J&k bank ltd.

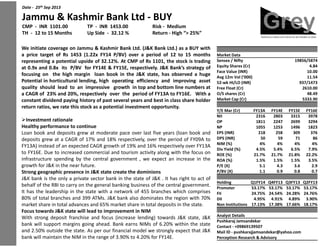

- 1. Date - 25th Sep 2013Date - 25th Sep 2013Date - 25 Sep 2013 Jammu & Kashmir Bank Ltd - BUYJammu & Kashmir Bank Ltd - BUYJammu & Kashmir Bank Ltd - BUYJammu & Kashmir Bank Ltd - BUYJammu & Kashmir Bank Ltd - BUY CMP - INR 1101.00 TP - INR 1453.00 RiskCMP - INR 1101.00 TP - INR 1453.00 RiskCMP - INR 1101.00 TP - INR 1453.00 Risk TH - 12 to 15 Months Up Side - 32.12 % ReturnTH - 12 to 15 Months Up Side - 32.12 % ReturnTH - 12 to 15 Months Up Side - 32.12 % ReturnTH - 12 to 15 Months Up Side - 32.12 % Return We initiate coverage on Jammu & Kashmir Bank Ltd. (J&K BankWe initiate coverage on Jammu & Kashmir Bank Ltd. (J&K BankWe initiate coverage on Jammu & Kashmir Bank Ltd. (J&K Bank a price target of Rs 1453 (1.22x FY14 P/BV) over a perioda price target of Rs 1453 (1.22x FY14 P/BV) over a perioda price target of Rs 1453 (1.22x FY14 P/BV) over a period representing a potential upside of 32.12%. At CMP of Rs 1101representing a potential upside of 32.12%. At CMP of Rs 1101representing a potential upside of 32.12%. At CMP of Rs 1101representing a potential upside of 32.12%. At CMP of Rs 1101 at 0.9x and 0.8x its P/BV for FY14E & FY15E, respectively. J&Kat 0.9x and 0.8x its P/BV for FY14E & FY15E, respectively. J&Kat 0.9x and 0.8x its P/BV for FY14E & FY15E, respectively. J&K focusing on the high margin loan book in the J&K state,focusing on the high margin loan book in the J&K state,focusing on the high margin loan book in the J&K state, Potential in horticultural lending, high operating efficiencyPotential in horticultural lending, high operating efficiencyPotential in horticultural lending, high operating efficiencyPotential in horticultural lending, high operating efficiency quality should lead to an impressive growth in top and bottomquality should lead to an impressive growth in top and bottomquality should lead to an impressive growth in top and bottom a CAGR of 23% and 20%, respectively over the period of FYa CAGR of 23% and 20%, respectively over the period of FYa CAGR of 23% and 20%, respectively over the period of FY constant dividend paying history of past several years and bestconstant dividend paying history of past several years and bestconstant dividend paying history of past several years and best return ratios, we rate this stock as a potential investment opportunity constant dividend paying history of past several years and best return ratios, we rate this stock as a potential investment opportunityreturn ratios, we rate this stock as a potential investment opportunityreturn ratios, we rate this stock as a potential investment opportunity Investment rationaleInvestment rationaleInvestment rationale Healthy performance to continueHealthy performance to continueHealthy performance to continueHealthy performance to continue Loan book and deposits grew at moderate pace over last fiveLoan book and deposits grew at moderate pace over last fiveLoan book and deposits grew at moderate pace over last five deposits grew at a CAGR of 17% and 18% respectively, over thedeposits grew at a CAGR of 17% and 18% respectively, over thedeposits grew at a CAGR of 17% and 18% respectively, over the FY13A) instead of an expected CAGR growth of 19% and 16% respectivelyFY13A) instead of an expected CAGR growth of 19% and 16% respectivelyFY13A) instead of an expected CAGR growth of 19% and 16% respectivelyFY13A) instead of an expected CAGR growth of 19% and 16% respectively to FY16E. Due to increased commercial and tourism activity alongto FY16E. Due to increased commercial and tourism activity alongto FY16E. Due to increased commercial and tourism activity along infrastructure spending by the central government , we expectinfrastructure spending by the central government , we expectinfrastructure spending by the central government , we expect growth for J&K in the near future.growth for J&K in the near future.growth for J&K in the near future. Strong geographic presence in J&K state create the dominionsStrong geographic presence in J&K state create the dominionsStrong geographic presence in J&K state create the dominionsStrong geographic presence in J&K state create the dominions J&K bank is the only a private sector bank in the state of J&KJ&K bank is the only a private sector bank in the state of J&KJ&K bank is the only a private sector bank in the state of J&K behalf of the RBI to carry on the general banking business of thebehalf of the RBI to carry on the general banking business of thebehalf of the RBI to carry on the general banking business of the It has the leadership in the state with a network of 455 branchesIt has the leadership in the state with a network of 455 branchesIt has the leadership in the state with a network of 455 branchesIt has the leadership in the state with a network of 455 branches 80% of total branches and 399 ATMs. J&K bank also dominates80% of total branches and 399 ATMs. J&K bank also dominates80% of total branches and 399 ATMs. J&K bank also dominates market share in total advances and 65% market share in total depositsmarket share in total advances and 65% market share in total depositsmarket share in total advances and 65% market share in total deposits Focus towards J&K state will lead to improvement in NIMFocus towards J&K state will lead to improvement in NIMFocus towards J&K state will lead to improvement in NIMFocus towards J&K state will lead to improvement in NIM With strong deposit franchise and focus (increase lending) towardsWith strong deposit franchise and focus (increase lending) towardsWith strong deposit franchise and focus (increase lending) towards bank will support margins going ahead. Bank earns NIMs of 6bank will support margins going ahead. Bank earns NIMs of 6bank will support margins going ahead. Bank earns NIMs of 6 and 2.50% outside the state. As per our financial model we stronglyand 2.50% outside the state. As per our financial model we stronglyand 2.50% outside the state. As per our financial model we strongly bank will maintain the NIM in the range of 3.90% to 4.20% for FYbank will maintain the NIM in the range of 3.90% to 4.20% for FYbank will maintain the NIM in the range of 3.90% to 4.20% for FYbank will maintain the NIM in the range of 3.90% to 4.20% for FY BUYBUYBUYBUYBUY Risk - MediumRisk - MediumRisk - Medium Return - High “> 25%”Return - High “> 25%”Return - High “> 25%”Return - High “> 25%” Bank Ltd.) as a BUY withBank Ltd.) as a BUY withBank Ltd.) as a BUY with period of 12 to 15 months Market Dataperiod of 12 to 15 months Market Dataperiod of 12 to 15 months 1101, the stock is trading Market Data Sensex / Nifty 19856/58741101, the stock is trading Sensex / Nifty 19856/58741101, the stock is trading Sensex / Nifty 19856/5874 Equity Shares (Cr) 4.84 1101, the stock is trading J&K Bank’s strategy of Equity Shares (Cr) 4.84J&K Bank’s strategy of Equity Shares (Cr) 4.84 Face Value (INR) 10.00 J&K Bank’s strategy of has observed a huge Face Value (INR) 10.00 has observed a huge Face Value (INR) 10.00 Avg 12m Vol (‘000) 11.54 has observed a huge and improving asset Avg 12m Vol (‘000) 11.54 and improving asset Avg 12m Vol (‘000) 11.54 52-wk HI/LO (INR) 937/1473and improving asset 52-wk HI/LO (INR) 937/1473and improving asset bottom line numbers at 52-wk HI/LO (INR) 937/1473 Free Float (Cr) 2610.00bottom line numbers at Free Float (Cr) 2610.00bottom line numbers at FY13A to FY16E. With a Free Float (Cr) 2610.00 O/S shares (Cr) 48.49FY13A to FY16E. With a O/S shares (Cr) 48.49FY13A to FY16E. With a best in class share holder O/S shares (Cr) 48.49 Market Cap (Cr) 5333.90best in class share holder Market Cap (Cr) 5333.90best in class share holder opportunity. Market Cap (Cr) 5333.90best in class share holder opportunity.opportunity. Y/E Mar (Cr) FY13A FY14E FY15E FY16E opportunity. Y/E Mar (Cr) FY13A FY14E FY15E FY16EY/E Mar (Cr) FY13A FY14E FY15E FY16E NII 2316 2803 3315 3978NII 2316 2803 3315 3978NII 2316 2803 3315 3978 OP 1811 2247 2699 3294OP 1811 2247 2699 3294OP 1811 2247 2699 3294 NP 1055 1253 1496 1823NP 1055 1253 1496 1823 five years (loan book and NP 1055 1253 1496 1823 EPS (INR) 218 258 309 376five years (loan book and EPS (INR) 218 258 309 376five years (loan book and the period of FY09A to EPS (INR) 218 258 309 376 DPS (INR) 50 59 71 86the period of FY09A to DPS (INR) 50 59 71 86the period of FY09A to respectively over FY13A DPS (INR) 50 59 71 86 NIM (%) 4% 4% 4% 4% respectively over FY13A NIM (%) 4% 4% 4% 4% respectively over FY13A NIM (%) 4% 4% 4% 4% Div Yield (%) 4.5% 5.4% 6.5% 7.9% respectively over FY13A along with the focus on Div Yield (%) 4.5% 5.4% 6.5% 7.9% along with the focus on Div Yield (%) 4.5% 5.4% 6.5% 7.9% ROE (%) 21.7% 21.7% 21.8% 22.2%along with the focus on expect an increase in the ROE (%) 21.7% 21.7% 21.8% 22.2% expect an increase in the ROE (%) 21.7% 21.7% 21.8% 22.2% ROA (%) 1.5% 1.5% 1.5% 3.5%expect an increase in the ROA (%) 1.5% 1.5% 1.5% 3.5% P/E (X) 5.1 4.3 3.6 2.9P/E (X) 5.1 4.3 3.6 2.9 dominions P/E (X) 5.1 4.3 3.6 2.9 P/BV (X) 1.1 0.9 0.8 0.7dominions P/BV (X) 1.1 0.9 0.8 0.7dominions P/BV (X) 1.1 0.9 0.8 0.7dominions J&K . It has right to act ofJ&K . It has right to act of Holding Q1FY14 Q4FY13 Q3FY13 Q2FY13 J&K . It has right to act of the central government. Holding Q1FY14 Q4FY13 Q3FY13 Q2FY13 the central government. Holding Q1FY14 Q4FY13 Q3FY13 Q2FY13 Promoter 53.17% 53.17% 53.17% 53.17% the central government. branches which comprises Promoter 53.17% 53.17% 53.17% 53.17% branches which comprises Promoter 53.17% 53.17% 53.17% 53.17% FII 24.75% 24.54% 24.28% 24.76%branches which comprises FII 24.75% 24.54% 24.28% 24.76%branches which comprises dominates the region with 70% FII 24.75% 24.54% 24.28% 24.76% DII 4.95% 4.91% 4.89% 3.90%dominates the region with 70% DII 4.95% 4.91% 4.89% 3.90%dominates the region with 70% deposits in the state. DII 4.95% 4.91% 4.89% 3.90% Non Institutions 17.13% 17.38% 17.66% 18.17%deposits in the state. Non Institutions 17.13% 17.38% 17.66% 18.17%deposits in the state. Non Institutions 17.13% 17.38% 17.66% 18.17% Analyst Details towards J&K state, J&K Analyst Details towards J&K state, J&K Analyst Details Pushkaraj Jamsandekar towards J&K state, J&K 6.20% within the state Pushkaraj Jamsandekar 6.20% within the state Pushkaraj Jamsandekar Contact - +098691395076.20% within the state strongly expect that J&K Contact - +09869139507 strongly expect that J&K Contact - +09869139507 Mail ID - pushkarajjamsandekar@yahoo.comstrongly expect that J&K FY14E. Mail ID - pushkarajjamsandekar@yahoo.com FY14E. Mail ID - pushkarajjamsandekar@yahoo.com Perception Research & AdvisoryFY14E. Perception Research & AdvisoryFY14E. Perception Research & Advisory

