This document provides an analysis of General Motors' (GM) strategic management from 2009. It includes GM's mission statement, vision statement, objectives, strategies, brands, vehicle details, and internal/external analyses. SWOT, EFE, IFE, SPACE, Grand Strategy, and QSPM matrices are presented to evaluate GM's strengths, weaknesses, opportunities, threats, competitive position, and strategies. The document concludes GM needs to improve alternative energy vehicles, global expansion, and profitability to compete in a changing industry.

![Oldsmobile, to a Buick, to a Cadillac. In order to differentiate GM brands from their competition, he

positioned each car line at the top of the price scale in its price-quality segment.

For more than a half century GM dominated the U.S auto industry like colossus with a market share

as high as 50% which made it a low-cost leader. So, it is ironic that even the most prestigious

handwork –Cadillac—of the man wrote the book on market segmentation and differentiation failed

the threshold of a differentiated product in Porter’s scheme of things. We would like to point out here

that while multiple brands might have been a good strategy for GM in the past it is not so today’s

global competition in which the successful firms like Toyota and others concentrate only on a limited

number of car lines.

Page | 8

GM Vehicle – Global Brands

Chevrolet

Chevrolet colloquially referred to as Chevy and formally

the Chevrolet Division of General Motors LLC. In 1919,

Alfred Sloan chose Chevrolet brand to become the volume

leader in the General Motors Family and mainstream

vehicles to compete with Henry Ford’s Model T. Then in

1923, Chevy overtook the Model T as the best-selling car in

the US.

Buick

Buick, formally the Buick Motor Division is premium

automobile brand, selling entry-level luxury vehicles

positioned above its mainstream Chevrolet, and below the

Cadillac. Buick cars mostly targeted for the North American

market.

Since the discontinuation of Saturn in 2009, GM has

positioned Buick to be an analogue to its

German Opel brand, sharing models and development.

Buick-branded vehicles are sold in the United States, Canada, Mexico, and China. Buick sold

1,032,331 vehicles worldwide in calendar year 2013, a record for the brand.[2]](https://image.slidesharecdn.com/class1-group3-completereport-141112131745-conversion-gate01/75/Keuka_Experiental-Learning_295924-8-2048.jpg)

