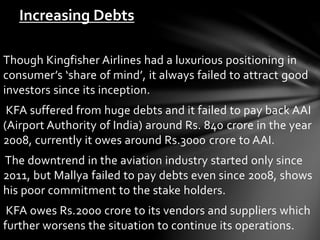

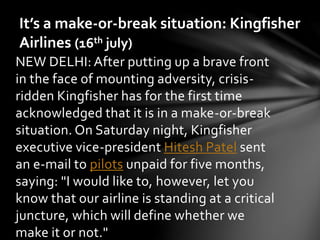

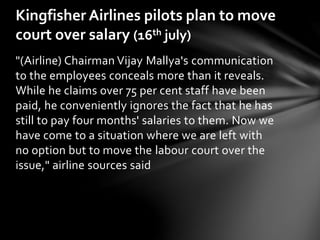

Though Kingfisher Airlines had a luxurious brand positioning, it failed to attract good investors since its inception due to huge debts. KFA owes around Rs. 3000 crore to the Airport Authority of India since 2008 and Rs. 2000 crore to vendors and suppliers. The airline's financial troubles were exacerbated by the acquisition of Air Deccan, a low-cost carrier, which diluted the Kingfisher brand. Ever since operations began in 2005, Kingfisher has been reporting losses. With increasing debts and declining revenues, Kingfisher has been unable to pay employee salaries for the past five months and many pilots have resigned, crippling flight operations. Vijay Mallya has stated that Kingfisher is in a critical situation and