ISM_Magazine_JuneJuly_2015

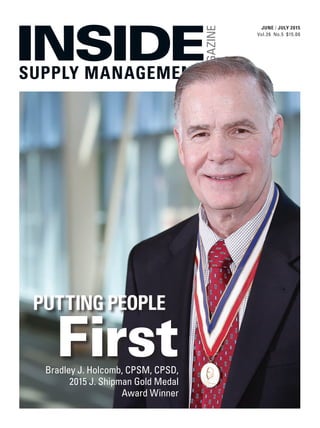

- 1. JUNE | JULY 2015 Vol.26 No.5 $15.00 First PUTTING PEOPLE Bradley J. Holcomb, CPSM, CPSD, 2015 J. Shipman Gold Medal Award Winner

- 2. This distinguished award recognizes our highest performing suppliers for their demonstrated commitment to quality, patient care, and continuous improvement. AT&S of Leoben, Austria Nolato MediTech of Hörby, Sweden Welch Fluorocarbon, Inc of Dover, NH, USA Congratulations To Boston Scientific’s 2014 Rhythm Award Winners All trademarks are property of their respective owners. © 2015 Boston Scientific Corporation or its affiliates. All rights reserved. INGEVITYTM PACING LEAD ACCOLADETM PACEMAKER S-ICDTM SYSTEM DYNAGENTM X4 CRT-D RHYTHMIATM MAPPING SYSTEM S-ICDS-ICDS-ICD BSC_8.375X11.125_ad_FINAL AD_ISM_MDDI.indd 1 4/14/15 4:20 PM00 Cov June_July15.indd 2 5/19/15 10:24 AM

- 3. ISM June | July 2015 1 26 12 Manufacturing The latest PMI® and manufacturing indexes. 13 Non-Manufacturing The latest NMI® and non- manufacturing indicators. 14 Global Business Trends International news items and indicators, plus a market trends report. Report On Business® Features COVER STORY 16 Putting People First Bradley J. Holcomb, the 2015 J. Shipman Gold Medal Award winner, measures his career by the success of those he has mentored and guided. By Mary Siegfried 22 Supply Management’s Rising Stars Meet the eight extraordinary students who are this year’s recipients of the R. Gene Richter Scholarship Awards. 26 ISM Mastery Model™ — Put Your Future First Build your next generation of talent, and strengthen your core team with the ISM Mastery Model™ . By Cecilia Mendoza and John Yuva 22 16 CoverphotobySergioDabdoub 01-03 TOC June_July15.indd 1 5/19/15 2:20 PM

- 4. ISM June | July 20152 4 In This Issue Passion for Procurement By John Yuva 8 Career ROI A Career Path in Demand By Jason Breault 10 Critical Skills Is There a Gorilla in Your Midst? By Stephanie Kessler Thayer 30 CAPS Research A Tool to Monitor Supply Chain Risk By CAPS Research Team 32 Tapping Into … Building a Future Talent Pool By Jerrett J. Chambers Departments 6 Just in Time News, notes and quotes — just when you need them. 34 NewsLine ISM® member and volunteer news. 36 Point to Point Focus on supply chain logistics. Columns ISM® Publishing Staff Thomas W. Derry Chief Executive Officer Tony Conant Chief Operating Officer Advertising Kelly Rich Account Manager krich@instituteforsupplymanagement.org Editorial John Yuva Managing Editor jyuva@instituteforsupplymanagement.org Lisa Arnseth Mary Siegfried Senior Writer Senior Writer Lisa Wolters-Broder Senior Copy Editor/Staff Writer Kristina M. Cahill ROB Media Relations Production & Design James Cain Art Director Inside Supply Management® (ISSN #1538-733X) is published 9 times a year (January/ February, March, April, May, June/July, August, September, October, November/December) by the Institute for Supply Management,® 2055 E. Centennial Circle, Tempe, Arizona 85284. Telephone: 480/752-6276, extension 3071 (Editorial), extension 3043 (Advertising). Copy- right ©2015 by the Institute for Supply Management® . All rights reserved. ISM® affiliates may reprint articles in their newsletters and magazines with credit given to Inside Supply Management® and author, unless noted otherwise within article. Requests for reprints by nonaffiliates must be approved by ISM® . Please send requests to the address above. Preferred Periodicals Postage paid at Tempe, Arizona, and additional mailing offices. POST- MASTER: Send address changes to: Inside Supply Management® , 2055 E. Centennial Circle, Tempe, Arizona 85284 or email to custsvc@instituteforsupplymanagement.org. Publications Mail Agreement Number 40048267. Send return addresses to: Canadian Institute for Sup- ply Management™ , c/o Global Prime Office Network, 130 King St. W Ste. 1800, Toronto, ON, M5X 1E3. Inside Supply Management® is the official publication of the Institute. ISM® members receive the publication as part of their membership fee which represents $24 of their total fee. This fee is non-deductible from membership dues. Subscriptions to university and public libraries are $48 annually. Single copies are available for $15. The authors of the articles published in Inside Supply Management® are solely responsible for their accuracy and content. Opinions expressed in the articles and materials published herein do not reflect the opinions of ISM® unless it is expressly stated that such opinions have been formally ad- opted by ISM® . The publication of an advertisement by Publisher is not an endorsement of the advertiser nor the products or services advertised. Publisher assumes no responsibility for claims or statements made in an advertisement. Institute for Supply Management® 2055 E. Centennial Circle, Tempe, AZ 85284 Phone: 800/888-6276 (U.S. or Canada) or +1 480/752-6276 (all others) Fax: +1 480/752-7890 www.instituteforsupplymanagement.org 01-03 TOC June_July15.indd 2 5/19/15 2:20 PM

- 5. wheels.com Results are about more than just your bottom line. At Wheels, we distill big data down to actionable information. This enables continuous improvement in ways that drive real results to your business. By combining proprietary tools with a focus on both your fleet and your drivers, we deliver optimal fleet performance year after year. Find out more at wheels.com Optimized Fleet. Real Results. PRODUCTIVITY 01-03 TOC June_July15.indd 3 5/19/15 10:24 AM

- 6. ISM June | July 20154 In this Issue from the managing editor By John Yuva Editor D id you have an opportunity to attend ISM2015 this year? There were many great sessions, several of which were blogged by our editorial team at http://magazine.ism.ws. The keynote sessions with Dr. Robert Gates, former U.S. Secretary of Defense, and Sallie Krawcheck, owner of Ellevate, were particularly insightful. Among Gates’ remarks surrounding international issues, military capa- bilities and investment, and the upcoming presidential campaign was his optimism for the future. “The thing that makes me feel the most optimistic about this country is the extraordinary quality of our young people,” says Gates. “They are smart and they care about a lot of things.” This outlook bodes well for the procurement and supply management profession, where an influx of millennials are gracing the doorsteps of many companies. And it’s no surprise to hear Gates tout the younger generation’s commitment to causes and ideals. It’s particularly important for companies to embrace such attributes with increased regulations around corporate social responsibility and community stewardship. Krawcheck delivered an empowering speech with key messages for attracting and retaining millennials and women in their organizations. “The power of diversity is diversity,” says Krawcheck. Without differing opinions and viewpoints, companies are limiting their ability to innovate. And that limitation is having an impact on talent attraction and retention. Speaking of talent, it’s a common storyline from seasoned supply man- agement practitioners — few entered the profession intentionally, with many finding their passion for procurement by happenstance. However, millennials are making the conscious decision to choose supply management and supply chain as their career of choice. And better yet, they’re giving back to the pro- fession at an early age. I had the pleasure of meeting several winners of the “30-Under-30 Rising Supply Chain Stars” program, including megawatt winner Katy Conrad Maynor. These young professionals have accomplished amazing things in such a short time. It’s impressive and should be commended. What struck a chord, however, is how many are serving as mentors for others entering the profession. It goes to show that regardless of your tenure in supply manage- ment, you can make a difference. While we may not all become J. Shipman Gold Medal winners, we can embody the spirit and dedication of the award and make a difference in the lives of others. ISM PassionforProcurement During ISM2015, a repeating message was the value of young profes- sionals and their commitment to the profession. Jami Bliss, CPSM Teva Pharmaceuticals Joe Cavinato, Ph.D. Thunderbird School of Global Management Bill Dempsey Molson Coors Ric Freeman, C.P.M. Tempur Sealy International Todd Genovese Home Depot Jerry Miller, CPSM, CPSD Capital One Services Tom Mulherin JDA Software Group Brian Schulties, C.P.M. Prysmian Group Joel Sutherland University of San Diego Ron Wilson, CPSM, C.P.M. Wilbur Curtis Company ISM® Editorial Advisory Board 04-05 Editor June_July15.indd 4 5/19/15 2:22 PM