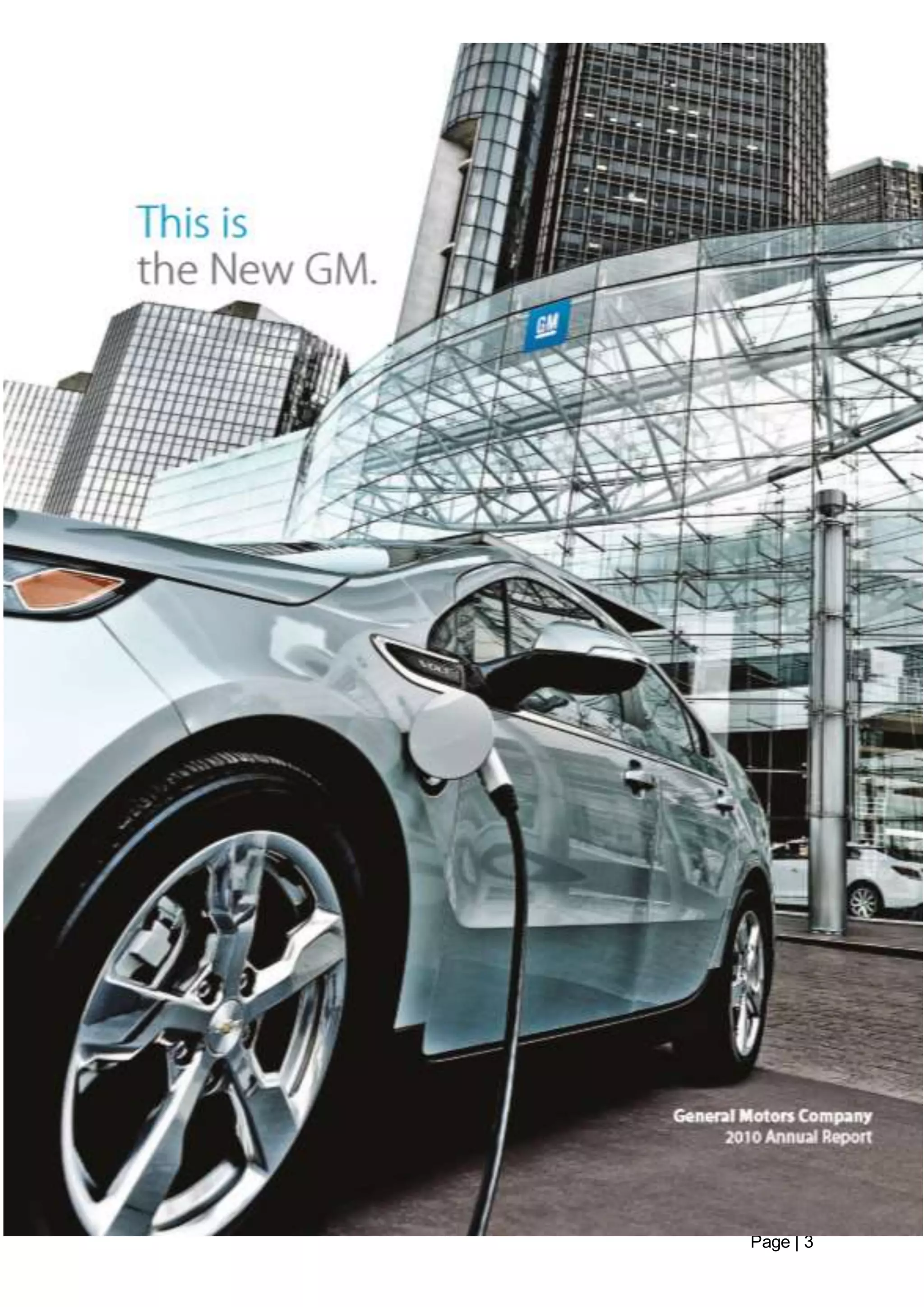

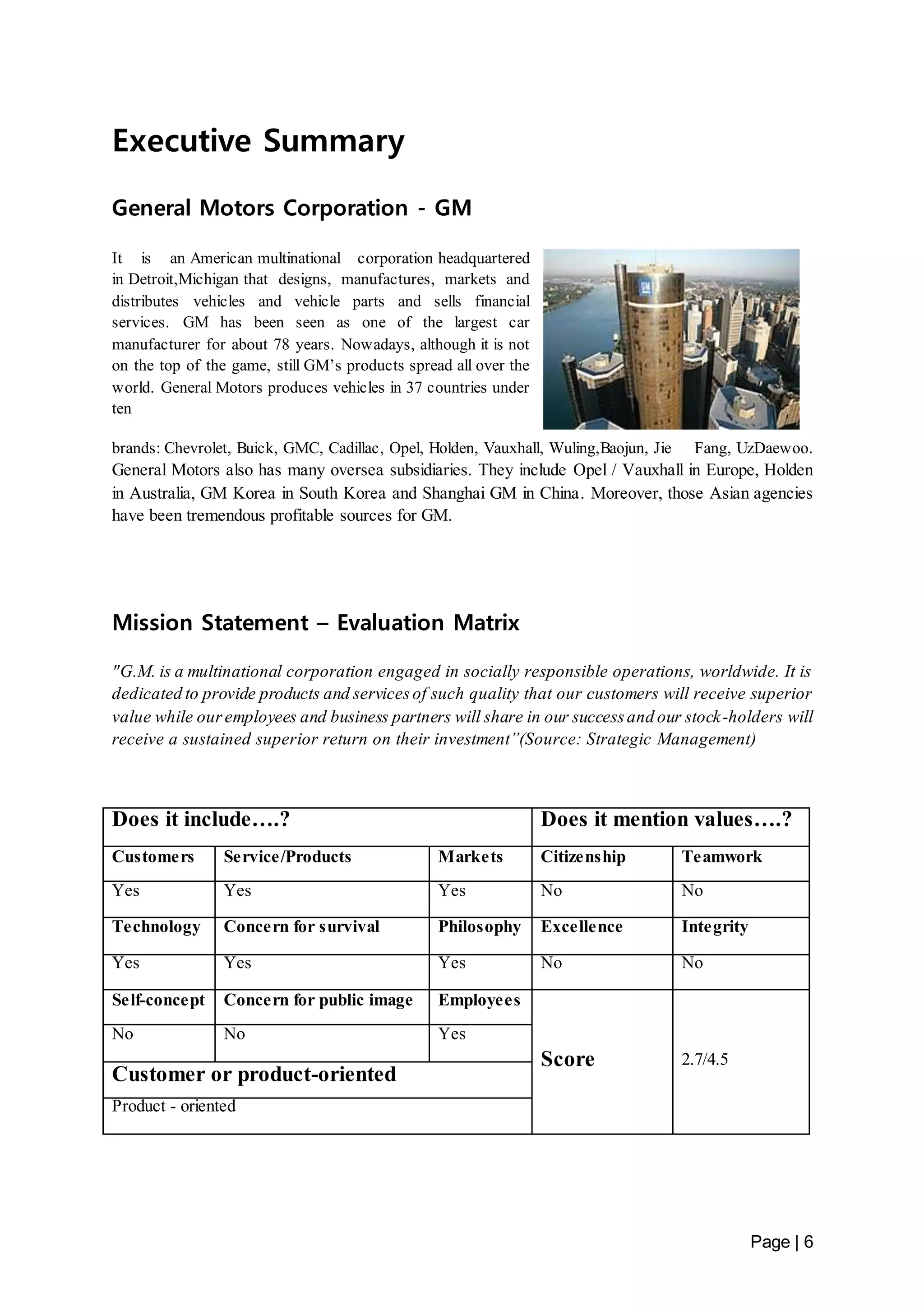

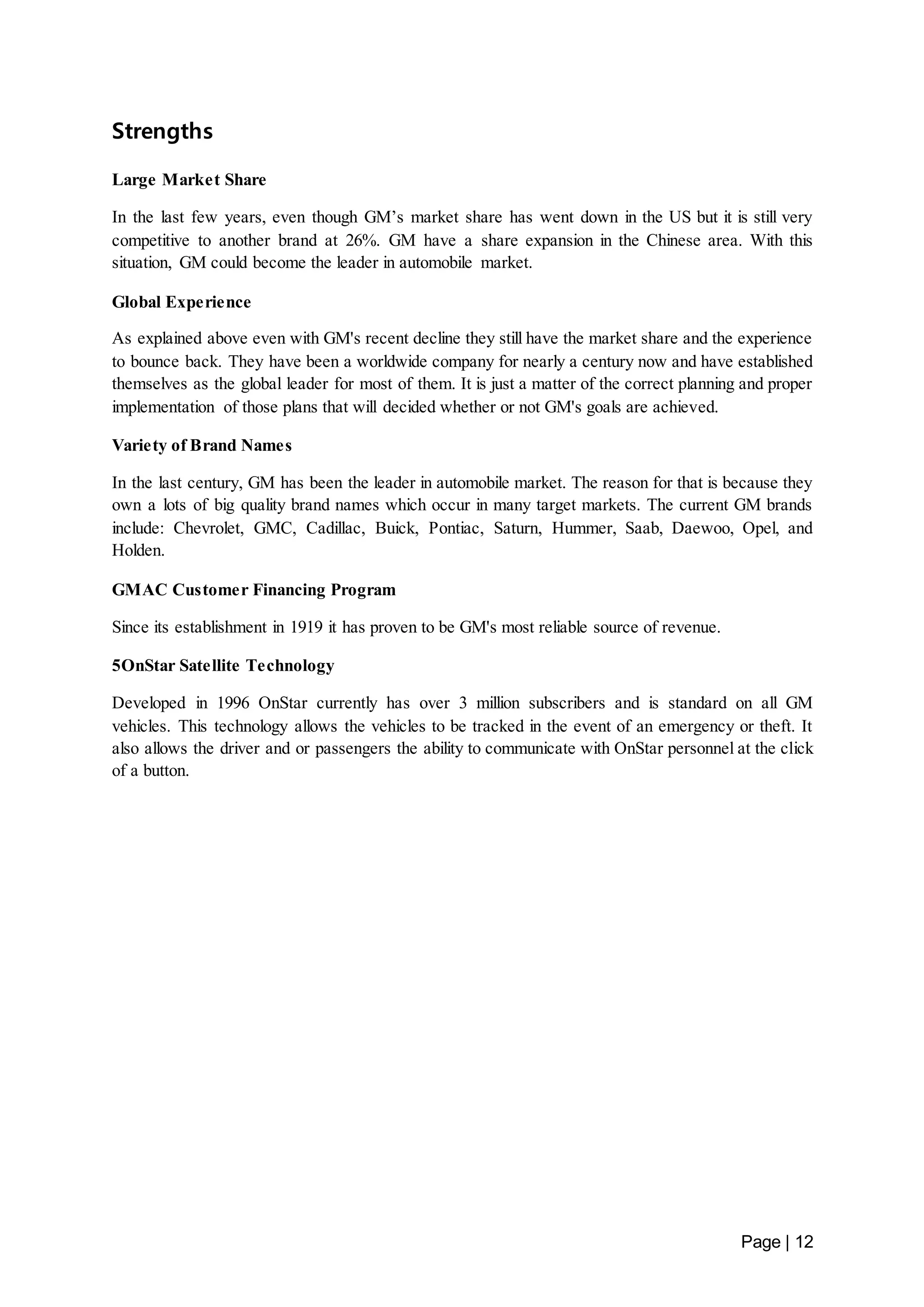

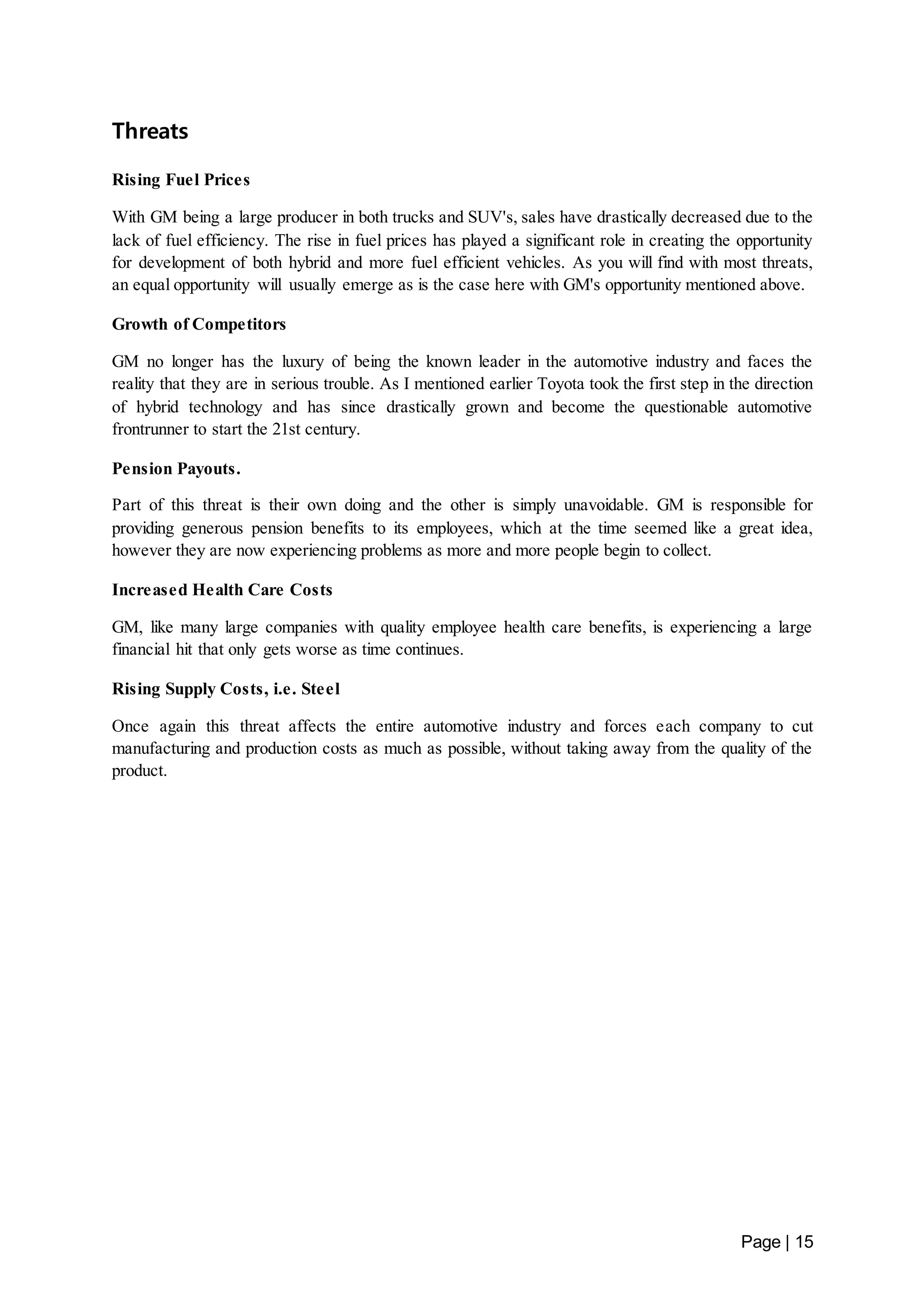

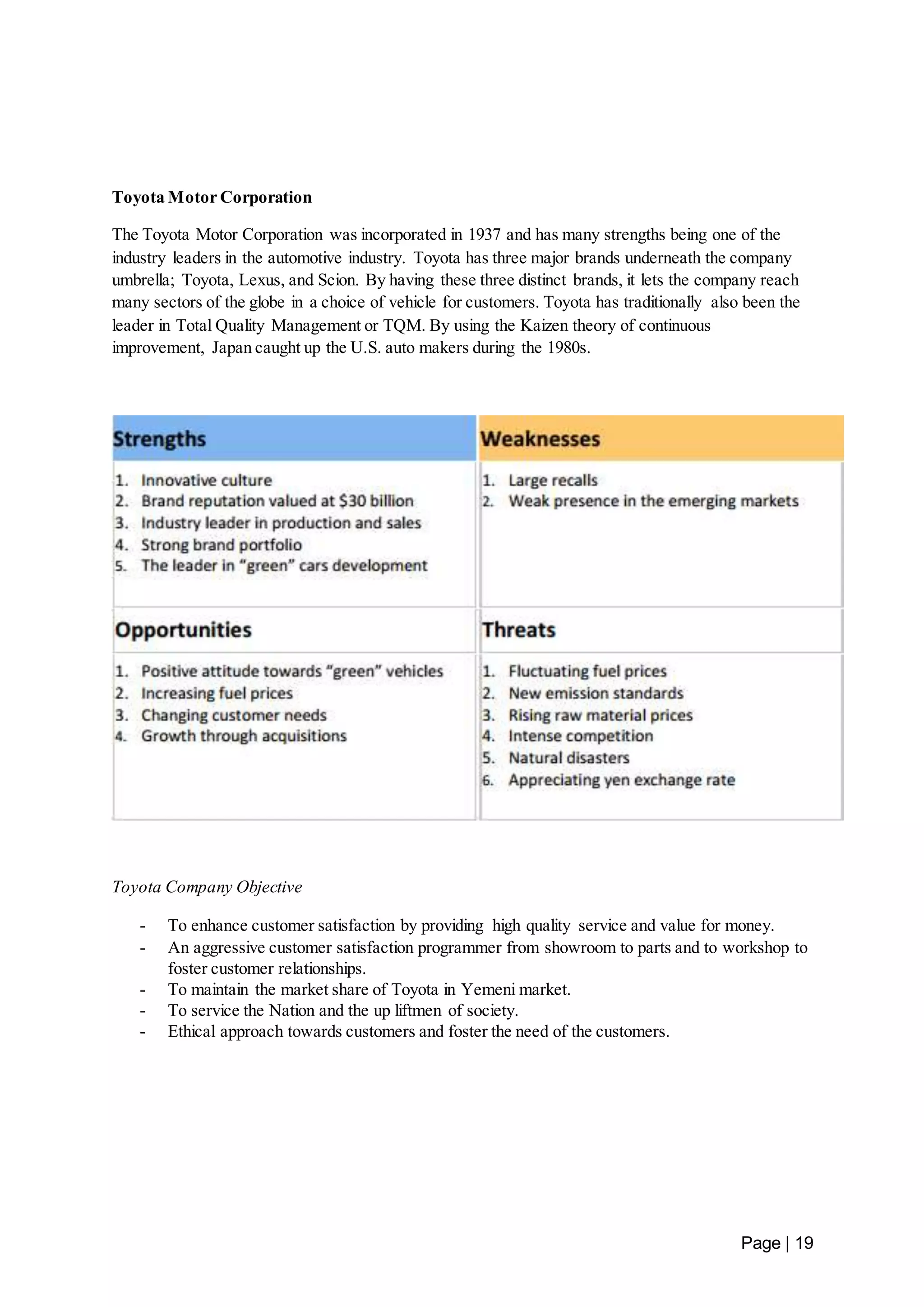

![Key Factors Production of fuel

efficient cars.

Page | 21

Global Market

Penetration

Alliance with the

competitor.

External Opportunities Weight AS TAS AS TAS AS TAS

Increasing demand for electric/hybrid/hydrogen celled vehicles 0.15 4 0.60 2 0.30 1 0.15

Strategic alliances to integrate additional technology with On-Star