- 2. Huge Potential in J&K state for Horticultural LendingHuge Potential in J&K state for Horticultural LendingHuge Potential in J&K state for Horticultural Lending J&K State produces 77 % of India’s total apple output andJ&K State produces 77 % of India’s total apple output andJ&K State produces 77 % of India’s total apple output andJ&K State produces 77 % of India’s total apple output and dedicated to apple cultivation. Out of a total of more than 283000dedicated to apple cultivation. Out of a total of more than 283000dedicated to apple cultivation. Out of a total of more than 283000 State, Bank’s finance has been extended to about 17300 growersState, Bank’s finance has been extended to about 17300 growersState, Bank’s finance has been extended to about 17300 growers remaining growers will generate credit of about Rs.7000 Cr moreremaining growers will generate credit of about Rs.7000 Cr moreremaining growers will generate credit of about Rs.7000 Cr moreremaining growers will generate credit of about Rs.7000 Cr more Apple growers get their financing from traders and are unawareApple growers get their financing from traders and are unawareApple growers get their financing from traders and are unaware cost works out to 36% to 54%, against the Bank’s interest rangingcost works out to 36% to 54%, against the Bank’s interest rangingcost works out to 36% to 54%, against the Bank’s interest ranging Current shortfall in Agriculture Sector Lending is Rs. 2335Current shortfall in Agriculture Sector Lending is Rs. 2335Current shortfall in Agriculture Sector Lending is Rs. 2335Current shortfall in Agriculture Sector Lending is Rs. 2335 incremental Agricultural Advances at Base Rate of 10.25 %incremental Agricultural Advances at Base Rate of 10.25 %incremental Agricultural Advances at Base Rate of 10.25 % (10.25% –4%) would generate an incremental revenue of about(10.25% –4%) would generate an incremental revenue of about(10.25% –4%) would generate an incremental revenue of about lending Rs. 2335 Cr to agricultural sector.lending Rs. 2335 Cr to agricultural sector.lending Rs. 2335 Cr to agricultural sector. Massive expansion in networkMassive expansion in networkMassive expansion in networkMassive expansion in network To improve the geographic presence and to obtain the moreTo improve the geographic presence and to obtain the moreTo improve the geographic presence and to obtain the more business J&K bank planned massive expansion in their networkbusiness J&K bank planned massive expansion in their networkbusiness J&K bank planned massive expansion in their network impressive expansion plan of 300 new branches and almost equivalentimpressive expansion plan of 300 new branches and almost equivalentimpressive expansion plan of 300 new branches and almost equivalentimpressive expansion plan of 300 new branches and almost equivalent of FY15.of FY15.of FY15. Cheap Valuation and High Dividend yieldCheap Valuation and High Dividend yieldCheap Valuation and High Dividend yield At current market price, J&K bank is still available at FY14E PriceAt current market price, J&K bank is still available at FY14E PriceAt current market price, J&K bank is still available at FY14E Price times. The estimated dividend yield for FY14 is 5.4%. High dividend At current market price, J&K bank is still available at FY14E Price times. The estimated dividend yield for FY14 is 5.4%. High dividendtimes. The estimated dividend yield for FY14 is 5.4%. High dividendtimes. The estimated dividend yield for FY14 is 5.4%. High dividend comfortable cushion. At CMP of Rs 1101, the stock is trading atcomfortable cushion. At CMP of Rs 1101, the stock is trading atcomfortable cushion. At CMP of Rs 1101, the stock is trading at for FY14E & FY15E, respectively.for FY14E & FY15E, respectively.for FY14E & FY15E, respectively. and controls 49 % of landand controls 49 % of landand controls 49 % of landand controls 49 % of land 283000 apple growers in the283000 apple growers in the283000 apple growers in the growers so far. Tapping thegrowers so far. Tapping thegrowers so far. Tapping the more. In J&K state’s 75% ofmore. In J&K state’s 75% ofmore. In J&K state’s 75% ofmore. In J&K state’s 75% of unaware that its effective interestunaware that its effective interestunaware that its effective interest ranging from 4% to 11%.ranging from 4% to 11%.ranging from 4% to 11%. 2335 cr. Assuming yield on2335 cr. Assuming yield on2335 cr. Assuming yield on2335 cr. Assuming yield on %, the incremental yield%, the incremental yield%, the incremental yield about Rs. 146 Cr per year onabout Rs. 146 Cr per year onabout Rs. 146 Cr per year on opportunities in bankingopportunities in bankingopportunities in banking network. The bank hasnetwork. The bank hasnetwork. The bank has equivalent ATMs by the endequivalent ATMs by the endequivalent ATMs by the endequivalent ATMs by the end Price to book value of 0.9Price to book value of 0.9Price to book value of 0.9 dividend yield provides with a Price to book value of 0.9 dividend yield provides with adividend yield provides with adividend yield provides with a at 4.3x and 3.5x to its PEat 4.3x and 3.5x to its PEat 4.3x and 3.5x to its PE

- 3. ConcernsConcernsConcerns Change in political environmentChange in political environmentChange in political environmentChange in political environment Instable geopolitical uncertainty in the J&K State would hamperInstable geopolitical uncertainty in the J&K State would hamperInstable geopolitical uncertainty in the J&K State would hamper sentiment.sentiment.sentiment. Rupee depreciationRupee depreciationRupee depreciationRupee depreciation The rupee has depreciated about 25 % this year and touchedThe rupee has depreciated about 25 % this year and touchedThe rupee has depreciated about 25 % this year and touched lower rupee value is the major concern for Indian economiclower rupee value is the major concern for Indian economiclower rupee value is the major concern for Indian economic adverse impact on Indian banking sector.adverse impact on Indian banking sector.adverse impact on Indian banking sector.adverse impact on Indian banking sector. Higher inflation rateHigher inflation rateHigher inflation rate Higher inflation rate is another major concern in India. Bank lendingHigher inflation rate is another major concern in India. Bank lendingHigher inflation rate is another major concern in India. Bank lending an inverse relation, observing the past trend it was absolutelyan inverse relation, observing the past trend it was absolutelyan inverse relation, observing the past trend it was absolutely inflation rate moves up it starts pulling down the bank lending rateinflation rate moves up it starts pulling down the bank lending rateinflation rate moves up it starts pulling down the bank lending rateinflation rate moves up it starts pulling down the bank lending rate Negative investor sentimentNegative investor sentimentNegative investor sentiment Higher inflation rate, unexpected rupee depreciation, lowerHigher inflation rate, unexpected rupee depreciation, lowerHigher inflation rate, unexpected rupee depreciation, lower uncertainty in political environment may hamper investor (FII &uncertainty in political environment may hamper investor (FII &uncertainty in political environment may hamper investor (FII &uncertainty in political environment may hamper investor (FII & Low GDP growth or below expectationLow GDP growth or below expectationLow GDP growth or below expectation For the current fiscal, India is targeting 4 to 5 percent GDP growthFor the current fiscal, India is targeting 4 to 5 percent GDP growthFor the current fiscal, India is targeting 4 to 5 percent GDP growth negatively impact on Indian banking sector.negatively impact on Indian banking sector.negatively impact on Indian banking sector.negatively impact on Indian banking sector. hamper the overall businesshamper the overall businesshamper the overall business touched a record low of 68.80.touched a record low of 68.80.touched a record low of 68.80. economic growth, along with aneconomic growth, along with aneconomic growth, along with an lending and inflation havelending and inflation havelending and inflation have absolutely clear that once theabsolutely clear that once theabsolutely clear that once the rate.rate.rate.rate. lower capital expenditure andlower capital expenditure andlower capital expenditure and & DII) sentiment.& DII) sentiment.& DII) sentiment.& DII) sentiment. growth. Lower in GDP maygrowth. Lower in GDP maygrowth. Lower in GDP may