- 7. ISM June | July 2015 5 Don’t just succeed in supply chain, master it. A path to mastery designed just for you When it comes to mastery, one size does not fit all. Achieve professional excellence with the ISM Mastery Model™ , a personalized curriculum designed to propel your career in supply man- agement. Use the 16 competencies and 69 sub-competencies to discover your key knowledge gaps.Then, choose the right ISM programs to cultivate a strategic learning path that will refine your supply management skills. Visit www.instituteforsupplymanagement.org to access the ISM Mastery Model™ . 04-05 Editor June_July15.indd 5 5/19/15 10:25 AM

- 8. ISM June | July 20156 Just in Time news, notes & quotes — just when you need them W hen assessing areas of risk facing their depart- ments, 45 percent of CPOs say supplier risk is a top concern, according to a new survey by Consero Group (http://consero.com) as part of its 2015 Global Procurement & Strategic Sourcing Data Survey. In addition, 64 percent don’t believe they have enough access to necessary resources to manage their operations effectively. And 72 percent don’t see a sufficient pool of trained procurement talent available to support their hiring needs. Additional findings Include: • Cost reduction is their top priority. Forty percent of CPOs say it’s their top priority for 2015. • Metrics drive the wrong behavior. Sixty-three percent think certain metrics used to evaluate procurement drive the wrong behavior in their organizations. • Sustainability programs are working. Forty-nine percent say they’ve achieved tangible cost reductions through sustainability programs, up from 33 percent in 2014. P rocurement’s Key Priorities in 2015: Harnessing Big Data and Renewing Training Programs to Promote Enterprise Agility, a new study from The Hackett Group, finds that, for 2015, the top priority of procurement organizations is to become a trusted adviser in support of improved enterprise agility. But it’s also one of several areas where procurement organizations currently have a low ability to meet their own objectives. The study recommends procurement organizations invest in new capa- bilities, particularly in the areas of talent management and analytics/big data. While most have already implemented basic reporting and data access capa- bilities, their use of next-generation analytics, such as multidimensional anal- ysis, remains limited. Only a few are using sophisticated techniques such as predictive modeling, risk analysis and data mining — meaning there’s more room for growth for everyone in these areas. A complimentary version of the study is available at www.thehackettgroup. com/research/2015/pr/keyissuespr15. Your Suppliers Still Put You at Risk Procurement as a Trusted Adviser “You miss 100 percent of shots you don’t take.” Wayne Gretzky Hockey Player/Coach CommOddities Crab Tell me about crab, the com- modity … Prices rise or fall with the tides of supply and demand to meet a consumer appetite of 1.5 million tons per year. Crab comprises one-fifth of all sea creatures caught worldwide. Where does it come from? The “spiders of the sea” are found and netted almost everywhere in the ocean, by every country. What’s it used for? Food — with the Japanese Blue Crab the most popular dinner-plate fare. And that’s a fact. Sometimes a crab really isn’t a crab: Hermit crabs, king crabs, porcelain crabs, horseshoe crabs and crab lice aren’t actually crabs despite their claim to the name. Hardy crab species can live in smoking volcanic vents thousands of feet below the surface and under Antarctic ice. One species even lives on land and climbs trees ( p l e a s a n t dreams). June | July 2015 ysis, remains limited. Only a few are using sophisticated techniques such as com/research/2015/pr/keyissuespr15. Antarctic ice. One species even lives on land and climbs trees ( p l e a s a n t 06-07 JIT_June15.indd 6 5/19/15 10:25 AM

- 9. 7 ODE TO A PURCHASING AGENT The fellow stood at the golden gate His head was bent and low, He meekly asked the man of fate The way that he should go. “What have you done,” St. Peter asked, “To gain admittance here?” “I’ve been a purchasing agent,” he said, “For many and many a year.” St. Peter opened wide the door And gently pressed the bell, “Go right in and choose your harp,” he said, “You’ve had your share of hell.” —Doug Boone, Southwestern Purchasing Agent, December 1965 Warehouses: essential evil? New York: Warehouses are a headache but we can’t live without them. So said E. Ralph Sims Jr., general manager of E. Ralph Sims Jr. & Associates, management consultants. After all, Sims noted, warehousing is “a reflection of management’s ability to schedule materials.” Sims went on to point out how automation can aid in the solution of some warehousing problems. Potential sources of high expense can be located by simulation, for example. … When the time comes to take the material off the shelf, the computer helps by separating full-pallet from odd-pallet shipments. — Purchasing Week, December 5, 1966 We read of corporate success stories, also of great technological and scientific improve- ments. I believe that the purchasing profession has a very important role to play in this era of challenge, providing we can qualify ourselves and take an active part in leading the way along these avenues of economic advancement. — Donald L. Harwood, President, P.A.A. of Chicago, The Bulletin of the National Association of Purchasing Agents, September 14, 1960 U.S. buyers see Red Washington: Don’t look now. But the platinum, palladium, rhodium, or chromium you’re using may well be carrying a “made in Russia” stamp. Sparked by Free World shortages—and in some cases by lower prices— American industry has been turning more and more to Communist lands to meet its import needs. In the past six years, while Free World nations have hiked their sales to American buyers by a respectable 68%, the Reds have scored an 87% gain. — Purchasing Week, September 5, 1966 Management Views the Credibility Gap Mr. R V. Hansberger, president, Boise Cascade Corporation … stated the changes which have occurred in this country in the last decade or so threaten to change the entire image of America as the world leader whose success has become a hallmark for future history. … The other reason for bringing this subject to purchasing men, he explained, is because they are leaders in the business community, knowing the inner workings of free and private enterprise—and private enterprise is the only group left to concern itself with credibility gaps. Purchasing people, he said, are well qualified to take on the awesome problems as any group in our society today. — The Bulletin of the National Association of Purchasing Agents, June 19, 1968 Another local association has strengthened its relationship with a neighboring university by working out a specific co-operative agreement. We are always glad to hear evidence of the development of good working arrangements between N.A.P.A. affiliated associations and universities. It is through such arrangements that good purchasing education can be established on a permanent basis. — The Bulletin of the National Association of Purchasing Agents, May 15, 1963 ISM June | July 2015 A Moment in Time The 1960s U.S. buyers see Red Washington: meet its import needs. In the past six years, while Free World nations have hiked their sales to American buyers by a respectable 68%, the Reds have scored 06-07 JIT_June15.indd 7 5/19/15 2:23 PM

- 10. Career ROI the path to leadership ISM June | July 20158 A s you move upwards along your career path in supply management, it can help to look for a niche that needs to be filled, and position yourself as the one who can best fill it. There are always those areas where more supply management expertise is needed — such as demand planning. As a supply chain recruiter for the past nine years, I’ve seen trends come and go. When I first started out, people I trusted said I should be recruiting in the area of international logistics. It seemed that everyone was outsourcing production to places like China. We saw many universities expanding their language-major offerings to include Chinese. This was a great path to getting high-level exposure earlier than usual. However, the need for this skill set has leveled off. There are other trends like this that were hot and then not. However, when it comes to an area of supply management that allows a newer graduate or practitioner to gain exposure and open doors early in their career, a good place to start is in demand planning. What Is Demand Planning? The ISM Glossary of Key Supply Management Terms (www. instituteforsupplymanagement. org/glossary) defines demand plan- ning as “the function of identifying demands for products and ser- vices to support the marketplace. Demand planning encompasses the activities of forecasting, order planning and determining outside warehouse requirements, produc- tion balancing and spare parts.” And the Glossary defines the area of demand management as “(1) the proactive compilation of requirements’ information regarding demand (i.e., customers, sales, marketing, finance) and the firm’s capabilities from the supply side (i.e., supply, operations and logistics management); (2) the development of a consensus regarding the ability to match the requirements and capabilities; and (3) the agreement upon a synthe- sized plan that can most effectively meet the customer requirements within the constraints imposed by supply chain capabilities.” How the Great Recession Helped My eyes really opened to this new niche in the 2009 to 2010 time frame. In the run up to the Great Recession, many compa- nies became fat, dumb and happy. As they kept making things, con- sumers kept buying them and everyone thought this was the new norm. Then the recession hit. When everyone awoke from their recessionary hangovers, compa- nies quickly realized looking into the future required greater respon- sibility. Cash was king again, with the forecast serving as the leading indicator of a good cash posi- tion. Therefore, demand planners gained a more prominent role in companies. Surprisingly, few companies at the time had a strong demand plan- ning process in place. These com- panies realized that they missed signs that others hadn’t. To remedy this, they built up demand planning teams — offering much better job A Career Path in Demand Supply management trends may come and go, but there’s one area where your talent will always be indispensable — and that offers room for growth. By Jason Breault 08-09 Career ROI June15.indd 8 5/19/15 10:25 AM