0.10 4 0.40 3 0.45 2 0.30

system [H]

New model types and styles [M] 0.10 4 0.40 3 0.30 2 0.20

GMNA market increase [M] 0.10 4 0.40 3 0.30 2 0.20

Continual manufacturing in lower health care and pensioned-countries

[M]

0.10 4 0.40 3 0.30 2 0.20

Continual saturation in Thailand and India which have shown

improved earnings [L]

0.05 4 0.20 3 0.15 2 0.10

External Threats

Rising raw material and transportation costs [H] 0.05 4 0.20 3 0.15 2 0.10

Declining demand for light vehicles [H] 0.05 2 0.10 1 0.05 3 0.15

Competitors have a higher level of perceived value with a solid

0.05 3 0.15 4 0.20 2 0.10

reputation for better product quality [H]

Chinese lack of intellectual property rights from government and

competitors [M]

0.05 3 0.15 2 0.10 4 0.20

Chinese regulations [L] 0.02 2 0.14 3 0.06 1 0.07

Rising Fuel Prices 0.08 3 0.24 4 0.32 2 0.16

Increased Health Care Costs 0.07 3 0.18 4 0.28 3 0.06](https://image.slidesharecdn.com/class1-group3-completereport-141112131745-conversion-gate01/75/Keuka_Experiental-Learning_295924-21-2048.jpg)