- 4. Company backgroundCompany backgroundCompany background The Bank, incorporated in 1938, as a universal bank in JammuThe Bank, incorporated in 1938, as a universal bank in JammuThe Bank, incorporated in 1938, as a universal bank in JammuThe Bank, incorporated in 1938, as a universal bank in Jammu specialized bank in the rest of the country. It is also thespecialized bank in the rest of the country. It is also thespecialized bank in the rest of the country. It is also the designated as RBI’s agent for banking business, and carries outdesignated as RBI’s agent for banking business, and carries outdesignated as RBI’s agent for banking business, and carries out the Central Government, besides collecting central taxes for CBDTthe Central Government, besides collecting central taxes for CBDTthe Central Government, besides collecting central taxes for CBDTthe Central Government, besides collecting central taxes for CBDT two-legged business model whereby it seeks to increase lendingtwo-legged business model whereby it seeks to increase lendingtwo-legged business model whereby it seeks to increase lending results in higher margins despite modest volumes, and at theresults in higher margins despite modest volumes, and at theresults in higher margins despite modest volumes, and at the capture niche lending opportunities on a pan-India basis to buildcapture niche lending opportunities on a pan-India basis to buildcapture niche lending opportunities on a pan-India basis to buildcapture niche lending opportunities on a pan-India basis to build margins.margins.margins. Share holding patternShare holding patternShare holding pattern Exhibit 01 : Change in holding by No. of sharesExhibit 01 : Change in holding by No. of sharesExhibit 01 : Change in holding by No. of shares Y/E March 31 Q1FY13 Q2FY13 Q3FY13 Q4FY13Y/E March 31 Q1FY13 Q2FY13 Q3FY13 Q4FY13Y/E March 31 Q1FY13 Q2FY13 Q3FY13 Q4FY13 (A) Promoter & Group 53.2% 53.2% 53.2% 53.2%(A) Promoter & Group 53.2% 53.2% 53.2% 53.2%(A) Promoter & Group 53.2% 53.2% 53.2% 53.2% Chief Secretary, Gov of J & K 50.2% 50.2% 50.2% 50.2%Chief Secretary, Gov of J & K 50.2% 50.2% 50.2% 50.2%Chief Secretary, Gov of J & K 50.2% 50.2% 50.2% 50.2% Secretary Fin Dept, Gov, of J & K 3.0% 3.0% 3.0% 3.0%Secretary Fin Dept, Gov, of J & K 3.0% 3.0% 3.0% 3.0% (B) Public Shareholding 46.8% 46.8% 46.8% 46.8%(B) Public Shareholding 46.8% 46.8% 46.8% 46.8%(B) Public Shareholding 46.8% 46.8% 46.8% 46.8% (1) Institutions 29.5% 28.7% 29.2% 29.4%(1) Institutions 29.5% 28.7% 29.2% 29.4%(1) Institutions 29.5% 28.7% 29.2% 29.4% Mutual Funds / UTI 2.5% 3.5% 4.5% 4.4%Mutual Funds / UTI 2.5% 3.5% 4.5% 4.4%Mutual Funds / UTI 2.5% 3.5% 4.5% 4.4% Financial Institutions / Banks 0.0% 0.0% 0.0% 0.0%Financial Institutions / Banks 0.0% 0.0% 0.0% 0.0%Financial Institutions / Banks 0.0% 0.0% 0.0% 0.0% Insurance Companies 0.4% 0.4% 0.4% 0.4%Insurance Companies 0.4% 0.4% 0.4% 0.4%Insurance Companies 0.4% 0.4% 0.4% 0.4% Foreign Institutional Investors 26.5% 24.8% 24.3% 24.5%Foreign Institutional Investors 26.5% 24.8% 24.3% 24.5%Foreign Institutional Investors 26.5% 24.8% 24.3% 24.5% (2) Non-Institutions 6.1% 6.1% 5.6% 5.4%(2) Non-Institutions 6.1% 6.1% 5.6% 5.4%(2) Non-Institutions 6.1% 6.1% 5.6% 5.4% (3) Individuals 10.8% 11.5% 11.2% 11.4%(3) Individuals 10.8% 11.5% 11.2% 11.4%(3) Individuals 10.8% 11.5% 11.2% 11.4% Any Others (Specify) 0.5% 0.6% 0.8% 0.6%Any Others (Specify) 0.5% 0.6% 0.8% 0.6%Any Others (Specify) 0.5% 0.6% 0.8% 0.6% Total share holding 100.0% 100.0% 100.0% 100.0%Total share holding 100.0% 100.0% 100.0% 100.0%Total share holding 100.0% 100.0% 100.0% 100.0% Source: Perception ResearchSource: Perception ResearchSource: Perception Research Private sector bank, despite government’s majority holdingPrivate sector bank, despite government’s majority holdingPrivate sector bank, despite government’s majority holding J&K Bank is the only bank which has 53.2% of governmentJ&K Bank is the only bank which has 53.2% of governmentJ&K Bank is the only bank which has 53.2% of governmentJ&K Bank is the only bank which has 53.2% of government banks. Out of the total promoter holding, 94% of shares are heldbanks. Out of the total promoter holding, 94% of shares are heldbanks. Out of the total promoter holding, 94% of shares are held government of J&K and balance 6% is held in strong handsgovernment of J&K and balance 6% is held in strong handsgovernment of J&K and balance 6% is held in strong hands department of government of J&K.department of government of J&K.department of government of J&K.department of government of J&K. Jammu & Kashmir and as aJammu & Kashmir and as aJammu & Kashmir and as aJammu & Kashmir and as a only private sector bankonly private sector bankonly private sector bank out the banking business ofout the banking business ofout the banking business of CBDT. J&K Bank follows aCBDT. J&K Bank follows aCBDT. J&K Bank follows aCBDT. J&K Bank follows a lending in its home state whichlending in its home state whichlending in its home state which the same time, seeks tothe same time, seeks tothe same time, seeks to build volumes and improvebuild volumes and improvebuild volumes and improvebuild volumes and improve Q4FY13 Q1FY14 % QOQ % SPLY Share Holding Pattern Q1FY14Q4FY13 Q1FY14 % QOQ % SPLY Share Holding Pattern Q1FY14Q4FY13 Q1FY14 % QOQ % SPLY Share Holding Pattern Q1FY14 53.2% 53.2% 0.0% 0.0%53.2% 53.2% 0.0% 0.0%53.2% 53.2% 0.0% 0.0% 50.2% 50.2% 0.0% 0.0%50.2% 50.2% 0.0% 0.0%50.2% 50.2% 0.0% 0.0% 3.0% 3.0% 0.0% 0.0% Promoter3.0% 3.0% 0.0% 0.0% 46.8% 46.8% 0.0% 0.0% Promoter 46.8% 46.8% 0.0% 0.0% 17%46.8% 46.8% 0.0% 0.0% 29.4% 29.7% 0.9% 0.7% 17% 29.4% 29.7% 0.9% 0.7%29.4% 29.7% 0.9% 0.7% 4.4% 4.5% 1.0% 78.7% 5% FII 4.4% 4.5% 1.0% 78.7% 5% FII 4.4% 4.5% 1.0% 78.7% 0.0% 0.0% -15.7% 0.0% 5% 0.0% 0.0% -15.7% 0.0% 53% 0.0% 0.0% -15.7% 0.0% 0.4% 0.4% 0.0% 0.0% 53% DII0.4% 0.4% 0.0% 0.0% 53% DII0.4% 0.4% 0.0% 0.0% 24.5% 24.8% 0.9% -6.7% 25% DII 24.5% 24.8% 0.9% -6.7% 25%24.5% 24.8% 0.9% -6.7% 5.4% 5.0% -6.2% -17.4% 25% 5.4% 5.0% -6.2% -17.4% Non Institutions5.4% 5.0% -6.2% -17.4% 11.4% 11.4% 0.3% 6.3% Non Institutions 11.4% 11.4% 0.3% 6.3%11.4% 11.4% 0.3% 6.3% 0.6% 0.7% 7.5% 33.4%0.6% 0.7% 7.5% 33.4%0.6% 0.7% 7.5% 33.4% 100.0% 100.0% 0.0% 0.0%100.0% 100.0% 0.0% 0.0%100.0% 100.0% 0.0% 0.0% holding in private sectorholding in private sectorholding in private sectorholding in private sector held by the chief secretaryheld by the chief secretaryheld by the chief secretary hands of secretary financehands of secretary financehands of secretary finance

- 5. Investment rationaleInvestment rationaleInvestment rationale Healthy performance to continueHealthy performance to continueHealthy performance to continueHealthy performance to continue Loan book and deposits grew at moderate pace over last fiveLoan book and deposits grew at moderate pace over last fiveLoan book and deposits grew at moderate pace over last five deposits grew at a CAGR of 17% and 18% respectively, overdeposits grew at a CAGR of 17% and 18% respectively, overdeposits grew at a CAGR of 17% and 18% respectively, over FY13A) instead of an expected CAGR growth of 19% and 16% respectivelyFY13A) instead of an expected CAGR growth of 19% and 16% respectivelyFY13A) instead of an expected CAGR growth of 19% and 16% respectivelyFY13A) instead of an expected CAGR growth of 19% and 16% respectively FY16E. Due to increased commercial and tourism activity alongFY16E. Due to increased commercial and tourism activity alongFY16E. Due to increased commercial and tourism activity along infrastructure spending by the central government , we expectinfrastructure spending by the central government , we expectinfrastructure spending by the central government , we expect for J&K in the near future.for J&K in the near future.for J&K in the near future.for J&K in the near future. Exhibit 02 : Growth in depositsExhibit 02 : Growth in depositsExhibit 02 : Growth in deposits 66605 30%80000 66605 26% 30%80000 56445 66605 26% 47432 56445 26% 60000 47432 56445 21% 19% 20% 60000 39200 47432 19% 21% 19% 18% 20% 33077 3920019% 19% 18% 40000 3307740000 10% 40000 10% 20000 10% 2000020000 0%0 0%0 0%0 FY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16E Advances Growth %Advances Growth %Advances Growth % Source: Perception ResearchSource: Perception Research J&K bank has strong deposit franchise and focus towards J&KJ&K bank has strong deposit franchise and focus towards J&KJ&K bank has strong deposit franchise and focus towards J&KJ&K bank has strong deposit franchise and focus towards J&K to deposits and 39% to loan book respectively. The managementto deposits and 39% to loan book respectively. The managementto deposits and 39% to loan book respectively. The management confident to maintain their market share in J&K state for the currentconfident to maintain their market share in J&K state for the currentconfident to maintain their market share in J&K state for the current DepositsDepositsDeposits Y/E 31 March 1QFY13 4QFY13 1QFY14 QOQ SPLY FY12A FY13A YOYY/E 31 March 1QFY13 4QFY13 1QFY14 QOQ SPLY FY12A FY13A YOYY/E 31 March 1QFY13 4QFY13 1QFY14 QOQ SPLY FY12A FY13A YOY Within J&K 34920 40867 39681 -3% 14% 35308 40867 16%Within J&K 34920 40867 39681 -3% 14% 35308 40867 16%Within J&K 34920 40867 39681 -3% 14% 35308 40867 16% Rest of India 18197 23354 18920 -19% 4% 13803 23354 69%Rest of India 18197 23354 18920 -19% 4% 13803 23354 69%Rest of India 18197 23354 18920 -19% 4% 13803 23354 69% Whole Bank 53117 64221 58601 -9% 10% 49111 64221 31%Whole Bank 53117 64221 58601 -9% 10% 49111 64221 31%Whole Bank 53117 64221 58601 -9% 10% 49111 64221 31% Within J&K 66% 64% 68% - - 72% 64%Within J&K 66% 64% 68% - - 72% 64%Within J&K 66% 64% 68% - - 72% 64% Rest of India 34% 36% 32% - - 28% 36%Rest of India 34% 36% 32% - - 28% 36%Rest of India 34% 36% 32% - - 28% 36% five years (loan book andfive years (loan book andfive years (loan book and over the period of FY09A toover the period of FY09A toover the period of FY09A to respectively over FY13A torespectively over FY13A torespectively over FY13A torespectively over FY13A to along with the focus onalong with the focus onalong with the focus on an increase in the growthan increase in the growthan increase in the growth Exhibit 03 : Growth in advancesExhibit 03 : Growth in advancesExhibit 03 : Growth in advances 66605 30%80000 66605 26% 30%80000 56445 66605 26% 47432 56445 26% 60000 47432 56445 21% 19% 20% 60000 39200 47432 19% 21% 19% 18% 20% 33077 3920019% 19% 18% 40000 3307740000 10% 40000 10% 20000 10% 2000020000 0%0 0%0 0%0 FY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16E Advances Growth %Advances Growth %Advances Growth % Source: Perception ResearchSource: Perception Research state would support 64%state would support 64%state would support 64%state would support 64% management of J&K bank is prettymanagement of J&K bank is prettymanagement of J&K bank is pretty current fiscal.current fiscal.current fiscal. Gross AdvancesGross AdvancesGross Advances YOY Y/E 31 March 1QFY13 4QFY13 1QFY14 QOQ SPLY FY12A FY13A YOYYOY Y/E 31 March 1QFY13 4QFY13 1QFY14 QOQ SPLY FY12A FY13A YOYYOY Y/E 31 March 1QFY13 4QFY13 1QFY14 QOQ SPLY FY12A FY13A YOY 16% Within J&K 13525 15839 16940 7% 25% 12574 15839 26%16% Within J&K 13525 15839 16940 7% 25% 12574 15839 26%16% Within J&K 13525 15839 16940 7% 25% 12574 15839 26% 69% Rest of India 20544 24293 23294 -4% 13% 20556 24293 18%69% Rest of India 20544 24293 23294 -4% 13% 20556 24293 18%69% Rest of India 20544 24293 23294 -4% 13% 20556 24293 18% 31% Whole Bank 34069 40132 40234 0% 18% 33130 40132 21%31% Whole Bank 34069 40132 40234 0% 18% 33130 40132 21%31% Whole Bank 34069 40132 40234 0% 18% 33130 40132 21% - Within J&K 40% 39% 42% - - 38% 39% -- Within J&K 40% 39% 42% - - 38% 39% -- Within J&K 40% 39% 42% - - 38% 39% - - Rest of India 60% 61% 58% - - 62% 61% -- Rest of India 60% 61% 58% - - 62% 61% -- Rest of India 60% 61% 58% - - 62% 61% -

