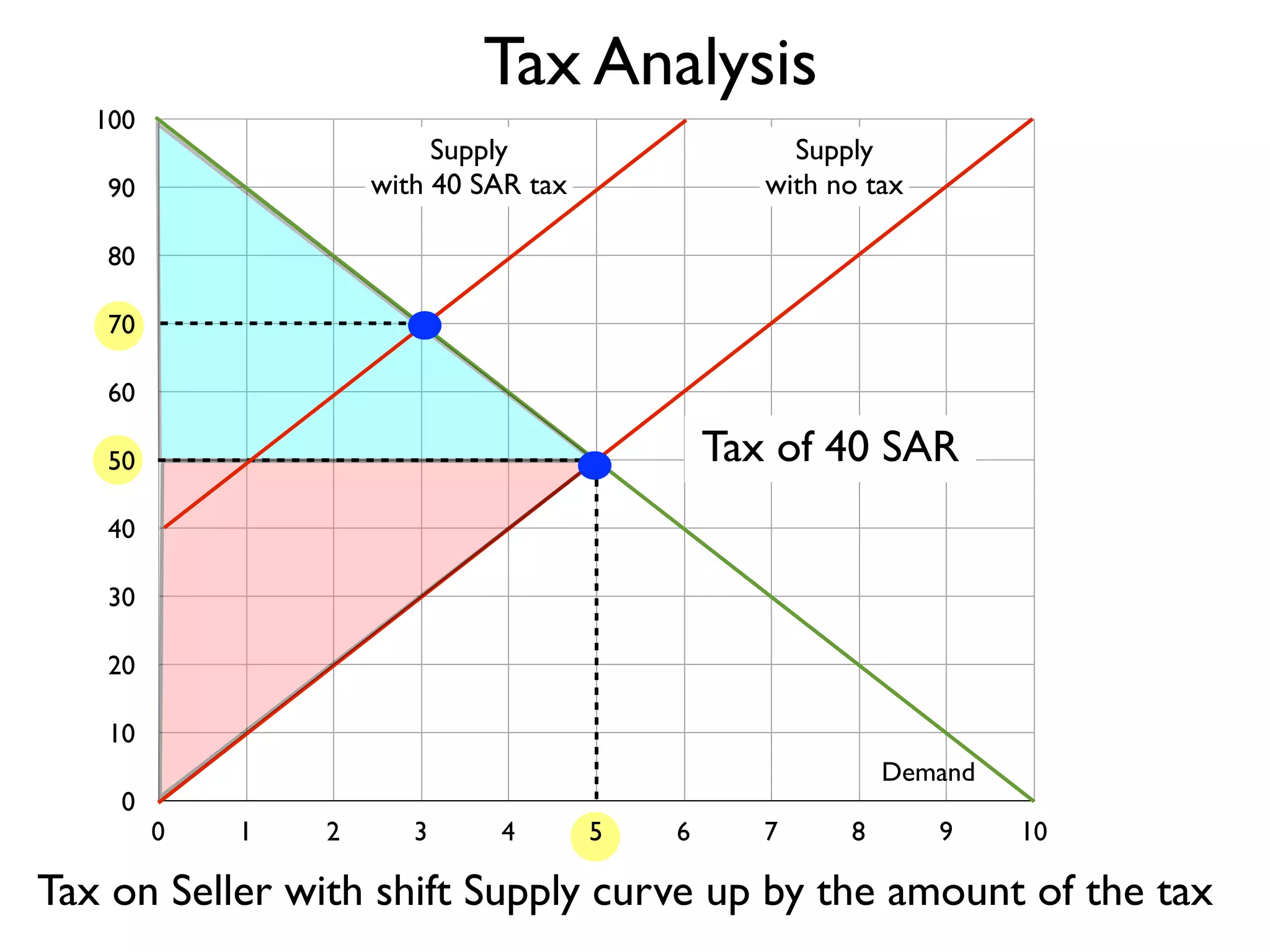

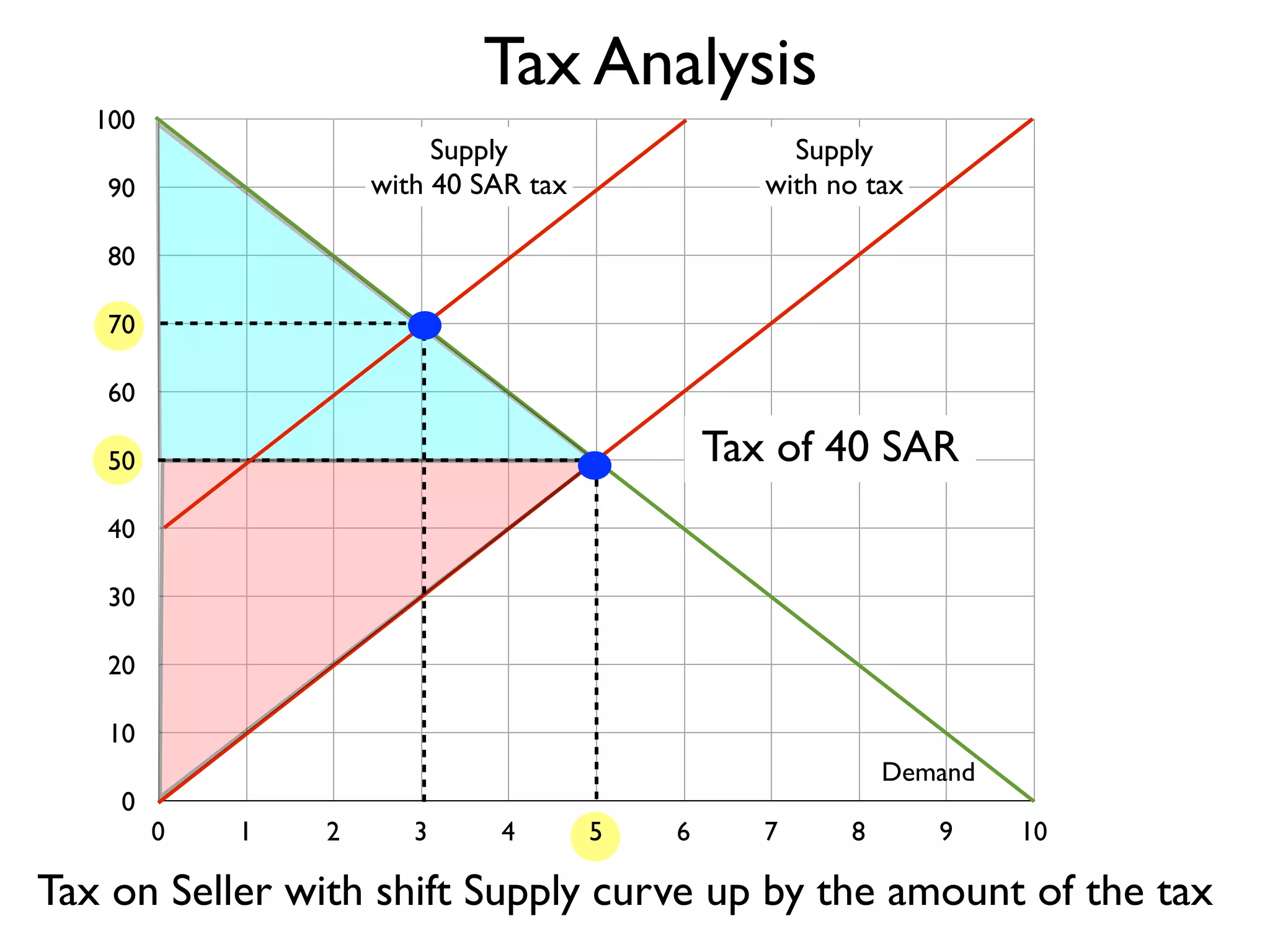

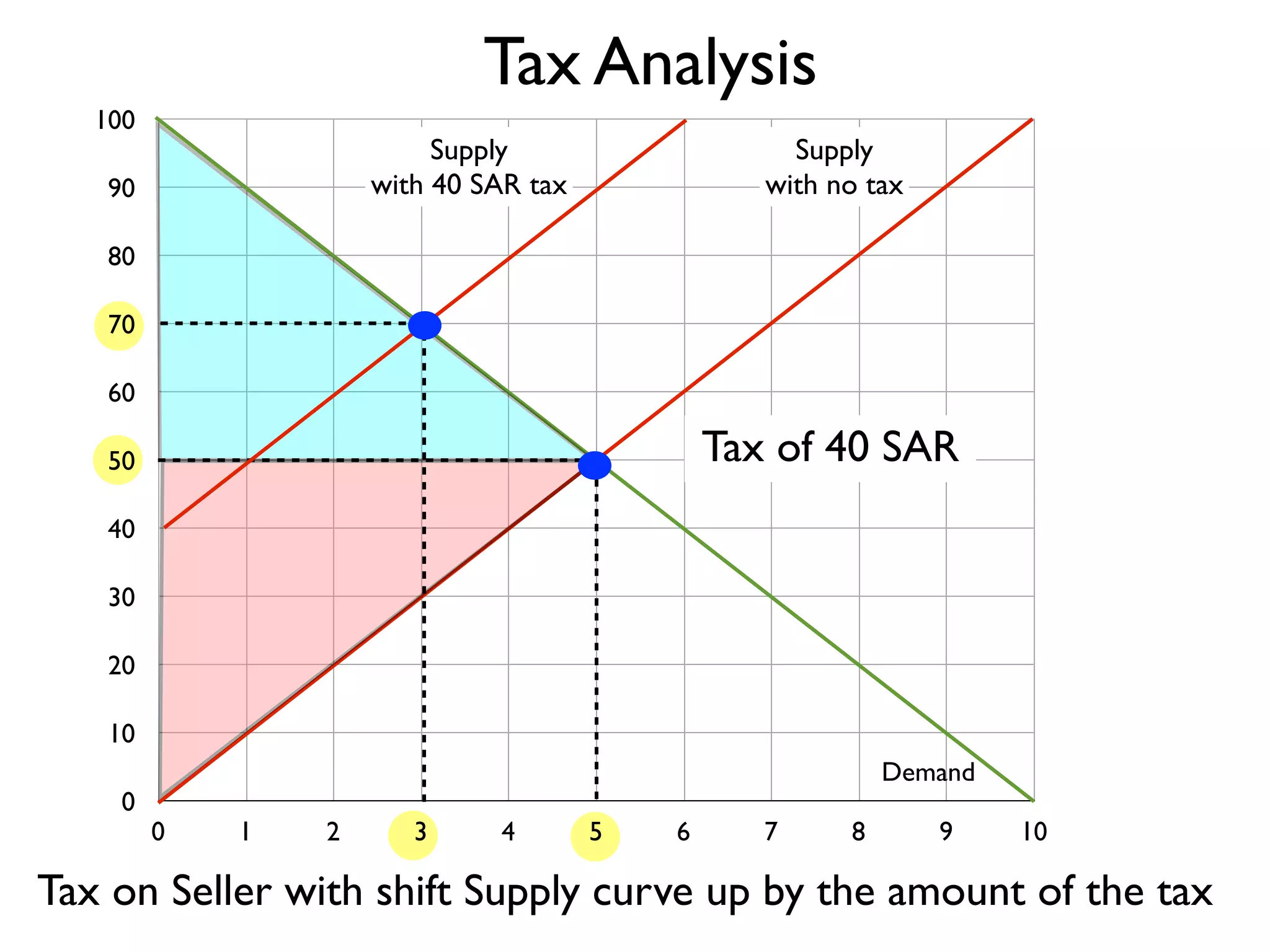

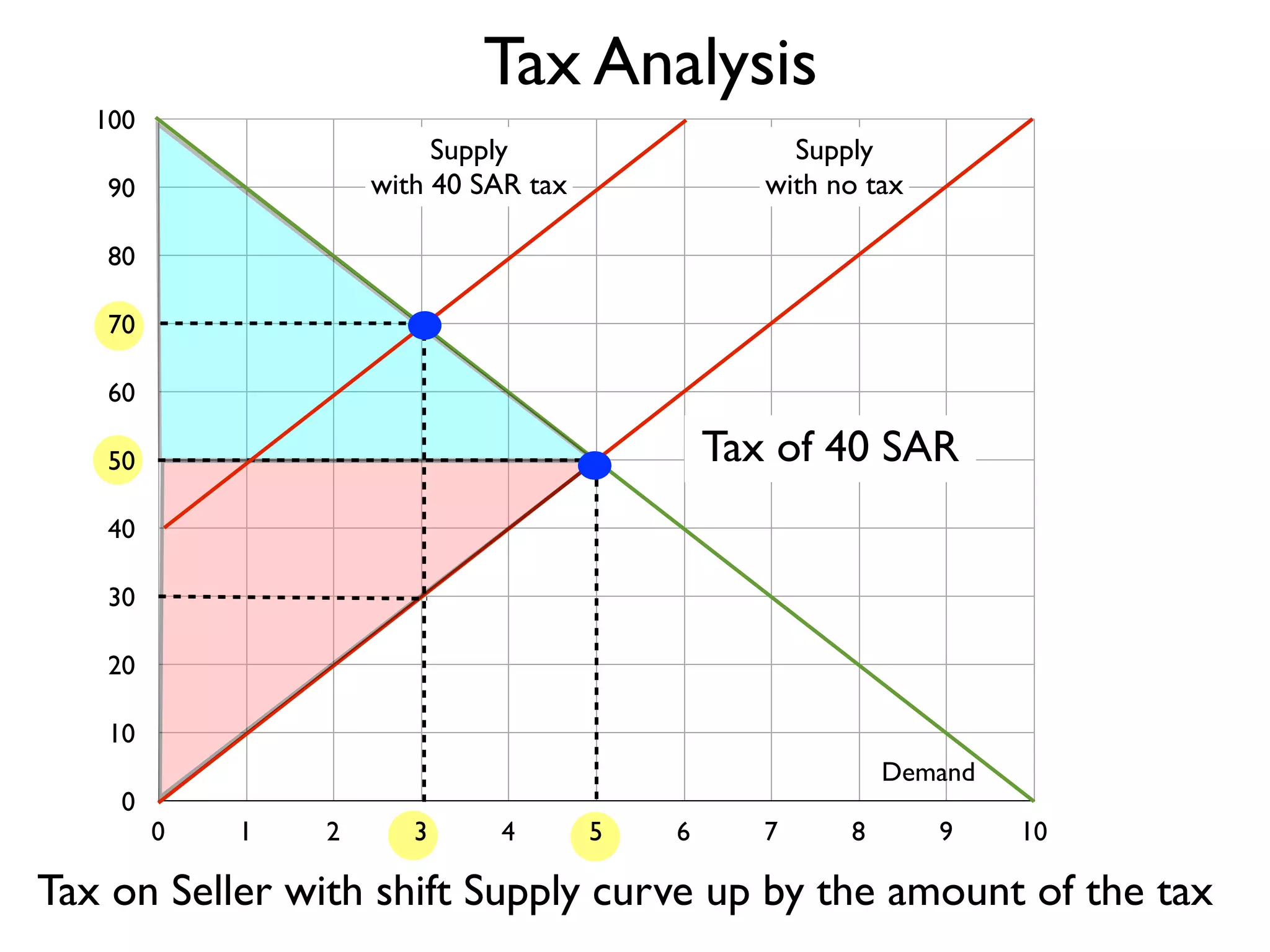