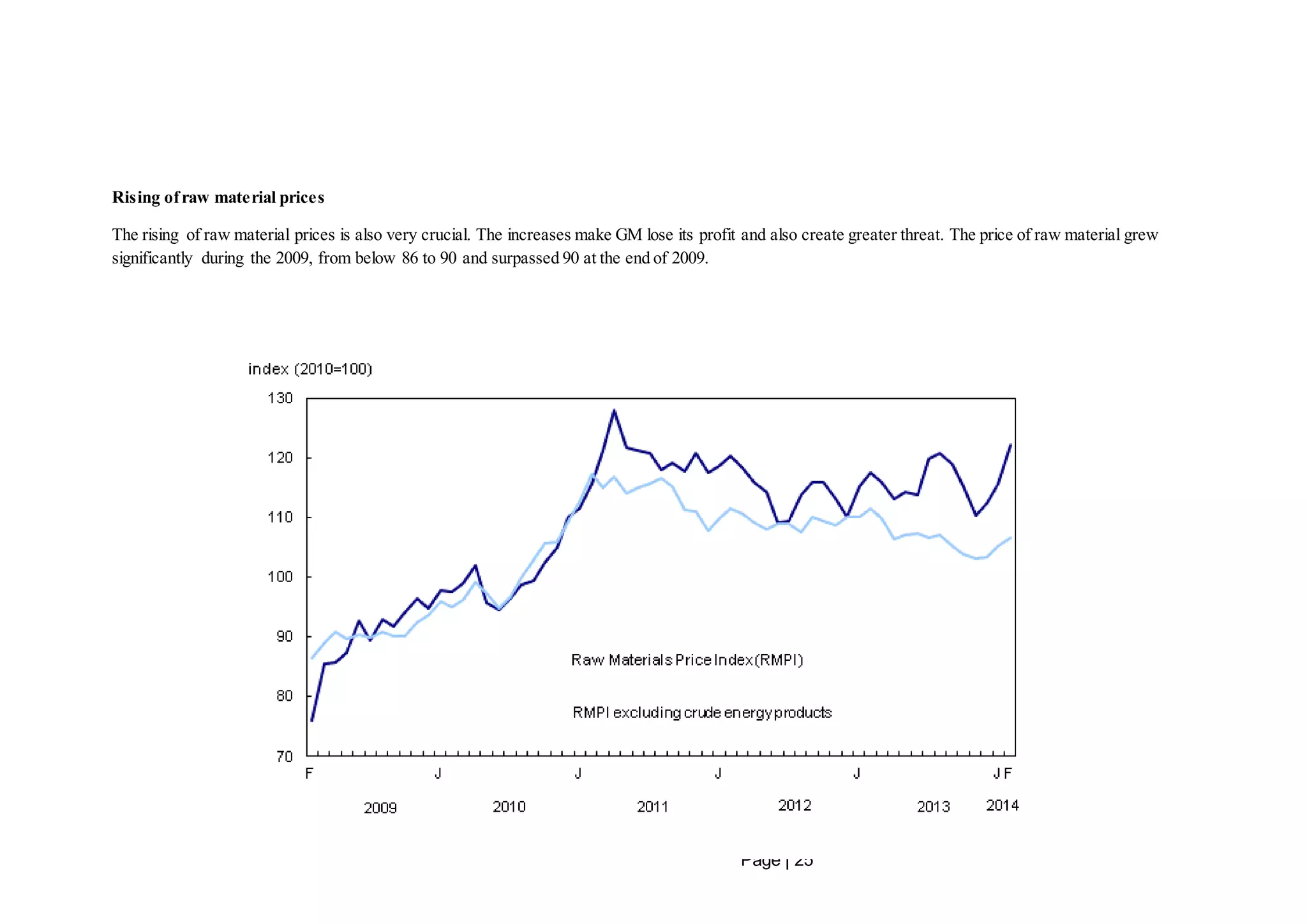

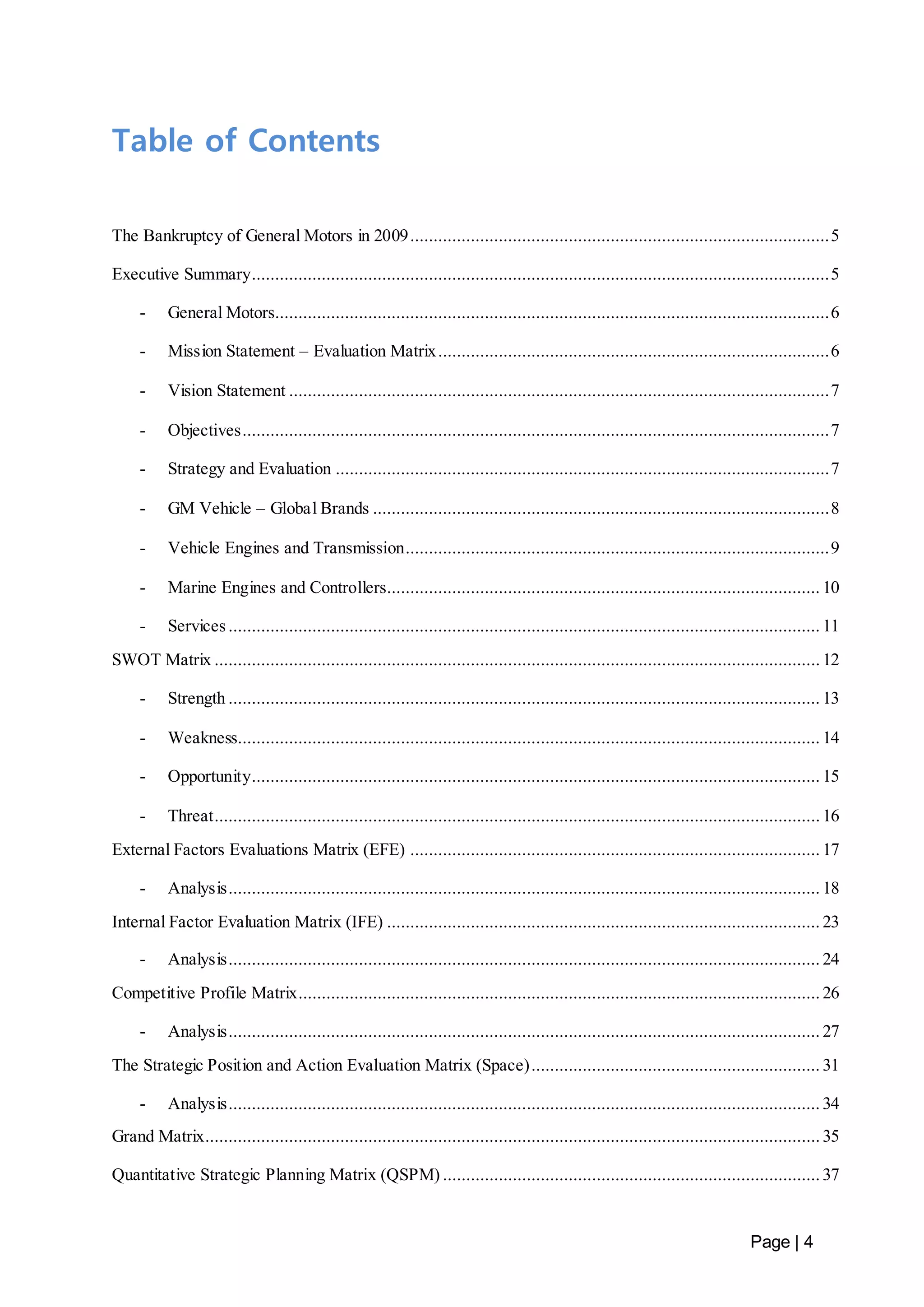

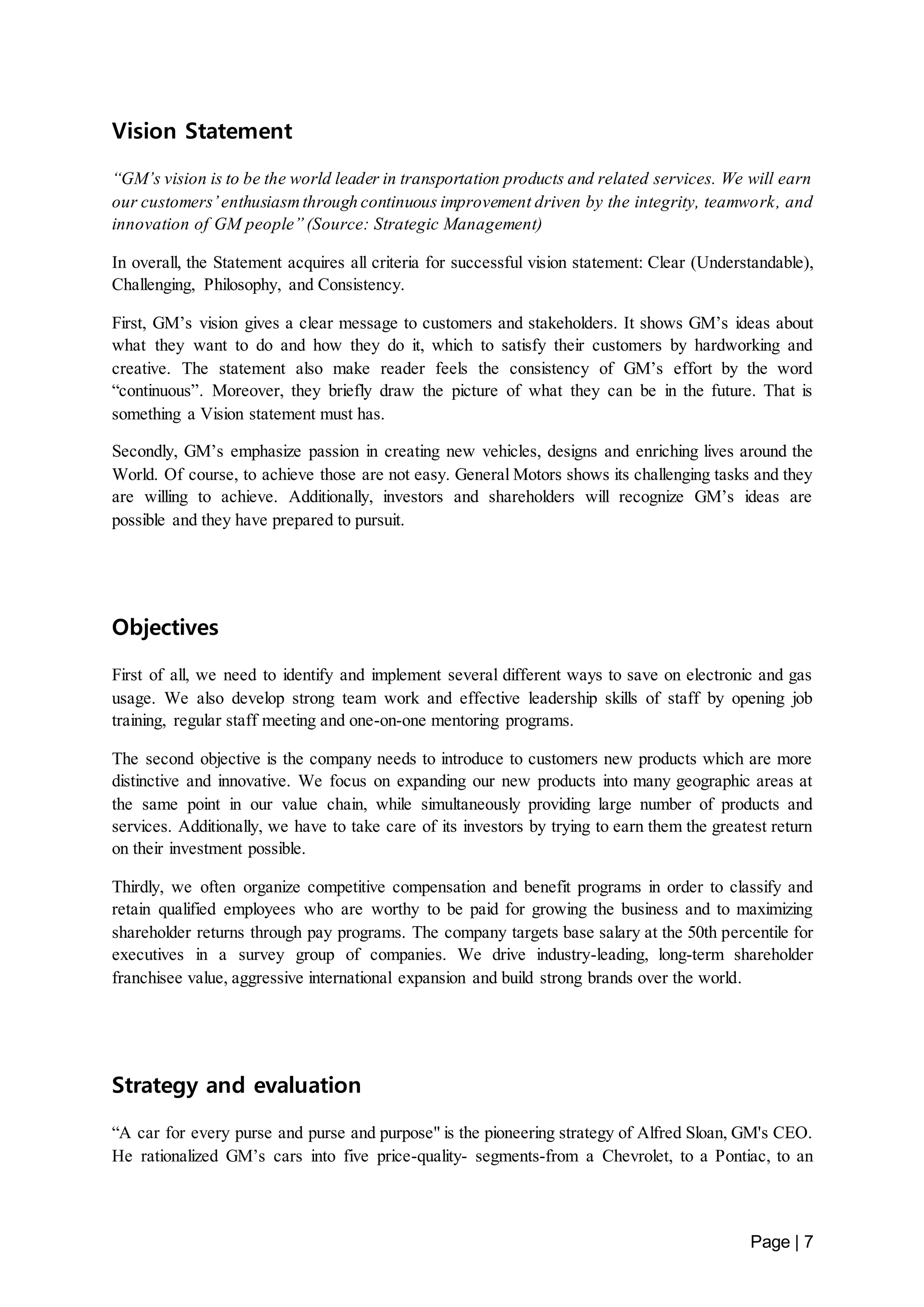

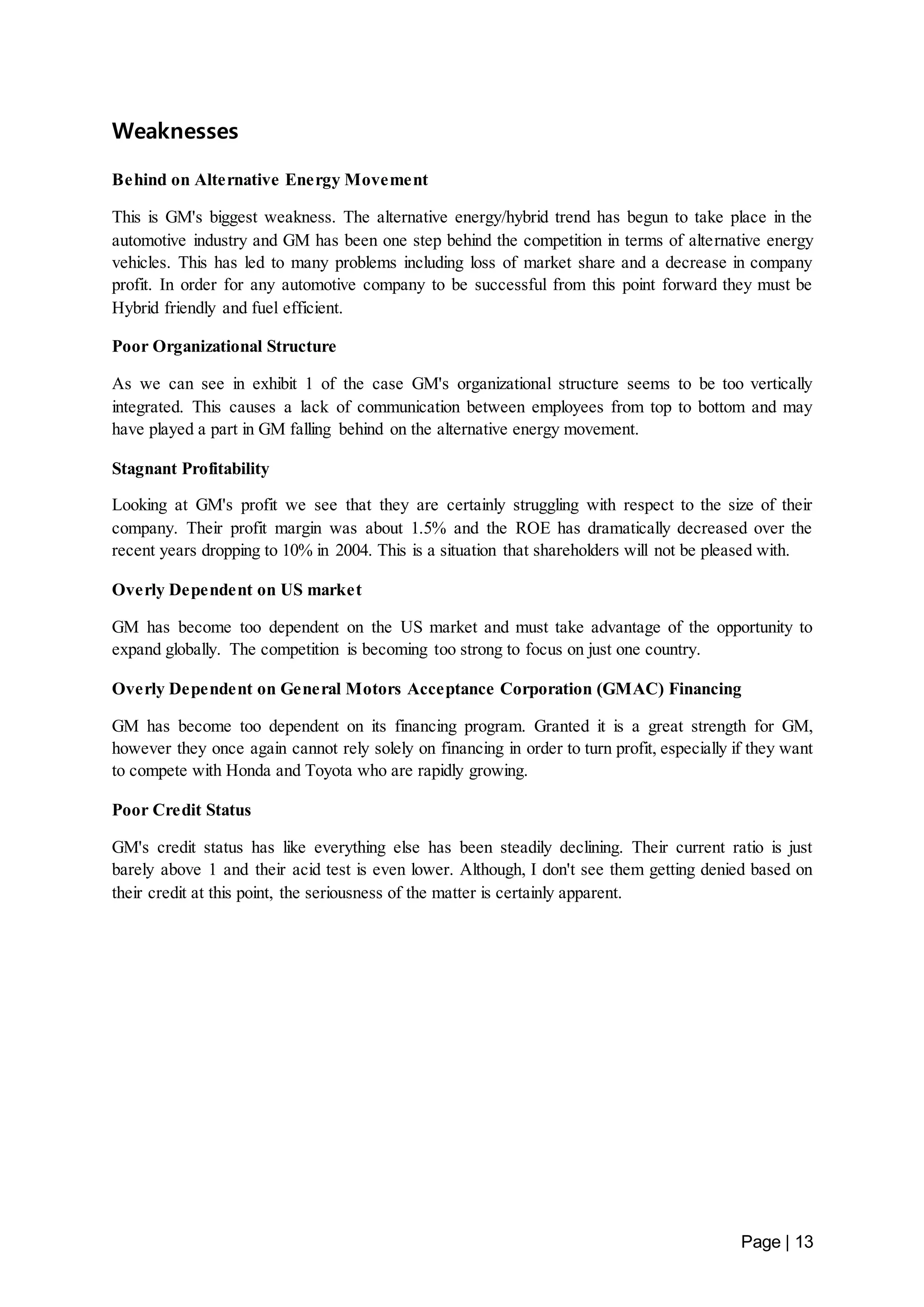

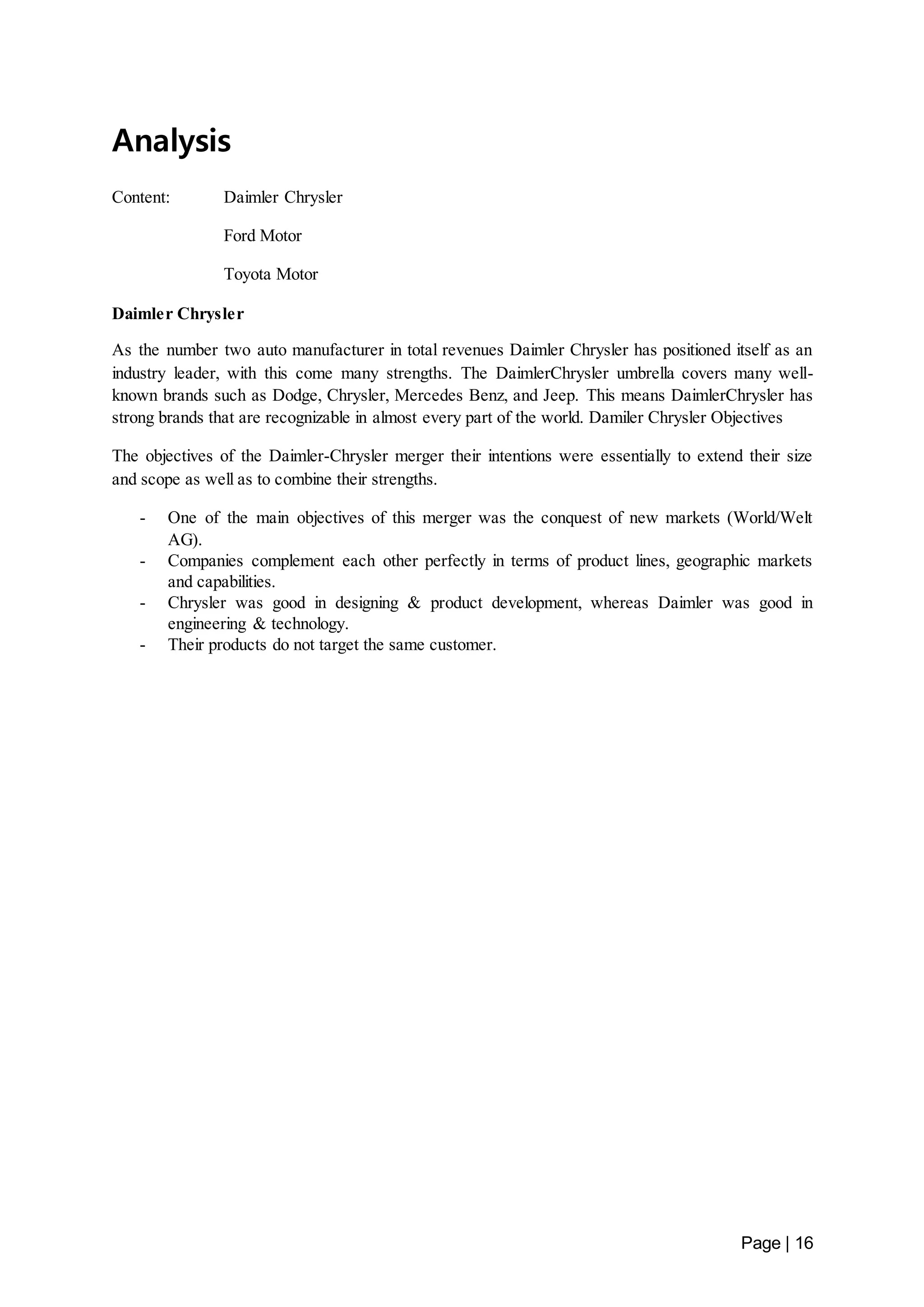

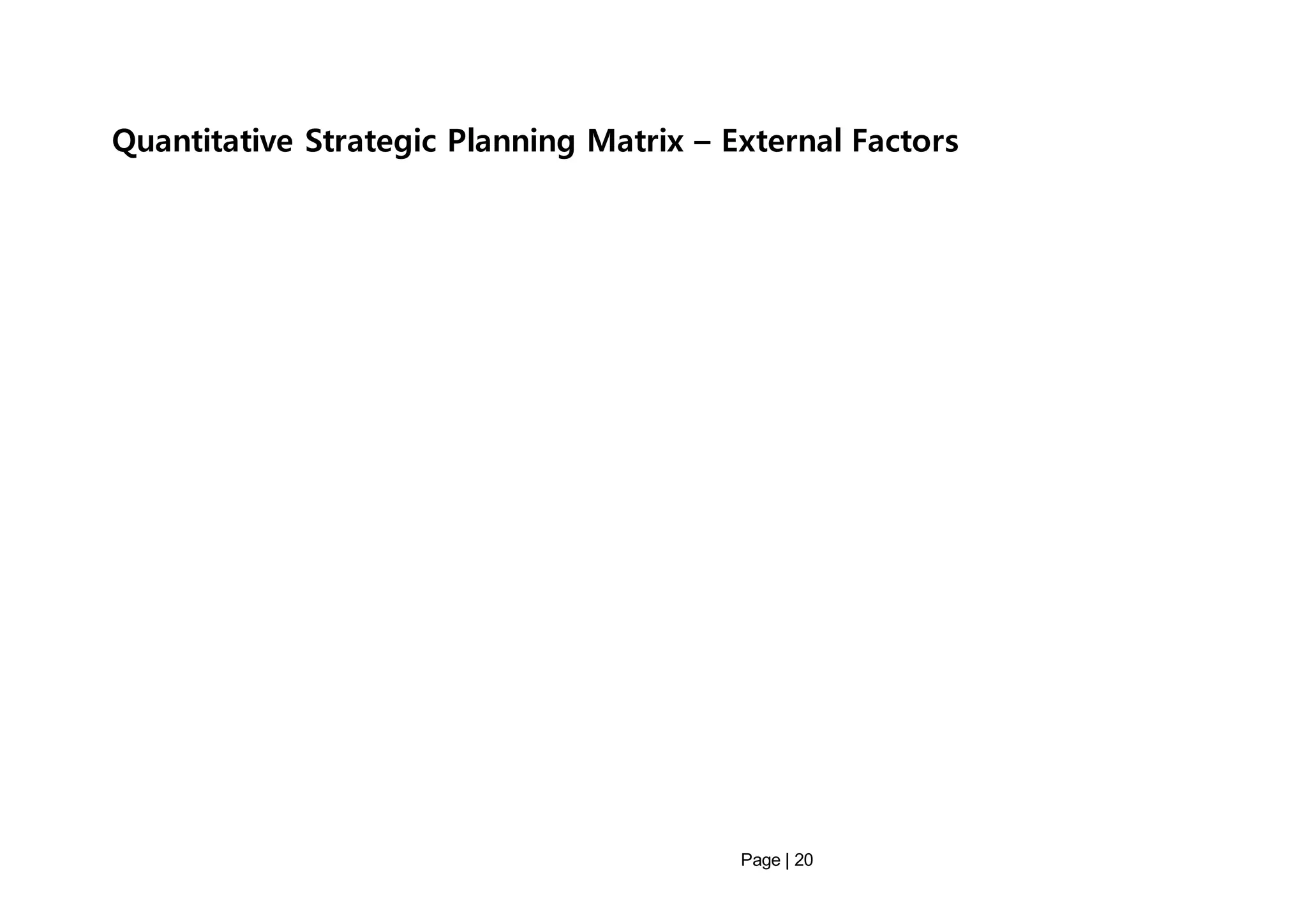

![Quantitative Strategic Planning Matrix – Internal Factors

Internal Opportunities Weight AS TAS AS

Large scale company operations [H] 0.8 3 0.30 2 0.20 4 0.40

