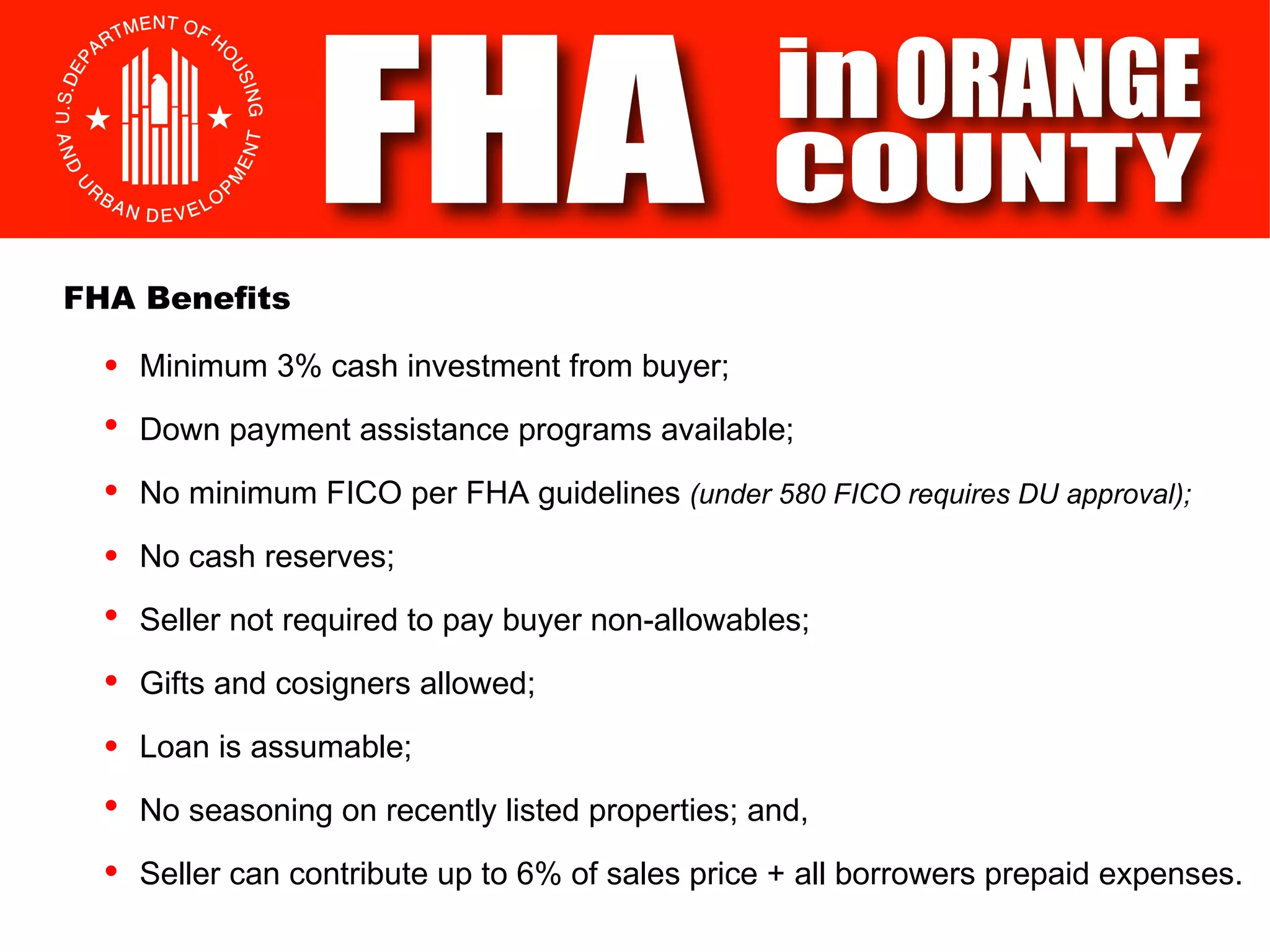

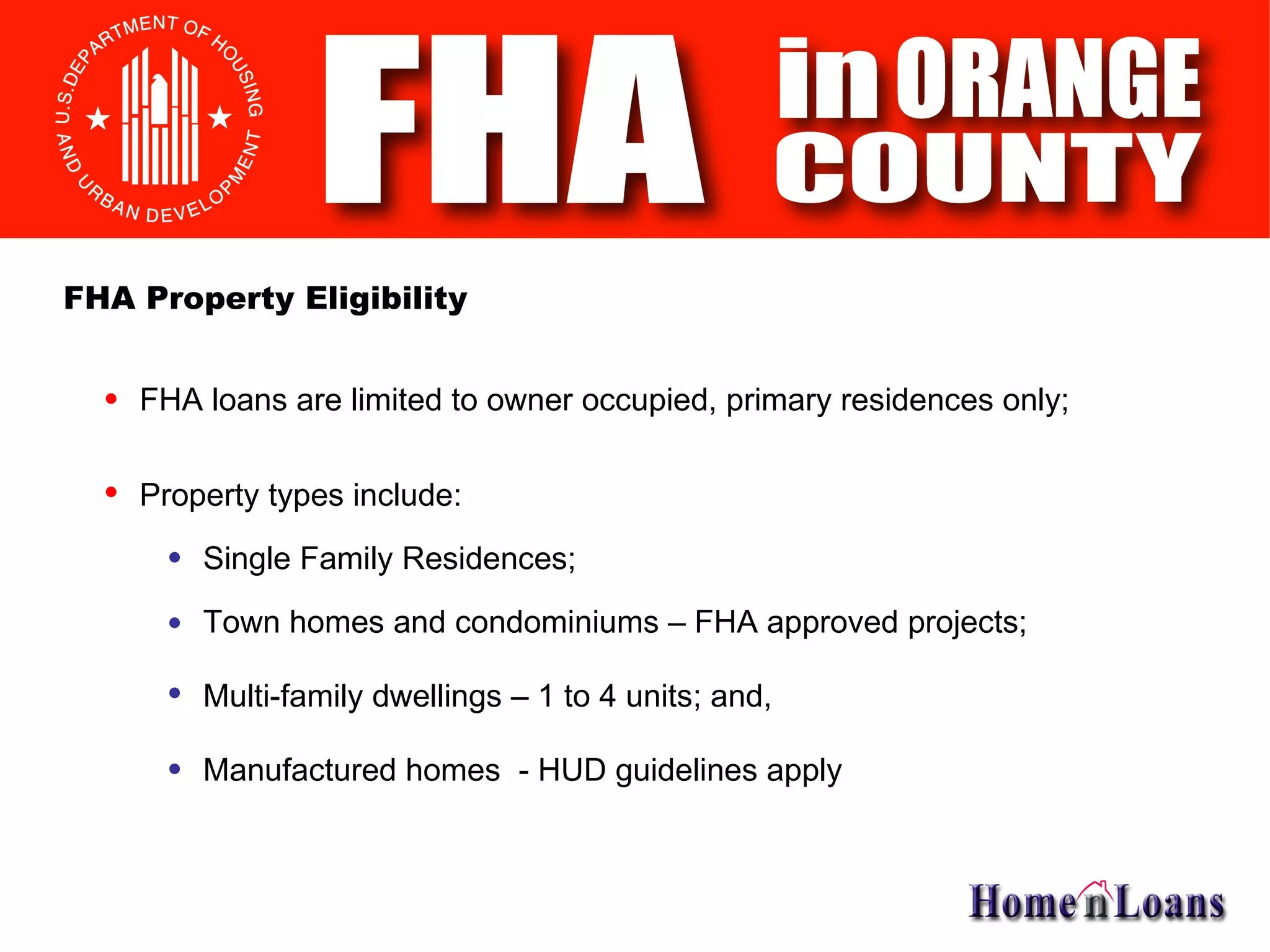

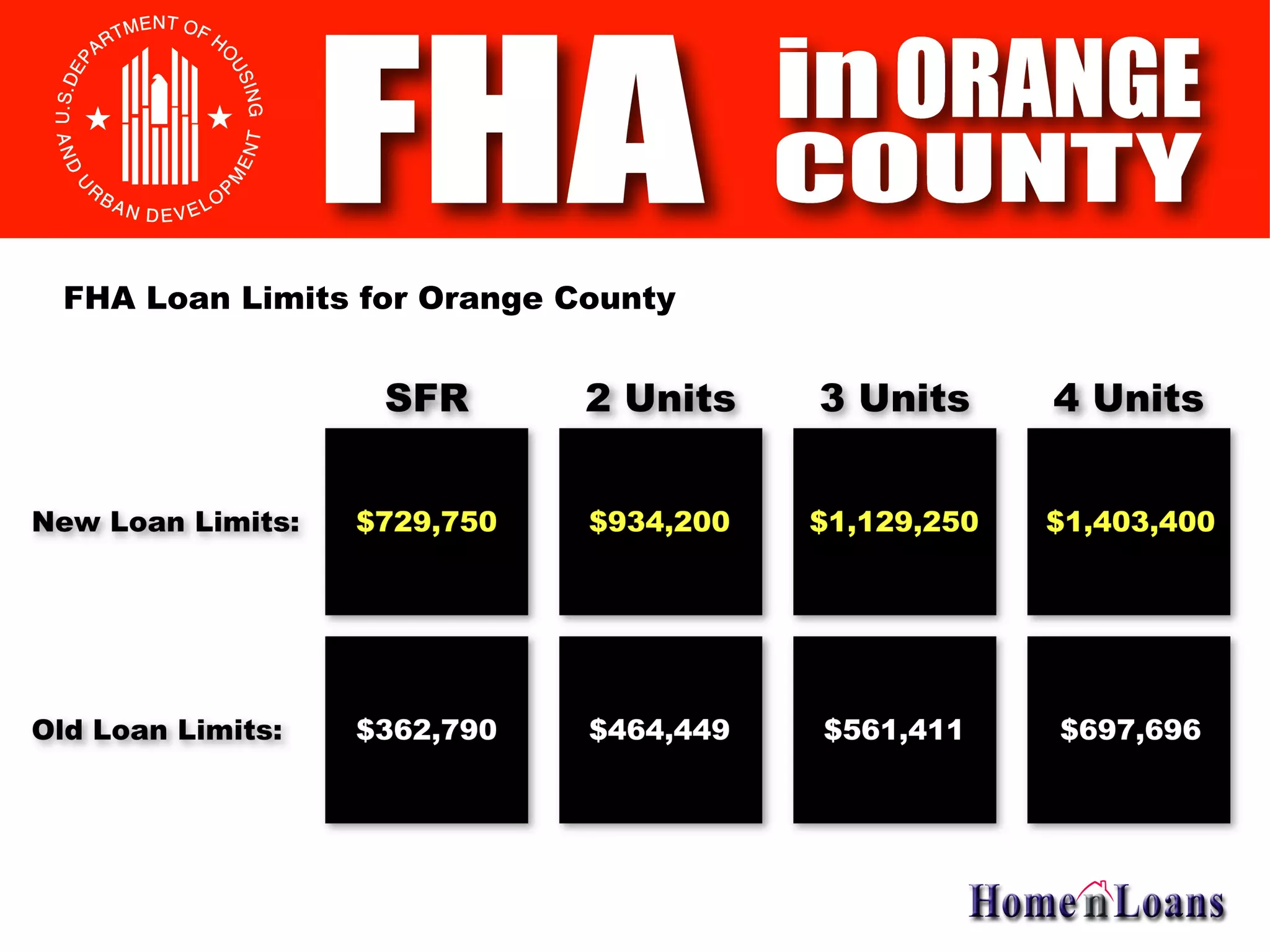

The document summarizes key points that were presented at a town hall meeting about the current real estate market and opportunities for first-time home buyers using Federal Housing Administration (FHA) loans. It discusses the decline in home prices and rise in foreclosures since 2007. It then outlines benefits of FHA loans for first-time buyers, such as low down payment requirements, more flexible credit guidelines, and the ability to use gift funds and cosigners. It provides details on FHA loan limits, eligibility requirements, and underwriting guidelines.