- 6. Strong geographic presence in J&K state creates the dominionsStrong geographic presence in J&K state creates the dominionsStrong geographic presence in J&K state creates the dominionsStrong geographic presence in J&K state creates the dominions J&K bank is the only a private sector bank in the state of J&K . ItJ&K bank is the only a private sector bank in the state of J&K . ItJ&K bank is the only a private sector bank in the state of J&K . It of the RBI to carry on the general banking business of the centralof the RBI to carry on the general banking business of the centralof the RBI to carry on the general banking business of the central leadership in the state with a network of 455 branches whichleadership in the state with a network of 455 branches whichleadership in the state with a network of 455 branches which branches and 399 ATMs. J&K bank also dominates the region withbranches and 399 ATMs. J&K bank also dominates the region withbranches and 399 ATMs. J&K bank also dominates the region withbranches and 399 ATMs. J&K bank also dominates the region with total advances and 65% market share in total deposits in the statetotal advances and 65% market share in total deposits in the statetotal advances and 65% market share in total deposits in the state Exhibit 04: Branches Total – J&K StateExhibit 04: Branches Total – J&K State 100%2000 100%2000 82% 85% 87% 87% 100%2000 82% 85% 87% 87% 80% 1500 85769% 82% 85% 80% 1500 715 85769% 60% 1500 715 69% 60% 579 715 60% 1000 380 496 579 40% 1000 380 496 40% 985 380 500 548 603 685 821 985 20% 500 548 603 685 821 985 20% 548 603 685 0%0 0%0 0%0 FY11A FY12A FY13A FY14E FY15EFY11A FY12A FY13A FY14E FY15EFY11A FY12A FY13A FY14E FY15E Total Branches J&K Branches J&K Branches % to toatlTotal Branches J&K Branches J&K Branches % to toatlTotal Branches J&K Branches J&K Branches % to toatl Source: Perception ResearchSource: Perception ResearchSource: Perception Research Massive expansion in networkMassive expansion in networkMassive expansion in network To improve the geographic presence and to obtain the moreTo improve the geographic presence and to obtain the moreTo improve the geographic presence and to obtain the more business J&K bank planned massive expansion in their networkbusiness J&K bank planned massive expansion in their networkbusiness J&K bank planned massive expansion in their network impressive expansion plan of 300 new branches and almost equivalentimpressive expansion plan of 300 new branches and almost equivalentimpressive expansion plan of 300 new branches and almost equivalentimpressive expansion plan of 300 new branches and almost equivalent of FY15.of FY15.of FY15. Exhibit 06: Expansion plan in Branches & ATMExhibit 06: Expansion plan in Branches & ATMExhibit 06: Expansion plan in Branches & ATM 50%2000 50%2000 50%2000 41% 40% 1500 837 41% 40% 1500 837 30% 1500 698 837 30% 613 698 25% 30% 1000 508 613 20% 20% 25% 21% 20% 20% 1000 246 288 361 508 20% 20% 17% 21% 20% 20% 985 246 288 361 14% 20% 20% 17% 21% 14% 20% 20% 500 603 685 821 985 246 10% 14% 10% 14% 10% 500 530 536 548 603 685 821 98510%10% 10% 500 530 536 548 603 685 1% 1% 2% 0%0 1% 1% 2% 0%0 1% 1% 0%0 FY9A FY10A FY11A FY12A FY13A FY14E FY15EFY9A FY10A FY11A FY12A FY13A FY14E FY15EFY9A FY10A FY11A FY12A FY13A FY14E FY15E Branches ATM Growth % Growth %Branches ATM Growth % Growth %Branches ATM Growth % Growth % Source: Perception ResearchSource: Perception ResearchSource: Perception Research dominionsdominionsdominionsdominions It has right to act of behalfIt has right to act of behalfIt has right to act of behalf central government. It has thecentral government. It has thecentral government. It has the which comprises 80% of totalwhich comprises 80% of totalwhich comprises 80% of total with 70% market share inwith 70% market share inwith 70% market share inwith 70% market share in state.state.state. Exhibit 05: ATM Total – J&K StateExhibit 05: ATM Total – J&K State 100%2000 90% 90% 100%2000 89% 90% 90% 100%2000 89% 90% 90% 80% 1500 68% 80% 1500 75461% 68% 60% 1500 628 75461% 68% 60% 1000 544 628 75461% 60% 1000 544 628 40% 1000 345 544 40% 837220 345 20% 500 508 613 698 837220 20% 500 361 508 613 698 837220 20% 361 508 613 0%0 0%0 0%0 FY11A FY12A FY13A FY14E FY15EFY11A FY12A FY13A FY14E FY15E Total ATM J&K ATM J&K ATM % to toatl FY11A FY12A FY13A FY14E FY15E Total ATM J&K ATM J&K ATM % to toatlTotal ATM J&K ATM J&K ATM % to toatl Source: Perception ResearchSource: Perception ResearchSource: Perception Research opportunities in bankingopportunities in bankingopportunities in banking network. The bank hasnetwork. The bank hasnetwork. The bank has equivalent ATMs by the endequivalent ATMs by the endequivalent ATMs by the endequivalent ATMs by the end Exhibit 07: Branches in Metro, Urban, Semi – Urban & RuralExhibit 07: Branches in Metro, Urban, Semi – Urban & RuralExhibit 07: Branches in Metro, Urban, Semi – Urban & Rural 120012001200 10001000 453800 453800 378 453 600 332 378600 197204 206 223 273 332 400 600 164 197204 206 223 273 332 400 119 121 118 123 136 164 197204 206 223400 222 266 119 121 118 123 136 164 200 166 168 168 168 178 222 266 119 121 118 123 200 41 41 39 39 39 57 69 166 168 168 168 178 222 0 41 41 39 39 39 57 6900 FY9A FY10A FY11A FY12A FY13A FY14E FY15EFY9A FY10A FY11A FY12A FY13A FY14E FY15EFY9A FY10A FY11A FY12A FY13A FY14E FY15E Metro Urban Semi-Urban RuralMetro Urban Semi-Urban Rural Source: Perception ResearchSource: Perception ResearchSource: Perception Research