- 11. ISM June | July 2015 9 security than other areas of supply management. Ten-plus years ago, forecasting was all about number-crunching. One person with really strong analytical skills would analyze data from various areas. He or she was often stereotyped as an introvert, with limited people skills. Somebody else would then take that output to drive business decisions. That has all changed. Now demand planners are expected to have those same analytical skills as well as the soft skills to help drive business decisions — lever- aging both the left and right brain. Whereas a forecast analyst in the past primarily looked at historical data, a demand planner is now expected to work cross-function- ally with sales, marketing, product development, finance and other parts of the supply chain. And, in some instances, work with cus- tomers. In some industries, this might be weekly interactions or a monthly cycle in others. Regardless, the exposure within the organization is tremendous when compared to the roles in other parts of the supply chain that are more siloed. Big Data’s Effect on Future Demand Planning Two years ago, I attended a roundtable at the Massachusetts Institute of Technology that included 50 executives from 25 companies. In each case, there were supply chain executives and their highest-ranked human- resources representative who directly supported the function. Topics included talent acquisition, development and retention. During one of the discussions, concerns for the future came up. Many compa- nies shared their concern about a lack of promotable supply chain talent with solid analytical and presentation skills. Sound familiar? Two years later, I better under- stand their concern. With the advent of big data, more parts of the supply chain and the organiza- tion have access to huge data sets that they’re trying to make sense of. Similar to the evolution from forecasting to demand planning, many other parts of supply chain now have individuals with strong analytical skills, but who lack pre- sentation skills. So, where are they pulling much of their talent from? You guessed it. Fifty percent of the demand planning roles we recruited in 2014 were open because the com- panyhadpromotedthedemandplan- ners to another part of the business. Demand planning as a career is ever-evolving. We’re even seeing more and more vice-president-level roles in this area. Whether you aspire to make a lifetime commit- ment to a career in demand plan- ning, or simply use it as a stepping stone along your supply manage- ment career path, after nine years of recruiting in this space — and seeing the constant ups and downs in other parts of supply chain — I remain convinced that this is the best place to propel your supply management career forward. ISM Jason Breault is managing director and supply chain recruiter for LifeWork Search in Westport, Massachusetts. We’re waiting for your story. Your magazine. Your knowledge. Your stories. Contact JohnYuva, managing editor of Inside Supply Management® 800/888-6276, extension 3021 or jyuva@instituteforsupplymanagement.org 08-09 Career ROI June15.indd 9 5/19/15 10:25 AM

- 12. 10 ISM June | July 2015 A s part of a 2013 Harvard Medical School study, a team of radiologists scrutinized an X-ray of a lung, poring over details, even- tually giving the lung a clean bill of health. The doctors were cor- rect: The X-ray showed a healthy lung. However, for this study, an image of a cartoon gorilla the size of a matchbook — visible to the naked eye — was added to the X-ray. Even as they scrutinized nooks and crannies of the image, seeking out known abnormalities, 83 percent noted nothing out of the ordinary. Due to “inattentional blindness,” they simply missed the gorilla because they were looking for something else. Databases and enterprise resource planning (ERP) systems house invaluable business data that supply management practitioners use to inform purchase orders, requisitions, forecasts and more. The maintenance of these data is extremely important for daily operations, as data are especially vulnerable when shifting from one system to another. What goes unnoticed can have a tremendous effect on the department and the company at large. Incongruities, much like the gorilla, are often unseen — missed completely because experts in supply chain often know exactly what they’re searching for, and are not actively seeking new interpretations of the data. An Accurate, Effective Review Process So, how do you determine if there is an opportunity for better efficiency and/or accuracy in your data? First, consider which reports and data sets you use frequently and where the data are pulled from. Review reports critically, seeking outliers and abnormalities, and identify precisely how each report is used within the company. As this is a small-scale internal audit, break the system down into pieces that make the most sense for the operation. The best way to do this may be to sort by supplier or item type. Begin the review pro- cess from a high level and note the number of items in each category. Compare common reports run within the department to confirm all necessary data are captured based on the aggregate list. If the number of records is significantly different, dive deeper and compare more thoroughly to identify, and potentially close, the gap. Over the past decade, many companies underwent mergers and acquisitions — events that have likely affected data within the system. Thus, it is wise to con- firm which primary and secondary supplier is listed for each item, and verify active business. Here’s a fictional example: Acme Corp. was purchased by Beta Inc. in 2009. Both were sep- arate suppliers to your company prior to this acquisition, so the database had items listed as one supplier or the other. When Acme was absorbed by Beta in 2009, a problem arose because items Acme supplied were not updated to show Beta as the supplier within the sup- plier’s database. Since then, as Beta Critical Skills fine-tuning your fundamentals Is There a Gorilla in Your Midst? By taking time to closely analyze and validate data, it’s possible to uncover supplier risks and opportunities that may have been hiding in plain sight. By Stephanie Kessler Thayer 10-11 Critical Skills June_July15.indd 10 5/19/15 2:24 PM

- 13. ISM June | July 2015 11 Inc. receives forecasts, or when the internal supply chain team reviews net requirements for Beta, items listed with Acme products do not populate, leaving out potentially valuable information. To identify incongruities with suppliers within the system, start with the sorted supplier list and cross-reference it with two to three years of historical accounting or purchase-order data to confirm the existence of the majority of the companies on the list. Performing a v-lookup in Excel is an efficient way to compare the data — though it seeks exact matches. A supplier may have been listed as “Alpha Inc” and “Alpha Inc.” within the system, and the formula will note them as different companies because of the inconsistency with the period after “Inc.” In such cases, a manual review may identify inconsisten- cies otherwise missed. A member of the procurement team is the best person to perform this task, because he or she will have knowl- edge of the current supply base and any recent changes as they scrub the supplier section of the database. This is an opportunity to val- idate or update supplier data pending team approval. This effort should add value to your reporting, as it offers a more complete list of forecast items for a supplier, may improve the relationship with the supplier and may potentially create volume discounts should the fore- cast quantity increase. Using the list of suppliers without recent interactions, cross-reference active items within the system marked as supplied by that supplier. Next, confirm the primary supplier for each item or category, and verify price and lead time with the supplier of note. To perform the update, most systems allow bulk uploads, or data rewrites using Excel, in lieu of manually updating hundreds or thousands of lines. An important note: It’s best to export and save the original data from the system prior to the upload, as some ERP systems require dele- tion and re-creation of sets rather than a simple rewrite. The saved export of the data will not only inform the template for the bulk upload, but also in the event that there is a problem and the data needs to be restored, the data are available and uncorrupted. Using the Best Possible Forecasting Method There are many forecast methods available, including net requirement, forecast versus usage, and others, and it is important to know which is used, how it is used in the company and why it was selected. Because spe- cific algorithms are used within the system to create forecasts, you should know how to set parame- ters manually for individual items and classes to solve for and resolve discontinuity in the future. As part of your review of fore- casting information and methods, take time to examine actual versus forecast data to verify the most accurate forecast is used going for- ward. Purchasing teams often need to make educated estimates based on historical usage, seasonality, marketing initiatives, and cost spikes in materials and finished goods. By knowing which factors inform pur- chasing decisions, the team can rec- ognize if the forecasts are realistic, adjust as needed for future demand and justify decisions to leadership in case an anomaly occurs. A few years ago, a Fortune 500 company suffered from inaccurate forecasts each month. This resulted in production planning issues, back orders and, ultimately, lost sales. After years of ongoing issues, the team searched for explanation for the errors and found that the common — though flawed — net requirement forecasting method considered planned work orders, finished goods, raw materials and current inventory when creating estimates 120 days out. Though this forecast held some value, the historical data were only available from the current fiscal year and, unfortunately, were not pulling accurate sales data. There was also a forecast versus usage report that offered a forecast number for 12 months as well as usage from the trailing 12 months of actual sales — this report did not consider inventory, but did allow for greater purchasing power. The supply management team saw value in both reports and implemented a hybrid forecasting method. This new forecasting method allowed them to plan accu- rately for sales increases, correct production issues and improve supplier relationships. Following this success, other areas of the business soon adopted the hybrid forecasting method. If you’re ready to find your company’s hidden gorilla, it will take time to do it correctly. Given the analytical nature of a validation project, it can be benchmarked and completed by one person or broken into sections for different individ- uals to manage over time when there are seasonal lulls in regular workloads. As with any project, maintain excellent communica- tion with the team at large, gather input and consider multiple courses of action prior to making an enter- prisewide decision. With careful and thorough attention to detail, this exercise will prove that risks and potential areas of opportunity can be found right in plain sight. ISM Stephanie Kessler Thayer is spe- cial projects manager for Carr Lane Manufacturing in St. Louis. 10-11 Critical Skills June_July15.indd 11 5/19/15 10:26 AM