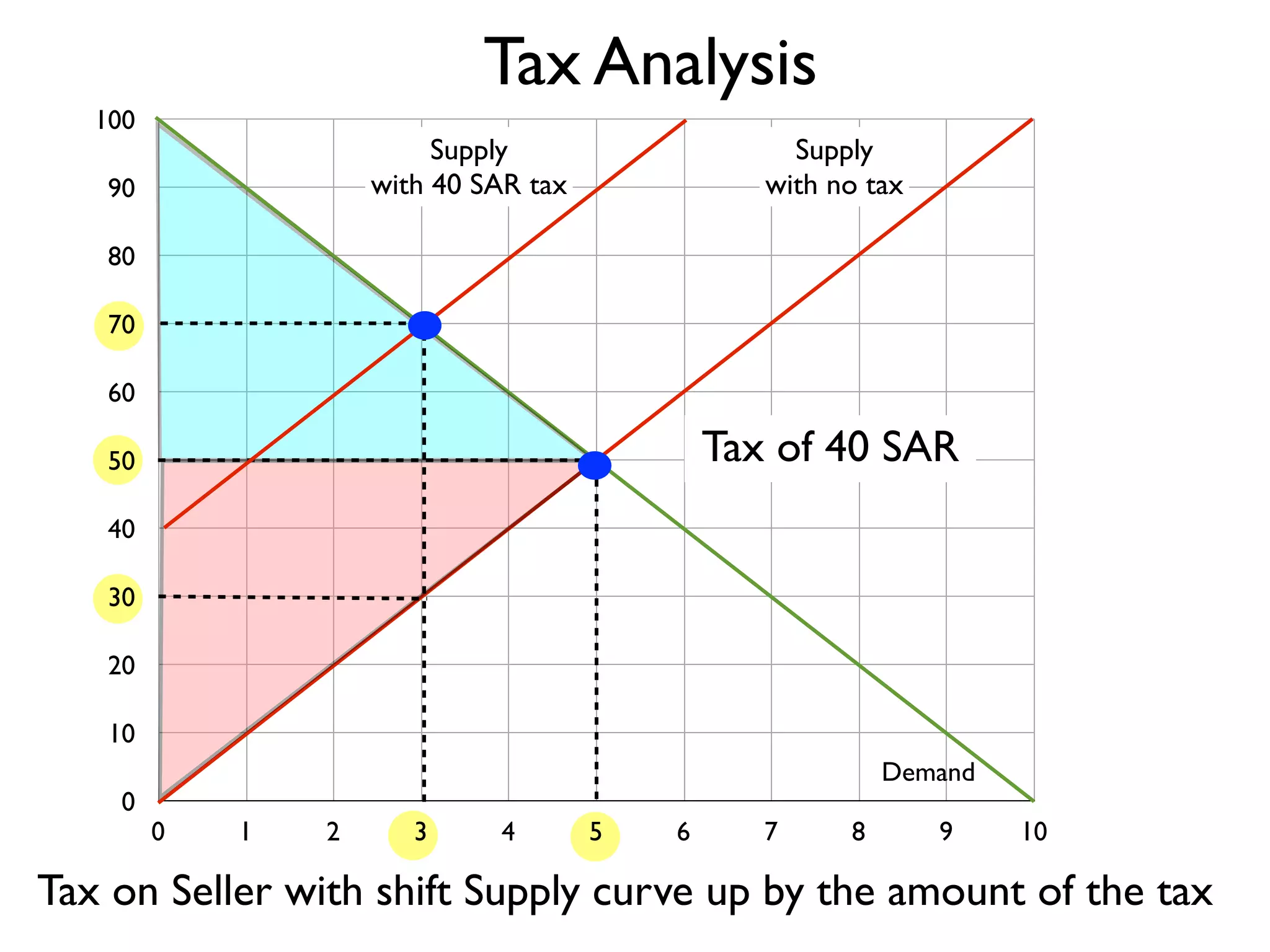

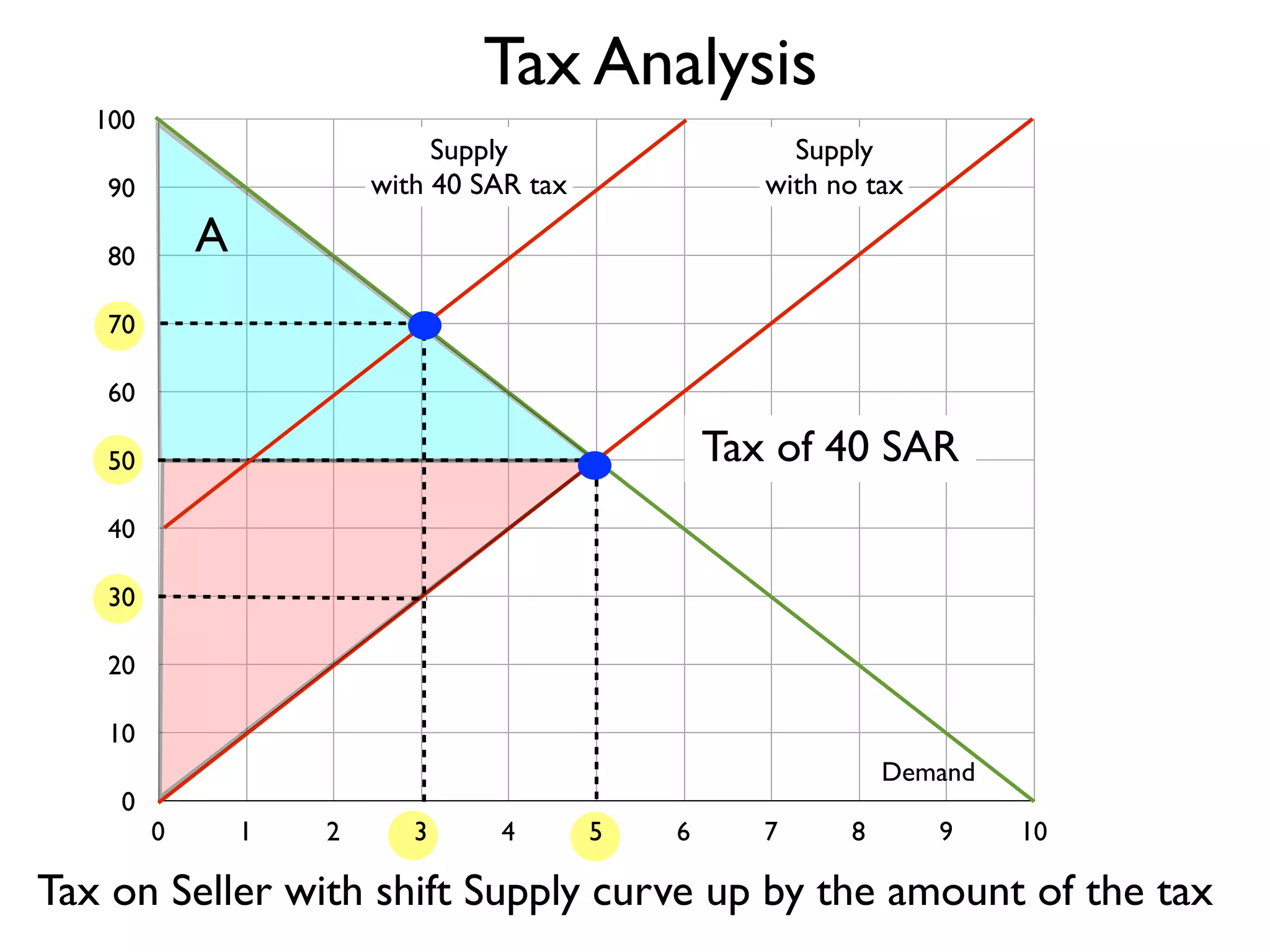

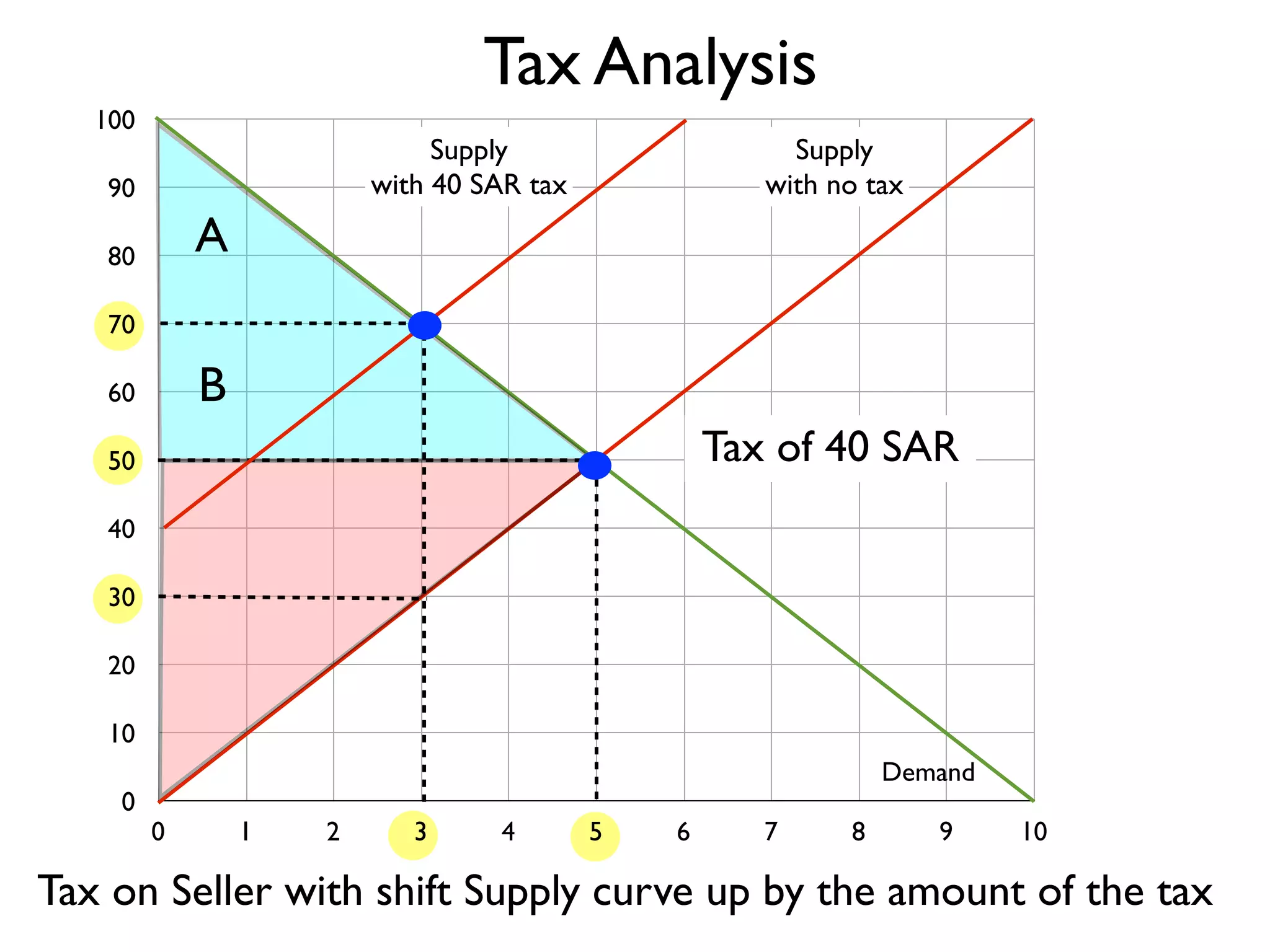