- 7. Focus towards J&K state will lead to improvement in NIMFocus towards J&K state will lead to improvement in NIMFocus towards J&K state will lead to improvement in NIMFocus towards J&K state will lead to improvement in NIM With strong deposit franchise and focus (increase lending) towardsWith strong deposit franchise and focus (increase lending) towardsWith strong deposit franchise and focus (increase lending) towards support margins going ahead. Bank earns NIMs of 6.20% withinsupport margins going ahead. Bank earns NIMs of 6.20% withinsupport margins going ahead. Bank earns NIMs of 6.20% within outside the state. We expected NIM to sustain at current levelsoutside the state. We expected NIM to sustain at current levelsoutside the state. We expected NIM to sustain at current levels the range of 61 to 65 percent, going ahead, and credit growththe range of 61 to 65 percent, going ahead, and credit growththe range of 61 to 65 percent, going ahead, and credit growththe range of 61 to 65 percent, going ahead, and credit growth portfolio) is expected to grow at a faster pace. J&K Bank hasportfolio) is expected to grow at a faster pace. J&K Bank hasportfolio) is expected to grow at a faster pace. J&K Bank has FY13, which we expect to improve to 63% in FY14E andFY13, which we expect to improve to 63% in FY14E andFY13, which we expect to improve to 63% in FY14E and management has guided credit growth (22-25%) will outpacemanagement has guided credit growth (22-25%) will outpacemanagement has guided credit growth (22-25%) will outpacemanagement has guided credit growth (22-25%) will outpace We have factored in 21% credit growth and 16.5% deposit growthWe have factored in 21% credit growth and 16.5% deposit growthWe have factored in 21% credit growth and 16.5% deposit growth Exhibit 08:Loan Book - J&K stats and Rest of IndiaExhibit 08:Loan Book - J&K stats and Rest of IndiaExhibit 08:Loan Book - J&K stats and Rest of India 30%80000 26% 30%80000 26% 25% 23% 26% 23% 23% 25% 60000 23% 23% 23% 21% 20% 60000 38620 21% 18% 18% 20% 33298 3862018% 18% 16% 16% 15% 20% 40000 28701 33298 13% 16% 16% 15%40000 24293 28701 33298 13% 10% 15%40000 20556 24293 2870113% 10% 20000 29135 20556 24293 10% 20000 19536 24113 29135 20556 5% 20000 12574 15839 19536 24113 29135 5% 12574 15839 19536 0%0 0%0 FY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16E J&K State Rest of India Growth (%) Growth (%)J&K State Rest of India Growth (%) Growth (%)J&K State Rest of India Growth (%) Growth (%) Source: Perception ResearchSource: Perception Research Exhibit 10:NIM - J&K stateExhibit 10:NIM - J&K stateExhibit 10:NIM - J&K state FY15E, 6.2% FY16E, 6.2%FY15E, 6.2% FY16E, 6.2% FY13A, 6.2% FY15E, 6.2% FY16E, 6.2% FY13A, 6.2%FY13A, 6.2% FY14E, 6.1%FY14E, 6.1%FY14E, 6.1% FY12A, 6.0%FY12A, 6.0%FY12A, 6.0% 0 1 2 3 4 5 60 1 2 3 4 5 6 Source: Perception ResearchSource: Perception ResearchSource: Perception Research towards J&K state wouldtowards J&K state wouldtowards J&K state would within the state and 2.5%within the state and 2.5%within the state and 2.5% levels of 4%+ as its CD ratio inlevels of 4%+ as its CD ratio inlevels of 4%+ as its CD ratio in growth with J&K (higher yieldinggrowth with J&K (higher yieldinggrowth with J&K (higher yieldinggrowth with J&K (higher yielding has a CD ratio of 61% as onhas a CD ratio of 61% as onhas a CD ratio of 61% as on 64% in FY15E. Even the64% in FY15E. Even the64% in FY15E. Even the deposit growth (17-18%).deposit growth (17-18%).deposit growth (17-18%).deposit growth (17-18%). growth in FY14E.growth in FY14E.growth in FY14E. Exhibit 09: Deposits - J&K stats and Rest of IndiaExhibit 09: Deposits - J&K stats and Rest of IndiaExhibit 09: Deposits - J&K stats and Rest of India 80%120000 69% 80%120000 69%100000 69% 60% 100000 41097 60% 80000 34865 4109780000 28430 34865 41097 40%60000 80000 23354 28430 34865 40%60000 13803 23354 28430 40% 40000 60000 59139 13803 23354 24% 22% 23% 20% 40000 40867 46387 52297 59139 13803 16% 14% 24% 22% 23% 18% 20% 20000 40000 35308 40867 46387 52297 59139 12% 16% 14% 13% 13% 22% 23% 18% 20% 20000 35308 40867 4638712% 16% 14% 13% 13%20000 0%0 0%0 FY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16E J&K State Rest of India Growth (%) Growth (%)J&K State Rest of India Growth (%) Growth (%)J&K State Rest of India Growth (%) Growth (%) Source: Perception ResearchSource: Perception Research Exhibit 11:NIM - Rest of IndiaExhibit 11:NIM - Rest of IndiaExhibit 11:NIM - Rest of India FY15E, 2.6%FY15E, 2.6% FY16E, 2.6% FY15E, 2.6% FY16E, 2.6%FY16E, 2.6% FY13A, 2.6%FY13A, 2.6% FY12A, 2.5% FY14E, 2.5%FY12A, 2.5% FY14E, 2.5%FY12A, 2.5% FY14E, 2.5% 0 1 2 3 4 5 60 1 2 3 4 5 60 1 2 3 4 5 6 Source: Perception ResearchSource: Perception ResearchSource: Perception Research

- 8. Huge Potential in J&K state for Horticultural LendingHuge Potential in J&K state for Horticultural LendingHuge Potential in J&K state for Horticultural LendingHuge Potential in J&K state for Horticultural Lending Agriculture involves about 70% of the population and contributesAgriculture involves about 70% of the population and contributesAgriculture involves about 70% of the population and contributes only 16 % of J&K Bank’s lending is to this sector. Horticulturalonly 16 % of J&K Bank’s lending is to this sector. Horticulturalonly 16 % of J&K Bank’s lending is to this sector. Horticultural about 45 % to Agricultural production and involves 30 lac peopleabout 45 % to Agricultural production and involves 30 lac peopleabout 45 % to Agricultural production and involves 30 lac people % by value of the State’s Horticultural output. J&K State produces% by value of the State’s Horticultural output. J&K State produces% by value of the State’s Horticultural output. J&K State produces% by value of the State’s Horticultural output. J&K State produces apple output and controls 49 % of land dedicated to apple cultivationapple output and controls 49 % of land dedicated to apple cultivationapple output and controls 49 % of land dedicated to apple cultivation Out of a total of more than 283000 apple growers in the State,Out of a total of more than 283000 apple growers in the State,Out of a total of more than 283000 apple growers in the State, extended to about 17300 growers so far. Tapping the remaining Out of a total of more than 283000 apple growers in the State, extended to about 17300 growers so far. Tapping the remainingextended to about 17300 growers so far. Tapping the remainingextended to about 17300 growers so far. Tapping the remaining credit of about Rs.7000 Cr more. In J&K 75 % of Apple growerscredit of about Rs.7000 Cr more. In J&K 75 % of Apple growerscredit of about Rs.7000 Cr more. In J&K 75 % of Apple growers traders and are unaware that its effective interest cost thattraders and are unaware that its effective interest cost thattraders and are unaware that its effective interest cost that 54%, against the Bank’s interest ranging from 4% to11%.54%, against the Bank’s interest ranging from 4% to11%.54%, against the Bank’s interest ranging from 4% to11%.54%, against the Bank’s interest ranging from 4% to11%. Current shortfall in Agriculture Sector Lending is Rs. 2335 Cr, whichCurrent shortfall in Agriculture Sector Lending is Rs. 2335 Cr, whichCurrent shortfall in Agriculture Sector Lending is Rs. 2335 Cr, which RIDF/MSME Bonds/RHF @ 3 to 5 % for 3-7 years. Interest SubventionRIDF/MSME Bonds/RHF @ 3 to 5 % for 3-7 years. Interest SubventionRIDF/MSME Bonds/RHF @ 3 to 5 % for 3-7 years. Interest Subvention to J&K Bank recently providing a level playing field vis-à-vis Publicto J&K Bank recently providing a level playing field vis-à-vis Publicto J&K Bank recently providing a level playing field vis-à-vis Publicto J&K Bank recently providing a level playing field vis-à-vis Public of pricing of agricultural loans and improve the flow of creditof pricing of agricultural loans and improve the flow of creditof pricing of agricultural loans and improve the flow of credit particularly in J&K State. Assuming yield on incremental Agriculturalparticularly in J&K State. Assuming yield on incremental Agriculturalparticularly in J&K State. Assuming yield on incremental Agricultural Rate of 10.25 %, the incremental yield (10.25% - 4 %) wouldRate of 10.25 %, the incremental yield (10.25% - 4 %) wouldRate of 10.25 %, the incremental yield (10.25% - 4 %) wouldRate of 10.25 %, the incremental yield (10.25% - 4 %) would revenue of about Rs. 146 Cr per year on lending Rs.revenue of about Rs. 146 Cr per year on lending Rs.revenue of about Rs. 146 Cr per year on lending Rs. sector, increasing agricultural advances which will improvesector, increasing agricultural advances which will improvesector, increasing agricultural advances which will improve helping in financial inclusion, widening customer base andhelping in financial inclusion, widening customer base andhelping in financial inclusion, widening customer base andhelping in financial inclusion, widening customer base and remote rural areas.remote rural areas.remote rural areas. Exhibit 12: Apple Grower in J&K StateExhibit 12: Apple Grower in J&K StateExhibit 12: Apple Grower in J&K State Total GrowerTotal GrowerTotal Grower , 283000, 283000, 283000 Source: Perception ResearchSource: Perception Research contributes 23 % to the GDP, yetcontributes 23 % to the GDP, yetcontributes 23 % to the GDP, yet Horticultural production contributesHorticultural production contributesHorticultural production contributes people. Apples account for 86people. Apples account for 86people. Apples account for 86 produces 77 % of India’s totalproduces 77 % of India’s totalproduces 77 % of India’s totalproduces 77 % of India’s total cultivation.cultivation.cultivation. State, Bank’s finance has beenState, Bank’s finance has beenState, Bank’s finance has been remaining growers will generate State, Bank’s finance has been remaining growers will generateremaining growers will generateremaining growers will generate growers get their financing fromgrowers get their financing fromgrowers get their financing from that works out to 36% tothat works out to 36% tothat works out to 36% to which has to be invested inwhich has to be invested inwhich has to be invested in Subvention Scheme extendedSubvention Scheme extendedSubvention Scheme extended Public Sector Banks in termsPublic Sector Banks in termsPublic Sector Banks in termsPublic Sector Banks in terms credit to agricultural sectorcredit to agricultural sectorcredit to agricultural sector Agricultural Advances at BaseAgricultural Advances at BaseAgricultural Advances at Base would generate an incrementalwould generate an incrementalwould generate an incrementalwould generate an incremental 2335 Cr to agricultural2335 Cr to agricultural2335 Cr to agricultural core advances portfoliocore advances portfoliocore advances portfolio and enhancing outreach inand enhancing outreach inand enhancing outreach inand enhancing outreach in Potential ForPotential ForPotential For Lending, 265700Lending, 265700Lending, 265700 J&K'sJ&K's Borrower,17300Borrower,17300Borrower,17300

- 9. Cheap Valuation and High Dividend yieldCheap Valuation and High Dividend yieldCheap Valuation and High Dividend yield At current market price, J&K bank is still available at FY14E Price Cheap Valuation and High Dividend yield At current market price, J&K bank is still available at FY14E PriceAt current market price, J&K bank is still available at FY14E PriceAt current market price, J&K bank is still available at FY14E Price times. The estimated dividend yield for FY14 is 5.4%. High dividendtimes. The estimated dividend yield for FY14 is 5.4%. High dividendtimes. The estimated dividend yield for FY14 is 5.4%. High dividend comfortable cushion. At CMP of Rs 1101, the stock is trading atcomfortable cushion. At CMP of Rs 1101, the stock is trading atcomfortable cushion. At CMP of Rs 1101, the stock is trading at for FY14E & FY15E, respectively.for FY14E & FY15E, respectively.for FY14E & FY15E, respectively.for FY14E & FY15E, respectively. Exhibit 13: P/E (x) & P/BV (x)Exhibit 13: P/E (x) & P/BV (x) 1.51.2 1.5 1.1 1.2 1.5 1.1 1.2 0.90.9 1.10.9 1.1 0.9 7.3 7.8 0.9 0.86.8 7.3 7.8 0.8 0.66.8 7.3 5.3 0.8 0.6 5.3 5.1 4.3 0.6 5.3 5.1 4.34.3 3.53.5 2.92.9 FY9A FY10A FY11A FY12A FY13A FY14E FY15E FY16EFY9A FY10A FY11A FY12A FY13A FY14E FY15E FY16E P/E (X) P/BV (X)P/E (X) P/BV (X) Source: Perception ResearchSource: Perception Research Price to book value of 0.9Price to book value of 0.9Price to book value of 0.9Price to book value of 0.9 dividend yield provides with adividend yield provides with adividend yield provides with a at 4.3x and 3.5x to its PEat 4.3x and 3.5x to its PEat 4.3x and 3.5x to its PE Exhibit 14: DPS & Dividend yieldExhibit 14: DPS & Dividend yield 88 10%100 88 10%100 72 88 10%100 728% 8% 8%80 59 728% 8% 8%80 50 59 7% 6%60 50 5% 7% 6%60 33 50 5% 5% 5% 6%60 26 334% 4% 5% 5% 5% 4%40 17 22 26 334% 4% 5% 4%40 17 22 26 2%20 17 2%20 2%20 0%0 0%0 0%0 FY9A FY10A FY11A FY12A FY13A FY14E FY15E FY16EFY9A FY10A FY11A FY12A FY13A FY14E FY15E FY16EFY9A FY10A FY11A FY12A FY13A FY14E FY15E FY16E DPS Dividend yield (%)DPS Dividend yield (%)DPS Dividend yield (%) Source: Perception ResearchSource: Perception Research

