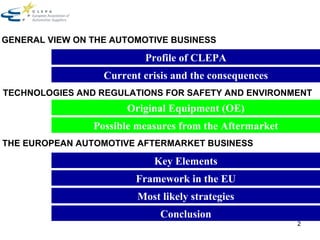

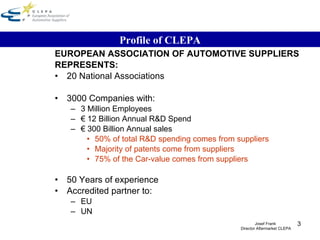

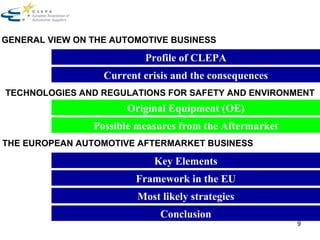

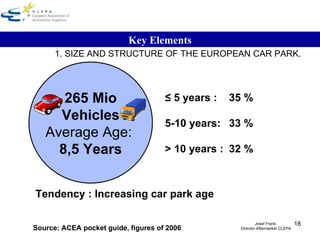

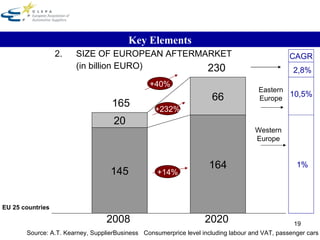

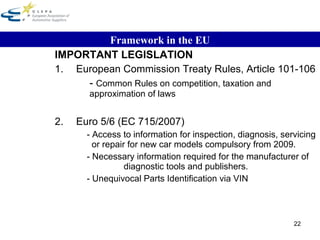

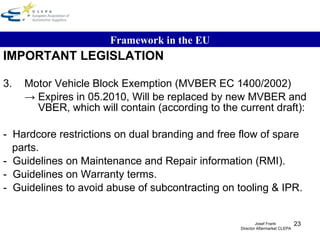

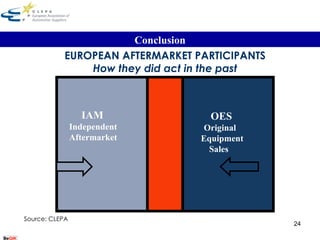

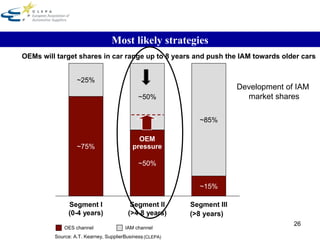

1. The document discusses the European automotive aftermarket industry, including its size, structure, key players, and strategies.

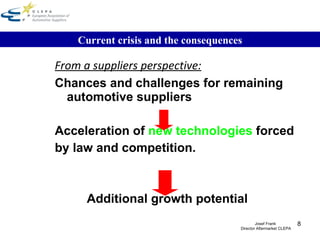

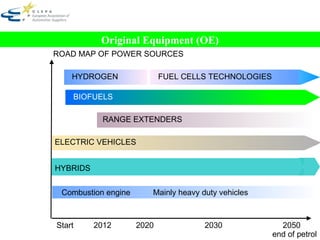

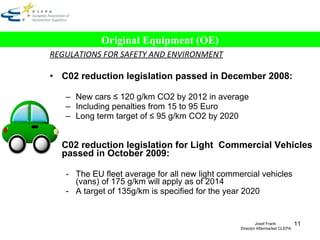

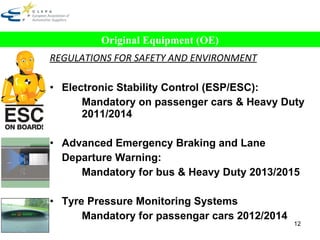

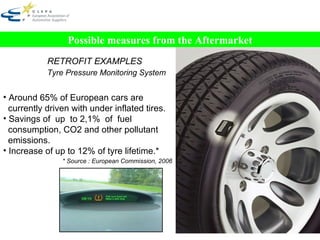

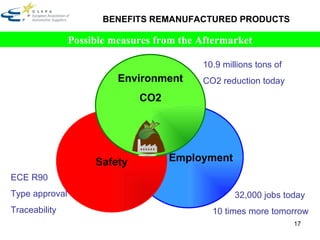

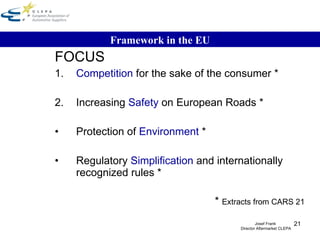

2. It outlines technologies like electric vehicles, regulations around emissions and safety, and measures like retrofitting and remanufacturing that can contribute to road safety and lower emissions.

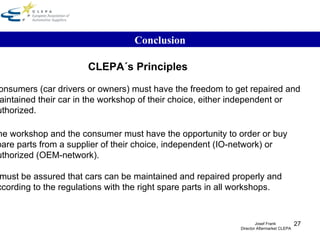

3. The conclusion emphasizes that consumer choice and fair competition between original equipment and independent aftermarket players are important principles for the industry.