- 14. ISM June | July 201512 ISM ® Report On Business® manufacturing Analysis by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® Manufacturing Business Survey Committee. Manufacturing at a Glance INDEX Apr Index Mar Index % Point Change Direction Rate of Change Trend* (months) PMI® 51.5 51.5 0.0 Growing Same 28 New Orders 53.5 51.8 +1.7 Growing Faster 29 Production 56.0 53.8 +2.2 Growing Faster 32 Employment 48.3 50.0 -1.7 Contracting From Unchanged 1 Supplier Deliveries 50.1 50.5 -0.4 Slowing Slower 23 Inventories 49.5 51.5 -2.0 Contracting From Growing 1 Customers’ Inventories 44.0 45.5 -1.5 Too Low Faster 5 Prices 40.5 39.0 +1.5 Decreasing Slower 6 Backlog of Orders 49.5 49.5 0.0 Contracting Same 2 Exports 51.5 47.5 +4.0 Growing From Contracting 1 Imports 54.0 52.5 +1.5 Growing Faster 27 Overall Economy Growing Same 71 Manufacturing Sector Growing Same 28 PMI ® at 51.5% PMI® Manufacturing expanded in April as the PMI® registered 51.5 percent, indicating growth in manufacturing for the 28th consecutive month. A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting. A PMI® in excess of 43.1 percent, over a period of time, generally indicates an expansion of the overall economy. Therefore, the April PMI® indicates growth for the 71st consecutive month in the overall economy. E conomic activity in the manufacturing sector expanded in April for the 28th consecutive month, and the overall economy grew for the 71st consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business® . The April PMI® registered 51.5 percent, the same reading as in March. The New Orders Index reg- istered 53.5 percent, an increase of 1.7 percentage points from the reading of 51.8 percent in March. The Production Index registered 56 percent, 2.2 percentage points above the March reading of 53.8 percent. The Employment Index registered 48.3 percent, 1.7 per- centage points below the March reading of 50 percent, reflecting contracting employment levels from March. While the March and April PMI® were equal, both reg- istering 51.5 percent, 15 of the 18 manufacturing industries reported growth in April while only 10 indus- tries reported growth in March, indicating a broader distribution of growth in April among the 18 industries. The 15 industries reporting growth in April — listed in order — are: Nonmetallic Mineral Products; Plastics & Rubber Products; Wood Products; Printing & Related Support Activities; Furniture & Related Products; Fabricated Metal Products; Food, Beverage & Tobacco Products; Paper P r o d u c t s ; Mi s c e llan e o u s Manufacturing‡; Machinery; Transportation Equipment; Textile Mills; Electrical Equipment, Appliances & Components; Chemical Products; and Primary Metals. ISM New Orders and Production Growing; Employment and Inventories Contracting; Supplier Deliveries Slowing PMI 51.5% 43.1% = Overall Economy Breakeven Line 50% = Manufacturing Economy Breakeven Line 201520142013 Commodities Reported Commodities Up in Price: The only commodity listed up in price for the month of April is Freight. Commodities Down in Price: Aluminum (5); Carbon Steel (4); Crude Oil; Nickel (4); Plastic Resin (5); Polypropylene Resin; Scrap Steel (5); Stainless Steel (6); Steel (5); Steel – Cold Rolled (2); and Steel – Hot Rolled (6). Commodities in Short Supply: There were no commodities listed in short supply for the month of April. ‡MiscellaneousManufacturing(productssuchasmedicalequipment and supplies, jewelry, sporting goods, toys and office supplies). April 2015 Note: The number of consecutive months the commodity is listed is indicated after each item. *Reported as both up and down in price. *Number of months moving in current direction. Manufacturing ISM® Report On Business® data is seasonally adjusted for the New Orders, Production, Employment and Supplier Deliveries Indexes. 12-13 ROB_June15.indd 12 4/29/15 9:30 AM

- 15. ISM June | July 2015 13 ISM ® Report On Business® non-manufacturingAnalysis by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® Non-Manufacturing Business Survey Committee. Non-Manufacturing at a Glance INDEX Apr Index Mar Index % Point Change Direction Rate of Change Trend* (months) NMI® 57.8 56.5 +1.3 Growing Faster 63 Business Activity 61.6 57.5 +4.1 Growing Faster 69 New Orders 59.2 57.8 +1.4 Growing Faster 69 Employment 56.7 56.6 +0.1 Growing Faster 14 Supplier Deliveries 53.5 54.0 -0.5 Slowing Slower 6 Inventories 51.0 49.5 +1.5 Growing From Contracting 1 Prices 50.1 52.4 -2.3 Increasing Slower 2 Backlog of Orders 54.5 53.5 +1.0 Growing Faster 3 New Export Orders 48.5 59.0 -10.5 Contracting From Growing 1 Imports 51.5 55.5 -4.0 Growing Slower 3 Inventory Sentiment 59.5 61.0 -1.5 Too High Slower 215 Overall Economy Growing Slower 69 Non-Manufacturing Sector Growing Slower 63 NMI ® at 57.8% NMI® In April, the NMI® registered 57.8 percent. An NMI® in excess of 48.7 percent, over a period of time, generally indicates an expansion of the overall economy. Therefore, the April NMI® indicates growth for the 69th consecu- tive month in the overall economy, and indi- cates expansion in the non-manufacturing sector for the 63rd consecutive month. The past relationship between the NMI® and the overall economy indicates that the NMI® for April (57.8 percent) corresponds to a 3.9 percent increase in real gross domestic product (GDP) on an annualized basis. E conomic activity in the non-manufacturing sector grew in April for the 63rd consecutive month, say the nation’s purchasing and supply executives in the latest Non- Manufacturing ISM® Report On Business® . The NMI® registered 57.8 per- cent in April, 1.3 percentage points higher than the March reading of 56.5 percent. This rep- resents continued growth in the non-manufacturing sector. The Non-Manufacturing Business Activity Index increased substan- tially to 61.6 percent, which is 4.1 percentage points higher than the March reading of 57.5 percent, reflecting growth for the 69th consecutive month at a faster rate. The New Orders Index regis- tered 59.2 percent, 1.4 percentage points higher than the reading of 57.8 percent registered in March. The Prices Index decreased 2.3 percentage points from the March reading of 52.4 percent to 50.1 per- cent, indicating prices increased in April for the second consecutive month, but at a slower rate. The 14 non-manufacturing industries reporting growth in April — listed in order — are: Arts, Entertainment & Recreation; Real Estate, Rental & Leasing; Management of Companies & Support Services; Transportation & Warehousing; Wholesale Trade; Finance & Insurance; Utilities; Health Care & Social Assistance; Agriculture, Forestry, Fishing & Hunting; Public Administration; Retail Trade; Accommodation & Food Services; Construction; and Educational Services. ISM Business Activity Index at 61.6%; New Orders Index at 59.2%; Employment Index at 56.7% NMI (Non-Manufacturing) 57.8% 201520142013 48.7% = Non-Manufacturing Economy Breakeven Line Commodities Reported Commodities Up in Price: Beef (6); Chicken (2); #1 Diesel Fuel (4); #2 Diesel Fuel*; Fuel (3); Gasoline* (4); IV Solutions; and Paper (2). Commodities Down in Price: Dairy (3); #2 Diesel Fuel*; Gasoline*; Medical Supplies; Monitors; Pork; Services Labor; and Steel Products. Commodities in Short Supply: Medical IV Solutions (16); Pharmacy Drugs (2); and Services Labor (3). April 2015 Note: The number of consecutive months the commodity is listed is indicated after each item. *Reported as both up and down in price. *Number of months moving in current direction. Non-Manufacturing ISM® Report On Business® data is seasonally adjusted for the Business Activity, New Orders, Prices and Employment Indexes. ✣Other Services (services such as Equipment Machinery Repair- ing; Promoting or Administering Religious Activities; Grantmaking; Advocacy; and Providing Dry-Cleaning Laundry Services, Person- al Care Services, Death Care Services, Pet Care Services, Photofin- ishing Services, Temporary Parking Services and Dating Services). 12-13 ROB_June15.indd 13 4/29/15 9:30 AM