- 10. Asset qualityAsset qualityAsset qualityAsset quality GNPA is slightly higher during FY13….and expecting to be sameGNPA is slightly higher during FY13….and expecting to be sameGNPA is slightly higher during FY13….and expecting to be same On the YOY basis J&K bank posted a slightly higher GNPA (Rs 39200On the YOY basis J&K bank posted a slightly higher GNPA (Rs 39200On the YOY basis J&K bank posted a slightly higher GNPA (Rs 39200 compared to previous year of FY12 (Rs 33077, 1.56 % to advance)compared to previous year of FY12 (Rs 33077, 1.56 % to advance)compared to previous year of FY12 (Rs 33077, 1.56 % to advance) from management of J&K bank and our financial model we stronglyfrom management of J&K bank and our financial model we stronglyfrom management of J&K bank and our financial model we stronglyfrom management of J&K bank and our financial model we strongly Bank will maintain there GNPA in the range of 1.65% to 1.70% forBank will maintain there GNPA in the range of 1.65% to 1.70% forBank will maintain there GNPA in the range of 1.65% to 1.70% for Well position PCR (Provision coverage ration)Well position PCR (Provision coverage ration)Well position PCR (Provision coverage ration) The bank consistently maintained the PCR at 90% in past threeThe bank consistently maintained the PCR at 90% in past threeThe bank consistently maintained the PCR at 90% in past threeThe bank consistently maintained the PCR at 90% in past three from management we expect that bank will maintain the PCR atfrom management we expect that bank will maintain the PCR atfrom management we expect that bank will maintain the PCR at Exhibit 15: Gross NPAExhibit 15: Gross NPAExhibit 15: Gross NPA 11041104 1.70%1200 958 1104 1.67% 1.68% 1.67% 1.70%1200 9581.67% 1.68% 1.67% 1.65%1000 809 9581.67% 1.68% 1.67% 1.65%1000 809 1.62% 1.65% 800 1000 644 1.62% 1.60% 800 517 644 1.62% 1.60% 800 517 1.60% 600 517 1.55% 600 1.54% 1.55% 400 1.54%400 1.50%200 1.50%200 1.45%0 200 1.45%0 1.45%0 FY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16E GNPA (Rs In Cr) GNPA (%)GNPA (Rs In Cr) GNPA (%)GNPA (Rs In Cr) GNPA (%) Source: Perception ResearchSource: Perception Research Exhibit 17: NPA - Substandard, Doubtful & LossExhibit 17: NPA - Substandard, Doubtful & LossExhibit 17: NPA - Substandard, Doubtful & Loss 12001200 77 1200 77 1000 72 77 1000 65 72 800 640 65800 556 640 57 65 600 469 556 640 57600 378 469 556 93 57 400 600 378 46993 400 247 378400 275 331 386 247 200 176 209 275 331 386200 176 209 275 331 00 FY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16E Substandard Doubtful LossSubstandard Doubtful Loss Source: Perception ResearchSource: Perception ResearchSource: Perception Research same for FY14Esame for FY14Esame for FY14E 39200, 1.64% to advance)39200, 1.64% to advance)39200, 1.64% to advance) advance). As per the guidanceadvance). As per the guidanceadvance). As per the guidance strongly expect that, the J&Kstrongly expect that, the J&Kstrongly expect that, the J&Kstrongly expect that, the J&K for the fiscal of FY14.for the fiscal of FY14.for the fiscal of FY14. year. As per the guidanceyear. As per the guidanceyear. As per the guidanceyear. As per the guidance at 91% for FY14E.at 91% for FY14E.at 91% for FY14E. Exhibit 16: Net NPAExhibit 16: Net NPAExhibit 16: Net NPA 9494 0.15%100 81 94 0.15%100 81 0.15% 69 0.15% 0.15% 80 69 0.15% 80 49 55 0.14% 0.14% 0.14% 0.15% 60 49 55 0.14% 0.14% 0.14%60 49 0.14% 0.14% 0.14% 60 0.14% 0.14% 40 0.14%40 0.14% 40 0.14% 20 0.14% 20 0.13%0 0.13%0 FY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16E NNPA (Rs In Cr) NNPA (%)NNPA (Rs In Cr) NNPA (%)NNPA (Rs In Cr) NNPA (%) Source: Perception ResearchSource: Perception Research Exhibit 18: PCRExhibit 18: PCRExhibit 18: PCR 91% 92% 92% 92% 92%1500 1150 91% 92% 92% 92% 92%1500 1150 105290% 91% 92% 92% 92% 90%966 1150 884 105290% 90% 90% 805 966 884 105290% 90% 1000 644 805737 884 88% 1000 519 517 644 805 589 737 88% 462 519 517 644 398 466 467 589 86% 86%462 519 517 398 466 46786% 86% 500 46239886% 86% 500 84% 500 84% 82%0 82%0 82%0 FY10A FY11A FY12A FY13A FY14E FY15E FY16EFY10A FY11A FY12A FY13A FY14E FY15E FY16E GNPA Provisions on BS Provisions coverage %GNPA Provisions on BS Provisions coverage %GNPA Provisions on BS Provisions coverage % Source: Perception ResearchSource: Perception ResearchSource: Perception Research

- 11. Slippages on a marginal increaseSlippages on a marginal increaseSlippages on a marginal increase Slippages are marginally increasing during the FY13. On yoy Slippages on a marginal increase Slippages are marginally increasing during the FY13. On yoySlippages are marginally increasing during the FY13. On yoySlippages are marginally increasing during the FY13. On yoy bank posted the slippage ratio of 1.16 for the period of FY13 againstbank posted the slippage ratio of 1.16 for the period of FY13 againstbank posted the slippage ratio of 1.16 for the period of FY13 against the 0.95 of FY12. Even for the Q1FY14 slippage is 0.88 whichthe 0.95 of FY12. Even for the Q1FY14 slippage is 0.88 whichthe 0.95 of FY12. Even for the Q1FY14 slippage is 0.88 which slightly higher on qoq basis. We have assumed 1.15 slippageslightly higher on qoq basis. We have assumed 1.15 slippageslightly higher on qoq basis. We have assumed 1.15 slippageslightly higher on qoq basis. We have assumed 1.15 slippage on for FY14E and expecting that it will gradually reduce in FY15on for FY14E and expecting that it will gradually reduce in FY15on for FY14E and expecting that it will gradually reduce in FY15 FY16EFY16EFY16E Consistency in CASAConsistency in CASAConsistency in CASAConsistency in CASA CASA ratio of J&K Bank is 40% against the industry average ofCASA ratio of J&K Bank is 40% against the industry average ofCASA ratio of J&K Bank is 40% against the industry average of Healthy CASA is one of the advantage of J&K bank. We stronglyHealthy CASA is one of the advantage of J&K bank. We stronglyHealthy CASA is one of the advantage of J&K bank. We strongly expect that bank will maintain this position in the coming twoexpect that bank will maintain this position in the coming twoexpect that bank will maintain this position in the coming twoexpect that bank will maintain this position in the coming two three years.three years.three years. Restructure assets % to total advanceRestructure assets % to total advanceRestructure assets % to total advance As restructure assets are technical in nature, there are marginalAs restructure assets are technical in nature, there are marginalAs restructure assets are technical in nature, there are marginalAs restructure assets are technical in nature, there are marginal decreases in restructure assets in advance for FY13. On yoy basisdecreases in restructure assets in advance for FY13. On yoy basisdecreases in restructure assets in advance for FY13. On yoy basis restructure assets in advance for FY 13 is 1490 Cr (3.84%) againstrestructure assets in advance for FY 13 is 1490 Cr (3.84%) againstrestructure assets in advance for FY 13 is 1490 Cr (3.84%) against 1366 Cr (4.13%) of FY12 and simultaneously for Q1FY14 it is 13671366 Cr (4.13%) of FY12 and simultaneously for Q1FY14 it is 13671366 Cr (4.13%) of FY12 and simultaneously for Q1FY14 it is 1367 (3.48%) against the same period last year of Q1FY13 was 1688 1366 Cr (4.13%) of FY12 and simultaneously for Q1FY14 it is 1367 (3.48%) against the same period last year of Q1FY13 was 1688(3.48%) against the same period last year of Q1FY13 was 1688(3.48%) against the same period last year of Q1FY13 was 1688 (5.08%).(5.08%).(5.08%). Exhibit 19 : SlippageExhibit 19 : Slippage yoy basis Exhibit 19 : Slippage yoy basisyoy basisyoy basis against 1.50%80000 against 599 1.50%80000 against which is 599 1.16% 1.15%60000which is 564 599 1.16% 1.15% 1.00% 1.00% 60000which is slippage ratio 545 564 0.95% 1.16% 1.15% 1.00% 0.90% 1.00% 60000 slippage ratio 455 545 564 0.95% 1.00% 0.90% 1.00% 40000slippage ratio 66605315 455 545 0.90% 40000slippage ratio 15E and 56445 66605315 455 0.50% 40000 15E and 39200 47432 56445 66605315 0.50% 20000 15E and 33077 39200 47432 56445 0.50% 20000 33077 3920020000 0.00%0 0.00%0 0.00%0 FY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16E Standard assets NPA Addition Slippage ratioStandard assets NPA Addition Slippage ratio Source: Perception ResearchSource: Perception Research Exhibit 20 : CASAExhibit 20 : CASA of 34%. Exhibit 20 : CASA of 34%.of 34%. strongly 41%150000strongly 41%150000strongly two to 41% 41% 41%150000 two to 40094 41% 41%two to 34865 40094 40% 41% 100000 two to 29927 3486540% 40% 40% 40%100000 25191 29927 3486540% 40% 40% 40%100000 21715 25191 29927 40% 21715 25191 39% 40% 87162 100236 21715 39% 39%50000 53347 64221 74817 87162 100236 39%50000 53347 64221 74817 87162 39%53347 64221 39% 38%0 38%0 FY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16E total Deposits Demand + saving CASAtotal Deposits Demand + saving CASA Source: Perception Research total Deposits Demand + saving CASA Source: Perception ResearchSource: Perception Research Exhibit 21 : Movement in Restructured AssetsExhibit 21 : Movement in Restructured AssetsExhibit 21 : Movement in Restructured Assets marginalmarginal 6.00%50000marginal 5.55% 6.00%50000marginal basis the 5.08% 5.55% 6.00%50000 basis the 1490 1490 13675.08% 5.55% 40000basis the against the 1366 1688 1367 1978 1490 1490 1367 4.13% 5.08% 3.99% 4.00% 40000 against the 1366 1688 1367 19784.13% 3.99% 3.80% 3.80% 3.48% 4.00% 30000against the 1367 Cr 1366 1688 13674.13% 3.99% 3.80% 3.80% 3.48% 4.00% 30000 1367 Cr 3.48% 20000 30000 1367 Cr 1688 Cr 33077 33225 34272 35657 39200 39200 39282 2.00% 20000 1367 Cr 1688 Cr 33077 33225 34272 35657 39200 39200 39282 2.00% 20000 1688 Cr 33077 33225 34272 35657 2.00% 10000 1688 Cr 10000 0.00%0 0.00%0 0.00%0 FY12 Q1FY13 Q2FY13 Q3FY13 Q4FY13 FY13 Q1FY14FY12 Q1FY13 Q2FY13 Q3FY13 Q4FY13 FY13 Q1FY14FY12 Q1FY13 Q2FY13 Q3FY13 Q4FY13 FY13 Q1FY14 Advances Restructured Assets RA % to total advanceAdvances Restructured Assets RA % to total advance Source: Perception ResearchSource: Perception ResearchSource: Perception Research

