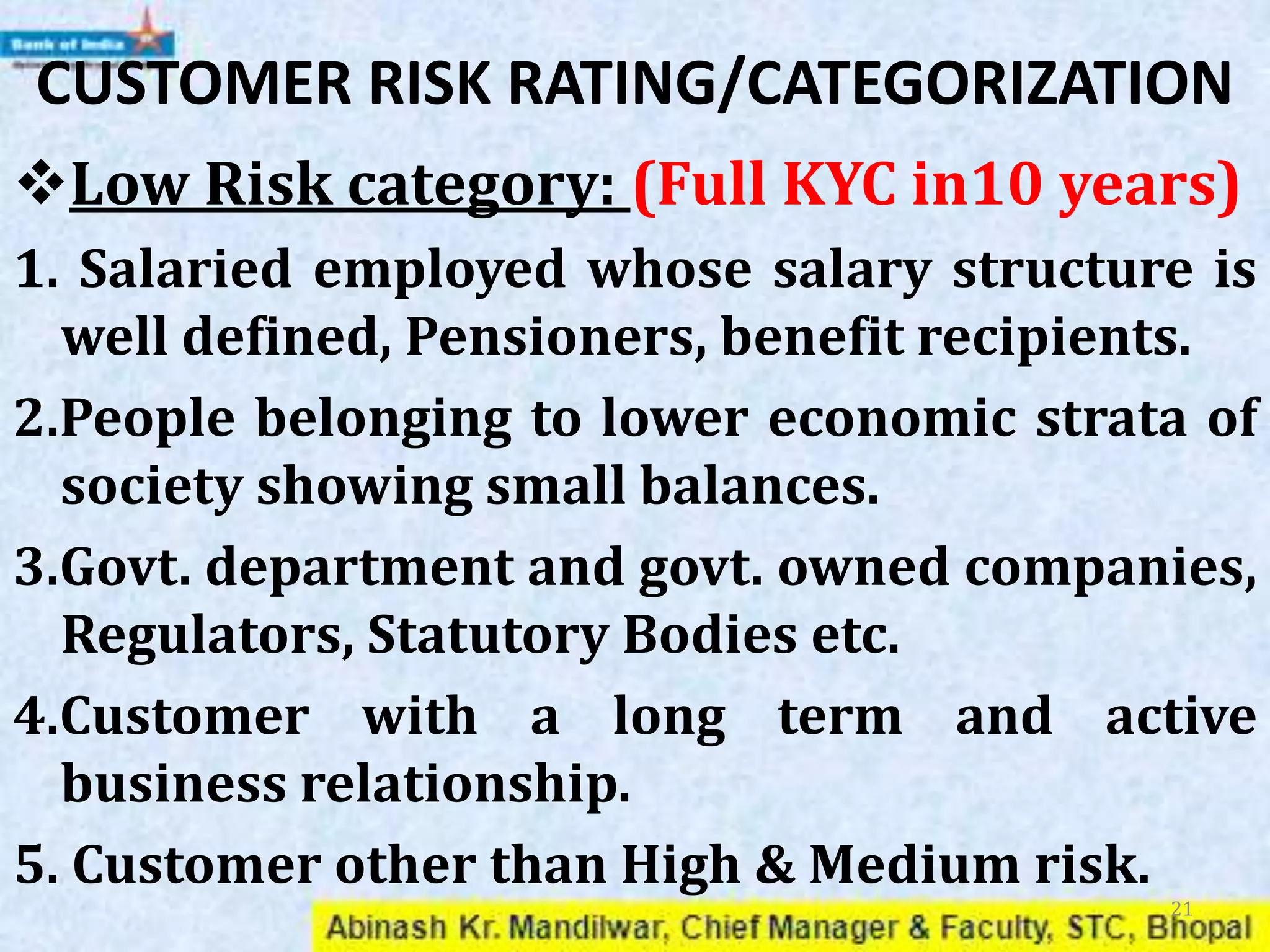

This document outlines the KYC/AML/CFT policy of a bank. It discusses key aspects like money laundering definitions, obligations under relevant acts, customer due diligence procedures, risk categorization of customers, identification of suspicious transactions, and reporting requirements. The objective is to prevent criminal activities like money laundering and terrorist financing through proper monitoring and compliance with regulatory guidelines.