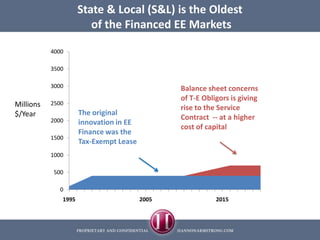

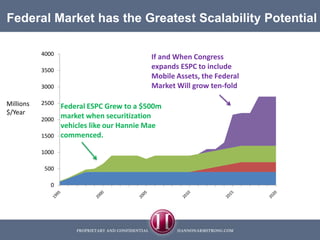

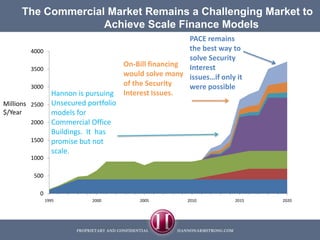

Hannon Armstrong Capital, an investment and merchant bank, focuses on financing energy efficiency and infrastructure projects in the U.S. The document discusses various financing innovations, including tax-exempt leases and the potential expansion of federal energy savings performance contracts (ESPC) to increase market scalability. Hannon is exploring unsecured portfolio financing for commercial buildings, although challenges remain in achieving significant scale.