- 12. Capital adequacyCapital adequacyCapital adequacy The bank is well capitalized with total capital adequacy ratio Capital adequacy The bank is well capitalized with total capital adequacy ratioThe bank is well capitalized with total capital adequacy ratioThe bank is well capitalized with total capital adequacy ratio 10.44% and Tier 2 at 1.90% by the end of FY13. The risk weighted10.44% and Tier 2 at 1.90% by the end of FY13. The risk weighted10.44% and Tier 2 at 1.90% by the end of FY13. The risk weighted stood at 46597 Cr, 56% to total assets.stood at 46597 Cr, 56% to total assets.stood at 46597 Cr, 56% to total assets. Exhibit 22 : Tier I & II & Capital AdequacyExhibit 22 : Tier I & II & Capital Adequacy 13.50%15.00% 11.88% 11.72% 11.75% 13.50%15.00% 10.43% 10.44% 11.88% 11.72% 11.75% 13.11% 13.50%15.00% 10.43% 10.44% 11.88% 11.72% 11.75% 13.11% 13.00% 10.43% 10.44% 13.11% 13.00% 10.00% 12.74% 12.61% 13.00% 10.00% 12.53% 12.74% 12.61%12.50% 10.00% 12.53% 12.34% 12.61%12.50%12.53% 12.34% 12.50% 5.00% 2.10% 1.90% 12.34% 12.00% 5.00% 2.10% 1.90% 1.23% 1.02% 0.86% 12.00% 5.00% 1.90% 1.23% 1.02% 0.86% 12.00% 11.50%0.00% 11.50%0.00% 11.50%0.00% FY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16E Tier 1 Tier 2 Capital adequacyTier 1 Tier 2 Capital adequacy Source: Perception ResearchSource: Perception ResearchSource: Perception Research ConclusionConclusionConclusionConclusion The bank’s asset quality remained stable sequentially, with a marginalThe bank’s asset quality remained stable sequentially, with a marginalThe bank’s asset quality remained stable sequentially, with a marginal gross NPA ratio to 1.62% and 1bp decline in the net NPA ratiogross NPA ratio to 1.62% and 1bp decline in the net NPA ratiogross NPA ratio to 1.62% and 1bp decline in the net NPA ratio levels were slightly higher at 140cr (for FY13 annualized slippagelevels were slightly higher at 140cr (for FY13 annualized slippagelevels were slightly higher at 140cr (for FY13 annualized slippage for FY12). The bank’s PCR which is the highest in the industryfor FY12). The bank’s PCR which is the highest in the industryfor FY12). The bank’s PCR which is the highest in the industryfor FY12). The bank’s PCR which is the highest in the industry sequential basis (yoy) by 97bp to 91.41%.sequential basis (yoy) by 97bp to 91.41%.sequential basis (yoy) by 97bp to 91.41%. of 12.35% with Tier 1 atof 12.35% with Tier 1 atof 12.35% with Tier 1 atof 12.35% with Tier 1 at weighted assets for FY13 isweighted assets for FY13 isweighted assets for FY13 is Exhibit 23 : RWA, RWA to total assetsExhibit 23 : RWA, RWA to total assets 69783 65%80000 69783 65%80000 58634 69783 65%80000 48652 58634 62%60000 46597 48652 60% 62% 60% 60000 39244 46597 48652 60% 60% 60000 39244 58% 60% 60% 40000 58%40000 55% 56% 55% 40000 55% 56% 55% 20000 55% 55% 2000020000 50%0 50%0 50%0 FY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16E Risk weighted assets RWA / Total assetsRisk weighted assets RWA / Total assets Source: Perception ResearchSource: Perception ResearchSource: Perception Research marginal increase of 8bp inmarginal increase of 8bp inmarginal increase of 8bp in ratio to 0.14%. The slippageratio to 0.14%. The slippageratio to 0.14%. The slippage slippage ratio of 1.16% v/s 0.95slippage ratio of 1.16% v/s 0.95slippage ratio of 1.16% v/s 0.95 industry by FY13, improved on aindustry by FY13, improved on aindustry by FY13, improved on aindustry by FY13, improved on a

- 13. J&K State EconomyJ&K State EconomyJ&K State Economy GDP Size and GrowthGDP Size and GrowthGDP Size and GrowthGDP Size and Growth Economy or GDP in J&K State is accelerating and is poised forEconomy or GDP in J&K State is accelerating and is poised forEconomy or GDP in J&K State is accelerating and is poised for Government spending and Private Investment on the rise. RecordGovernment spending and Private Investment on the rise. RecordGovernment spending and Private Investment on the rise. Record last two years, more expected this year. Increased investmentlast two years, more expected this year. Increased investmentlast two years, more expected this year. Increased investmentlast two years, more expected this year. Increased investment pushing up credit demand. The demand for financing private sectorpushing up credit demand. The demand for financing private sectorpushing up credit demand. The demand for financing private sector ancillaries on the rise. Trickle down impact of all this will leadancillaries on the rise. Trickle down impact of all this will leadancillaries on the rise. Trickle down impact of all this will lead income and savings, increasing capacity for servicing personal loansincome and savings, increasing capacity for servicing personal loansincome and savings, increasing capacity for servicing personal loansincome and savings, increasing capacity for servicing personal loans Exhibit 24 : Sector wise contribution to GDPExhibit 24 : Sector wise contribution to GDPExhibit 24 : Sector wise contribution to GDP 5000050000 6.2240000 5.96 6.2240000 5.96 6.22 220164.8030000 18662 20344 220164.8030000 18662 20344 220164.80 2000020000 9871 9980 10600 20000 9871 9980 10600 10000 9871 9980 10600 10000 7796 8061 8154 10000 7796 8061 8154 0 7796 8061 8154 00 FY10 FY11 FY12FY10 FY11 FY12 Primary Sector Secondary Sector Tertiary SectorPrimary Sector Secondary Sector Tertiary Sector Source: Perception Research Primary Sector Secondary Sector Tertiary Sector Source: Perception ResearchSource: Perception Research J&K State Credit GapJ&K State Credit GapJ&K State Credit GapJ&K State Credit Gap J&K accounts for 0.6% of India’s GDP, for FY13 and absorbs onlyJ&K accounts for 0.6% of India’s GDP, for FY13 and absorbs onlyJ&K accounts for 0.6% of India’s GDP, for FY13 and absorbs only credit. J&K accounts for 1% of India’s population and yet accountscredit. J&K accounts for 1% of India’s population and yet accountscredit. J&K accounts for 1% of India’s population and yet accounts India’s personal credit. Credit in J&K needs to increase five-foldIndia’s personal credit. Credit in J&K needs to increase five-foldIndia’s personal credit. Credit in J&K needs to increase five-fold J&K has to triple to catch up with the national average.J&K has to triple to catch up with the national average.J&K has to triple to catch up with the national average.J&K has to triple to catch up with the national average. for further growth in future.for further growth in future.for further growth in future. Record tourist inflow duringRecord tourist inflow duringRecord tourist inflow during investment in tourist infrastructureinvestment in tourist infrastructureinvestment in tourist infrastructureinvestment in tourist infrastructure sector projects, SME’s andsector projects, SME’s andsector projects, SME’s and lead to increase in per capitalead to increase in per capitalead to increase in per capita loans.loans.loans.loans. FY13 - J&K State’s Economy J&K StateFY13 - J&K State’s Economy J&K StateFY13 - J&K State’s Economy J&K State Population (In Cr) 1.25Population (In Cr) 1.25Population (In Cr) 1.25 Area (in Sq Km) 2222368.00 Area (in Sq Km) 2222368.00 Area (in Sq Km) 222236 Density (Per/Sq Km) 1247.01 7.00 Density (Per/Sq Km) 124 Per Capita Income 30889 7.01 7.00 Per Capita Income 308896.00 Per Capita Income 30889 Population BPL (%) 21.63%23947 6.00 Population BPL (%) 21.63%23947 5.00 Population BPL (%) 21.63% Literacy 68.74% 23947 4.00 5.00 Literacy 68.74%4.00 Literacy 68.74% Unemployment Rate 4.90% 3.00 4.00 Unemployment Rate 4.90% FY13 - Indian Economy All India 3.00 FY13 - Indian Economy All India10711 2.00 3.00 FY13 - Indian Economy All India Population (In Cr) 121.02 10711 2.00 Population (In Cr) 121.02 1.00 2.00 Population (In Cr) 121.02 Area (in Sq Kms) 32872408970 1.00 Area (in Sq Kms) 3287240 Density (Per/Sq Km) 382 8970 0.00 1.00 Density (Per/Sq Km) 382 8970 0.00 Density (Per/Sq Km) 382 Per Capita Income 39143 0.00 Per Capita Income 39143FY13 Per Capita Income 39143 Population BPL (%) 27.50% FY13 Population BPL (%) 27.50% J&K GDP Growth Rate Population BPL (%) 27.50% Literacy 74.04%J&K GDP Growth Rate Literacy 74.04% Unemployment Rate 9.40% J&K GDP Growth Rate Unemployment Rate 9.40%Unemployment Rate 9.40% only 0.30% of total nationalonly 0.30% of total nationalonly 0.30% of total national accounts for only 0.2% ofaccounts for only 0.2% ofaccounts for only 0.2% of fold and Personal Credit infold and Personal Credit infold and Personal Credit in

