The document is a whitepaper for JFinCoin, which aims to create a decentralized digital lending platform and ecosystem to provide financial services to the unbanked and underbanked populations of Southeast Asia. It notes that over 72% of Southeast Asia's population lacks access to basic banking services. The platform will use blockchain technology and smart contracts to enable peer-to-peer lending in a decentralized network, reducing costs and inefficiencies of traditional centralized lending. An Initial Coin Offering of the JFinCoin utility token will raise $20 million to fund the platform's development.

![debt management and collection based in Thailand. This ensures that loan

defaults and non-performing loans (NPL) are taken care of efficiently. Credit

recovery is made through analysis and approval of proper recovery strategies

i.e. restructuring and legal proceedings.

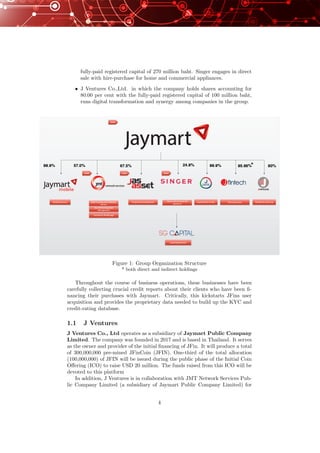

We firmly believe that the competitive advantage of the synergy among our

subsidies will bring forth financial services that will successfully disrupt the

existing financial services in Thailand and around the globe. Crucially, it will

pioneer new approaches in extending financial inclusion to the unbanked and

underbanked in Thailand and the rest of Southeast Asia.

2 The Problem and Opportunities

Over 72% of Southeast Asias population are unbanked or underbanked lacking

access to basic financial services such as cash deposits, money transfers or loans.

The majority of the people in Indochina are no exception, and what is crucially

needed by them are basic banking services such as deposit, withdrawal, and

most importantly micro loans.

However, due to inefficiencies in the current financial system, it is too costly

for established banks to provide such services to the 72% of the population

who remain unbanked or underbanked. Further, all of this assumes that the

applicants have the documents and transaction histories required to apply for a

loan which is seldom the case for those in rural areas with poor records keeping

or migrant workers. According to the Thailand Ministry of Labour, there are

approximately 4 million migrant workers in Thailand.

The traditional loan process is slow and tedious. It requires lot of paperwork

and a long lead time from a day to a month to complete the whole process. The

process includes application, know-your-customer (KYC), credit checking, ap-

proval, and money transfer. In the worst case, after a long wait, the application

may be rejected due to various reasons.

Apart from the prolonged processes, the rejection rates for personal loan is

high. According to Ayudhya Capital Services, the personal loan rejection rate

was at 61% in September 2017. It increased from 57% in the previous month,

due to the new regulation that each person can only take personal loan from a

maximum of 3 companies at a time [3].

With limited access to the money that they need, loan applicants become

desperate and inevitably take higher risks by seeking illegal loans from so-called

loan sharks. These loan sharks mitigate their risks of non-performing loans/bad

debts is by offering loans that charge more than 150% in interest per year which

puts good borrowers at the receiving end while bad borrowers escape through

vaious means. As a result, the household debt in Thailand has been increasing

every year. According to Kasikorn Research Center, household debt in Thailand

is more than 16 trillion baht (0.5 trillion USD)[11].

Additionally, the interest rate gap in financing markets is vast, due to the

fact that banks offer low interest rates for savings account but take high interest

rates for loans. In Thailand, deposit and bond interest rate can be as low as

0.5% per year, compared to the interest rate for a personal loan at 20-28% per

year [10]. Without a good KYC process and centralised or totally decentralised

credit rating system, banks take the most conservative approach (similar to loan

sharks) by increasing the interest rate and letting good borrowers bear the brunt

5](https://image.slidesharecdn.com/jfincoin-whitepaper-180203062649/85/Jfincoin-whitepaper-5-320.jpg)

![Figure 3: JFin Ecosystem

3.1.1 Loan Origination

Loan Origination is a process by which a borrower applies for a new loan, which

typically includes the series of steps taken by the lender/bank from the point the

customer shows interest in a loan product all the way to disbursal of the funds.

The JFin Loan Origination platform will allow borrowers to complete documents

digitally, make online payments, and view their loan status at anytime during

the process.

3.1.2 Credit Scoring

The evaluation of individual loan requests is performed automatically via credit

scoring technique. Each borrower will be determined by the weight and calcula-

tions from the information given as well as their past financial and non-financial

records from other sources, such as payment history, social network interaction,

transaction history in JFin’s DDLP, etc. The information inputs are used for

calculating a maximum total credit limit, interest rate for a specific loan request,

and payment terms. Criteria for calculation of creditworthy of the borrowers

are determined dynamically by machine learning techniques.

Furthermore, as Jaymart has been in the space of consumer sales and finance

for decades, it has collected sufficient data on the ability of repayment for many

individuals (Jaymart customers). This is data that is uniquely Jaymarts and

allows it to develop a non-traditional credit scoring model. With the inclusion of

mobile top up history data, coupled with state-of-the-art machine learning algo-

rithms to better predict their ability for repayment, these individuals now have

their own credit-worthiness encoded in the blockchain, supported by their own

sound data analytics on their historical repayment capabilities, thus allowing

them to borrow effectively at lower interest rates.

