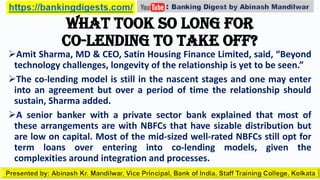

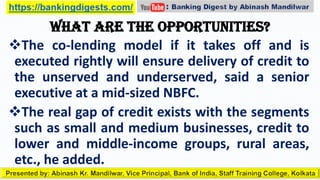

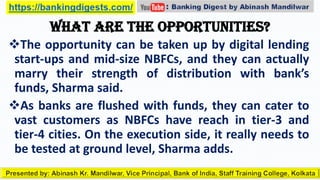

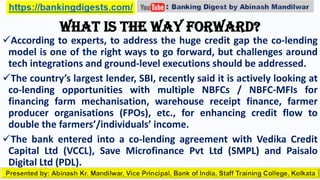

The Reserve Bank of India (RBI) has established a 'co-lending model' that allows banks and non-banking financial companies (NBFCs) to jointly provide credit for the priority sector, sharing risks in an 80:20 ratio. The model aims to enhance credit flow to underserved segments by leveraging banks' lower costs and NBFCs' distribution reach, although challenges in system integration and execution have hindered its initial rollout. Moving forward, the model is expected to facilitate credit delivery for small businesses and rural areas, with recent co-lending agreements indicating increased interest from major lenders.