- 16. ISM June | July 201514 Global Trends news in a changing world Private companies are upbeat about the economy, their growth prospects and hiring, according to PwC’s latestaccording to PwC’s latest Trendsetter BarometerTrendsetter Barometer. The. The report finds 63 percent ofreport finds 63 percent of companies plan to add full-companies plan to add full- time employees this year, 86time employees this year, 86 percent indicate they antici-percent indicate they antici- pate positive revenue growthpate positive revenue growth and nearly three-quartersand nearly three-quarters intend to increase operationalintend to increase operational expenses in areas such as tech-expenses in areas such as tech- nology, new products and ser-nology, new products and ser- vices, and facilities expansion.vices, and facilities expansion. ”Private companies’ agility”Private companies’ agility in responding quickly to cus-in responding quickly to cus- tomers’ changing demands,tomers’ changing demands, coupled with the ability tocoupled with the ability to make long-term investmentsmake long-term investments and weather short-termand weather short-term economic downturns, haseconomic downturns, has generally led to stronger per-generally led to stronger per- formances and higher growth,”formances and higher growth,” says Ken Esch, PwC partner.says Ken Esch, PwC partner. Respondents admit they are concerned about the lack ofconcerned about the lack of qualified workers and growingqualified workers and growing wage pressure. Technologywage pressure. Technology and engineering professionalsand engineering professionals remain in highest demand. A majority of consumers in Canada believe brands and companies should be environ-companies should be environ- mentally responsible, reflectingmentally responsible, reflecting the view of consumers world-the view of consumers world- wide. A survey by GfK, whichwide. A survey by GfK, which interviewed 28,000 people in 23interviewed 28,000 people in 23 countries, notes that 76 percentcountries, notes that 76 percent of consumers worldwide agreeof consumers worldwide agree that companies need to bethat companies need to be environmentally responsible.environmentally responsible. “Worldwide, only 6 percent“Worldwide, only 6 percent believe that brands don’t have to be environmentally respon- sible and 11 percent indicate they buy products and ser- vices that don’t appeal to theirvices that don’t appeal to their beliefs,” the study finds. Fifty- five percent of Canadians alsofive percent of Canadians also say they only buy products andsay they only buy products and services that appeal to theirservices that appeal to their beliefs, values or ideals, andbeliefs, values or ideals, and 53 percent say they feel guilty53 percent say they feel guilty when they do something thatwhen they do something that is not environmentallis not environmentally friendly. Labor disruptions, political instability and human-rights issues are among the reasons companies should carefully examine their supply chains. The Global Supply ChainThe Global Supply Chain Intelligence report by BSIreport by BSI Supply Chain Solutions warnsSupply Chain Solutions warns companies, particularly thosecompanies, particularly those in the apparel trade, to scru-in the apparel trade, to scru- tinize their supply chains. Ittinize their supply chains. It notes that Haiti, for example,notes that Haiti, for example, reportedly has 29 percent ofreportedly has 29 percent of all children between the agesall children between the ages of 5 and 14 working in slave-of 5 and 14 working in slave- like conditions. “Companieslike conditions. “Companies are facing an increasingly wideare facing an increasingly wide range of challenges in theirrange of challenges in their supply chains, from human-supply chains, from human- right issues to natural disas-right issues to natural disas- ters,” says Shereen Abuzobaa,ters,” says Shereen Abuzobaa, commercial director at BSI.commercial director at BSI. Such complexity creates “blackSuch complexity creates “black holes of risk” for organizations,holes of risk” for organizations, which can affect both thewhich can affect both the bottom line and a company’sbottom line and a company’s reputation, she adds. Otherreputation, she adds. Other risks affecting supply chainsrisks affecting supply chains last year include port conges-last year include port conges- tion, strikes, cargo theft and natural disasters. Resources Information in this report was gathered from the following sources. BSI Supply Chain Solutions www.bsigroup.com GfK www.gfk.com PwC www.pwc.com/US Reportlinker www.reportlinker.com SAP www.sap.com US United States CA Canada HT Haiti 14-15 Global June_July15.indd 14 5/19/15 10:26 AM

- 17. ISM June | July 2015 15 Business growth in both the manufacturing and non-manufac- turing sectors is expected to continue through the remainder of 2015, according to the Spring 2015 Semiannual Economic Forecast. Fourteen of the 18 industries in the manufacturing sector, and 13 of the 18 in the non-manufacturing sector, expect to see growth in revenues throughout 2015. Manufacturing Overall revenue growth is expected to be 3.5 percent, a “mean- ingful” decrease of 2.1 percent from December 2014 when the survey predicted 5.6 percent for 2015. Fifty-five percent of respondents pre- dict revenue growth at 9 percent, 16 percent expect an 8.9 percent decline and 29 percent foresee no change in revenue. Some highlights from the semiannual forecast include: • Operating rate is at 79.5 percent of normal capacity. • Production capacity is expected to increase 3.4 percent. • Prices are expected to decrease a total of 0.9 percent. • Employment is expected to increase 0.7 percent during the remainder of the year. Non-manufacturing Revenue growth is expected to increase 2.9 percent for 2015, less than the 10 percent increase forecast in December 2014. Despite a “cooling off” in the rate of growth, the sector will continue on a growth path throughout the year. Some highlights from the semiannual forecast include: • Operating rate is at 86 percent of normal capacity. • Capital expenditures are expected to increase 1.5 percent. • Employment is expected to increase 2 percent. • Prices are expected to decrease 0.4 percentage points for the rest of 2015. The complete Spring 2015 Semiannual Economic Forecast, released May 6, 2015, can be found at www.instituteforsupply management.org. ISM Bradley J. Holcomb, CPSM, CPSD, is chair of the Institute for Supply Management® Manufacturing Business Survey Committee. Anthony S. Nieves, CPSM, C.P.M., A.P.P., CFPM, is chair of the Institute for Supply Management® Non-Manufacturing Business Survey Committee. Business Growth Expected to Continue Through 2015 High-performing companies that use talent to drive bot- tom-line growth share several key characteristics, includingkey characteristics, including an emphasis on training andan emphasis on training and mentoring. A global studymentoring. A global study from Oxford Economics withfrom Oxford Economics with support from SAP,support from SAP, WorkforceWorkforce 20202020, says more than half of, says more than half of the high-performing companiesthe high-performing companies offer supplemental trainingoffer supplemental training programs as an employee ben-programs as an employee ben- efit. They also are 16 percentefit. They also are 16 percent more likely to have a formalmore likely to have a formal mentoring program than under-mentoring program than under- performing companies, theperforming companies, the study notes. “The study resultsstudy notes. “The study results demonstrate a clear divisiondemonstrate a clear division between those who are posi-between those who are posi- tioning their companies for thetioning their companies for the future of work and those whofuture of work and those who are not,” says Edward Cone ofare not,” says Edward Cone of Oxford Economics. The study finds other high-performing companies also reward talent on merit instead of tenure, and they understand and planand they understand and plan for the demographics of the future workplace. China’s air transport and air- port industry continues to grow, driven largely by tour- ists’ leisure demand, and a small uptick in exports ofsmall uptick in exports of both cargo and mail. Last year,both cargo and mail. Last year, China’s total passenger turn-China’s total passenger turn- over increased 11.6 percentover increased 11.6 percent and its cargo and mail turn-and its cargo and mail turn- over increased 8.8 percent,over increased 8.8 percent, according to Reportlinker’saccording to Reportlinker’s China Air Transport andChina Air Transport and Airport IndustryAirport Industry Report. “To improve performance, the air-improve performance, the air- lines in China have sought tolines in China have sought to make progress in two aspectsmake progress in two aspects since 2013 — accelerating the opening up of international andopening up of international and regional routes, and expandingregional routes, and expanding its low-cost aviation industry,”its low-cost aviation industry,” the report says. In 2014, Airthe report says. In 2014, Air China added 12 new routes andChina added 12 new routes and China Southern Airlines addedChina Southern Airlines added nine new international routes.nine new international routes. Influences on the industry areInfluences on the industry are slower economic growth bothslower economic growth both in China and globally, and high-in China and globally, and high- speed rail. Chinese airlines alsospeed rail. Chinese airlines also suffered exchange losses duesuffered exchange losses due to the yuan’s depreciationto the yuan’s depreciation against the U.S. dollar.. dollar. DE Germany CN China 14-15 Global June_July15.indd 15 5/19/15 10:26 AM