Several machine learning and statistics techniques are used to evaluate indi-

vidual credit scoring, for example, k-nearest neighbors-classifier, logistic classi-

fier, and random forest [6][5][7]. We performed back-testings by sampling credit

9](https://image.slidesharecdn.com/jfincoin-whitepaper-180203062649/85/Jfincoin-whitepaper-9-320.jpg)

![The users of JFin are needed to provides KYC documents registered in a

digital form. All the information will be confidentially retained. The informa-

tion will be used to calculate credit scoring once required. The KYC procedures

are a critical function to assess and monitor customer risk and a legal require-

ment to comply with Anti-Money Laundering (AML) laws. After complete the

process, the Wallet ID will then be created.

3.1.9 JFin Wallet Management

JFin Wallet will be created for individual after JFin KYC is completed. It is a

secured digital wallet that holds an amount of funds that allows to be used to

purchase in store, cash out, or pay utility services.

The mobile application includes a JFin wallet that can be used to securely

hold money in various currencies. It has an ability to perform an international

money transfers, simple payments, fast withdrawal payouts and instant online

payments with low fees through the blockchain network.

Money return and collection according to loan terms are done via JFin Wallet

by top-up money back to the wallet prior to the due date. The blockchain

contract will enforce money transfer back automatically via blockchain network.

In case of NPL or loan defaults, debt collection agents will perform necessary

procedures to recover funds that are past due or accounts that are in default,

according to the Debt Collection Act.

3.1.10 JFin Decentralized Network

The JFin Decentralized Network (JDN) is a layer built on top of the blockchain.

The blockchain technology serves as a decentralized and distributed digital

ledger that records every transactions between two parties in the network in

a verifiable and permanent way [1] [8]. Once records are written in the block of

data, they cannot be altered retroactively without the alteration of all blocks

prior to the current block. Blockchains are secure by design and are an ex-

ample of a distributed computing system with high Byzantine fault tolerance.

Decentralized consensus has therefore been achieved with a blockchain[12].

We implement smart contracts in order to operate a lending service. Smart

Contracts are self-executing contracts written into lines of code to ensure the

terms and agreement between two parties. The code and the agreement are

contained and distributed in the JDN network. Smart Contracts allow transac-

tions and agreements to be carried out in a trust manner on trust-less networks

and parties. They deliver transactions with transparency, trace-ability, and

permanence[13].

We will use Tendermint or other proof-of-stake algorithms as a consensus

engine in the JDN that enables Byzantine fault tolerance on machines spread

across the globe, with strong security guarantees [4]. One possible example

is the use of Tendermint. Tendermint consensus algorithm provides benefit

such as speed, security, and scalability, as opposed to using Proof-Of-Work

systems, [2] [9]. Tendermint blocks can commit to finality in the order of 1

second. TendermintCore can handle transaction volume at the rate of 10,000

transactions per second for 250byte transactions. The algorithm can scale to

hundreds or thousands of validators unlike Proof-Of-Work technique [4].

12](https://image.slidesharecdn.com/jfincoin-whitepaper-180203062649/85/Jfincoin-whitepaper-12-320.jpg)

![References

[1] Blockchain. Investopedia URL: https://www.investopedia.com/terms/b/blockchain.asp.

Retrieved 2017-01-01.

[2] Byzantine consensus algorithm. URL:

https://github.com/tendermint/tendermint/wiki/Byzantine-Consensus-

Algorithm. Retrieved 2017-12-01.

[3] Personal loan rejection rate soars from new regulation from bot. URL:

https://www.posttoday.com/economy/finance/514932. Retrieved 2017-12-

01.

[4] Tendermint. URL: https://github.com/tendermint/tendermint/wiki/. Re-

trieved 2017-12-01.

[5] N. S. Altman. An introduction to kernel and nearest-neighbor nonpara-

metric regression. The American Statistician, 46(3):175–185, August 1992.

[6] David A. Freedman. Statistical Models: Theory and Practice. Cambridge

University Press, 2009.

[7] Tin Kam Ho. Random decision forests. Proceedings of the 3rd International

Conference on Document Analysis and Recognition, Montreal, QC 14-16,

page 278282., 1995.

[8] Karim R. Iansiti, Marco; Lakhani. The truth about blockchain, January

2017.

[9] Jae Kwon. Tendermint: Consensus without mining. Draft v. 0.6, fall, 2014.

[10] Bank of Thailand. Interest rate statistic. URL:

https://www.bot.or.th/thai/statistics/ layouts/application/interest rate/in rate.aspx.

Retrieved 2017-12-01.

[11] The Secretariat of the House of Representatives. Loan shark issues and

way to overcome. Hot Issue, 2016.

[12] Siraj Raval. Decentralized Applications: Harnessing Bitcoin’s Blockchain

Technology. O’Reilly Media, Inc., 2016.

[13] Melanie Swan. Blockchain: Blueprint for a New Economy. O’Reilly Media,

Inc., 2015.

23](https://image.slidesharecdn.com/jfincoin-whitepaper-180203062649/85/Jfincoin-whitepaper-23-320.jpg)