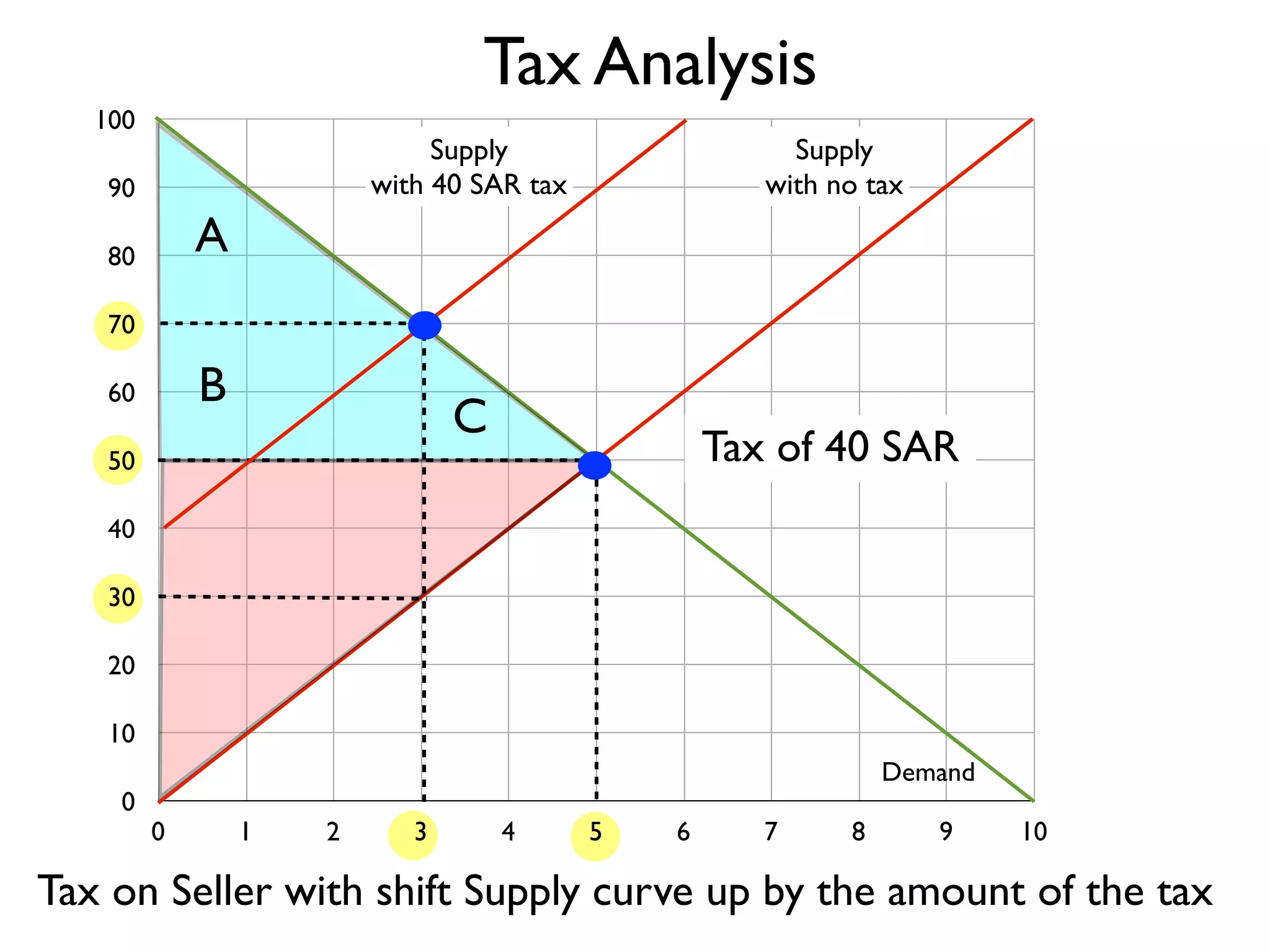

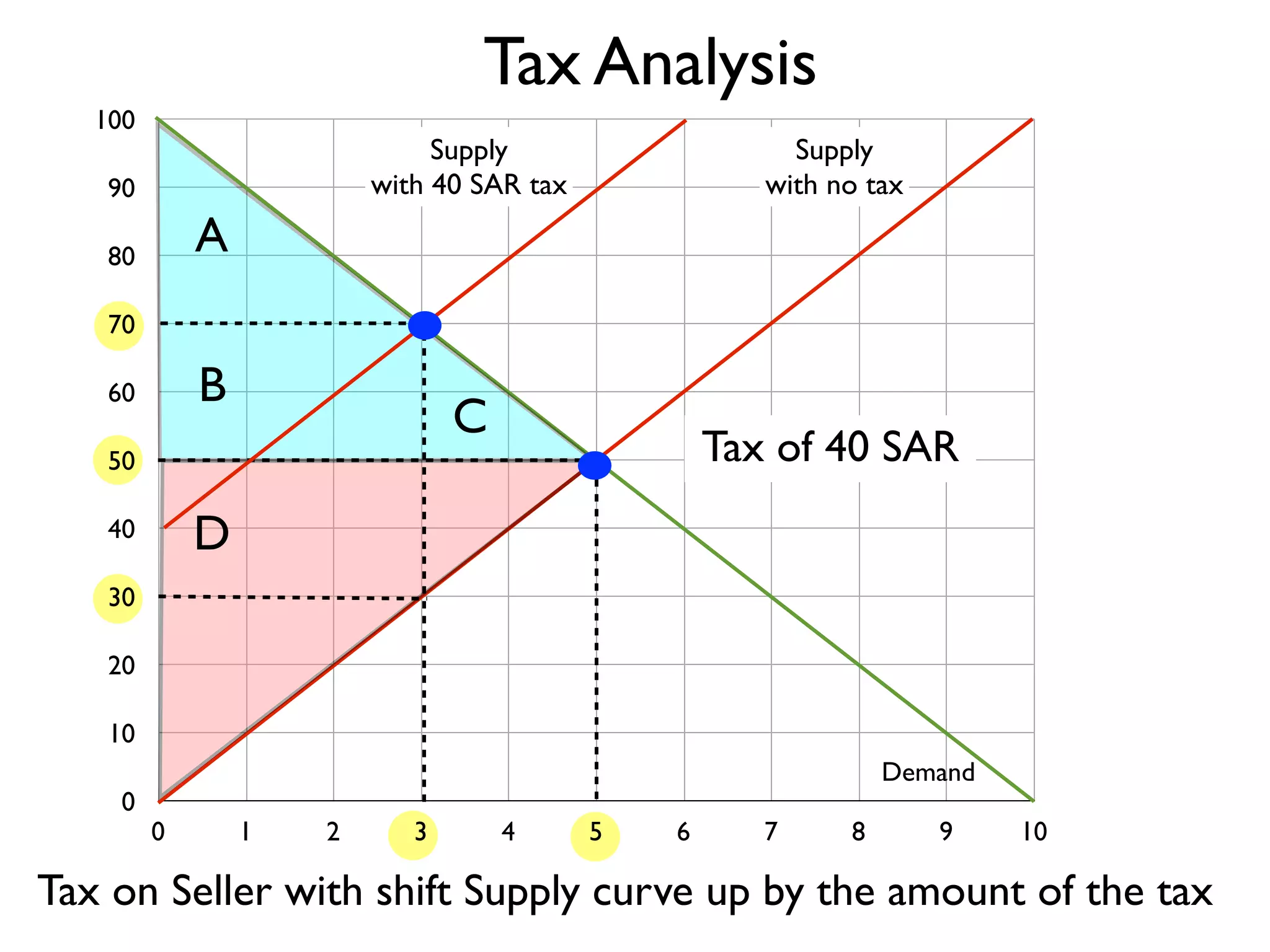

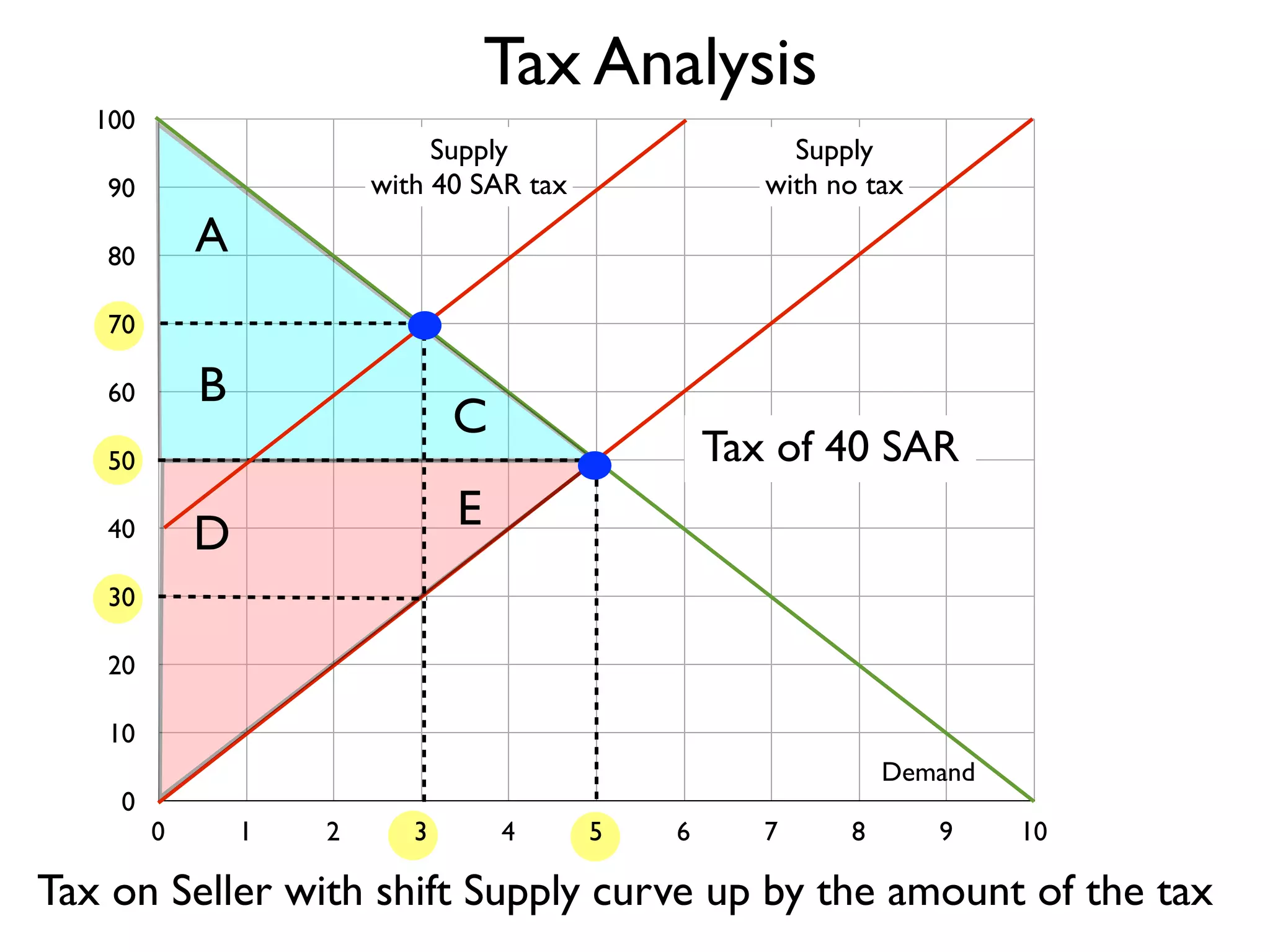

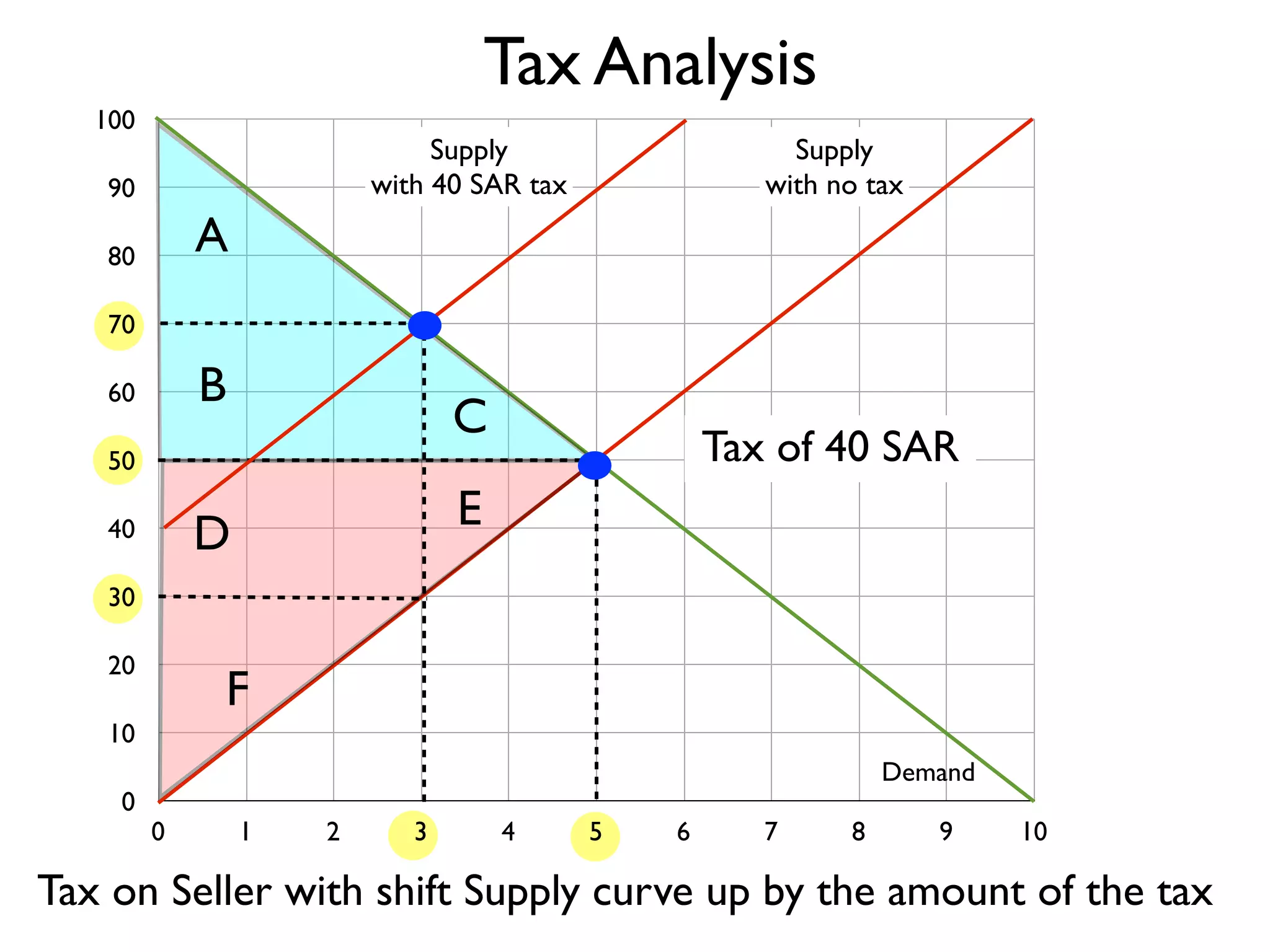

