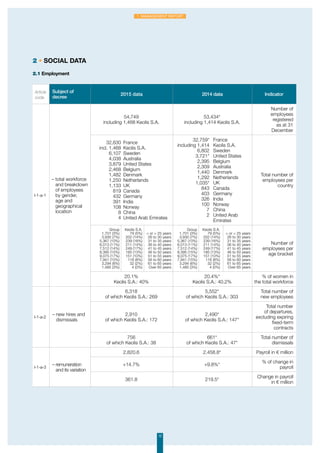

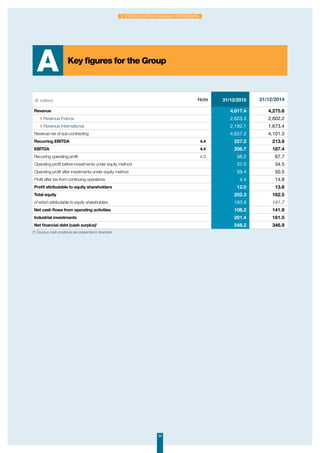

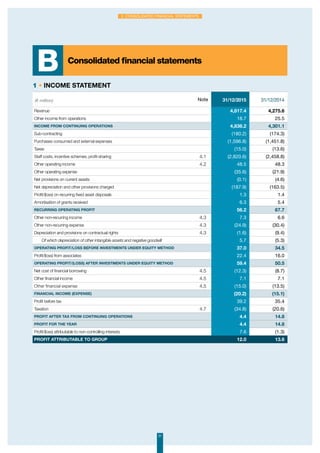

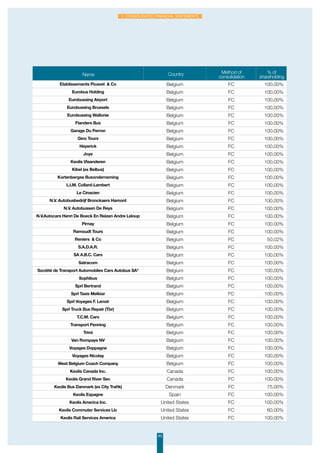

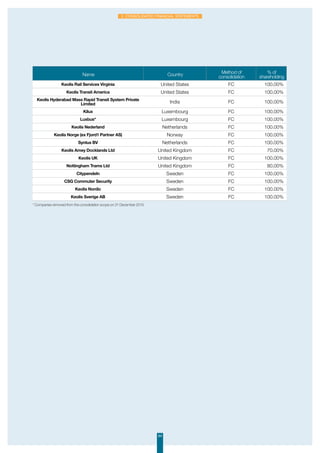

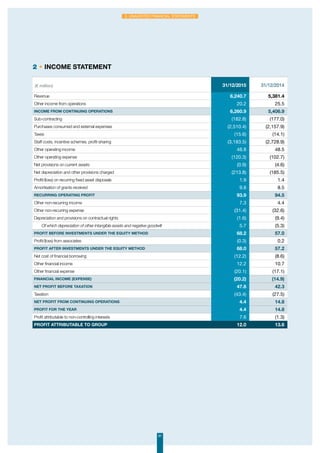

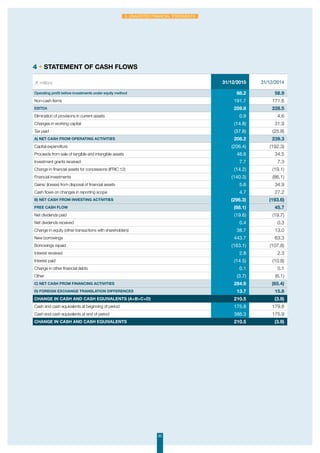

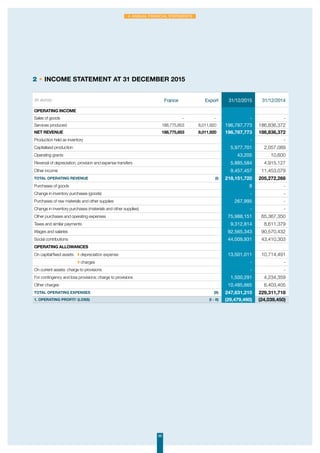

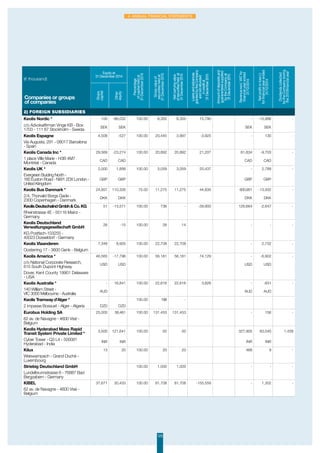

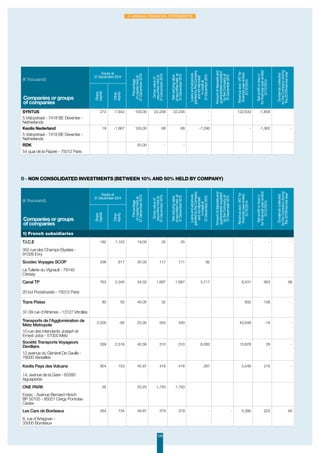

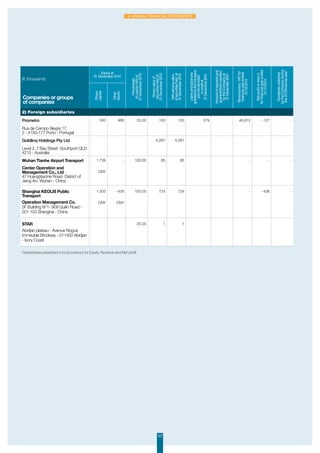

The 2015 financial report of Keolis S.A. outlines the company's management activities, financial results, and strategic developments during the year, showcasing a turnover of €4.817 billion, a 12.7% increase from 2014. Key events include contract renewals and acquisitions, such as Australian Transit Enterprises, reinforcing Keolis's position in both domestic and international markets. The report also addresses operational challenges and ongoing efforts to improve profitability, particularly in North America.