This document discusses the role and actions of the European Central Bank (ECB) and its president, Mario Draghi, during the Eurozone crisis. It makes the following key points:

1. Draghi has taken extraordinary measures to provide liquidity and prevent financial market tensions, such as direct debt purchases and bond-buying programs, pushing the limits of the ECB's mandate.

2. Draghi's announcement of unlimited bond purchases (OMT program) in September 2012 was pivotal in calming markets and buying time for political leaders to act, making the ECB a more influential actor than individual governments.

3. However, the ECB's crisis response has also attracted criticism for stretching its independence and over

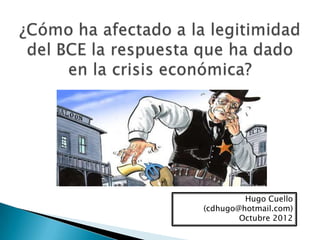

![ “El BCE hará cuanto sea necesario para mantener la

estabilidad de los precios. Mantendrá su independencia. Y

lo hará dentro del marco de acción contemplado en su

mandato. Sin embargo, resulta relevante comprender que

nuestro mandato nos exige que, a veces, vayamos más allá

de las medidas político-monetarias ordinarias. […]

En ocasiones, exige medidas extraordinarias. Tomar estas

medidas, si llega el caso, es nuestra responsabilidad como

banco central para toda la zona euro. […]

Sería recomendable que se renovase la arquitectura de la

zona euro, porque únicamente así se podrá alcanzar la

prosperidad y garantizar la estabilidad a largo plazo, tanto

para la zona monetaria en general como, más

concretamente, para Alemania.”

Mario Draghi en Die Zeit. 30 agosto 2012](https://image.slidesharecdn.com/independenciadelbce-130813182249-phpapp01/85/Independencia-del-BCE-5-320.jpg)