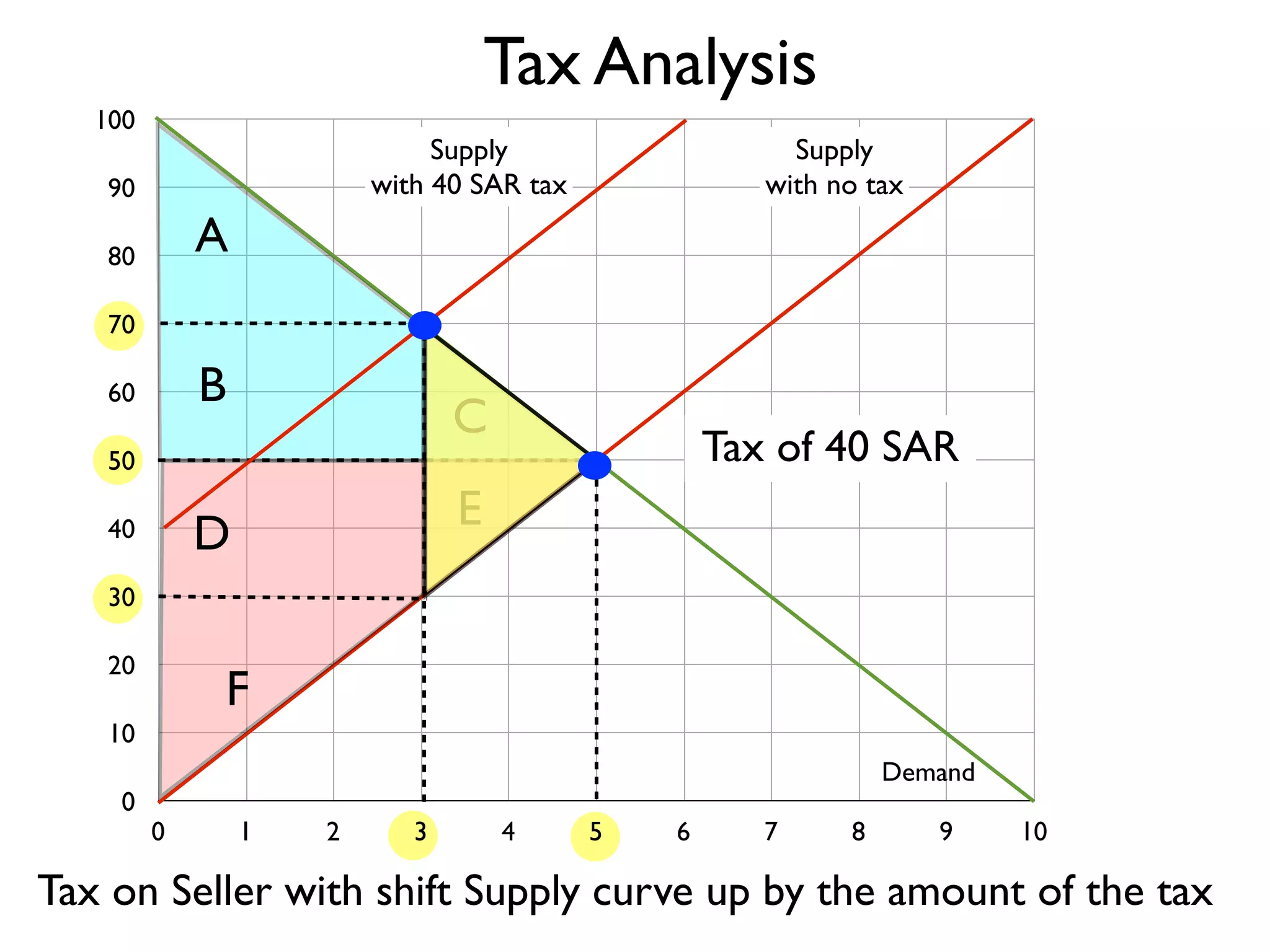

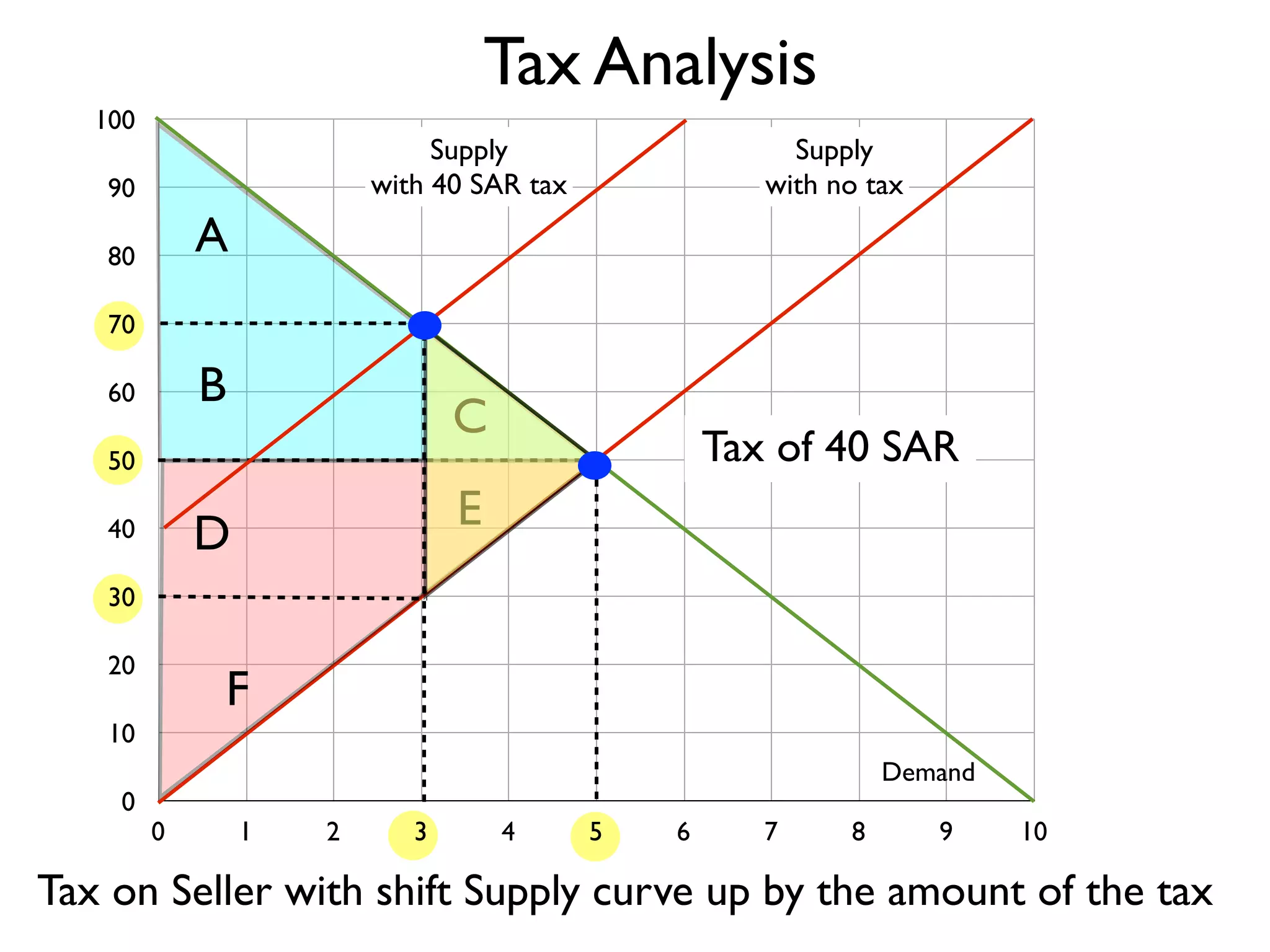

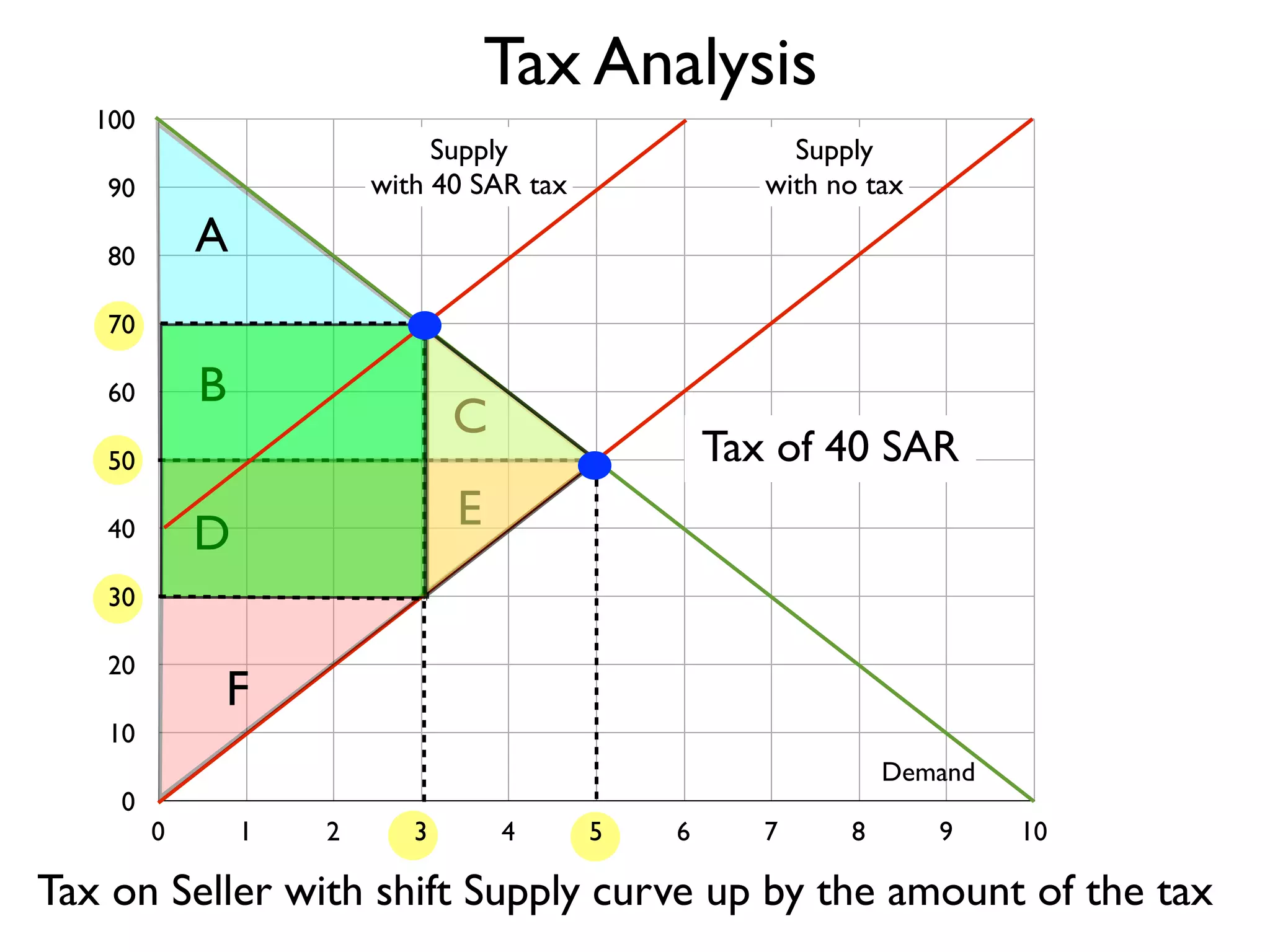

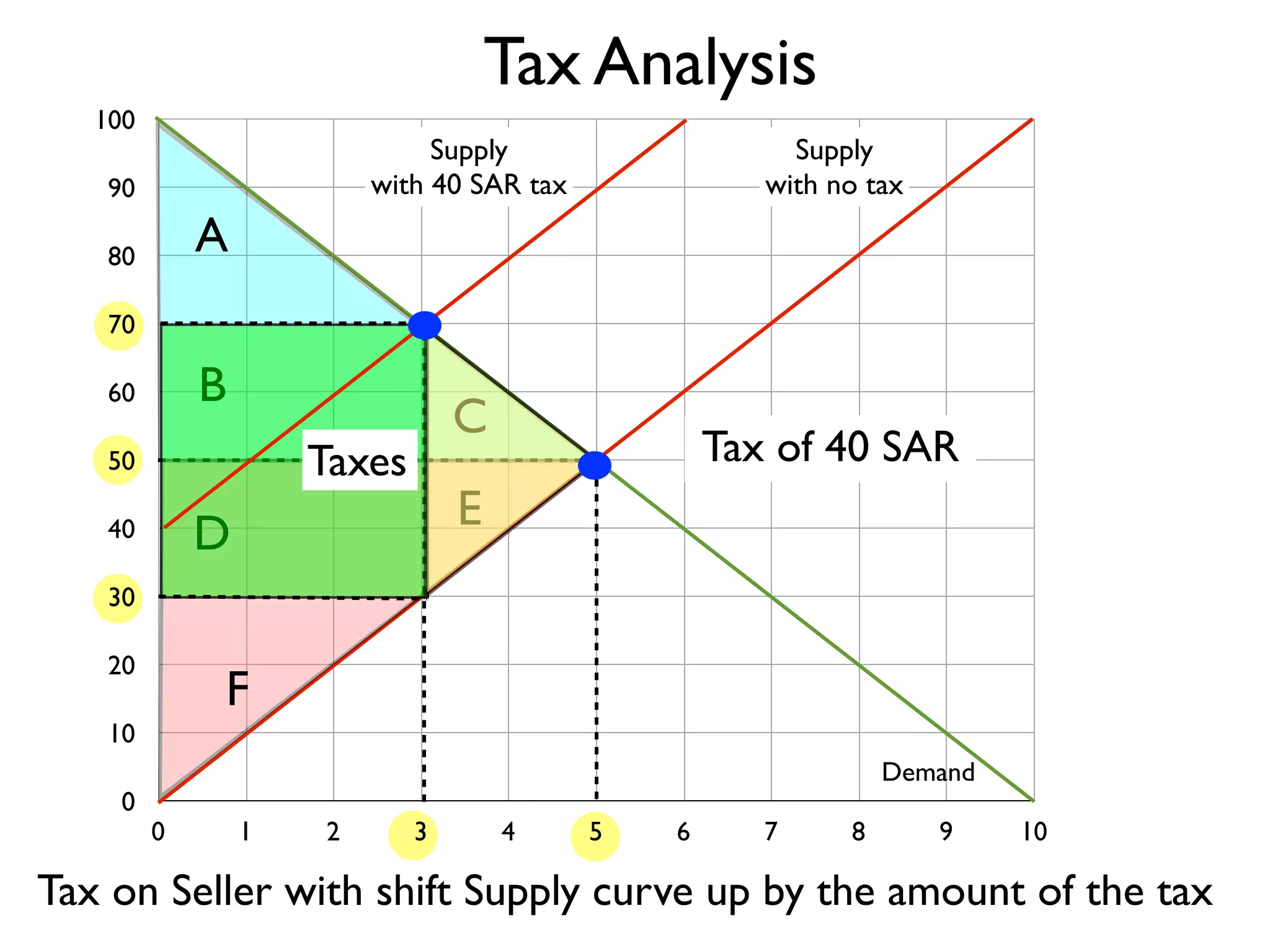

