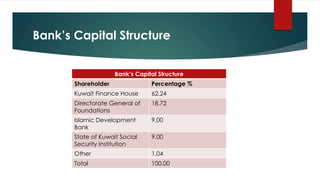

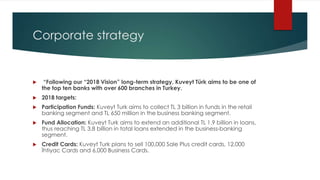

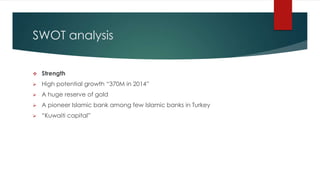

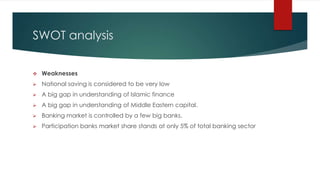

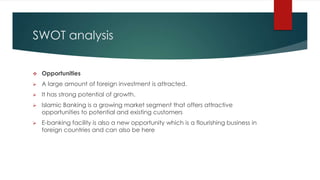

Kuveyt Turk was established in 1989 as a private financial institution in Turkey. It is majority owned by Kuwait Finance House, with other major shareholders including the Islamic Development Bank and Kuwait's social security institution. The board of directors is chaired by Hamad Abdulmohsen Al Marzouq. Kuveyt Turk aims to grow its branch network to over 600 branches and increase its portfolio of participation funds and loans as part of its 2018 strategic vision. It has a strong capital base but also faces threats from competition and challenges adhering to Islamic banking rules in Turkey.