Growing business, specifically in Asia Pacific & Latin America regions [H] 0.10 3 0.30 4 0.40 1 0.10

Quality/cost improvement through outsourcing [H] 0.08 3 0.30 4 0.40 1 0.10

Radical product development organization [H] 0.12 3 0.45 4 0.60 2 0.30

Voluntary environmental policy [L] 0.05 4 0.60 2 0.30 3 0.45

China partnerships and joint ventures [M] 0.05 3 0.15 4 0.20 2 0.10

OnStar communications (automotive industry‘s leading telematics provider) and

0.07 4 0.28 2 0.14 2 0.14

electronic stability control [M]

Page | 22

Highest annual productivity improvement among all automakers from 1999-

2004 [H]

0.05 3 0.15 2 0.10 1 0.10

Raise in GMAC credit rating [M] 0.05 4 0.20 2 0.10 3 0.10

Internal Weaknesses

Decreasing market share [H] 0.05 4 0.40 2 0.20 3 0.30

Pension debt [H] 0.03 2 0.20 1 0.10 3 0.30

Increasing health care [H] 0.02 2 0.10 1 0.05 3 0.15

Numerous product recalls [H] 0.04 2 0.20 2 0.20 3 0.30

Saturn strategy failure which lost as much as $15B [M] 0.02 3 0.18 3 0.06 3 0.06

Quality problems with foreign production [M] 0.03 3 0.09 1 0.03 2 0.06

Pricing strategy [M] 0.07 3 0.21 2 0.14 3 0.21

Declining financial performance 0.10 4 0.40 3 0.30 2 0.20

Total 1 7.31 5.94 5.33](https://image.slidesharecdn.com/class1-group3-completereport-141112131745-conversion-gate01/75/Keuka_Experiental-Learning_295924-22-2048.jpg)