This document summarizes key points from Lecture 2 of an Intermediate Microeconomics course. It introduces risk and expected utility, defines risk attitudes like risk aversion and risk neutrality, and discusses how expected utility theory can represent preferences over risky outcomes. It also provides an example of how insurance markets work based on individuals' risk attitudes and the incentives of insurance companies.

![Intermediate

microeconomics:

Lecture 2

Risk and Expected

utility

Risk attitude

Application to

insurance market

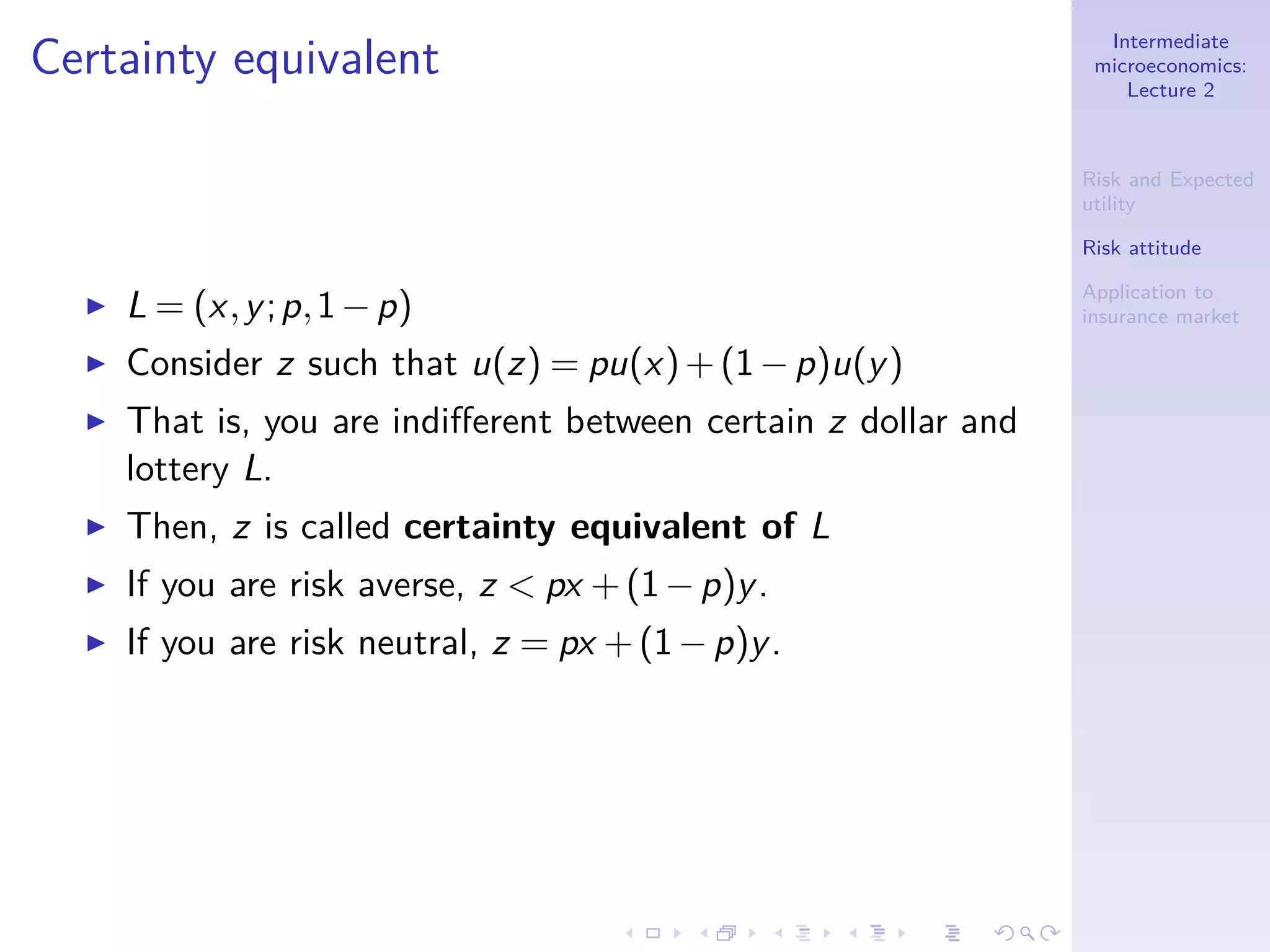

Example

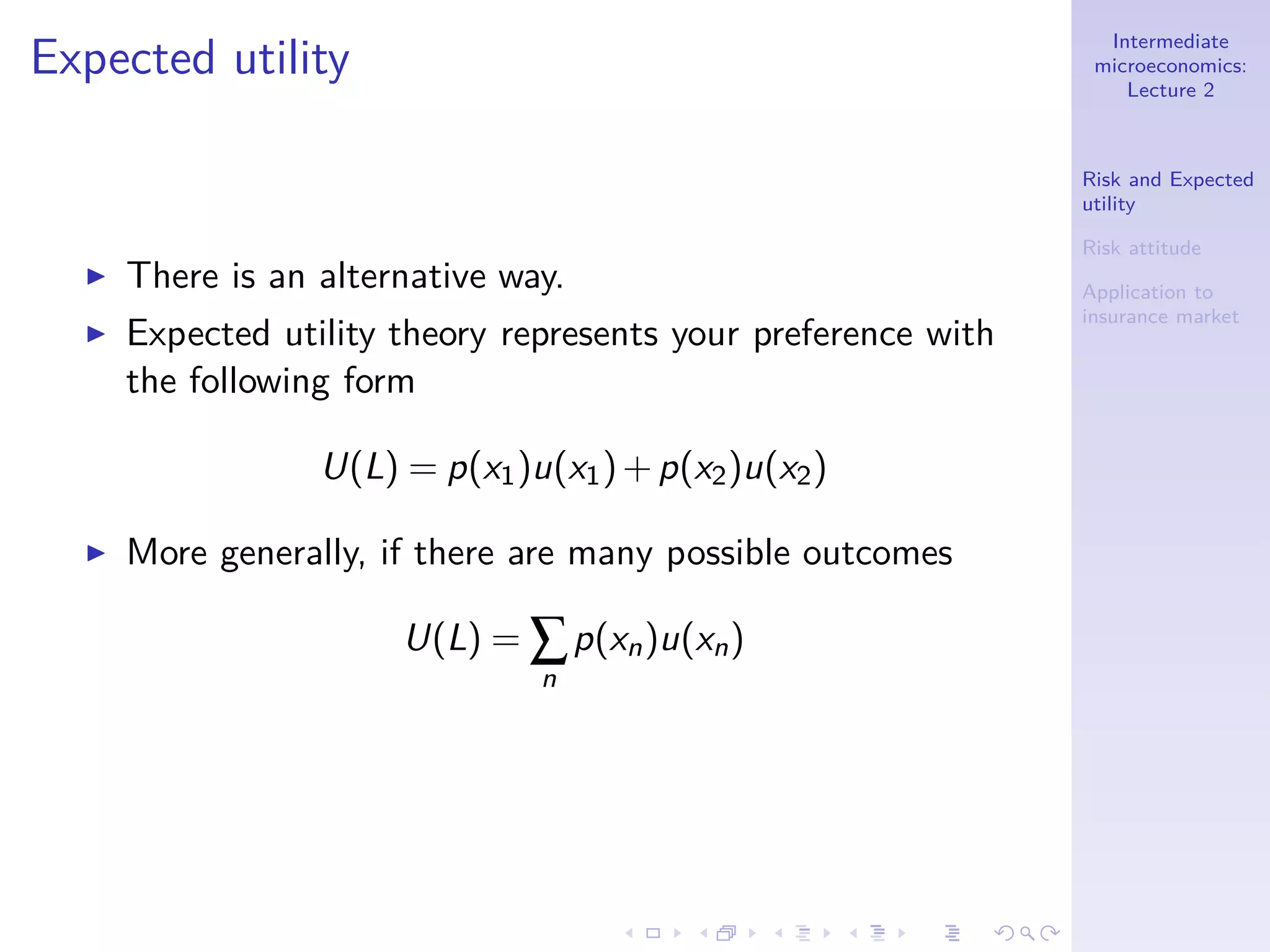

◮ Suppose you cast a dice. If your get x ∈ {1,2,..,6}, you

receives $x.

