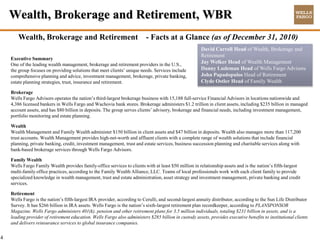

Wells Fargo & Company, following the acquisition of Wachovia, is positioned as a leading diversified financial services provider in the U.S., with a robust wealth management group managing over $140 billion in client assets. The document outlines various job opportunities within Wells Fargo, including roles in product management, operational risk consulting, and brokerage management, emphasizing a client-centric approach and adherence to compliance regulations. Key responsibilities for several positions include developing and managing financial products, optimizing operational processes, and ensuring regulatory compliance.