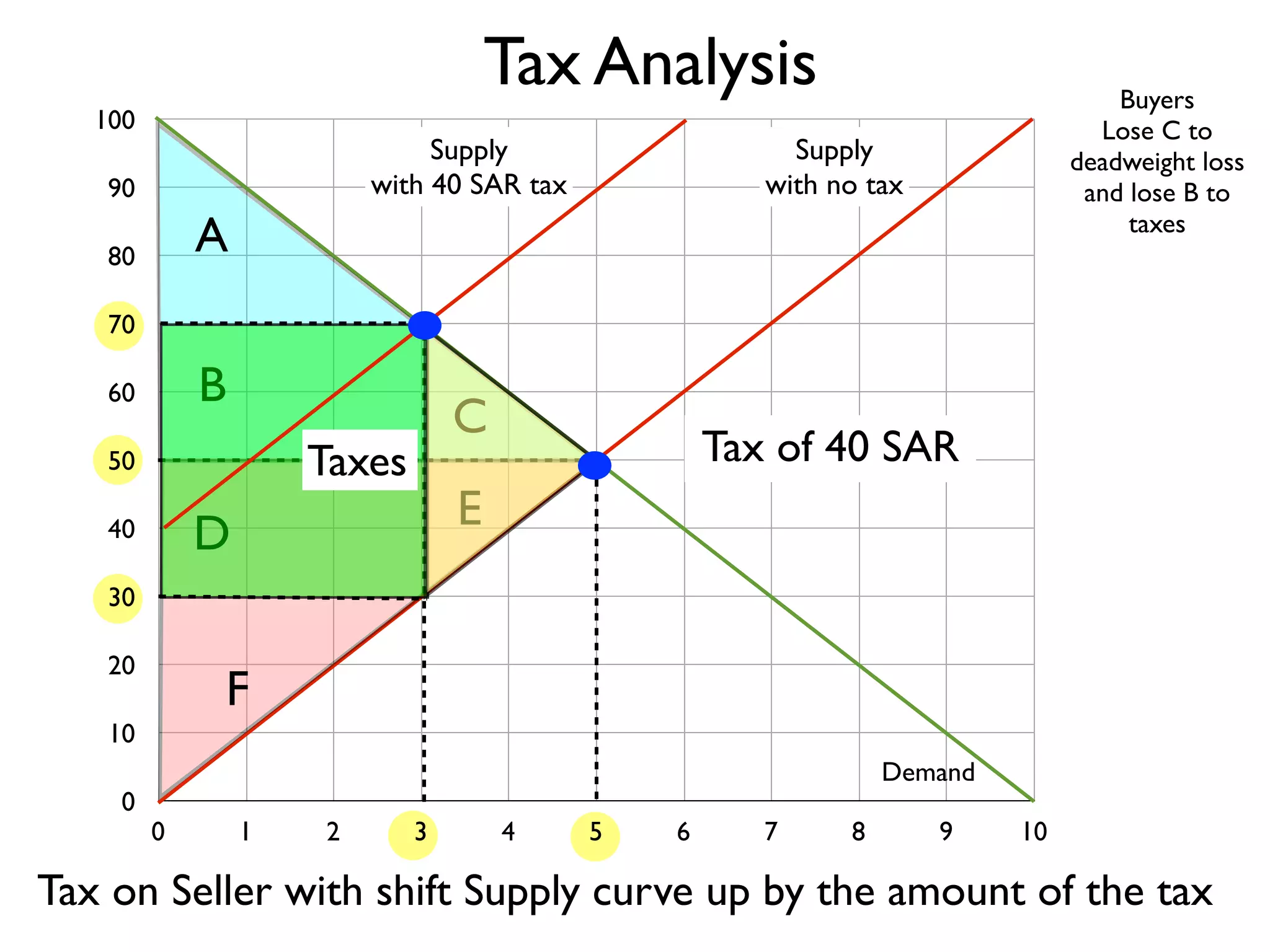

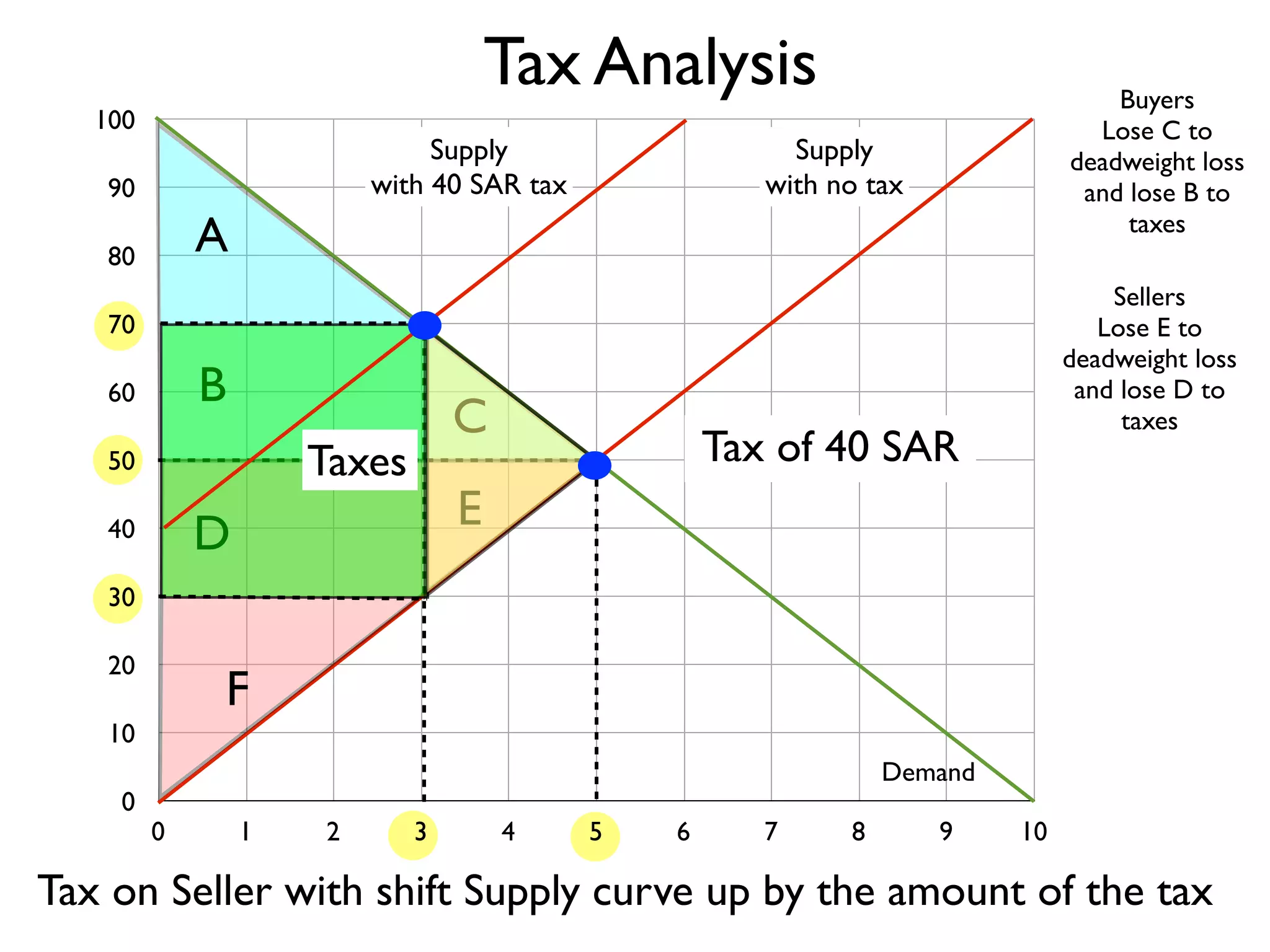

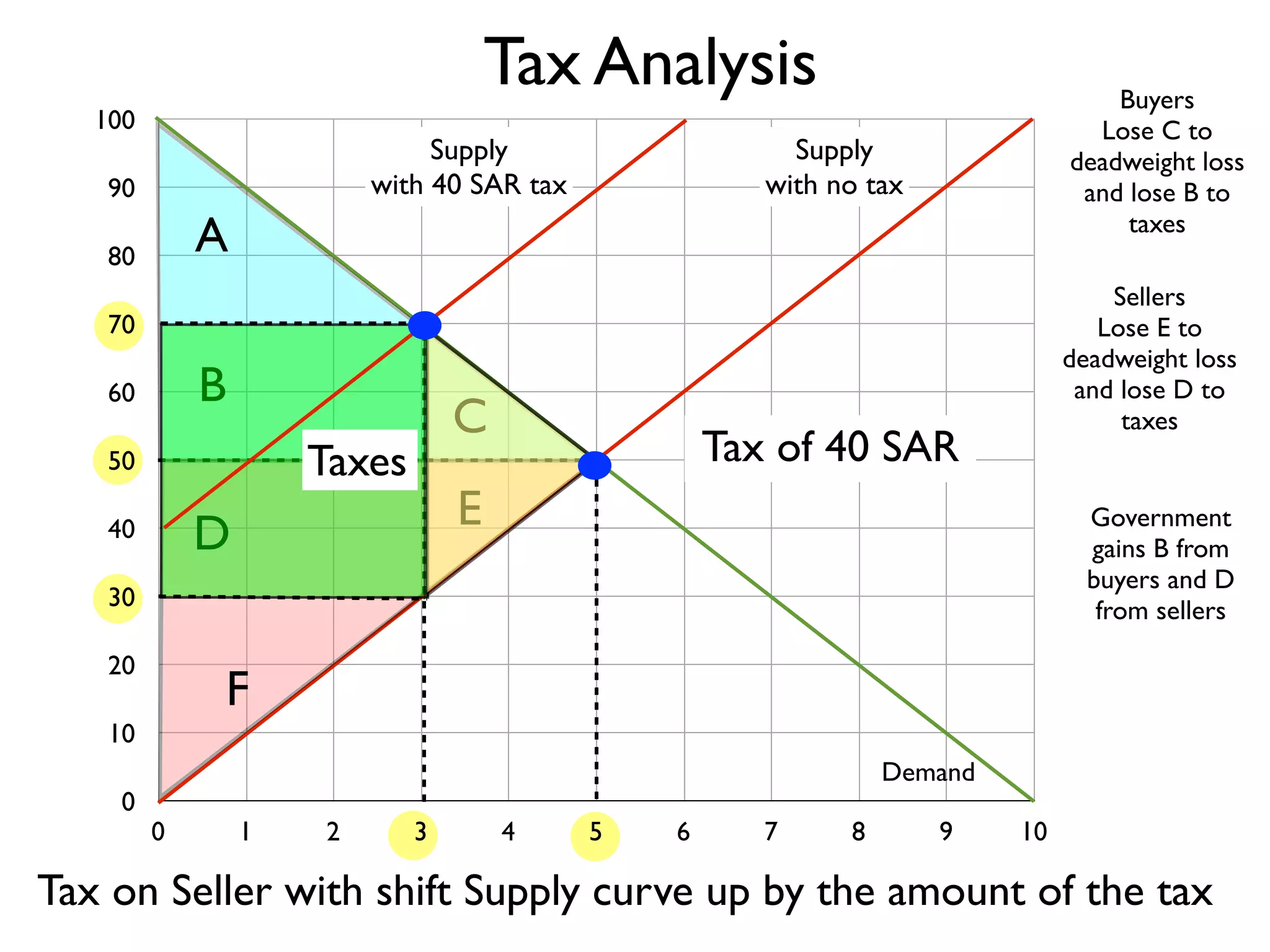

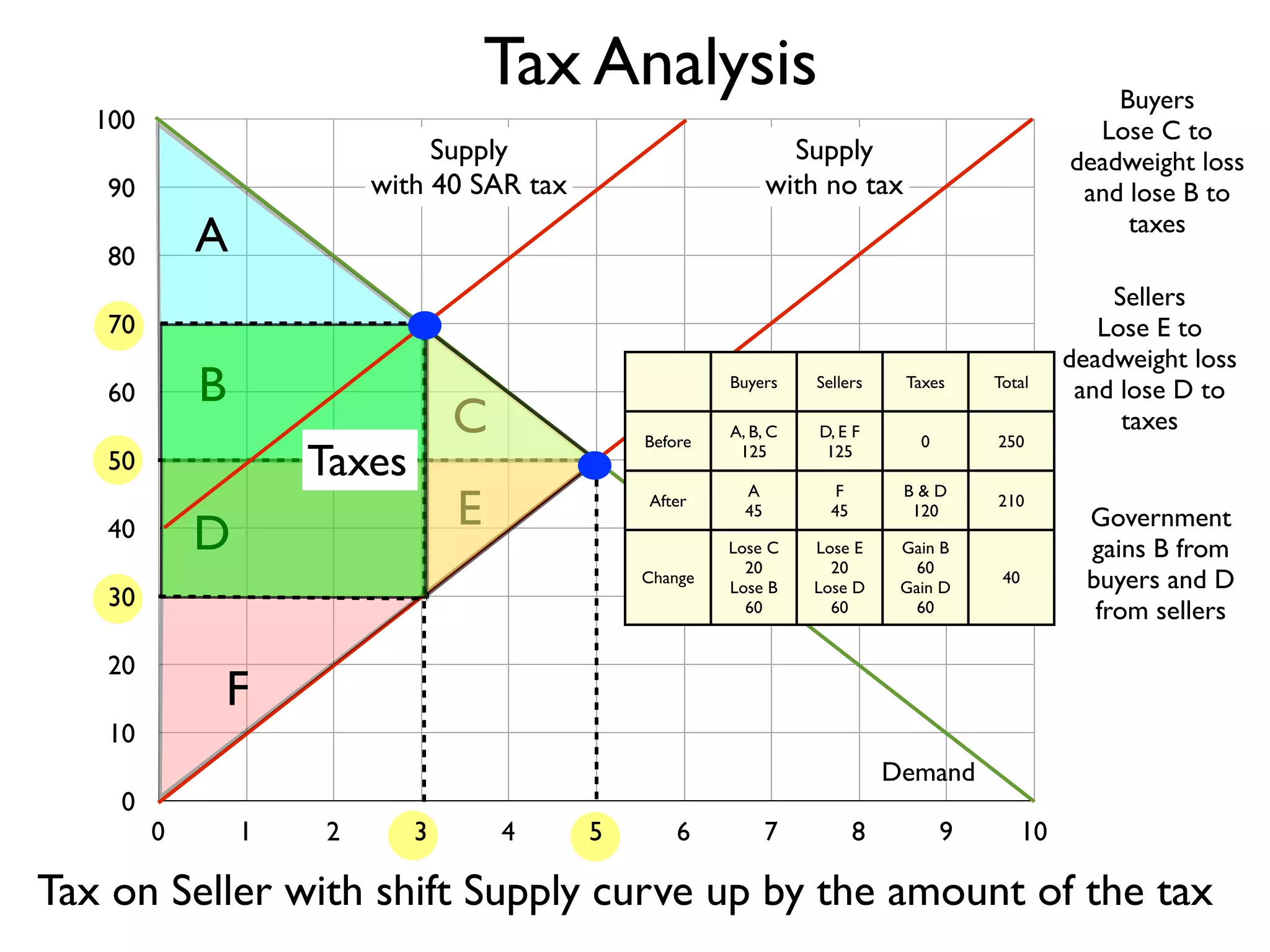

The document analyzes the effects of a tax on sellers. It shows the supply and demand curves shifting as a result of a 40 SAR tax on sellers. This results in deadweight loss for both buyers and sellers, as buyers lose areas B and C while sellers lose areas D and E. The government gains the tax amount of areas B and D. In total, buyers and sellers are worse off by the deadweight loss areas C and E, while the government gains tax revenue of areas B and D.