Embed presentation

Download to read offline

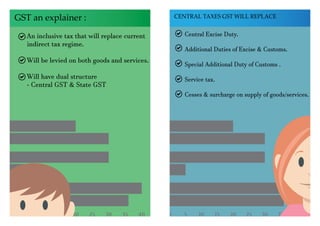

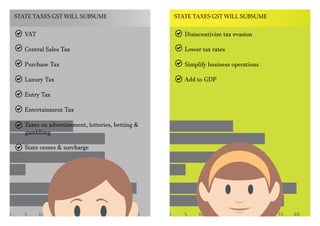

GST is an inclusive tax intended to replace the existing indirect tax framework, applicable to both goods and services. It features a dual structure comprising Central GST and State GST, which will subsume various existing taxes at both levels. The implementation of GST aims to disincentivize tax evasion, simplify business operations, and contribute positively to GDP.