- 18. ISM June | July 201516 The 2015 Institute for Supply Management® — Michigan State University Awards for Excellence in Supply Management and the R. Gene Richter Scholarship Program would not have been possible without the generous support of our sponsors. ISM® is grateful for their continued support. Thank You Sponsor 16-17 June_July15 Sponsor.indd 16 5/19/15 10:26 AM

- 19. www.ism.ws 17 T his 10-page special section features two prestigious programs presented by ISM® — the J. Shipman Gold Medal Award and the R. Gene Richter Scholarship Awards. These awardswerepresentedatISM2015,heldMay3-6, 2015, in Phoenix. OnMonday,May4,aspecialdinnerwasheldto recognize the winners of the Institute for Supply Management® — Michigan State University AwardsforExcellenceinSupplyManagement.Also recognized at that event were the winners of the 2015 scholarships, awarded by the R. Gene and Nancy D. Richter Foundation and the ISM R. Gene Richter Scholarship Fund. The R. Gene Richter ScholarshipProgramwasestablishedin2004and named in memory of R. Gene Richter, who was a galvanizing force in the field of procurement. The next year, the R. Gene and Nancy D. Richter Foun- dation partnered with ISM to expand the Founda- tion’sscholarshipprogramintothelargestnational scholarshipprograminthefieldofsupplymanage- ment. With the goal to establish the ability to pro- vide for the funding of scholarships on an ongoing basis,theISMR.GeneRichterScholarshipProgram Fundwasestablishedin2008.ThefundatISMhas a goal to grow the principal to US$2 million. The proceeds from this fund will provide a portion of the scholarships for future Richter scholars. OnTuesday,May5,ISMawardedtheJ.Shipman Gold Medal Award at a special luncheon. This award honors a single individual for a lifetime of contributions to the profession. The award was created by the Purchasing Management Associa- tionofNewYorkin1931,andispresentedtothose individuals whose modest, unselfish, sincere and persistent efforts have aided the advancement of thesupplymanagementfield.Thosechosenforthe award have also assisted and guided members of the supply management profession in their endeavors. Beginning on the next page, we are pleased to provide an in-depth article on this year’s Shipman Award winner, Bradley J. Holcomb, CPSM, CPSD, followed by synopses of the exceptional achieve- mentsattainedbytheeightstudentswhoreceived 2015 Richter Scholarships. Recognizing the 2015 J. Shipman Award Winner and Tomorrow’s Leaders 16-17 June_July15 Sponsor.indd 17 5/19/15 10:26 AM

- 20. ISM June | July 201518 Putting People First t was 2011, and Bradley J. Holcomb was wrapping up a successful 35-year career in which he held positions in manufacturing, marketing and sales — eventually finding his passion in procurement and supply management. That passion took him on a journey to various compa- nies, always with the mission to build or transform the supply chain function to a high-performing, respected organization. But as Holcomb, CPSM, CPSD, reflected on his career, he realized he had some unfinished business. He wanted to say thank you and share his success with his first boss and mentor at Eastman Kodak Company, where he started his career in 1976. It was important to Holcomb, the ISM® 2015 J. Shipman Gold Medal Award winner, because a hallmark of his career has been mentoring young professionals — and his first boss was the inspiration. “I realized that Paul Kruggel was the first and most genuine mentor I ever had,” Holcomb says. “I didn’t really know it at the time, but as I began guiding and mentoring others, the importance of what he did really struck me.” Holcomb located the 81-year-old Kruggel and flew to Rochester, New York, to take him to lunch and thank him. “I hadn’t seen him for 25 or 30 years, but we picked up like it was yesterday.” Finding Joy in Mentoring Holcomb says he’s fashioned his mentoring style after his former boss. “Paul would tell you that his calling was to bring young talent into the company, groom and grow them, and then send them off to other departments in the company,” Holcomb says. “He was very comfortable in that role. There were vice presidents and senior vice presidents at Kodak who all had come through his door. He was completely and totally unselfish.” Bradley J. Holcomb, the 2015 J. Shipman Gold Medal Award winner, measures his career by the success of those he has mentored and guided. I PhotobySergioDabdoub By Mary Siegfried JUNE | JULY COVER STORY 18-21 Shipman Winner June/July15.indd 18 5/19/15 10:27 AM

- 21. ISM June | July 2015 19 18-21 Shipman Winner June/July15.indd 19 5/19/15 10:27 AM

- 22. ISM June | July 201520 Holcomb, who was honored at ISM2015 in Phoenix on May 5, 2015, is chair of the ISM Manufacturing Business Survey Committee and, after a 20-year career at Eastman Kodak, held executive-level supply manage- ment positions in companies ranging from Praxair to Dean Foods. Although he talks with pride about his supply management career — often building departments from the ground up — he clearly measures success in terms of the college students, young profes- sionals and up-and-coming leaders he’s mentored and guided through their careers. He says he’s experienced “abso- lute joy” in mentoring many young colleagues as well as several Richter Scholars over the years. “It keeps me connected with young people, and that is terribly important because they’re the vitality and future of our profession. It’s important to help them realize their highest and best poten- tial,” he explains. Understanding the Servant Role He encourages other supply management professionals to get involved with mentoring. “For those people who have succeeded in our profession, I’m just saying it’s time to give back. Many do, of course, but everyone can. It should come natu- rally,” he says. Giving back is something Holcomb says comes naturally to him. Maybe that’s why he found his niche in supply management. “We really have to appreciate our role and under- stand that we are servants,” he says about the profession. “I’ve always believed that my organization was a service organization to other depart- ments. Procurement is positioned to help every other department achieve the best value for their purchasing dollars and to help them align with the very best suppliers and partners.” Holcomb, with a bachelor’s and two master’s degrees in engineering, was introduced to procurement when he was asked to re-engineer Kodak’s global procurement organization in 1994. Kodak was going through major changes at the time as the last of the “home-grown” CEOs left and a new CEO was brought in from Motorola, the same company from which both of Holcomb’s parents had retired. “My mentor at the time picked me to lead that effort and globalize procurement at Kodak,” he recalls. There were 13 independent procure- ment organizations around the com- pany, spread across the United States, Europe, Canada, Australia and Brazil. “And each was doing its own thing, never talking to each other, but we changed all of that together,” he adds. Building a Procurement Organization Holcomb brought the procure- ment leaders together in Rochester where they “huddled together literally for a month to create new processes for the new global organization.” He then continued to help lead the department as the director of supplier relationship management. During the redesign of the depart- ment, Holcomb says he relied on his engineering background as the group worked to re-engineer people, orga- nizations, systems and processes. They focused on four key processes: strategic planning, strategic sourcing, supplier relationship management and tactical processes. The first key step was strategic planning, he explains, because Kodak had a long-standing corporate stra- tegic-planning process. “We plugged into that process and built a module that flowed and fit into the broader strategic-planning process of the company,” he explains. By aligning the new procurement organization strategically with the overall company, the newly redesigned department was given a seat at the executive table from the outset. “I did that for two years, we saved the company a ton of money and I fell in love with the profession,” he says. Learning From the Best That love of the profession became a springboard for a supply management career that spanned 15 years and five companies as Holcomb continued to re-engineer supply chain organizations. He left Kodak in 1996 when he was offered the position of vice president, global procurement, at Praxair Inc. in Danbury, Connecticut. Holcomb was tasked with trans- forming an “old-school purchasing shop into a modern sourcing and supply management organization.” Although excited about the chal- lenge, he admits he was apprehen- sive because “this was my first time swimming out to open waters.” So he did what many young, rising supply chain professionals did in the mid- to late 1990s — he sought guidance from R. Gene Richter, who had transformed the procurement organization at IBM. “My boss at Kodak had intro- duced me to Gene Richter earlier, and I called him, explained that I was new at Praxair and could really use his help,” Holcomb says. “He invited me and three of my managers to his office in Somers, New York, and — this is so Gene — he took us into his confer- ence room, brought in several of his managers and we all spent eight hours together connecting. I was totally blown away.” He says he learned some new things and also found he was moving his procurement organiza- tion in the right direction. “But to get that affirmed by Gene Richter was amazing,” he notes. It’s only fit- ting that Holcomb has volunteered to mentor six Richter scholars, and takes calls from several other Richter scholars who need advice or someone to bounce ideas off of. Putting People First 18-21 Shipman Winner June/July15.indd 20 5/19/15 2:25 PM