◮ The expected utility is

EU(x) =

1

6

[u(1)+u(2)+u(3)+u(4)+u(5)+u(6)]

◮ For example, if u(x) =

√

x, then EU(x) = 1.805303682](https://image.slidesharecdn.com/lecture2-130420210559-phpapp01/75/Lecture-2-10-2048.jpg)

![Intermediate

microeconomics:

Lecture 2

Risk and Expected

utility

Risk attitude

Application to

insurance market

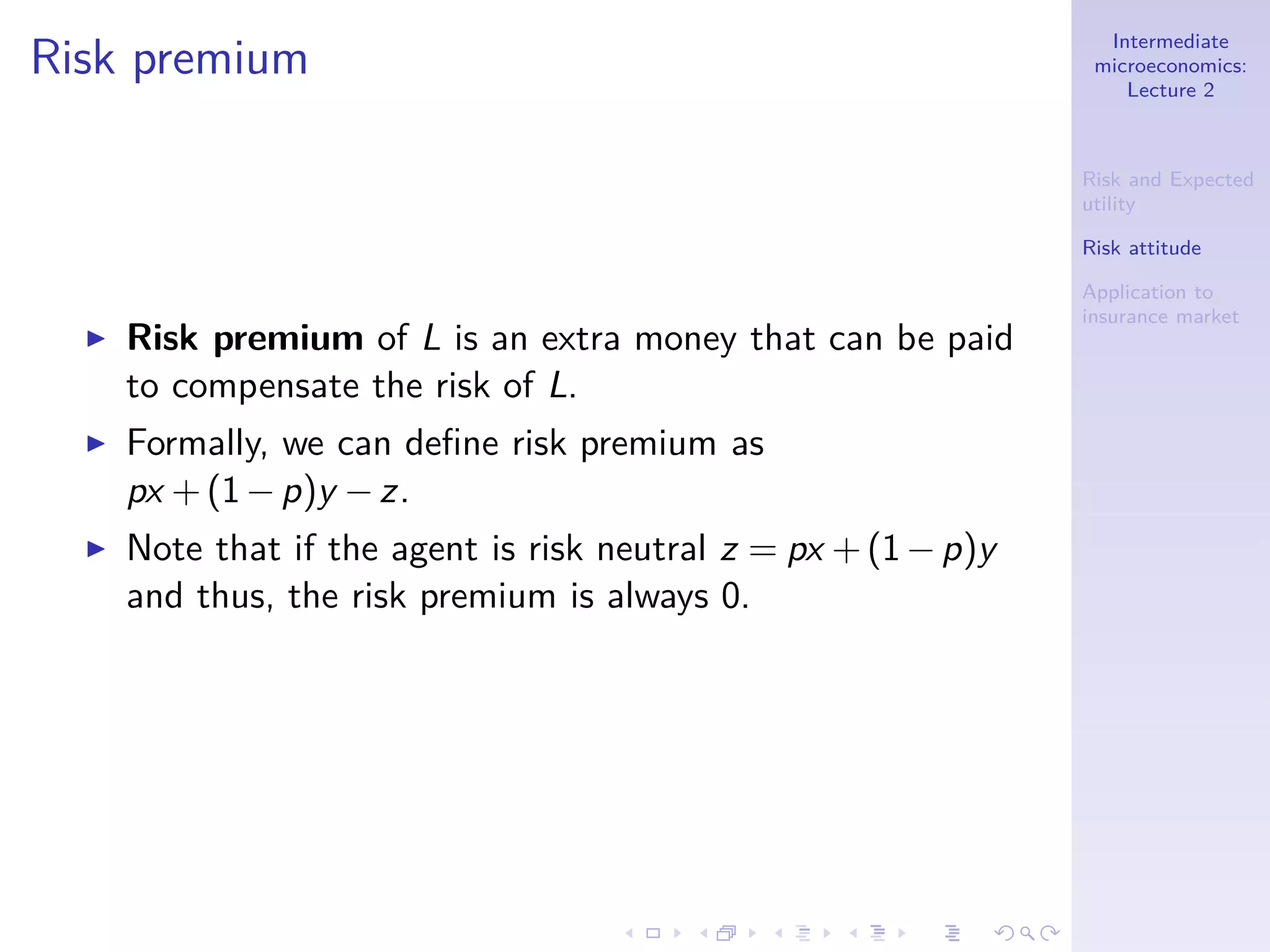

Independence

Definition

A preference over lotteries satisfies independence

assumption if, for any lotteries L′,L′′,L′′′ such that L′ L′′,

αL′ +(1−α)L′′′ αL′′ +(1−α)L′′′ for any α ∈ (0,1].

◮ Roughly put, if you expand two lotteries with a common

lottery, it should not affect preference over the two

lotteries.](https://image.slidesharecdn.com/lecture2-130420210559-phpapp01/75/Lecture-2-13-2048.jpg)