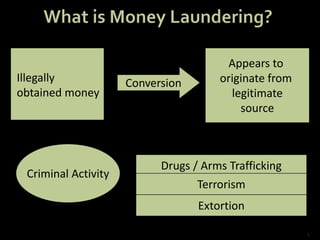

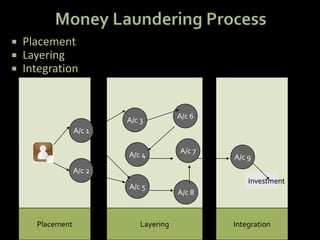

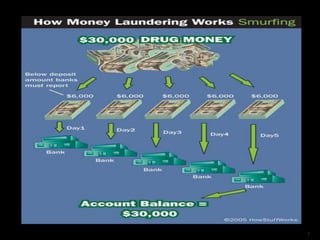

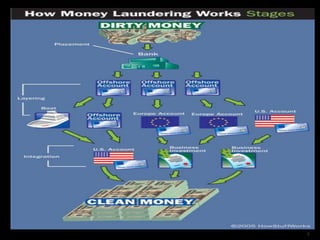

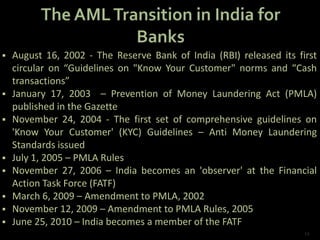

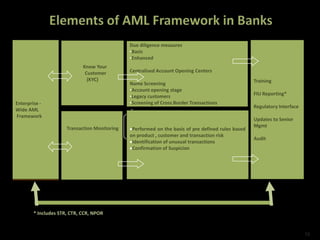

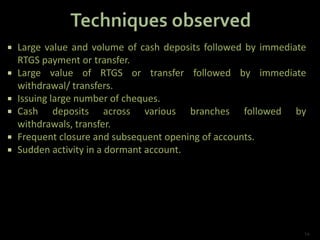

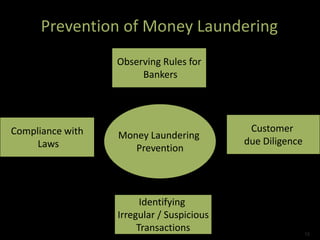

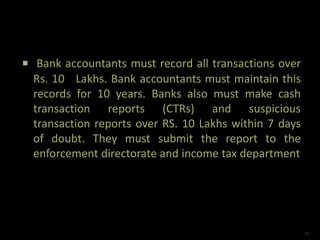

Money laundering involves converting illegally obtained money to make it appear legitimate through a three-stage process. The first stage, placement, involves moving dirty money into the financial system. The second, layering, uses complex transactions to obscure the audit trail. The final stage, integration, makes the money appear to come from legal sources. Banks are at risk of reputational, legal, operational, and concentration risks if they allow money laundering. Indian regulations require banks to follow know-your-customer procedures, monitor transactions, and report suspicious activity to authorities to prevent money laundering and comply with anti-money laundering laws.