- 14. Financials & ProjectionsFinancials & ProjectionsFinancials & Projections Exhibit 25: Profit and Loss A/C (Rs In Cr)Exhibit 25: Profit and Loss A/C (Rs In Cr)Exhibit 25: Profit and Loss A/C (Rs In Cr) Y/E 31 March FY9A FY10A FY11AY/E 31 March FY9A FY10A FY11AY/E 31 March FY9A FY10A FY11A Interest IncomeInterest IncomeInterest Income Yield on Advances 2295 2342 2630Yield on Advances 2295 2342 2630Yield on Advances 2295 2342 2630 Yield on Investments 646 705 1066Yield on Investments 646 705 1066 Yield on RBI & Inter Bank 31 11 17Yield on RBI & Inter Bank 31 11 17Yield on RBI & Inter Bank 31 11 17 Yield on Others 0 0 0Yield on Others 0 0 0Yield on Others 0 0 0 Total Interest Income 2972 3057 3713Total Interest Income 2972 3057 3713Total Interest Income 2972 3057 3713 Interest ExpenditureInterest ExpenditureInterest Expenditure Cost of Deposits 1915 1841 2069Cost of Deposits 1915 1841 2069Cost of Deposits 1915 1841 2069 Cost of RBI - Inter-Bank Borrowings 73 83 46Cost of RBI - Inter-Bank Borrowings 73 83 46Cost of RBI - Inter-Bank Borrowings 73 83 46 Cost of Subordinate Debt - Other 0 14 54Cost of Subordinate Debt - Other 0 14 54Cost of Subordinate Debt - Other 0 14 54 Total Interest Expenditure 1988 1938 2169Total Interest Expenditure 1988 1938 2169Total Interest Expenditure 1988 1938 2169 Net Interest Income 984 1119 1544Net Interest Income 984 1119 1544Net Interest Income 984 1119 1544 Non-Interest Income 261 416 365Non-Interest Income 261 416 365Non-Interest Income 261 416 365 Total Income 1245 1536 1908Total Income 1245 1536 1908Total Income 1245 1536 1908 Salaries/Wages 279 366 524Salaries/Wages 279 366 524 Depreciation 33 37 38Depreciation 33 37 38Depreciation 33 37 38 Other operating expenses 160 174 197Other operating expenses 160 174 197Other operating expenses 160 174 197 Pre Provision Profits 774 958 1149Pre Provision Profits 774 958 1149Pre Provision Profits 774 958 1149 Loan loss provisions 56 150 130Loan loss provisions 56 150 130Loan loss provisions 56 150 130 Investment provisions 42 -39 41Investment provisions 42 -39 41Investment provisions 42 -39 41 Other provisions 44 55 44Other provisions 44 55 44Other provisions 44 55 44 Provisions 142 167 215Provisions 142 167 215Provisions 142 167 215 Net Profit before tax 632 792 934Net Profit before tax 632 792 934Net Profit before tax 632 792 934 Income tax 222 279 319Income tax 222 279 319Income tax 222 279 319 Net Profit After Tax 410 513 615Net Profit After Tax 410 513 615Net Profit After Tax 410 513 615 AppropriationsAppropriations Transfer to Statutory Reserve 102 129 154 Appropriations Transfer to Statutory Reserve 102 129 154Transfer to Statutory Reserve 102 129 154 Transfer to Other Reserves 212 259 314Transfer to Other Reserves 212 259 314Transfer to Other Reserves 212 259 314 Equity Dividend 82 107 126Equity Dividend 82 107 126Equity Dividend 82 107 126 Dividend Tax 14 18 21Dividend Tax 14 18 21Dividend Tax 14 18 21 Source: Perception ResearchSource: Perception ResearchSource: Perception Research FY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16E 3394 4318 5763 6830 80593394 4318 5763 6830 80593394 4318 5763 6830 8059 1403 1723 1893 2143 24261403 1723 1893 2143 2426 39 97 95 96 9739 97 95 96 9739 97 95 96 97 0 0 0 0 00 0 0 0 00 0 0 0 0 4836 6137 7751 9069 105834836 6137 7751 9069 105834836 6137 7751 9069 10583 2902 3741 4863 5666 65152902 3741 4863 5666 65152902 3741 4863 5666 6515 41 26 31 34 3641 26 31 34 3641 26 31 34 36 54 54 54 54 5454 54 54 54 5454 54 54 54 54 2997 3821 4948 5753 66052997 3821 4948 5753 66052997 3821 4948 5753 6605 1838 2316 2803 3315 39781838 2316 2803 3315 39781838 2316 2803 3315 3978 334 484 526 571 621334 484 526 571 621334 484 526 571 621 2172 2800 3329 3886 45992172 2800 3329 3886 45992172 2800 3329 3886 4599 521 652 731 818 916521 652 731 818 916 44 50 50 54 5944 50 50 54 5944 50 50 54 59 237 287 301 315 330237 287 301 315 330237 287 301 315 330 1370 1811 2247 2699 32941370 1811 2247 2699 32941370 1811 2247 2699 3294 90 158 217 260 30890 158 217 260 30890 158 217 260 308 12 15 16 19 2112 15 16 19 2112 15 16 19 21 67 111 144 187 24467 111 144 187 24467 111 144 187 244 169 284 377 466 572169 284 377 466 572169 284 377 466 572 1201 1527 1870 2233 27221201 1527 1870 2233 27221201 1527 1870 2233 2722 398 471 617 737 898398 471 617 737 898398 471 617 737 898 803 1055 1253 1496 1823803 1055 1253 1496 1823803 1055 1253 1496 1823 201 264 313 374 456201 264 313 374 456201 264 313 374 456 414 508 601 718 875414 508 601 718 875414 508 601 718 875 162 242 288 344 419162 242 288 344 419162 242 288 344 419 26 41 50 60 7326 41 50 60 7326 41 50 60 73

- 15. Exhibit 26 : Yield on AdvancesExhibit 26 : Yield on AdvancesExhibit 26 : Yield on Advances 40%10000 8059 40%10000 6830 8059 33%8000 6830 29% 33% 30%8000 5763 6830 29% 27% 30%8000 576329% 27% 30% 6000 4318 20% 6000 3394 4318 19% 18% 20% 4000 3394 19% 18% 20% 4000 10.3% 11.0% 12.2% 12.1% 12.1% 10% 4000 10.3% 11.0% 12.2% 12.1% 12.1% 10%2000 10.3% 11.0% 10%2000 0%0 2000 0%0 0%0 FY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16E Yield on Advances Growth % Yield on Advances %Yield on Advances Growth % Yield on Advances % Source: Perception Research Yield on Advances Growth % Yield on Advances % Source: Perception ResearchSource: Perception Research Exhibit 28 : Total Interest Income & NIMExhibit 28 : Total Interest Income & NIMExhibit 28 : Total Interest Income & NIM 40%15000 40%15000 10583 9069 10583 30% 30% 7751 906930% 27% 26% 30% 10000 7751 906927% 26%10000 6137 7751 26% 20% 4836 6137 17% 17% 20% 4836 17% 17% 5000 17% 17% 10% 5000 10% 5000 3% 4% 4% 4% 4% 10% 3% 4% 4% 4% 4% 0%0 3% 4% 4% 4% 4% 0%0 0%0 FY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16E Interest Income Growth % NIM %Interest Income Growth % NIM % Source: Perception Research Interest Income Growth % NIM % Source: Perception ResearchSource: Perception Research Exhibit 30 : Deposits & Cost of depositedExhibit 30 : Deposits & Cost of deposited 7.0%8000 6515 7.0%8000 6515 7.0%8000 5666 6515 6.5% 6.5% 6.5% 6.5% 4863 56666.5% 6.5% 6.5% 6.5%6000 4863 6.5% 6.5% 6.5% 6.5%6000 3741 4863 5.8% 6.0% 2902 3741 5.8% 6.0% 4000 2902 5.4% 5.8% 5.5% 4000 2902 5.4% 5.5%5.4% 5.5% 2000 5.0%2000 5.0% 4.5%0 4.5%0 4.5%0 FY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16E Deposits Cost of deposits %Deposits Cost of deposits % Source: Perception Research Deposits Cost of deposits % Source: Perception ResearchSource: Perception Research Exhibit 27 : Yield on InvestmentExhibit 27 : Yield on InvestmentExhibit 27 : Yield on Investment 40%3000 2426 40%3000 2143 2426 32% 1893 214332% 30% 1723 189332% 30% 2000 1403 1723 23% 2000 1403 23% 20% 23% 20% 13% 13% 20% 1000 10% 13% 13% 10% 1000 10% 13% 13% 6.5% 6.7% 6.5% 6.5% 6.5% 10% 1000 10% 6.5% 6.7% 6.5% 6.5% 6.5% 10% 6.5% 6.7% 6.5% 6.5% 6.5% 0%0 0%0 0%0 FY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16E Yield on Investment Growth % Yield on Investment %Yield on Investment Growth % Yield on Investment % Source: Perception ResearchSource: Perception ResearchSource: Perception Research Exhibit 29 : NII & % to Interest IncomeExhibit 29 : NII & % to Interest IncomeExhibit 29 : NII & % to Interest Income 39%5000 3978 39%5000 3315 3978 4000 331538% 38%4000 2803 331538% 38% 38% 38%4000 2316 280338% 38%3000 1838 2316 38% 37% 3000 1838 2316 37% 37% 2000 1838 37%2000 36% 37% 36% 2000 36% 36%1000 36%1000 35%0 35%0 35%0 FY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16E Net Interest Income NII % to Interest IncomeNet Interest Income NII % to Interest Income Source: Perception Research Net Interest Income NII % to Interest Income Source: Perception ResearchSource: Perception Research Exhibit 31 : Operating Expenses & % to total incomeExhibit 31 : Operating Expenses & % to total income 40%1500 40%1500 37% 35% 40%1500 37% 35% 32% 330 35% 32% 31% 28% 30% 59301 315 33031% 28% 30% 1000 54 59 287 301 315 28%1000 50 54 59 237 287 301 20% 50 50 54 237 287 20% 916 44 50237 500 652 731 818 916 44 10% 500 521 652 731 818 916 10% 500 521 652 731 10% 521 0%0 0%0 0%0 FY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16EFY12A FY13A FY14E FY15E FY16E Salaries Depreciation Otexpenses Op Exp % to total incomeSalaries Depreciation Otexpenses Op Exp % to total income Source: Perception ResearchSource: Perception ResearchSource: Perception Research