- 23. ISM June | July 2015 21 Developing a Supplier Strategy It was at Praxair that Holcomb realized a key to success in building or transforming a procurement orga- nization was developing strong peer relationships. “The most important relationships are not those above or below your level, but with peers with whom you don’t have a reporting relationship,” he notes. “Those are the people you have to work with. You need to immediately show them respect by listening to them as cli- ents or future clients.” Throughout his career, Holcomb said developing a vision for both his staff and the supply base was essential. He recalls how important it was to share his vision with the supply base at Houston-based Waste Management when he joined as CPO in 2000. “Suppliers are companies, but they also are made up of people, just like our people,” he explains. “And we need to have suppliers that are better at what they do than we are. Suppliers should be companies that don’t just make products or provide services, but ones that have deep RD and are always innovating. And I want to bring their whole company to the table.” After just three months into his new job at Waste Management, Holcomb called together the top 75 suppliers to explain that his new organization was centralizing oper- ations. “I told them we would be picking only the best of the best. Then I asked them to look to their left and right, before saying that at next year’s meeting those two people would probably not be there.” Holcomb says some complacent suppliers thought they would out- last him, but they didn’t. “And those suppliers that won on their merits received three times the volume of business. My vision has always been to build an extraordinary supply base, picking the very best suppliers upfront, and then making them better for us through a disci- plined supplier performance man- agement process.” It’s All About People His vision for his own procure- ment staff is a simple one. “My secret is surrounding myself with people who are exceptionally good at what they do,” he says. “I goal them up and get out of their way. My job then becomes providing air cover — something that comes from my years in the Air Force. I then deal with the other executives, departments and budgets so my people don’t get bogged down in such things as office politics.” His four years in the U.S. Air Force in the late 1960s and early 1970s, when the Vietnam War was raging, were a time of great personal development for Holcomb. It’s a time in which he takes great pride. The 18-year-old Holcomb was trained as an electronics technician, helping maintain a fleet of F-111 aircraft in the United States and in the U.K. “I learned new skills and a disci- plined way of living,” he says. “I never thought I could care so much about spit-shining my shoes and creasing my pants. The military was an oppor- tunity to serve, but helped me to grow up. I was offered the GI Bill, allowing me go to college and get two engi- neering degrees paid for.” Because of his military experi- ence, Holcomb says he has always given strong consideration to job applicants who have a military back- ground. “At Waste Management, I hired a ‘bird colonel’ for a key pro- curement position,” he recalls. “I remember thinking, ‘I used to salute guys like that.’ But I found that people with a military background fit perfectly into supply management because both require a disciplined way of thinking and attention to details.” Because of his commitment to and investment in the supply man- agement teams he has assembled over the years, Holcomb has been asked what he looks for in job can- didates. The answer, he admits, is very simple. “The first thing I look for is whether he or she is a nice person. I ask, ‘Is this a person I would enjoy working with? Would my team enjoy working with him or her?’ It’s hard to put a definition around it, but you know it almost immediately,” he says. Once that key factor is evident, Holcomb evaluates the candidate’s skills such as negotiating, project management and time manage- ment. “I pick the best of the best people and they stick with me. Some have been with me at two or even three companies,” he adds. “There are directors, vice presidents and senior vice presidents who have all come through my door — much like I came through Paul Kruggel’s door all those years ago.” ISM Mary Siegfried is a senior writer for Inside Supply Management® . Bradley J. Holcomb, 2015 J. Shipman Gold Medal Award winner, says he was “proud and humbled” as he accepted the award at ISM2015 in Phoenix. PhotobySergioDabdoub 18-21 Shipman Winner June/July15.indd 21 5/19/15 10:27 AM

- 24. ISM June | July 201522 T he R. Gene Richter Scholarship Program is a partnership between ISM® and the R. Gene and Nancy D. Richter Foundation. It is viewed as the most esteemed scholarship program for exceptional students in supply management in the United States. Established in 2004, this exclusive award honors students who have outstanding GPAs, are actively engaged in professional extracurricular activities and are passionate about the profession of supply management. The 2015 winners are no excep- tion. Each of the eight recipients has proved strong commitment and dedication to the field, and has worked hard to achieve tremendous accomplishments. The award provides recipients with up to US$5,000 of tuition funding, and the oppor- tunity to work with a previous Richter schol- arship recipient as a junior mentor, as well as an executive senior mentor. They also receive complimentary attendance at the ISM Annual Conference. ISM and the Richter Foundation are pleased to recognize these eight students as the 2015 R. Gene Richter Scholars: Matt Christiansen A junior at Duquesne University majoring in supply chain management, and double minoring in information systems management and sales, Matthew Christiansen has a cumu- lative GPA of 3.81 and will graduate in May 2016. Christiansen, a member of the ISM— Pittsburgh, Inc., affiliate, is currently presi- dent of the Duquesne Supply Chain Council, a student organization with 60 members that provides a number of networking opportunities connecting students to experts in the field. Christiansen has completed internships at United States Steel Corporation and Curtiss- Wright, where he has developed cost savings models and completed entire sourcing projects from beginning to end, including researching the industry, developing RFPs, communicating with buyers, analyzing bids and negotiating with suppliers. Christiansen began his third internship at E.L. DuPont de Nemours and Company in May 2015. Christiansen is certified as a Lean Six Sigma Yellow Belt and has been the recip- ient of several supply chain scholarships. After working full-time for several years, Christiansen has his sights set on attaining graduate-level education. Christiansen’s executive mentor is Shelley Stewart, Jr., CPSM, chief procurement officer and vice president of sourcing at DuPont. His junior mentor is 2013 Richter scholar Daniel Dodell, a business analyst at McKinsey Co. Meet the eight extraordinary students who are this year’s recipients of the R. Gene Richter Scholarship Awards. STARS SUPPLY MANAGEMENT’S RISING 22-25 Richter June/July15.indd 22 5/19/15 2:26 PM

- 25. ISM June | July 2015 23 Kevin Cronin Kevin Cronin is a junior at Michigan State University with a major in supply chain management. Cronin currently holds a 3.85 GPA and will graduate in May 2016. Cronin is actively engaged in supply chain through exten- sive participation in the Michigan State University Supply Chain Management Association (SCMA). Within this association, he facili- tated a supply management career fair that featured 128 companies and was attended by over 700 students, making it the largest student-run fair on campus. “I have grown more from this experience than any other that I have had in college,” Cronin says of SCMA. In addition to his time with SCMA, Cronin has also spent time interning with AbbVie Inc., where he realized his passion for the pharma- ceutical industry. He plans to return and intern with the company again this summer. Upon graduation, Cronin hopes to join AbbVie Inc. for long-term employment before pursuing his graduate degree. Cronin’s executive mentor is David Natoff, head of procure to pay for Google. His junior mentor is 2013 Richter scholar Hanna Downs, a buyer at General Motors Company. Shahan Din Shahan Din is a junior at University of South Carolina (USC) with a double major in global supply chain operations management and international business, with a minor in Spanish. Din currently holds a cumulative 3.95 GPA. Din was introduced to the field of supply management by his senior mentor and realized that the work suited his personality perfectly. “I love the idea of providing continuous PhotobySergioDabdoub 2015 Richter Scholar Winners Back row (left to right): Shahan Din, University of South Carolina; Samuel Setiawan, Michigan State University; Erika Mionis, Arizona State University; Kevin Cronin, Michigan State University; Matt Christiansen, Duquesne University. Front row (left to right): Marchela Stancheva, Rutgers University; Jenna Fischer, The Pennsylvania State University; Emily Socha, Bryant University. 22-25 Richter June/July15.indd 23 5/19/15 10:27 AM

- 26. ISM June | July 201524 improvement for a company,” Din says. “You can always find areas that need to be made better, and you’ll never hit a wall.” Driven to help others, Din founded the USC Food Recovery Network, which distributes leftover food from the university to local homeless shel- ters and food banks. This effort takes a lot of strategic planning, ranging from logistics to sourcing and many other aspects of the supply management field. Din will be interning with Amazon this summer to receive experience in another area of supply management. His future plans are to continue to gain experience in different industries and see where he fits best. Din plans to receive his MBA once he has sufficient full-time work experience. Din’s executive mentor is Christopher J. Ledger, head of global sourcing and procurement for LinkedIn. His junior mentor is 2013 Richter scholar Mackenzie Mylod, a fulfillment professional at IBM. Jenna Fischer A junior in the Schreyer Honors College at The Pennsylvania State University, Jenna Fischer is majoring in supply chain management and minoring in Spanish, with a cumula- tive GPA of 3.8. She is actively involved in the Council of Supply Chain Management Professionals and serves as vice president of student recruiting after holding a number of leadership positions in the group. She is also a member of the Sapphire Leadership Program, participating in professional development workshops and net- works with experts in the field. After a Johnson Johnson commercial and business services procurement co-op, Fischer learned that working with different teams is an exciting part of supply manage- ment. “Just in procurement alone, I worked with partners in marketing and finance, and worked with various different suppliers,” she says. “It brings all of the different interests of the company together in an attempt to make everyone happy.” Fischer’s future plans include taking part in a rotational program to see which area of supply chain she best fits, before moving on to obtain an MBA after several years of experience. Fischer’s executive mentor is Kristen Gorman, vice president, pro- curement at Northern Trust Bank. Her junior mentor is 2013 Richter scholar Chelsea Miller, a supply chain coordi- nator at ConocoPhillips. Erika Mionis Erika Mionis is a junior at the Barrett Honors College at Arizona State University, double majoring in supply chain management and finance, with a certificate in interna- tional business. Moinis will graduate in May 2016 with a cumulative GPA of 4.0. Mionis is highly active in all things supply chain, including various internships and association mem- berships. Her largest involvement is in the Supply Chain Management Association (SCMA) at Arizona State University, where she will become president next year, after holding various leadership positions. The most satisfying aspect of this club for Mionis is the ability to plan career fairs, which connect hundreds of companies to hundreds of students. “It’s very rewarding to create that vehicle for my peers to get interviews for internships and full-time careers,” she says. Following a logistics internship at General Mills, where she led her team in implementing a new process that would reduce the plant’s shipment errors by over 60 percent, she knew supply management was the right career choice. “I learned that even the most talented team will not perform well if the individual skills of the mem- bers are not called upon and utilized effectively,” she says. Mionis will expand her profes- sional experience when she begins a supply chain internship for Starbucks this June in Seattle. After graduation, she plans to enter the workforce to gain several years of experience before pursuing an MBA. Mionis’ executive mentor is Mercedes Romero, vice president of procurement for Diageo. Her junior mentor is 2013 Richter scholar Beth Albers, a purchasing specialist at Bechtel. Samuel Setiawan Samuel Setiawan is a senior at Michigan State University, majoring in supply chain management and minoring in information technology, with a cumulative GPA of 4.0. He will graduate in December 2015. He chose the profession of supply management after counsel from professors, family and friends, and his choice was solid- ified after previous Richter scholars provided additional inspiration. Setiawan has maintained a number of jobs and internships throughout college, including a global sourcing internship at Owens Corning Roofing and Asphalt. At Owens Corning, he worked with a team to help identify more than US$328,000 in cost savings through various value creation initiatives, which included revamping the organization’s rail-car optimizer tool to include linear pro- gramming principles to make pro- cesses easier and more powerful. As a member of Supply Chain Management Association, Setiawan is involved in teaching elementary-level students the basics of the supply chain profession and why it is important. “Lots of people don’t think about supply chain until they’re already in college, so it’s a good way to have people start thinking about it, while also giving back to the community,” he says. Setiawan plans to enter the work- force upon graduation and pursue an STARS SUPPLY MANAGEMENT’S RISING 22-25 Richter June/July15.indd 24 5/19/15 2:26 PM

- 27. ISM June | July 2015 25 MBA after a few years of profes- sional experience. Setiawan’s executive mentor is Beverly Gaskin, CPSM, exec- utive director, GM Powertrain at General Motors Company. His junior mentor is 2013 Richter scholar Tyler Morrison, production supervisor at Whirlpool Corporation. Emily Socha Emily Socha is a junior at Bryant University, double majoring in global supply chain manage- ment and applied analytics. With a cumulative GPA of 3.92, Socha will graduate in May 2016. Socha chose a career in supply to turn her natural tendency of analyzing how different firms can maximize productivity into a full-time job. “Supply chain is a profession that touches every aspect of a business,” she says. “A chain is only as strong as its weakest link and I want to use my innovative, problem-solving and interpersonal skills to make sure each link is cre- ating win-win scenarios to maximize value for all parties involved.” During her internships at United Technologies Aerospace Systems for the past two summers, Socha has taken the lead on several dif- ferent projects, where she became immersed in the entire procurement process and worked with suppliers every single day. Socha is a member of ISM—Rhode Island, Inc., and is currently working with other stu- dents to develop an ISM affiliate at Bryant University. She has been instrumental in the development of the first networking conference at Bryant University that will connect industry experts with students who are interested in exploring this field. After graduation, Socha’s goal is to pursue professional experi- ence in a strategic sourcing role for a company that values ethical decision-making and embraces technology and globalization as a catalyst for change. Socha’s executive mentor is Maria Lindenberg, chief procure- ment officer at Chevron Corporation. Her junior mentor is 2013 Richter scholar Caitlyn McCarthy, who works for Polaris Industries as an associate ODP. Marchela Stancheva Marchela Stancheva is a junior in the Rutgers Newark Honors College at Rutgers University, studying supply chain management with a 4.0 GPA. A recent immigrant to the United States from Bulgaria, Stancheva was initially drawn to studies in supply management after learning about the problem-solving aspect of the field at a career open house. In addition to becoming a U.S. citizen, learning to speak English and pursuing her college career, Stancheva co-founded and is pres- ident of the Business Association for Supply Expertise (BASE). BASE is a student organization that was formed to address the needs defined by the corporate world. The orga- nization works closely with Fortune 500 companies to ensure that stu- dents develop problem-solving skills by using essential tools. “My goal was to pursue my own continuous growth, as the supply chain field is constantly evolving,” Stancheva says of BASE. “I also wished to aid the numerous other students at the Rutgers Business School who seek to develop their skills and grow professionally.” Stancheva plans to attend grad- uate school after gaining profes- sional experience. Stancheva’s executive mentor is Paula Wittbrodt, vice president, global packaging and global supplier relations for the Estee Lauder Group. Her junior mentor is 2013 Richter scholar Richard Westbrook, a supply chain analyst at 3M. ISM R. Gene Richter Scholarship Selection Committee Joseph C. Black, Jr. Vice President Procurement Chief Procurement Officer Procurement, Real Estate Security Aetna Inc. David Depkon Vice President, Supply Management Operations Hilton Worldwide Clive R. Heal, CPSM Supplier Relationship Center, Team Leader, Global Pharma Procurement — Strategy Realization and Operations Roche Holly LaCroix Johnson ISM R. Gene Richter Scholarship Contact Sandy Lukasik Executive Director R. Gene Richter Scholarship Program R. Gene and Nancy D. Richter Foundation Jim Pazzanese Vice President, Supply Management Sodexo Cathy A. Rodgers Vice President, IBM Global Engagement Office IBM Claretta A. Strickland, C.P.M. Printing Personal Systems Group Central Direct Procurement Services Hewlett-Packard 22-25 Richter June/July15.indd 25 5/19/15 10:28 AM

- 28. ISM June | July 201526 Build your next generation of talent and strengthen your core team with the ISM Mastery Model™ . 26-29 Mastery Model.indd 26 5/19/15 10:28 AM